FREE Investor Database

Top Venture Investors in Industry 4.0 Industry

Top Venture Investors in Industry 4.0 Industry

Discover leading VC and CVC investors specializing in Industry 4.0. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The world of Industry 4.0 has seen a surge of investment activity in the past three years, as businesses and investors recognize the transformative potential of emerging technologies. Since 2022, the industry has witnessed a flurry of investments, with numerous startups and established players receiving significant funding to drive innovation and digital transformation.

According to industry reports, over 500 Industry 4.0-related investments have been made in the last three years, totaling more than $25 billion. Some of the core startups that have received substantial investments include Automation Anywhere, a leading robotic process automation (RPA) provider, which raised $290 million, and Uptake, a predictive analytics platform, which secured $117 million in funding.

Several of the most expensive deals in this space include Siemens' acquisition of Mendix, a low-code application development platform, for $730 million, and the $500 million investment in Bright Machines, a provider of intelligent automation solutions. One particularly interesting deal was the $200 million investment in Tulip, a manufacturing execution system (MES) platform, highlighting the growing demand for advanced manufacturing technologies.

In summary, the surge of investments in Industry 4.0 over the past three years underscores the industry's immense potential and the widespread recognition of the transformative power of digital technologies in the manufacturing and industrial sectors.

According to industry reports, over 500 Industry 4.0-related investments have been made in the last three years, totaling more than $25 billion. Some of the core startups that have received substantial investments include Automation Anywhere, a leading robotic process automation (RPA) provider, which raised $290 million, and Uptake, a predictive analytics platform, which secured $117 million in funding.

Several of the most expensive deals in this space include Siemens' acquisition of Mendix, a low-code application development platform, for $730 million, and the $500 million investment in Bright Machines, a provider of intelligent automation solutions. One particularly interesting deal was the $200 million investment in Tulip, a manufacturing execution system (MES) platform, highlighting the growing demand for advanced manufacturing technologies.

In summary, the surge of investments in Industry 4.0 over the past three years underscores the industry's immense potential and the widespread recognition of the transformative power of digital technologies in the manufacturing and industrial sectors.

99 active VC investors in Industry 4.0

In the last three years, venture capital firms have been actively investing in Industry 4.0, the fourth industrial revolution. Key players in this space include Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins. One notable example is Anthropic's $200 million Series B funding round in 2022, led by Dustin Moskovitz's Founder's Fund. This investment highlights the growing interest in advanced AI and machine learning technologies that are shaping the future of manufacturing, logistics, and smart infrastructure, which are core components of Industry 4.0.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Yunhe Partners | new energy vehicle value chain, clean energy, new materials, energy efficiency improvement, environment conservation, recycling, clean production, life quality improvement, overall efficiency improvement | ||||

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| Yingke Capital | life science, dual-carbon technology, hardcore technology, chip semiconductor, integrated circuit, new materials, high-end manufacturing | ||||

| XRC Labs | analytics, consumer brand, consumer healthtech, data infrastructure, ecom tech, generative ai, martech, marketplace, commerce, manufacturing, store tech, supply chain, web3 | Generalist; United States; Canada; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Cameroon; Comoros; Djibouti; Egypt; Equatorial Guinea; Eritrea; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates | Series A, Seed | ||

| Xplorer Capital | artificial intelligence, automation, iot, enterprise saas, data solutions, robotics, autonomous, drones, machine learning, big data,disruptive technology | Canada; United States; Germany | Seed, Series A, Series B | USD 100000000 | |

| Xesgalicia | biotechnological, industry | Spain, Galicia | Pre-Seed, Seed | ||

| Xerox Ventures | Industry 4.0 | Seed |

84 active CVC investors in Industry 4.0

Active corporate venture capital (CVC) firms have been investing heavily in Industry 4.0 technologies over the past 3 years. Notable players include GE Ventures, which backed AI-powered robotics startup Vicarious, and Siemens' Next47, which invested in blockchain platform Chainyard. These CVC firms are shaping the future of manufacturing and industrial automation.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Xerox Ventures | Industry 4.0 | Seed | |||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed | ||

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Viessmann | heat transfer, district heating, boiler rooms, manufactures, drinking water, renewable, climate control, horticulture, buildings, greenhouse cultivation, energy efficient | ||||

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| TRUMPF Venture GmbH | photonics,laser technology, manufacturing technology, sensors, automation, connectivity,compute, industrial software systems,sustainability | Generalist | Series A, Series B, Series C, Series D |

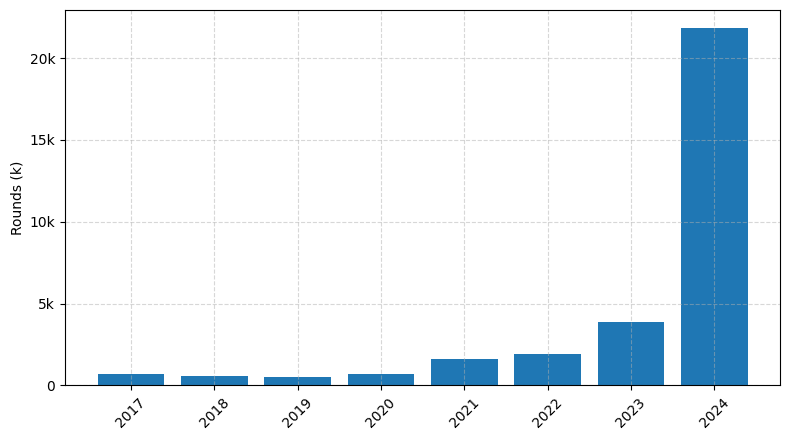

Investments by year: Round

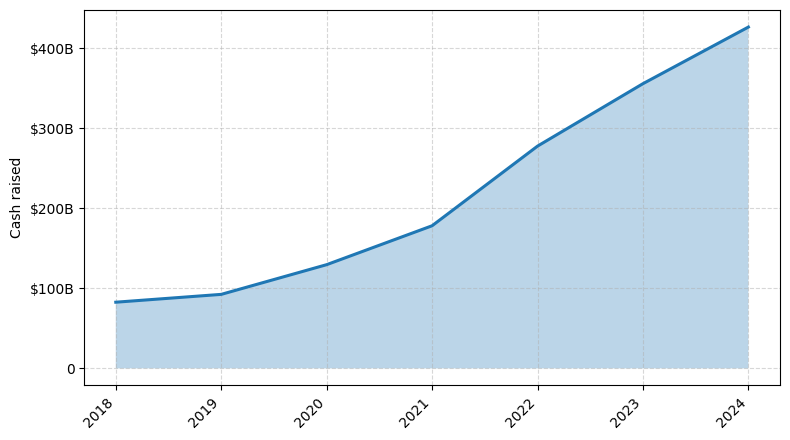

Investments by year: Cash raised

How is fundraising in Industry 4.0 different from other VC fundraising

Fundraising for Industry 4.0 startups differs from general startup fundraising due to the unique challenges posed by emerging technologies. Industry 4.0 startups often require significant upfront investment for research, development, and prototyping of advanced technologies, such as artificial intelligence, robotics, and the Internet of Things. Investors may be more cautious about the technical risks and longer timelines associated with these innovations. Additionally, Industry 4.0 startups may need to navigate complex regulatory environments and establish partnerships with established industry players. Demonstrating the scalability and real-world applications of their technologies is crucial to securing funding. Successful Industry 4.0 fundraising requires a deep understanding of the technological landscape, a clear value proposition, and a compelling vision for how the startup can transform traditional industries.

Top Funded Industry 4.0 Startups

1. Automation Anywhere: Approximately $840 million in funding, focused on robotic process automation (RPA) and intelligent automation.

2. UiPath: Approximately $2 billion in funding, specializing in enterprise RPA and AI-powered automation.

3. Bright Machines: Approximately $179 million in funding, developing modular, software-defined manufacturing solutions.

4. Tulip Interfaces: Approximately $100 million in funding, providing industrial IoT and manufacturing execution systems.

5. Seebo: Approximately $50 million in funding, offering process-based artificial intelligence for manufacturing optimization.

2. UiPath: Approximately $2 billion in funding, specializing in enterprise RPA and AI-powered automation.

3. Bright Machines: Approximately $179 million in funding, developing modular, software-defined manufacturing solutions.

4. Tulip Interfaces: Approximately $100 million in funding, providing industrial IoT and manufacturing execution systems.

5. Seebo: Approximately $50 million in funding, offering process-based artificial intelligence for manufacturing optimization.

What you should include in Industry 4.0 pitch deck

When pitching Industry 4.0, your deck should include the following unique slides:

1. Industry 4.0 Overview: Explain the key concepts, technologies, and benefits of this industrial revolution.

2. Digital Transformation: Showcase how your solution enables the integration of digital technologies into manufacturing processes.

3. Cyber-Physical Systems: Highlight the interconnectivity between physical assets and digital systems in your offering.

4. Data Analytics and Automation: Demonstrate how your solution leverages data-driven insights and automation to optimize operations.

5. Sustainability and Efficiency: Emphasize how your Industry 4.0 approach promotes environmental sustainability and operational efficiency.

1. Industry 4.0 Overview: Explain the key concepts, technologies, and benefits of this industrial revolution.

2. Digital Transformation: Showcase how your solution enables the integration of digital technologies into manufacturing processes.

3. Cyber-Physical Systems: Highlight the interconnectivity between physical assets and digital systems in your offering.

4. Data Analytics and Automation: Demonstrate how your solution leverages data-driven insights and automation to optimize operations.

5. Sustainability and Efficiency: Emphasize how your Industry 4.0 approach promotes environmental sustainability and operational efficiency.

How to Prepare Your Industry 4.0 Startup for Investment

Preparing an Industry 4.0 startup for investment can be a crucial step in securing the necessary funding to drive growth and innovation. As an advisory, it is essential to understand the key elements that venture capital (VC) investors typically expect to see in a startup's pitch deck.

Here is a summary and five bullet points outlining what VC investors typically expect:

Preparing an Industry 4.0 startup for investment requires a strategic approach. VC investors often seek startups that demonstrate a clear understanding of the market, a unique value proposition, a scalable business model, a strong team, and a well-defined roadmap for growth and profitability.

VC investors typically expect startups to demonstrate:

1. A deep understanding of the Industry 4.0 landscape and the specific problem the startup is addressing.

2. A unique and innovative solution that leverages emerging technologies, such as the Internet of Things (IoT), artificial intelligence, or advanced analytics.

3. A scalable business model with a clear path to revenue generation and profitability.

4. A talented and experienced team with the necessary expertise to execute the startup's vision.

5. A well-defined roadmap for growth, including milestones, market expansion plans, and a clear use of the invested capital.

By addressing these key elements, startups can increase their chances of securing investment and positioning themselves for success in the rapidly evolving Industry 4.0 landscape.

Here is a summary and five bullet points outlining what VC investors typically expect:

Preparing an Industry 4.0 startup for investment requires a strategic approach. VC investors often seek startups that demonstrate a clear understanding of the market, a unique value proposition, a scalable business model, a strong team, and a well-defined roadmap for growth and profitability.

VC investors typically expect startups to demonstrate:

1. A deep understanding of the Industry 4.0 landscape and the specific problem the startup is addressing.

2. A unique and innovative solution that leverages emerging technologies, such as the Internet of Things (IoT), artificial intelligence, or advanced analytics.

3. A scalable business model with a clear path to revenue generation and profitability.

4. A talented and experienced team with the necessary expertise to execute the startup's vision.

5. A well-defined roadmap for growth, including milestones, market expansion plans, and a clear use of the invested capital.

By addressing these key elements, startups can increase their chances of securing investment and positioning themselves for success in the rapidly evolving Industry 4.0 landscape.