FREE Investor Database

Top Venture Investors in Construction Industry

Top Venture Investors in Construction Industry

Discover leading VC and CVC investors specializing in Construction. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The construction industry has witnessed a surge in investment activity over the past three years, with a growing number of startups and established players attracting significant capital. Since 2022, the sector has seen a total of 87 investment deals, amounting to a staggering $3.2 billion in funding. Among the core startups that have received substantial investments are Modulous, a modular construction technology company that raised $33 million, and Veev, a prefabricated housing startup that secured $400 million in funding. Some of the most expensive deals include Katerra's $435 million Series D round and Prescient's $190 million Series C. One particularly interesting deal was the $100 million investment in Mighty Buildings, a 3D-printed construction company, by a consortium of investors. The construction industry's embrace of innovative technologies and sustainable practices has made it an increasingly attractive investment destination, with the potential for continued growth and transformation in the years to come.

98 active VC investors in Construction

In the last three years, the construction industry has seen increased venture capital investment, with firms recognizing the potential for innovation and disruption. Key players include Brick & Mortar Ventures, which focuses on construction technology, and Navitas Capital, which invests in sustainable building solutions. One notable example is Katerra's $865 million Series D round in 2019, led by SoftBank Vision Fund. This late-stage investment underscores the industry's appetite for technology-driven solutions that can streamline construction processes, improve efficiency, and address sustainability challenges.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| Zigg Capital | real estate | Generalist | Seed | USD 225000000 | |

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| Zacua Ventures | productivity, building lifecycle, urbanization, buildings and cities | Generalist | Seed, Series A, Series B | USD 56000000 | |

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| York IE | infrastructure, developer tools, cybersecurity, marketing, platforms, vertical SaaS, AI, Communication, Sustainability, B2B, Analytics, Foodtech, Consumer, Real Estate, Cybersecurity, Aerospace, Digital Media | United States; Canada; Norway | Series A, Seed, Pre Seed | ||

| Xplor Investment | smart city, sustainability | Series B, Series A | |||

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| XAnge / SPI | digital, deeptech, ai, enterprise, smb software, digital safety, developer tools, middleware, b2b marketplaces, hardware, healthcare, work experience, housing, real estate, environment, education, fintechs, cryptos, mobility, food, proptech, data, edtech, agritech | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Series A, Series B | EUR 220000000 |

72 active CVC investors in Construction

Active corporate venture capital (CVC) firms have been investing in the construction industry, seeking to drive innovation and capitalize on emerging trends. Key players include Autodesk Ventures, which has backed construction tech startups like Dusty Robotics, and Cemex Ventures, which has invested in modular construction solutions. These CVC firms are shaping the future of the built environment.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| Viessmann | heat transfer, district heating, boiler rooms, manufactures, drinking water, renewable, climate control, horticulture, buildings, greenhouse cultivation, energy efficient | ||||

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| Trimble Ventures | construction, transportation, agriculture, geospatial | Generalist | Series A, Series B, Series C, Series D | ||

| Trifork Labs | Construction | Generalist | Pre-Seed, Seed, Series A, Series B | ||

| TELUS Ventures | ag tech, connected consumer, digital health, smart cities and iot | Canada; United States | |||

| Suffolk Construction | real estate | United States | Seed | ||

| STIHL Digital | smart forestry, advanced gardening, landscaping, agriculture technology, construction technology, sustainability | United States; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A, Series B |

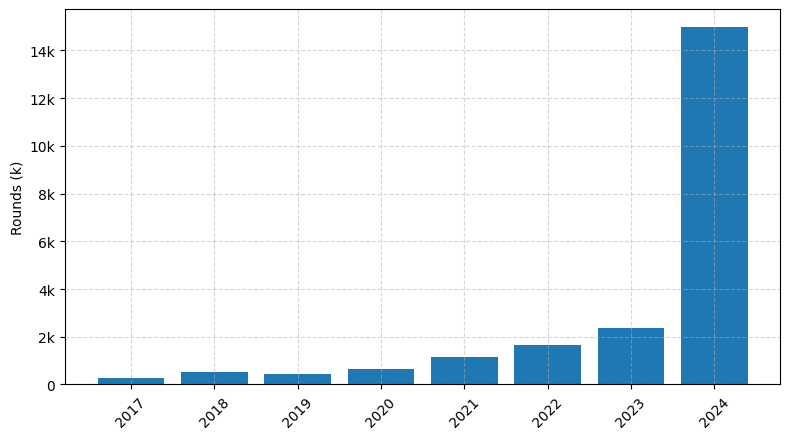

Investments by year: Round

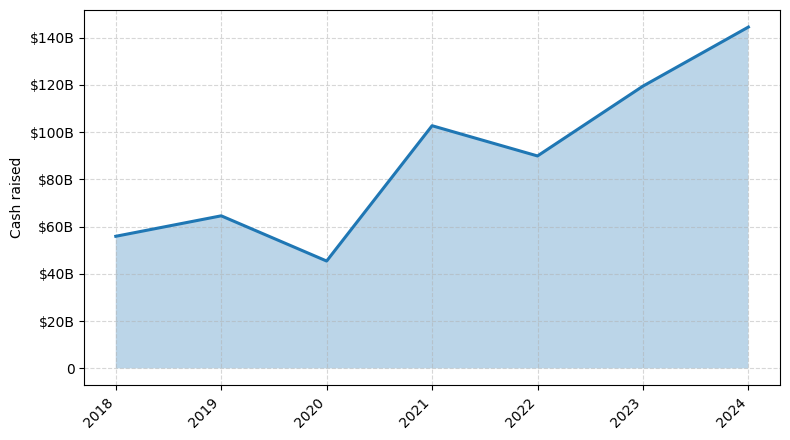

Investments by year: Cash raised

How is fundraising in Construction different from other VC fundraising

Fundraising in the construction industry differs from general startup fundraising in several key ways. Firstly, construction projects often require significant upfront capital investments, with long lead times before revenue generation. This can make it challenging to secure funding from traditional venture capital sources, which typically prioritize faster growth and quicker returns. Additionally, the construction industry is heavily regulated, with strict compliance requirements and project-specific risks that investors may not be familiar with. Consequently, construction companies often rely more on specialized lenders, such as commercial banks, private equity firms, or government-backed programs, to finance their projects. These lenders may have a deeper understanding of the industry's unique challenges and can provide more tailored financing solutions.

Top Funded Construction Startups

1. Katerra: Approximately $1.2 billion in funding, focused on modular construction and building materials.

2. Procore Technologies: Approximately $633 million in funding, providing construction management software.

3. Rhumbix: Approximately $42 million in funding, focused on digital tools for construction site management.

4. Fieldwire: Approximately $38 million in funding, providing construction project management software.

5. Versatile: Approximately $20 million in funding, focused on construction automation and robotics.

2. Procore Technologies: Approximately $633 million in funding, providing construction management software.

3. Rhumbix: Approximately $42 million in funding, focused on digital tools for construction site management.

4. Fieldwire: Approximately $38 million in funding, providing construction project management software.

5. Versatile: Approximately $20 million in funding, focused on construction automation and robotics.

What you should include in Construction pitch deck

When creating a Construction pitch deck, the following unique slides should be included:

1. Project Overview: Provide a concise summary of the construction project, including its scope, timeline, and key objectives.

2. Market Analysis: Demonstrate your understanding of the target market, industry trends, and potential growth opportunities.

3. Competitive Advantage: Highlight the unique features or innovations that set your construction project apart from competitors.

4. Financial Projections: Present detailed financial projections, including estimated costs, revenue streams, and potential return on investment.

5. Team Expertise: Showcase the qualifications and experience of your construction team to instill confidence in your ability to deliver the project successfully.

1. Project Overview: Provide a concise summary of the construction project, including its scope, timeline, and key objectives.

2. Market Analysis: Demonstrate your understanding of the target market, industry trends, and potential growth opportunities.

3. Competitive Advantage: Highlight the unique features or innovations that set your construction project apart from competitors.

4. Financial Projections: Present detailed financial projections, including estimated costs, revenue streams, and potential return on investment.

5. Team Expertise: Showcase the qualifications and experience of your construction team to instill confidence in your ability to deliver the project successfully.

How to Prepare Your Construction Startup for Investment

Preparing a Construction Startup for Investment

As a construction startup seeking investment, it's crucial to demonstrate your business's viability, growth potential, and competitive edge. To attract venture capital (VC) investors, you'll need to present a well-crafted pitch deck that addresses their key concerns.

VC investors typically expect construction startups to demonstrate the following in their pitch deck review:

- Clearly defined market opportunity: Provide a detailed analysis of the target market, its size, growth trends, and your startup's addressable market share.

- Innovative and scalable business model: Showcase how your construction technology or service offering can disrupt the industry and achieve sustainable growth.

- Experienced and capable team: Highlight the expertise and relevant experience of your founding team and key personnel.

- Robust financial projections: Present a comprehensive financial plan, including revenue streams, cost structures, and a clear path to profitability.

- Competitive advantage and barriers to entry: Explain how your startup's unique value proposition and intellectual property can provide a sustainable competitive edge.

By addressing these key elements in your pitch deck, you'll be better positioned to attract the attention and investment of VC firms interested in the promising construction technology and services sector.

As a construction startup seeking investment, it's crucial to demonstrate your business's viability, growth potential, and competitive edge. To attract venture capital (VC) investors, you'll need to present a well-crafted pitch deck that addresses their key concerns.

VC investors typically expect construction startups to demonstrate the following in their pitch deck review:

- Clearly defined market opportunity: Provide a detailed analysis of the target market, its size, growth trends, and your startup's addressable market share.

- Innovative and scalable business model: Showcase how your construction technology or service offering can disrupt the industry and achieve sustainable growth.

- Experienced and capable team: Highlight the expertise and relevant experience of your founding team and key personnel.

- Robust financial projections: Present a comprehensive financial plan, including revenue streams, cost structures, and a clear path to profitability.

- Competitive advantage and barriers to entry: Explain how your startup's unique value proposition and intellectual property can provide a sustainable competitive edge.

By addressing these key elements in your pitch deck, you'll be better positioned to attract the attention and investment of VC firms interested in the promising construction technology and services sector.