FREE Investor Database

Top Venture Investors in Food & Beverage Industry

Top Venture Investors in Food & Beverage Industry

Discover leading VC and CVC investors specializing in Food & Beverage. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The food and beverage industry has been a hotbed of investment activity in recent years, with a surge of interest from venture capitalists and private equity firms. Over the past three years, since 2022, the sector has witnessed a significant influx of capital, with hundreds of investments taking place. According to industry reports, the total amount invested in food and beverage startups during this period has exceeded $10 billion.

Some of the core startups that have received substantial investments include plant-based meat alternatives like Beyond Meat and Impossible Foods, as well as innovative food delivery platforms like DoorDash and Uber Eats. The most expensive deals in the sector have involved the acquisition of established brands, such as the $4.2 billion acquisition of Whole Foods by Amazon in 2017.

One particularly interesting deal was the $1.8 billion investment in Oatly, a Swedish oat milk company, by a consortium of investors including Blackstone, Oprah Winfrey, and Natalie Portman. This investment underscores the growing demand for healthier and more sustainable food and beverage options.

The food and beverage industry's resilience and the increasing consumer focus on wellness and sustainability have made it an attractive investment destination, with the potential for continued growth and innovation in the years to come.

Some of the core startups that have received substantial investments include plant-based meat alternatives like Beyond Meat and Impossible Foods, as well as innovative food delivery platforms like DoorDash and Uber Eats. The most expensive deals in the sector have involved the acquisition of established brands, such as the $4.2 billion acquisition of Whole Foods by Amazon in 2017.

One particularly interesting deal was the $1.8 billion investment in Oatly, a Swedish oat milk company, by a consortium of investors including Blackstone, Oprah Winfrey, and Natalie Portman. This investment underscores the growing demand for healthier and more sustainable food and beverage options.

The food and beverage industry's resilience and the increasing consumer focus on wellness and sustainability have made it an attractive investment destination, with the potential for continued growth and innovation in the years to come.

95 active VC investors in Food & Beverage

In the last three years, the food and beverage industry has seen a surge in venture capital investment. Key players like Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins have been actively investing in innovative food and beverage startups. One of the biggest venture capital rounds in the last two years was Impossible Foods' $500 million Series F funding in 2020, led by existing investors including Mirae Asset Global Investments and Khosla Ventures. This investment highlights the growing interest and confidence in plant-based meat alternatives, as the industry continues to evolve and attract significant funding.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| ZORA Ventures | climate change, sustainable food systems, deep tech | Israel | Series A, Series B | ||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| Zintinus | food tech | Generalist; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zane Venture Fund | housing, climate, digital health, financial inclusion, housing security, food access, stability, health equity, financial inclusion, education | United States | Series A, Pre-Seed, Seed, Series B | ||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed |

50 active CVC investors in Food & Beverage

Active corporate venture capital (CVC) firms have been investing heavily in the Food & Beverage sector in the past 3 years. Key players like PepsiCo Ventures, Tyson New Ventures, and Danone Manifesto Ventures have backed innovative startups in areas like alternative proteins, sustainable packaging, and personalized nutrition.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Tyson Ventures | future of food | ||||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 | |

| Syngenta Ventures | agri-food system, food | ||||

| Stanford GSB Impact Fund | education, energy and the environment, fintech, food, agriculture, justice, healthcare, urban development | Generalist; United States | Seed, Series A | ||

| Sony Innovation Fund | Food & Beverage | Generalist | Seed | ||

| Seeds Capital | manufacturing, health, biomedical sciences, sustainability, agritech, foodtech, artificial intelligence, blockchain, quantum, space technologies, maritime tech, engineering, urban solutions | Singapore | Pre-Seed, Seed, Series A, Series B |

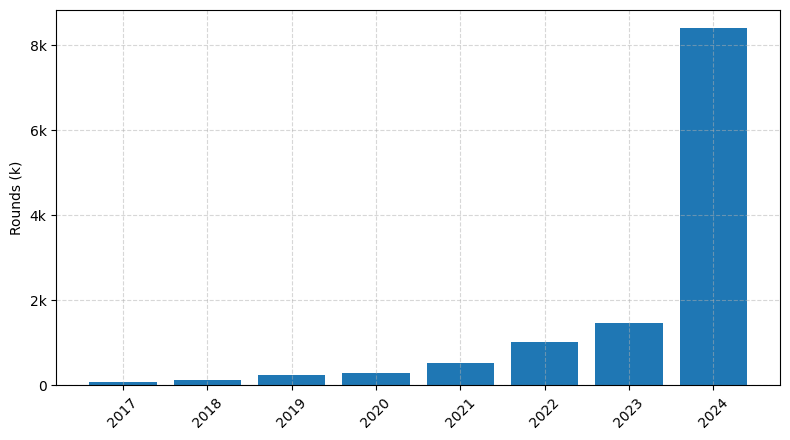

Investments by year: Round

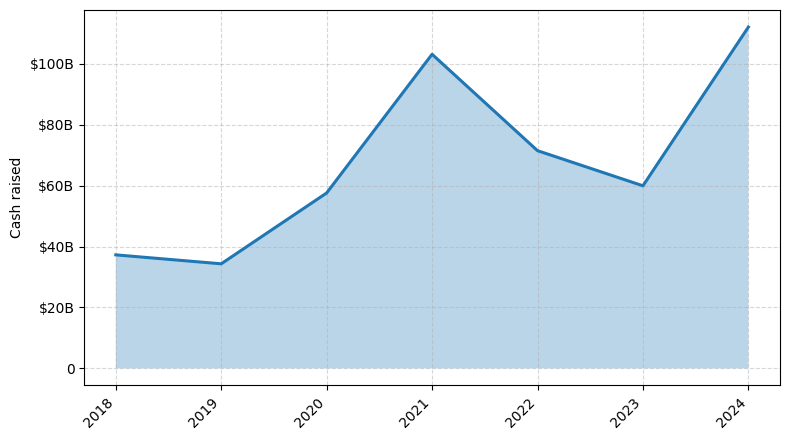

Investments by year: Cash raised

How is fundraising in Food & Beverage different from other VC fundraising

Fundraising in the Food & Beverage industry differs from general startup fundraising in several key ways. Firstly, the capital requirements are often higher due to the need for specialized equipment, inventory, and distribution networks. Additionally, the regulatory landscape is more complex, with strict food safety and labeling requirements that must be navigated. Investors in this space also tend to have a deeper understanding of the industry's unique challenges, such as fluctuating commodity prices, supply chain disruptions, and the importance of brand building. Furthermore, the timeline to profitability can be longer, as new food and beverage products often require extensive consumer testing and market validation. Consequently, Food & Beverage startups must demonstrate a clear path to scalability and profitability to secure funding from discerning investors.

Top Funded Food & Beverage Startups

1. Impossible Foods: Approximately $1.5 billion in total funding, focused on plant-based meat alternatives.

2. Oatly: Approximately $1.2 billion in total funding, focused on oat-based dairy alternatives.

3. Instacart: Approximately $2.7 billion in total funding, focused on online grocery delivery and pickup services.

4. Sweetgreen: Approximately $730 million in total funding, focused on fast-casual, healthy, and sustainable restaurant chain.

5. Juul Labs: Approximately $14.5 billion in total funding, focused on e-cigarette and vaping products.

2. Oatly: Approximately $1.2 billion in total funding, focused on oat-based dairy alternatives.

3. Instacart: Approximately $2.7 billion in total funding, focused on online grocery delivery and pickup services.

4. Sweetgreen: Approximately $730 million in total funding, focused on fast-casual, healthy, and sustainable restaurant chain.

5. Juul Labs: Approximately $14.5 billion in total funding, focused on e-cigarette and vaping products.

What you should include in Food & Beverage pitch deck

When creating a Food & Beverage pitch deck, include the following unique slides:

1. Product Overview: Provide a detailed description of your food or beverage product, highlighting its unique features and benefits.

2. Market Analysis: Demonstrate your understanding of the target market, competition, and industry trends.

3. Production and Sourcing: Explain your manufacturing process, supply chain, and sourcing of ingredients.

4. Branding and Packaging: Showcase your product's branding, packaging design, and how it appeals to your target audience.

5. Financial Projections: Present your financial projections, including sales, costs, and profitability.

1. Product Overview: Provide a detailed description of your food or beverage product, highlighting its unique features and benefits.

2. Market Analysis: Demonstrate your understanding of the target market, competition, and industry trends.

3. Production and Sourcing: Explain your manufacturing process, supply chain, and sourcing of ingredients.

4. Branding and Packaging: Showcase your product's branding, packaging design, and how it appeals to your target audience.

5. Financial Projections: Present your financial projections, including sales, costs, and profitability.

How to Prepare Your Food & Beverage Startup for Investment

Preparing a Food & Beverage startup for investment requires a strategic approach to ensure that the business is investment-ready. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your Food & Beverage startup for investment, consider the following:

1. Develop a Compelling Business Plan: Craft a comprehensive business plan that outlines your market opportunity, competitive landscape, product or service offerings, financial projections, and growth strategies.

2. Demonstrate a Unique Value Proposition: Clearly articulate how your startup's products or services address a specific market need and differentiate it from competitors.

3. Highlight Traction and Scalability: Provide evidence of your startup's growth, customer acquisition, and the potential for scalability to showcase its viability and future potential.

4. Assemble a Strong Management Team: Highlight the expertise, experience, and track record of your founding team and key personnel to instill confidence in your ability to execute the business plan.

5. Outline a Robust Financial Model: Present a detailed financial model that includes revenue projections, cost structures, and a clear path to profitability and sustainable growth.

By addressing these key elements, you can increase your chances of securing investment and positioning your Food & Beverage startup for success.

To prepare your Food & Beverage startup for investment, consider the following:

1. Develop a Compelling Business Plan: Craft a comprehensive business plan that outlines your market opportunity, competitive landscape, product or service offerings, financial projections, and growth strategies.

2. Demonstrate a Unique Value Proposition: Clearly articulate how your startup's products or services address a specific market need and differentiate it from competitors.

3. Highlight Traction and Scalability: Provide evidence of your startup's growth, customer acquisition, and the potential for scalability to showcase its viability and future potential.

4. Assemble a Strong Management Team: Highlight the expertise, experience, and track record of your founding team and key personnel to instill confidence in your ability to execute the business plan.

5. Outline a Robust Financial Model: Present a detailed financial model that includes revenue projections, cost structures, and a clear path to profitability and sustainable growth.

By addressing these key elements, you can increase your chances of securing investment and positioning your Food & Beverage startup for success.