FREE Investor Database

Top Venture Investors in Sustainability Industry

Top Venture Investors in Sustainability Industry

Discover leading VC and CVC investors specializing in Sustainability. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

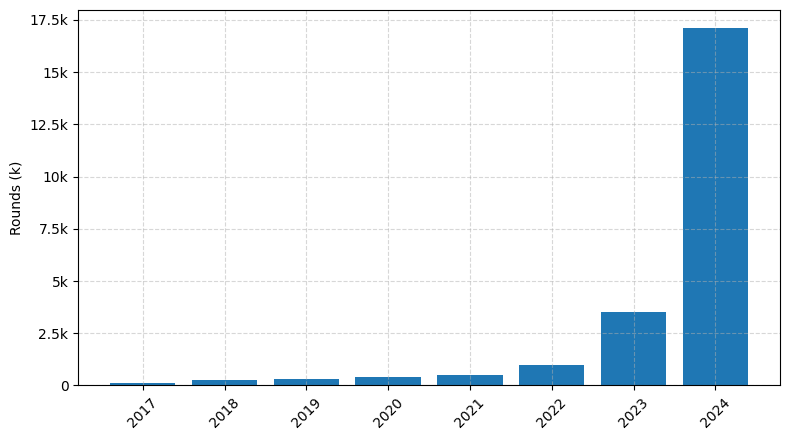

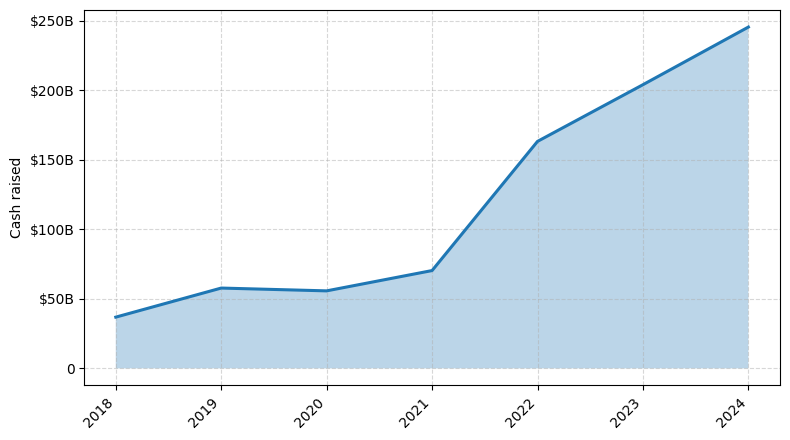

Sustainability has become a top priority for investors in recent years, with a surge of capital flowing into eco-friendly technologies and green initiatives. Over the past three years, since 2022, the investment landscape has undergone a remarkable transformation, with a significant increase in the number of sustainability-focused deals.

According to industry reports, the number of sustainability investments has more than doubled, reaching unprecedented levels. In total, over $50 billion has been poured into this sector, with several high-profile startups receiving substantial funding. Notable recipients include Sunrun, a leading solar energy provider, Impossible Foods, a plant-based meat alternative, and Lilium, a pioneer in electric vertical take-off and landing (eVTOL) aircraft.

The most expensive deals in the sustainability space have involved companies like Rivian, an electric vehicle manufacturer, and Northvolt, a Swedish battery startup. One particularly interesting investment was the $1.2 billion raised by Climeworks, a Swiss company that specializes in direct air capture technology, a promising solution for carbon removal.

In summary, the investment landscape has witnessed a remarkable shift towards sustainability, with billions of dollars being poured into innovative solutions that aim to address the pressing environmental challenges of our time.

According to industry reports, the number of sustainability investments has more than doubled, reaching unprecedented levels. In total, over $50 billion has been poured into this sector, with several high-profile startups receiving substantial funding. Notable recipients include Sunrun, a leading solar energy provider, Impossible Foods, a plant-based meat alternative, and Lilium, a pioneer in electric vertical take-off and landing (eVTOL) aircraft.

The most expensive deals in the sustainability space have involved companies like Rivian, an electric vehicle manufacturer, and Northvolt, a Swedish battery startup. One particularly interesting investment was the $1.2 billion raised by Climeworks, a Swiss company that specializes in direct air capture technology, a promising solution for carbon removal.

In summary, the investment landscape has witnessed a remarkable shift towards sustainability, with billions of dollars being poured into innovative solutions that aim to address the pressing environmental challenges of our time.

96 active VC investors in Sustainability

In the last three years, venture capital firms have increasingly focused on investing in sustainability-focused startups. Key players in this space include Breakthrough Energy Ventures, which has backed innovative solutions in clean energy and climate tech, and Prelude Ventures, which has invested in companies tackling challenges in food, water, and waste management. One notable example is Impossible Foods' $500 million Series F round in 2020, which was led by existing investors including Khosla Ventures and Horizons Ventures, highlighting the growing appetite for sustainable food alternatives among venture capitalists.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| ZORA Ventures | climate change, sustainable food systems, deep tech | Israel | Series A, Series B | ||

| Zoma Capital | early childhood development, workforce, community economic development, water and energy | Generalist | |||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| ZIM Ventures | Sustainability | Israel | Seed | ||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Zenture Capital Partners | Avon, Connecticut | digital transformation, healthcare, sustainability, ai, automation, | Seed, Pre-Seed |

98 active CVC investors in Sustainability

Active corporate venture capital firms have been investing heavily in sustainability-focused startups in the past three years. Notable players include Shell Ventures, which invested in Eavor, a geothermal energy company, and Chevron Technology Ventures, which backed Natron Energy, a manufacturer of sustainable battery storage solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| ZIM Ventures | Sustainability | Israel | Seed | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Yara Growth Ventures | agriculture, clean hydrogen | ||||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| XT Hi-Tech | Sustainability | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Xerox Ventures | Sustainability | Seed | |||

| Viessmann | heat transfer, district heating, boiler rooms, manufactures, drinking water, renewable, climate control, horticulture, buildings, greenhouse cultivation, energy efficient | ||||

| Valkea Growth Club | clean energy, energy | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom |

Investments by year: Round

Investments by year: Cash raised

How is fundraising in Sustainability different from other VC fundraising

Fundraising for sustainability-focused startups often faces unique challenges compared to general startup fundraising. Sustainability ventures typically require significant upfront investments for research, development, and infrastructure, with longer timelines to achieve profitability. Investors may be hesitant to commit capital to unproven green technologies or business models. Additionally, sustainability startups must navigate complex regulatory environments and navigate the balance between profitability and environmental/social impact. Successful sustainability fundraising often requires demonstrating a clear path to scalable, measurable impact, as well as a compelling financial case. Securing grants, impact investments, and partnerships with established organizations can be crucial for sustainability startups to overcome these hurdles and secure the necessary funding to drive meaningful change.

Top Funded Sustainability Startups

1. Impossible Foods: Approximately $2 billion in total funding, focused on developing plant-based meat alternatives.

2. Oatly: Approximately $1.4 billion in total funding, focused on producing oat-based dairy alternatives.

3. Brightsource Energy: Approximately $1.3 billion in total funding, focused on developing large-scale solar thermal power plants.

4. Proterra: Approximately $1 billion in total funding, focused on manufacturing electric buses and charging infrastructure.

5. Lilium: Approximately $1 billion in total funding, focused on developing electric vertical take-off and landing (eVTOL) aircraft.

2. Oatly: Approximately $1.4 billion in total funding, focused on producing oat-based dairy alternatives.

3. Brightsource Energy: Approximately $1.3 billion in total funding, focused on developing large-scale solar thermal power plants.

4. Proterra: Approximately $1 billion in total funding, focused on manufacturing electric buses and charging infrastructure.

5. Lilium: Approximately $1 billion in total funding, focused on developing electric vertical take-off and landing (eVTOL) aircraft.

What you should include in Sustainability pitch deck

When creating a Sustainability pitch deck, the following unique slides should be included:

1. Sustainability Vision: Clearly articulate your company's commitment to sustainability and the long-term goals.

2. Sustainability Initiatives: Outline the specific programs, policies, and actions your company is taking to address environmental and social impact.

3. Sustainability Metrics: Present measurable data and key performance indicators that demonstrate your progress and impact.

4. Competitive Advantage: Explain how your sustainability efforts provide a competitive edge and create value for your stakeholders.

5. Future Roadmap: Outline your plans for continuous improvement and future sustainability initiatives.

1. Sustainability Vision: Clearly articulate your company's commitment to sustainability and the long-term goals.

2. Sustainability Initiatives: Outline the specific programs, policies, and actions your company is taking to address environmental and social impact.

3. Sustainability Metrics: Present measurable data and key performance indicators that demonstrate your progress and impact.

4. Competitive Advantage: Explain how your sustainability efforts provide a competitive edge and create value for your stakeholders.

5. Future Roadmap: Outline your plans for continuous improvement and future sustainability initiatives.

How to Prepare Your Sustainability Startup for Investment

Preparing a Sustainability startup for investment requires a strategic approach to demonstrate the venture's viability, scalability, and positive environmental impact. As an advisory, it is crucial to ensure that the startup's pitch deck addresses the key elements that venture capital (VC) investors typically expect.

VC investors typically expect the following from Sustainability startups in their pitch deck review:

1. Clear and compelling value proposition: Articulate the startup's unique solution to a pressing sustainability challenge and how it creates value for customers and the environment.

2. Robust market analysis: Provide a thorough understanding of the target market, competitive landscape, and growth potential.

3. Scalable business model: Demonstrate the startup's ability to scale its operations and achieve financial sustainability while maintaining its environmental commitment.

4. Experienced and diverse team: Highlight the founders' and key team members' relevant expertise, track record, and ability to execute the business plan.

5. Measurable environmental impact: Quantify the startup's positive impact on the environment, such as greenhouse gas emissions reduction, resource conservation, or waste management.

By addressing these key elements, Sustainability startups can increase their chances of securing investment from VC investors who are actively seeking innovative solutions to drive sustainable change.

VC investors typically expect the following from Sustainability startups in their pitch deck review:

1. Clear and compelling value proposition: Articulate the startup's unique solution to a pressing sustainability challenge and how it creates value for customers and the environment.

2. Robust market analysis: Provide a thorough understanding of the target market, competitive landscape, and growth potential.

3. Scalable business model: Demonstrate the startup's ability to scale its operations and achieve financial sustainability while maintaining its environmental commitment.

4. Experienced and diverse team: Highlight the founders' and key team members' relevant expertise, track record, and ability to execute the business plan.

5. Measurable environmental impact: Quantify the startup's positive impact on the environment, such as greenhouse gas emissions reduction, resource conservation, or waste management.

By addressing these key elements, Sustainability startups can increase their chances of securing investment from VC investors who are actively seeking innovative solutions to drive sustainable change.