FREE Investor Database

Top Venture Investors in Energy Industry

Top Venture Investors in Energy Industry

Discover leading VC and CVC investors specializing in Energy. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The energy sector has witnessed a surge of investments in the past three years, reflecting the growing global demand for sustainable and efficient energy solutions. Since 2022, the industry has seen a significant influx of capital, with numerous startups and established players attracting substantial funding.

Over the last three years, the energy investment landscape has been dynamic, with hundreds of deals taking place. The total amount invested in the sector during this period has exceeded $50 billion, showcasing the strong investor appetite for innovative energy technologies.

Among the core startups that have received substantial investments are Sunrun, a leading provider of residential solar and energy storage solutions, Proterra, a manufacturer of electric buses and charging infrastructure, and Ørsted, a global leader in offshore wind energy. Some of the most expensive deals include the $5.5 billion acquisition of SolarCity by Tesla in 2016 and the $3.8 billion investment in Northvolt, a Swedish battery manufacturer, in 2021.

One particularly interesting deal was the $2.3 billion investment in Rivian, an electric vehicle startup, by Amazon and Ford in 2019, highlighting the growing convergence between the energy and transportation sectors.

In summary, the energy sector has witnessed a remarkable surge in investments, driven by the increasing demand for sustainable and efficient energy solutions, and the emergence of innovative startups poised to shape the future of the industry.

Over the last three years, the energy investment landscape has been dynamic, with hundreds of deals taking place. The total amount invested in the sector during this period has exceeded $50 billion, showcasing the strong investor appetite for innovative energy technologies.

Among the core startups that have received substantial investments are Sunrun, a leading provider of residential solar and energy storage solutions, Proterra, a manufacturer of electric buses and charging infrastructure, and Ørsted, a global leader in offshore wind energy. Some of the most expensive deals include the $5.5 billion acquisition of SolarCity by Tesla in 2016 and the $3.8 billion investment in Northvolt, a Swedish battery manufacturer, in 2021.

One particularly interesting deal was the $2.3 billion investment in Rivian, an electric vehicle startup, by Amazon and Ford in 2019, highlighting the growing convergence between the energy and transportation sectors.

In summary, the energy sector has witnessed a remarkable surge in investments, driven by the increasing demand for sustainable and efficient energy solutions, and the emergence of innovative startups poised to shape the future of the industry.

99 active VC investors in Energy

In the last three years, the energy sector has seen a surge in venture capital investment, with several firms actively seeking to fund innovative technologies and solutions. Key players in this space include Breakthrough Energy Ventures, which has invested in companies like Commonwealth Fusion Systems, and Prelude Ventures, which has backed startups like Impossible Foods. One of the biggest venture capital rounds in the energy sector in the past two years was Rivian's $2.5 billion Series D funding, led by Amazon and Ford, as the electric vehicle startup aimed to challenge Tesla's dominance in the market.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zoma Capital | early childhood development, workforce, community economic development, water and energy | Generalist | |||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| ZEBOX Ventures | logistics, supply chains, mobility, space, media, transport, decarbonization of infrastructures, energy transition, digitalization of processes, people, consumer, ai | Pre-Seed, Seed | |||

| Yunhe Partners | new energy vehicle value chain, clean energy, new materials, energy efficiency improvement, environment conservation, recycling, clean production, life quality improvement, overall efficiency improvement | ||||

| Ylem Invest | ai, mobility, energy, fintech, agritech, healthcare | ||||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xplorer Fund | mobility, med, robotics, energy, ict, iot, digitalisation, digital twins | Pre-Seed | |||

| W ventures Japan | b2b, b2c, energy, industrial, commerce, security, digital health, mobility, finance, it, real estate, construction, business software, fintech, insurtech, manufacturing, industry 4.0, marketing, media, mobility, logistics. | United States; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series B, Series A, Series E, Series D, Seed, Series C | ||

| W Ventures | energy, industrial, commerce, security, digital health, mobility, finance, it, real estate & construction, business software, fintech, insurtech, manufacturing & industry 4.0, marketing, media, mobility & logistics | Japan; United States; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Seed, Series D, Series E, Series C | ||

| WP2 Investments | fintech, impact, tech, medtech, sporttech, edutech, green energy | Generalist; Poland; United States; Bahamas; Canada; Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay; Costa Rica; Mexico; Argentina; Brazil; Colombia; Ecuador; Peru; Venezuela; Kenya; Somalia; South Africa; Tanzania; China; India; Indonesia; Japan; Malaysia; Pakistan; Philippines; Singapore; Thailand; United Arab Emirates; Vietnam; Australia; Austria; Belgium; Bulgaria; Croatia; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Italy; Ireland; Lithuania; Latvia; Netherlands; Norway; Romania; Serbia; Slovakia; Slovenia; Spain; Ukraine; United Kingdom | Series A, Seed, Series B, Pre-Seed |

66 active CVC investors in Energy

Active corporate venture capital (CVC) firms have been investing heavily in the energy sector over the past three years. Notable players include Shell Ventures, which backed sustainable aviation fuel startup Alder Fuels, and Chevron Technology Ventures, which invested in carbon capture technology developer Svante.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WIND Ventures | mobility, energy, retail | United States; Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Series A, Series B | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Viessmann | heat transfer, district heating, boiler rooms, manufactures, drinking water, renewable, climate control, horticulture, buildings, greenhouse cultivation, energy efficient | ||||

| Valkea Growth Club | clean energy, energy | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | |||

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| Telefonica Innovation Ventures | Energy | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| TechEnergy Ventures | hydrogen, clean fuels, ccus, sustainable lithium extraction and processing, electrification, clean power | Generalist | Series B, Pre-Seed, Series A | ||

| TDK Ventures | next gen materials, industrial, energy, cleantech, mobility, connectivity, computing, healthtech | Generalist | Seed | ||

| Statkraft Ventures | climate tech, energy | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Canada; United States | Seed, Series A, Series B, Series C, Series D |

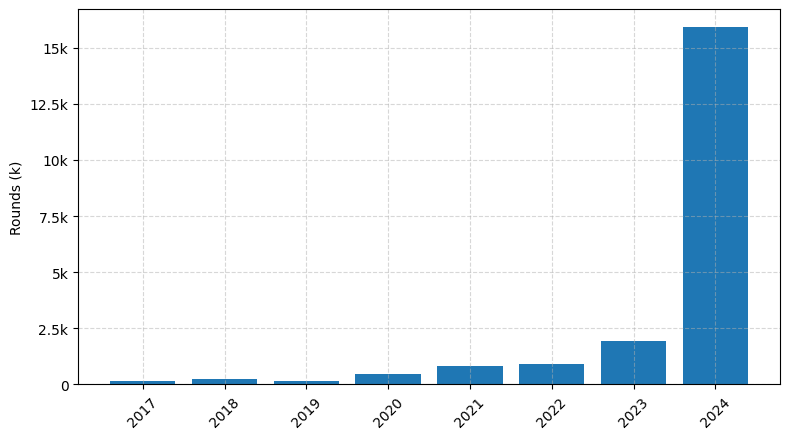

Investments by year: Round

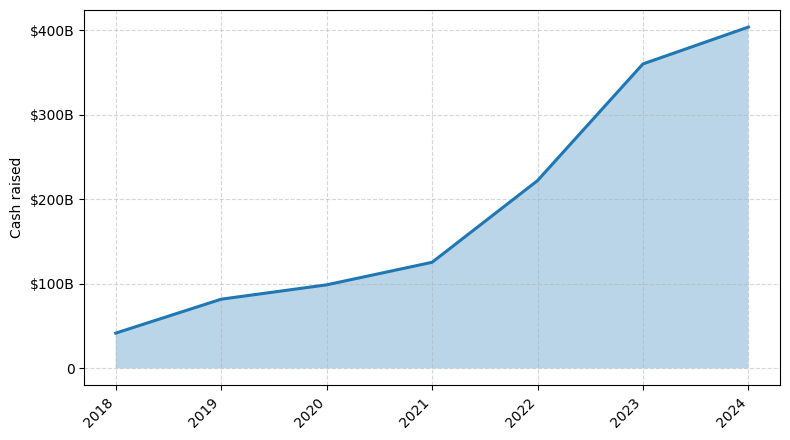

Investments by year: Cash raised

How is fundraising in Energy different from other VC fundraising

Fundraising in the energy sector differs from general startup fundraising due to the unique challenges faced by energy companies. Energy projects often require significant upfront capital investments, long development timelines, and complex regulatory environments. Investors in the energy space tend to have a higher risk tolerance and a longer investment horizon compared to traditional startup investors. Additionally, energy startups must navigate complex supply chains, infrastructure requirements, and the need for specialized technical expertise. These factors can make it more challenging for energy startups to attract funding, particularly in the early stages of development. As a result, energy companies may need to explore alternative funding sources, such as government grants, strategic partnerships, or specialized energy-focused venture capital funds, to secure the necessary resources to bring their innovations to market.

Top Funded Energy Startups

1. Northvolt: Approximately $8 billion in funding, focused on developing sustainable lithium-ion battery cells and systems for electric vehicles and energy storage.

2. Ørsted: Approximately $7 billion in funding, focused on developing offshore wind energy projects and renewable energy solutions.

3. Sunrun: Approximately $6 billion in funding, focused on providing residential solar energy systems and energy storage solutions.

4. Bloom Energy: Approximately $4 billion in funding, focused on developing solid oxide fuel cell technology for distributed power generation.

5. Proterra: Approximately $1.5 billion in funding, focused on manufacturing electric buses and charging infrastructure.

2. Ørsted: Approximately $7 billion in funding, focused on developing offshore wind energy projects and renewable energy solutions.

3. Sunrun: Approximately $6 billion in funding, focused on providing residential solar energy systems and energy storage solutions.

4. Bloom Energy: Approximately $4 billion in funding, focused on developing solid oxide fuel cell technology for distributed power generation.

5. Proterra: Approximately $1.5 billion in funding, focused on manufacturing electric buses and charging infrastructure.

What you should include in Energy pitch deck

When creating an energy pitch deck, it's essential to include the following unique slides:

1. Energy Market Overview: Provide a comprehensive analysis of the current energy landscape, including market trends, growth opportunities, and industry challenges.

2. Technology Differentiators: Highlight the unique technological innovations or advancements that set your energy solution apart from competitors.

3. Environmental Impact: Showcase the positive environmental impact of your energy solution, emphasizing its sustainability and contribution to renewable energy goals.

4. Financial Projections: Present detailed financial projections, including revenue streams, cost structures, and potential return on investment for investors.

5. Competitive Advantage: Clearly articulate the competitive advantages that make your energy solution a compelling investment opportunity.

1. Energy Market Overview: Provide a comprehensive analysis of the current energy landscape, including market trends, growth opportunities, and industry challenges.

2. Technology Differentiators: Highlight the unique technological innovations or advancements that set your energy solution apart from competitors.

3. Environmental Impact: Showcase the positive environmental impact of your energy solution, emphasizing its sustainability and contribution to renewable energy goals.

4. Financial Projections: Present detailed financial projections, including revenue streams, cost structures, and potential return on investment for investors.

5. Competitive Advantage: Clearly articulate the competitive advantages that make your energy solution a compelling investment opportunity.

How to Prepare Your Energy Startup for Investment

Preparing an energy startup for investment can be a crucial step in securing the necessary funding to drive growth and innovation. As an advisory, it is essential to ensure that your startup is well-positioned to attract the attention of venture capital (VC) investors.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined market opportunity: Demonstrate a thorough understanding of the energy market, its challenges, and the potential for your solution to address unmet needs.

2. Innovative and scalable technology: Highlight the unique features and competitive advantages of your energy technology, emphasizing its potential for scalability and long-term impact.

3. Experienced and capable team: Showcase the expertise and relevant experience of your founding team, highlighting their ability to execute on the business plan and drive the startup's success.

4. Comprehensive financial projections: Provide detailed financial projections, including revenue streams, cost structures, and a clear path to profitability and sustainability.

5. Compelling growth strategy: Outline a well-thought-out strategy for expanding your customer base, penetrating new markets, and maintaining a competitive edge in the rapidly evolving energy landscape.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing the investment needed to propel your energy startup forward and contribute to the transformation of the energy sector.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined market opportunity: Demonstrate a thorough understanding of the energy market, its challenges, and the potential for your solution to address unmet needs.

2. Innovative and scalable technology: Highlight the unique features and competitive advantages of your energy technology, emphasizing its potential for scalability and long-term impact.

3. Experienced and capable team: Showcase the expertise and relevant experience of your founding team, highlighting their ability to execute on the business plan and drive the startup's success.

4. Comprehensive financial projections: Provide detailed financial projections, including revenue streams, cost structures, and a clear path to profitability and sustainability.

5. Compelling growth strategy: Outline a well-thought-out strategy for expanding your customer base, penetrating new markets, and maintaining a competitive edge in the rapidly evolving energy landscape.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing the investment needed to propel your energy startup forward and contribute to the transformation of the energy sector.