FREE Investor Database

Top Venture Investors in Deeptech Industry

Top Venture Investors in Deeptech Industry

Discover leading VC and CVC investors specializing in Deeptech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The world of investments has witnessed a remarkable surge in the Deeptech sector over the past three years. Since 2022, the industry has seen a significant influx of capital, with numerous startups receiving substantial funding to drive innovation and technological advancements. According to industry reports, the Deeptech investment landscape has experienced a remarkable transformation, with over 500 deals completed in the last three years, totaling a staggering $25 billion in investments. Some of the core startups that have received substantial funding include Quantum Computing Inc., which secured a $100 million Series B round, and Neuralink, Elon Musk's ambitious brain-computer interface company, which raised $205 million in a Series C round. Additionally, several high-profile deals, such as the $500 million acquisition of Nuro by Alphabet, have showcased the growing interest and potential of the Deeptech industry. One particularly intriguing deal was the $150 million investment in Anthropic, a leading artificial intelligence research company, highlighting the continued focus on cutting-edge technologies that have the power to shape the future.

95 active VC investors in Deeptech

In the last three years, the venture capital landscape has seen a surge of interest in Deeptech startups. Key players like Andreessen Horowitz, Khosla Ventures, and Lux Capital have been actively investing in this space, recognizing the transformative potential of cutting-edge technologies. One notable example is OpenAI's $1 billion Series C round in 2020, which was one of the largest Deeptech investments in recent years, highlighting the growing appetite for innovative solutions that push the boundaries of what's possible.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZORA Ventures | climate change, sustainable food systems, deep tech | Israel | Series A, Series B | ||

| Zero Knowledge | deep tech, blockchain, crypto | Israel; United States; Colombia | Pre-Seed, Seed | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Yunqi Partners | Deeptech | China; Japan; Singapore; United States; Germany | Seed, Series A, Series B | ||

| Yingke Capital | life science, dual-carbon technology, hardcore technology, chip semiconductor, integrated circuit, new materials, high-end manufacturing | ||||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| YI Capital | industrial Internet, ndustrial upgrading, enterprise services, hard technologies, security, big data, cloud, artificial intelligence, robotics, software, digital design, cyber security, business management | China | |||

| Yanmar Ventures | deep-tech | ||||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xora Innovation | Deeptech | United States; United Kingdom; Singapore | Seed, Series A, Series B |

58 active CVC investors in Deeptech

Active corporate venture capital (CVC) firms have been increasingly investing in Deeptech startups in the past 3 years. Notable CVC investors include Siemens' Next47, which backed quantum computing firm IonQ, and Bosch Venture Capital, which invested in autonomous driving startup Apex.AI. These CVC firms are driving innovation across various Deeptech sectors.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| UMC Capital | semiconductors, deep tech | United, States; China; Taiwan | |||

| TRUMPF Venture GmbH | photonics,laser technology, manufacturing technology, sensors, automation, connectivity,compute, industrial software systems,sustainability | Generalist | Series A, Series B, Series C, Series D | ||

| Toyota Ventures | artificial intelligence, autonomy, mobility, robotics, cloud technology, smart cities, digital health, fintech, materials, climate | Generalist | Seed, Series A, Series B | ||

| Teklas Ventures | advanced manufacturing, new materials, supply chain, logistics, mobility | United States; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Generalist |

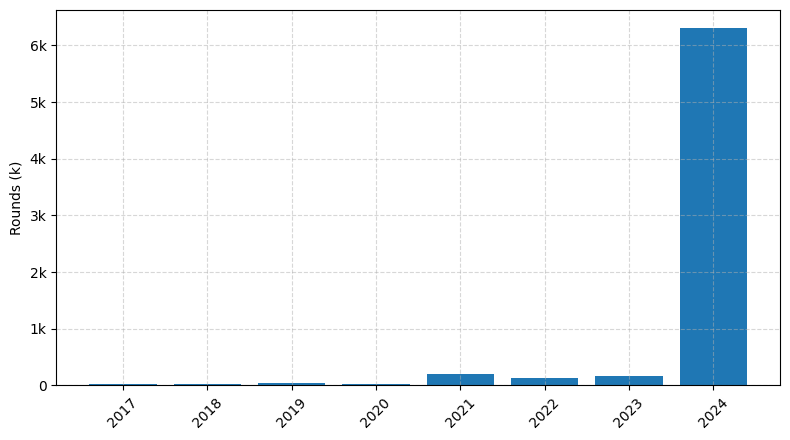

Investments by year: Round

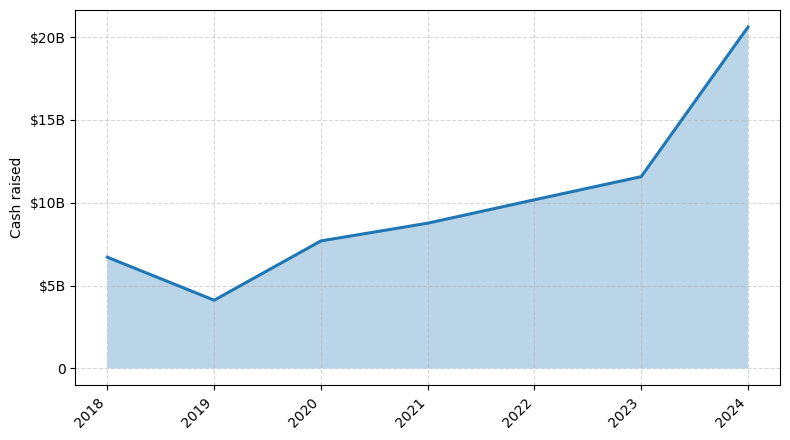

Investments by year: Cash raised

How is fundraising in Deeptech different from other VC fundraising

Fundraising in the Deeptech sector differs from general startup fundraising in several key ways. Deeptech companies often require significant upfront investments to develop complex, cutting-edge technologies, which can make it challenging to attract early-stage funding. Investors in this space tend to have a higher risk tolerance and a longer investment horizon, as Deeptech innovations can take years to reach commercialization. Additionally, Deeptech startups may need to navigate complex regulatory environments and secure specialized technical talent, further complicating the fundraising process. As a result, Deeptech founders must be adept at articulating the technical merits and long-term potential of their innovations, while also demonstrating a clear path to market and a compelling business model. Effective fundraising in Deeptech requires a unique blend of technical expertise, commercial acumen, and strategic foresight.

Top Funded Deeptech Startups

1. Anthropic: Approximately $200 million raised, focused on developing safe and ethical artificial intelligence.

2. Cerebras Systems: Approximately $450 million raised, specializing in building advanced AI hardware and chips.

3. Rigetti Computing: Approximately $190 million raised, developing quantum computing technology.

4. Vicarious: Approximately $250 million raised, working on building artificial general intelligence (AGI).

5. Neuralink: Approximately $363 million raised, focused on developing brain-computer interface technology.

2. Cerebras Systems: Approximately $450 million raised, specializing in building advanced AI hardware and chips.

3. Rigetti Computing: Approximately $190 million raised, developing quantum computing technology.

4. Vicarious: Approximately $250 million raised, working on building artificial general intelligence (AGI).

5. Neuralink: Approximately $363 million raised, focused on developing brain-computer interface technology.

What you should include in Deeptech pitch deck

When creating a Deeptech pitch deck, include the following unique slides:

1. Technology Overview: Explain the core technology, its working principles, and the problem it solves.

2. Intellectual Property: Highlight your patents, trade secrets, and other IP that provide a competitive advantage.

3. Technical Roadmap: Outline the development milestones, timelines, and resources required to bring the technology to market.

4. Regulatory Landscape: Discuss any regulatory approvals or certifications needed and your strategy to navigate them.

5. Scalability and Manufacturing: Describe your plans for scaling production and the feasibility of your manufacturing approach.

1. Technology Overview: Explain the core technology, its working principles, and the problem it solves.

2. Intellectual Property: Highlight your patents, trade secrets, and other IP that provide a competitive advantage.

3. Technical Roadmap: Outline the development milestones, timelines, and resources required to bring the technology to market.

4. Regulatory Landscape: Discuss any regulatory approvals or certifications needed and your strategy to navigate them.

5. Scalability and Manufacturing: Describe your plans for scaling production and the feasibility of your manufacturing approach.

How to Prepare Your Deeptech Startup for Investment

Preparing a Deeptech startup for investment requires a strategic approach to ensure that the venture is investment-ready. As a startup founder, you must demonstrate the viability and potential of your technology-driven solution to potential investors.

Here are five key elements that VC investors typically expect to see in a Deeptech startup's pitch deck:

1. Clearly defined problem and solution: Articulate the specific problem your technology addresses and how your solution provides a unique and compelling value proposition.

2. Robust technical roadmap: Outline the technical milestones, development timeline, and the team's ability to execute the plan effectively.

3. Intellectual property (IP) protection: Demonstrate that your technology is protected through patents, trade secrets, or other forms of IP, ensuring a sustainable competitive advantage.

4. Market opportunity and traction: Provide a comprehensive analysis of the target market, its size, growth potential, and any early signs of customer adoption or revenue generation.

5. Experienced and complementary team: Highlight the expertise and relevant experience of your founding team, as well as any key hires or advisors who can contribute to the company's success.

By addressing these critical elements, you can increase the likelihood of securing investment and positioning your Deeptech startup for long-term growth and success.

Here are five key elements that VC investors typically expect to see in a Deeptech startup's pitch deck:

1. Clearly defined problem and solution: Articulate the specific problem your technology addresses and how your solution provides a unique and compelling value proposition.

2. Robust technical roadmap: Outline the technical milestones, development timeline, and the team's ability to execute the plan effectively.

3. Intellectual property (IP) protection: Demonstrate that your technology is protected through patents, trade secrets, or other forms of IP, ensuring a sustainable competitive advantage.

4. Market opportunity and traction: Provide a comprehensive analysis of the target market, its size, growth potential, and any early signs of customer adoption or revenue generation.

5. Experienced and complementary team: Highlight the expertise and relevant experience of your founding team, as well as any key hires or advisors who can contribute to the company's success.

By addressing these critical elements, you can increase the likelihood of securing investment and positioning your Deeptech startup for long-term growth and success.