FREE Investor Database

Top Venture Investors in Fintech Industry

Top Venture Investors in Fintech Industry

Discover leading VC and CVC investors specializing in Fintech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The fintech industry has witnessed a surge in investments over the past three years, with the sector attracting significant attention from investors worldwide. Since 2022, the fintech ecosystem has seen a remarkable influx of capital, with numerous startups securing substantial funding to drive innovation and disrupt traditional financial services.

In the last three years, the fintech industry has witnessed a staggering number of investments, with over 5,000 deals completed globally. The total amount of money invested in fintech startups during this period has exceeded $150 billion, showcasing the immense potential and growth of the sector.

Some of the core fintech startups that have received significant investments include Stripe, Chime, and Plaid, each securing multi-billion-dollar funding rounds. Additionally, several high-profile deals, such as Visa's acquisition of Plaid for $5.3 billion and Mastercard's purchase of Finicity for $825 million, have further highlighted the industry's attractiveness.

Investments in fintech continue to soar, as the sector's ability to revolutionize financial services and provide innovative solutions to consumers and businesses alike has made it a prime target for investors seeking to capitalize on the industry's promising future.

In the last three years, the fintech industry has witnessed a staggering number of investments, with over 5,000 deals completed globally. The total amount of money invested in fintech startups during this period has exceeded $150 billion, showcasing the immense potential and growth of the sector.

Some of the core fintech startups that have received significant investments include Stripe, Chime, and Plaid, each securing multi-billion-dollar funding rounds. Additionally, several high-profile deals, such as Visa's acquisition of Plaid for $5.3 billion and Mastercard's purchase of Finicity for $825 million, have further highlighted the industry's attractiveness.

Investments in fintech continue to soar, as the sector's ability to revolutionize financial services and provide innovative solutions to consumers and businesses alike has made it a prime target for investors seeking to capitalize on the industry's promising future.

95 active VC investors in Fintech

In the last three years, the fintech industry has seen a surge in venture capital investment, with leading firms like Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins actively backing innovative startups. One of the biggest venture capital rounds in recent years was Stripe's $600 million Series G funding in 2021, which valued the digital payments company at $95 billion. This late-stage investment highlights the continued appetite for fintech solutions that streamline financial services and drive digital transformation across industries.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Fintech | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zone2boost | fintech, retail | France; Spain; United Kingdom; Ireland | Series A, Seed | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| Zeta Alpha | Fintech | Seed | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zero-One Capital | Fintech | ||||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Zentro Founders | media, fintech, marketplaces | ||||

| Zeno Ventures | Fintech | Generalist | Series A, Series B |

98 active CVC investors in Fintech

Active corporate venture capital (CVC) firms have been increasingly investing in the fintech sector over the past three years. Notable CVC investors include Citi Ventures, which backed digital banking platform Chime, and Barclays Ventures, which invested in blockchain startup Chainalysis. These CVC firms are driving innovation and shaping the future of financial services.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Fintech | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zone2boost | fintech, retail | France; Spain; United Kingdom; Ireland | Series A, Seed | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xerox Ventures | Fintech | Seed | |||

| Wormhole Capital | Fintech | Series A, Seed, Series B, Series C | |||

| Workday Ventures | financial management, human capital, planning, analytics, collaboration, productivity, intelligent automation, mixed reality, blockchain | Series D, Series A, Series E, Series F, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Wintermute Ventures | Fintech | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Whisk Ventures | web3, esports/gaming, fintech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C |

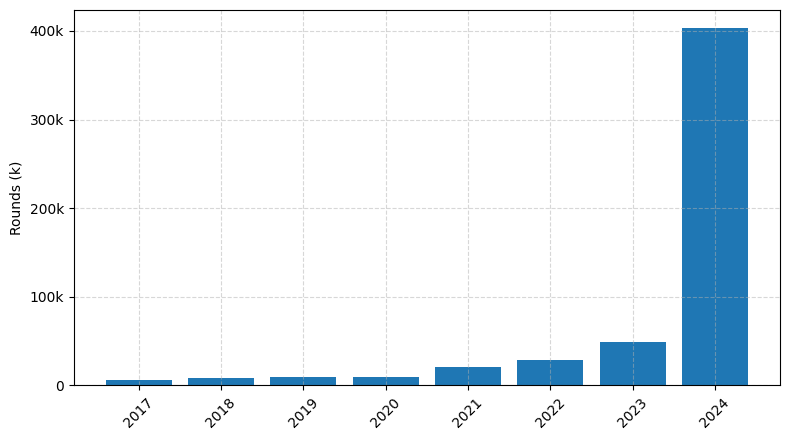

Investments by year: Round

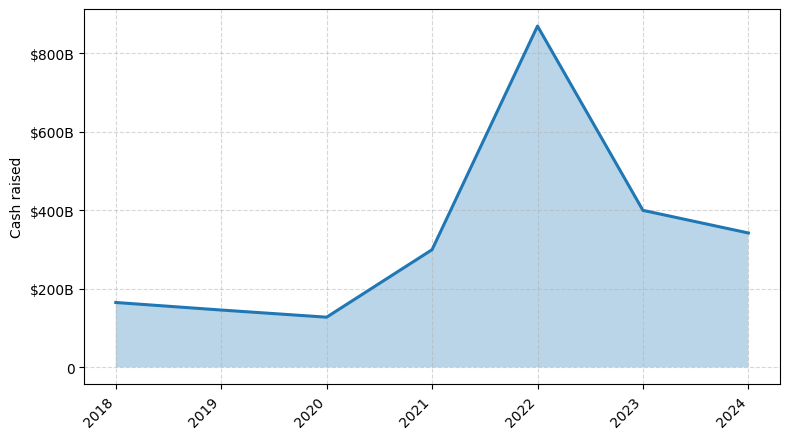

Investments by year: Cash raised

How is fundraising in Fintech different from other VC fundraising

Fundraising in the Fintech industry differs from general startup fundraising due to the unique challenges faced by Fintech companies. Fintech startups operate in a highly regulated environment, requiring extensive compliance and regulatory approvals, which can significantly increase the time and resources required to raise funds. Additionally, Fintech companies often need to demonstrate a strong track record of security, privacy, and risk management, which can be more challenging to convey to investors compared to other tech startups. Furthermore, Fintech startups may face increased scrutiny from investors due to the sensitive nature of financial data and the potential for reputational damage in the event of a security breach or regulatory violation. As a result, Fintech fundraising often requires a more comprehensive and strategic approach to address these industry-specific challenges.

Top Funded Fintech Startups

Here is a summary of the top-funded Fintech startups globally:

• Stripe: Approximately $2.2 billion in total funding, focused on online payment processing and financial infrastructure.

• Chime: Approximately $1.5 billion in total funding, focused on digital banking and mobile banking services.

• Robinhood: Approximately $1.7 billion in total funding, focused on commission-free stock trading and investing.

• Revolut: Approximately $1.7 billion in total funding, focused on digital banking, currency exchange, and financial services.

• Klarna: Approximately $1.2 billion in total funding, focused on buy-now-pay-later services and online payments.

• Stripe: Approximately $2.2 billion in total funding, focused on online payment processing and financial infrastructure.

• Chime: Approximately $1.5 billion in total funding, focused on digital banking and mobile banking services.

• Robinhood: Approximately $1.7 billion in total funding, focused on commission-free stock trading and investing.

• Revolut: Approximately $1.7 billion in total funding, focused on digital banking, currency exchange, and financial services.

• Klarna: Approximately $1.2 billion in total funding, focused on buy-now-pay-later services and online payments.

What you should include in Fintech pitch deck

A Fintech pitch deck should include the following unique slides:

1. Problem Statement: Clearly articulate the problem your Fintech solution aims to solve.

2. Market Opportunity: Demonstrate the size and growth potential of the target market.

3. Unique Value Proposition: Highlight the unique features and benefits that differentiate your Fintech solution.

4. Business Model: Explain how your Fintech startup generates revenue and achieves profitability.

5. Competitive Landscape: Analyze the competitive landscape and position your Fintech solution within it.

6. Regulatory Compliance: Demonstrate your understanding of the regulatory environment and how your Fintech solution adheres to relevant regulations.

1. Problem Statement: Clearly articulate the problem your Fintech solution aims to solve.

2. Market Opportunity: Demonstrate the size and growth potential of the target market.

3. Unique Value Proposition: Highlight the unique features and benefits that differentiate your Fintech solution.

4. Business Model: Explain how your Fintech startup generates revenue and achieves profitability.

5. Competitive Landscape: Analyze the competitive landscape and position your Fintech solution within it.

6. Regulatory Compliance: Demonstrate your understanding of the regulatory environment and how your Fintech solution adheres to relevant regulations.

How to Prepare Your Fintech Startup for Investment

Preparing a Fintech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to have a well-crafted pitch deck that showcases the startup's unique value proposition, market opportunity, and growth potential.

When presenting to venture capital (VC) investors, startups should be prepared to demonstrate the following:

1. Innovative Technology: Highlight the cutting-edge technology that underpins the Fintech solution and how it addresses a specific market need.

2. Scalable Business Model: Demonstrate a clear path to revenue growth and profitability, with a focus on the startup's ability to scale efficiently.

3. Experienced Team: Emphasize the expertise and domain knowledge of the founding team, showcasing their ability to execute on the business plan.

4. Competitive Advantage: Clearly articulate the startup's unique competitive edge and how it differentiates itself from existing players in the Fintech space.

5. Traction and Milestones: Provide evidence of the startup's progress, such as user growth, partnerships, or regulatory approvals, to instill confidence in the investors.

By addressing these key areas, Fintech startups can increase their chances of securing investment and positioning themselves for long-term success.

When presenting to venture capital (VC) investors, startups should be prepared to demonstrate the following:

1. Innovative Technology: Highlight the cutting-edge technology that underpins the Fintech solution and how it addresses a specific market need.

2. Scalable Business Model: Demonstrate a clear path to revenue growth and profitability, with a focus on the startup's ability to scale efficiently.

3. Experienced Team: Emphasize the expertise and domain knowledge of the founding team, showcasing their ability to execute on the business plan.

4. Competitive Advantage: Clearly articulate the startup's unique competitive edge and how it differentiates itself from existing players in the Fintech space.

5. Traction and Milestones: Provide evidence of the startup's progress, such as user growth, partnerships, or regulatory approvals, to instill confidence in the investors.

By addressing these key areas, Fintech startups can increase their chances of securing investment and positioning themselves for long-term success.