FREE Investor Database

Top Venture Investors in Aerospace Industry

Top Venture Investors in Aerospace Industry

Discover leading VC and CVC investors specializing in Aerospace. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The aerospace industry has witnessed a surge of investments in the past three years, with a growing appetite for innovation and technological advancements. Since 2022, the sector has seen a significant influx of capital, with numerous startups and established players securing funding to drive their ambitious projects forward.

Over the last three years, the aerospace industry has witnessed a staggering number of investments, with over 150 deals recorded. The total amount of money invested during this period has exceeded $25 billion, showcasing the industry's immense potential and the confidence of investors.

Among the core startups that have received substantial investments are Rocket Lab, Relativity Space, and Boom Supersonic, each pushing the boundaries of space exploration, satellite technology, and supersonic air travel, respectively. Some of the most expensive deals include the $1.2 billion raised by Rocket Lab and the $650 million secured by Relativity Space.

One particularly interesting deal was the $200 million investment in Boom Supersonic, a company aiming to revolutionize the future of air travel by developing a new generation of supersonic aircraft.

In summary, the aerospace industry has experienced a remarkable surge in investments, with a focus on cutting-edge technologies and ambitious projects that are shaping the future of the sector.

Over the last three years, the aerospace industry has witnessed a staggering number of investments, with over 150 deals recorded. The total amount of money invested during this period has exceeded $25 billion, showcasing the industry's immense potential and the confidence of investors.

Among the core startups that have received substantial investments are Rocket Lab, Relativity Space, and Boom Supersonic, each pushing the boundaries of space exploration, satellite technology, and supersonic air travel, respectively. Some of the most expensive deals include the $1.2 billion raised by Rocket Lab and the $650 million secured by Relativity Space.

One particularly interesting deal was the $200 million investment in Boom Supersonic, a company aiming to revolutionize the future of air travel by developing a new generation of supersonic aircraft.

In summary, the aerospace industry has experienced a remarkable surge in investments, with a focus on cutting-edge technologies and ambitious projects that are shaping the future of the sector.

93 active VC investors in Aerospace

In the last three years, the aerospace industry has seen a surge in venture capital investment. Key players like Airbus Ventures, Boeing HorizonX, and Lockheed Martin Ventures have been actively funding innovative startups in the sector. One notable example is Relativity Space's $500 million Series D round in 2021, which was one of the largest venture capital investments in the aerospace industry during this period. This funding round, led by Fidelity Management & Research Company, enabled Relativity Space to accelerate the development of its 3D-printed rockets and expand its capabilities in the rapidly evolving commercial space market.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZEBOX Ventures | logistics, supply chains, mobility, space, media, transport, decarbonization of infrastructures, energy transition, digitalization of processes, people, consumer, ai | Pre-Seed, Seed | |||

| York IE | infrastructure, developer tools, cybersecurity, marketing, platforms, vertical SaaS, AI, Communication, Sustainability, B2B, Analytics, Foodtech, Consumer, Real Estate, Cybersecurity, Aerospace, Digital Media | United States; Canada; Norway | Series A, Seed, Pre Seed | ||

| Yes VC | ai automating work, aviation, space, carbon sequestration, climate, consumer brands, defi, daos, nfts, delivery, digital infrastructure, fertility and parenting, fintech and personal finance, food, healthcare, reinventing construction | United States; Finland; France; United Kingdom; Israel | Pre-Seed, Seed | ||

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| Xfund | enterprise software, machine intelligence, computer vision, nlp, deep learning applications, frontier technologies, space, robotics, vr/ar, autonomous vehicles, healthit, consumer tech, marketplaces, ecommerce, mobile-first | Generalist; United States | Seed, Series A, Series B | USD 120000000 | |

| Celesta Capital | 5g, ai/ml, aerospace, agritech, automotive, cleantech, construction tech, consumer electronics, data infrastructure, data storage, edtech, edge computing, enterprise solutions, fintech, foodtech, healthtech, imaging, iot, life sciences, materials, medtech, networking, realtech, retailtech, robotics, security, semiconductors, software, deep tech | United States, California, Silicon Valley | Series A, Series B | ||

| Wonder Ventures | consumer, fintech, healthcare, marketplace, prop tech, space tech, b2b, enterprise, saas, blockchain, web3, clean tech | United States, Southern California | Pre-Seed, Seed, Series A, Series B | USD 57000000 | |

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| Veteran Ventures Capital | security,aerospace,logistics | United States | Seed, Series A | USD 50000000 | |

| Vesna deep tech | energytech, biotech, water & marine, circular economies, agritech, smart cities, touristtech, mobility & transportation, waste management, hydrogen, supply chains, polymers, biomaterials, smart materials, nanotech, semiconductors, life sciences, spacetech, big data, robotics, additive manufacturing, industrialtech, end-use applied ai, edge ai, defi / fintech ai, machine learning, natural language processing, ict powered life sciences, iot, augmented reality, quantum computing, cyber security | Croatia; Slovenia | EUR 50M |

19 active CVC investors in Aerospace

Active corporate venture capital (CVC) firms have been investing heavily in the aerospace industry over the past three years. Notable players include Boeing HorizonX, Lockheed Martin Ventures, and Airbus Ventures, which have backed innovative startups in areas like electric aviation, satellite technology, and advanced materials.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| United Airlines Ventures | sustainability, aerospace | Seed | |||

| State Farm Ventures | aerial data, ai, blockchain, home safety, home services, insurtech, fintech, mobility, safety, real estate tech, senior living, telematics, vr/ar | United States; Singapore | Generalist | ||

| Skyrora Ventures | Aerospace | United Kingdom; Denmark; Estonia; Finland; Iceland; Ireland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Monaco; Montenegro; Portugal; San Marino; Serbia; Slovenia; Spain; Austria; Bulgaria; Czechia; Hungary; Moldova; Poland; Romania; Slovakia; Ukraine; Belgium; France; Germany; Liechtenstein; Luxembourg; Netherlands; Switzerland | Series A, Series B | ||

| Seeds Capital | manufacturing, health, biomedical sciences, sustainability, agritech, foodtech, artificial intelligence, blockchain, quantum, space technologies, maritime tech, engineering, urban solutions | Singapore | Pre-Seed, Seed, Series A, Series B | ||

| Safran Corporate Ventures | aviation, space, defense, data analytics, on-demand aviation, new maintenance methods, co-creation, collaborative engineering, ai, blockchain, connectivity, augmented cabin, comfort, in-flight entertainment, human-machine interface, nanotechnologies, surface treatment processes, composites, ceramics, advanced manufacturing processes, low-carbon materials, industry 4.0, non-destructive testing, augmented reality, industrial iot, robotics/cobotics, additive manufacturing, industrial cyber security | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| OHB Venture Capital | Aerospace, Agriculture, Data Management, Maritime, Logistics, Communication, Developer Tools | United States; France; Germany | Pre Seed, Seed | ||

| Nabtesco Technology Ventures | robotics, motors, sensors, additive manufacturing, artificial intelligence, iot, precision reduction gears, electro hydraulic systems, railroad vehicle technology, prosthetic devices, mobility devices, marine vessel, commercial vehicle, aviation, packaging, systems development, cae, additive manufacturing, surface treatment | Generalist | Seed, Series A, Series B | EUR 75000000 | |

| Lockheed Martin Ventures | artificial intelligence, autonomy, robotics, cybersecurity, human potential, materials, manufacturing, nextgen electronics, power, propulsion, quantum technologies, sensor technologies, signals, communication tech, space technologies, synthetic biology | Generalist | Series A, Series B, Seed | ||

| JG Digital Equity Ventures | air transportation, banking, food manufacturing, hotels, petrochemicals, power generation, real estate, property development, telecommunications, ecommerce, fintech, supply chain, b2b saas | Series A, Series B |

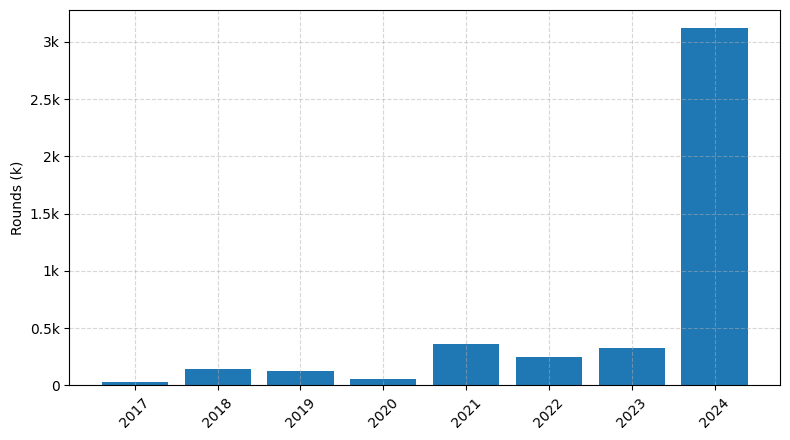

Investments by year: Round

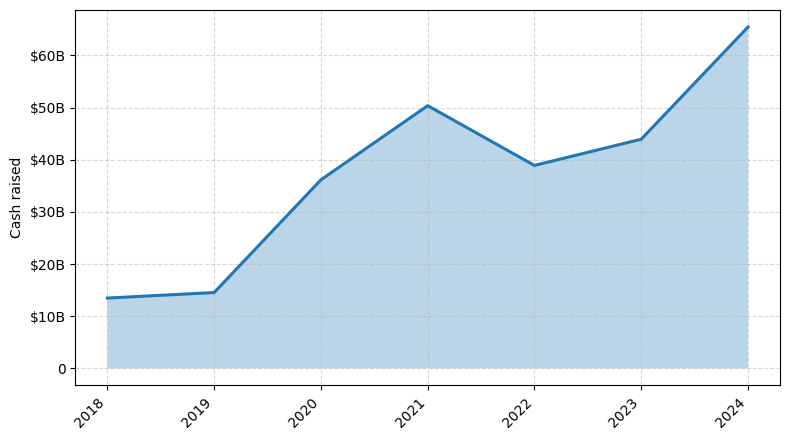

Investments by year: Cash raised

How is fundraising in Aerospace different from other VC fundraising

Fundraising in the aerospace industry differs from general startup fundraising due to the unique challenges faced by aerospace companies. Aerospace projects often require significant upfront capital investments, lengthy development timelines, and specialized technical expertise. Investors in this sector must have a deeper understanding of the industry's regulatory environment, technological complexities, and the long-term nature of aerospace projects. Additionally, the high barriers to entry and the capital-intensive nature of the industry make it more difficult for new players to secure funding compared to other startup sectors. Aerospace companies must demonstrate a clear path to commercialization, a strong technical team, and a well-defined regulatory strategy to attract investors. The unique risks and requirements of the aerospace industry necessitate a more specialized approach to fundraising compared to general startup fundraising.

Top Funded Aerospace Startups

1. SpaceX: Approximately $7.5 billion in funding, focused on reusable rocket technology and space exploration.

2. Rocket Lab: Approximately $1.5 billion in funding, focused on small satellite launch services.

3. Virgin Galactic: Approximately $1 billion in funding, focused on commercial space tourism.

4. Relativity Space: Approximately $1.2 billion in funding, focused on 3D-printed rocket technology.

5. Astra Space: Approximately $500 million in funding, focused on small satellite launch services.

2. Rocket Lab: Approximately $1.5 billion in funding, focused on small satellite launch services.

3. Virgin Galactic: Approximately $1 billion in funding, focused on commercial space tourism.

4. Relativity Space: Approximately $1.2 billion in funding, focused on 3D-printed rocket technology.

5. Astra Space: Approximately $500 million in funding, focused on small satellite launch services.

What you should include in Aerospace pitch deck

When creating an aerospace pitch deck, the following unique slides should be included:

1. Industry Overview: Provide a comprehensive analysis of the current state of the aerospace industry, including market trends, growth opportunities, and key players.

2. Technology Showcase: Highlight the innovative technologies or solutions your aerospace company has developed, emphasizing their competitive advantages and potential impact.

3. Regulatory Landscape: Discuss the regulatory environment in the aerospace industry, addressing any relevant certifications, safety standards, or compliance requirements your company has met or plans to address.

4. Competitive Advantage: Clearly articulate the unique value proposition and competitive edge your aerospace company offers, differentiating it from existing players in the market.

1. Industry Overview: Provide a comprehensive analysis of the current state of the aerospace industry, including market trends, growth opportunities, and key players.

2. Technology Showcase: Highlight the innovative technologies or solutions your aerospace company has developed, emphasizing their competitive advantages and potential impact.

3. Regulatory Landscape: Discuss the regulatory environment in the aerospace industry, addressing any relevant certifications, safety standards, or compliance requirements your company has met or plans to address.

4. Competitive Advantage: Clearly articulate the unique value proposition and competitive edge your aerospace company offers, differentiating it from existing players in the market.

How to Prepare Your Aerospace Startup for Investment

Preparing an aerospace startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract the necessary funding to drive its growth and development.

When preparing for a pitch deck review, VC investors typically expect the following from aerospace startups:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the target market, its size, growth potential, and the startup's ability to capture a significant share.

2. Innovative technology and intellectual property: Highlight the startup's unique technological advantages, patents, or proprietary solutions that set it apart from competitors.

3. Experienced and capable team: Emphasize the expertise, relevant experience, and complementary skills of the founding team and key personnel.

4. Robust financial projections: Present realistic financial projections, including revenue models, cost structures, and a clear path to profitability and scalability.

5. Compelling go-to-market strategy: Outline a well-thought-out plan for product development, customer acquisition, and market penetration.

By addressing these key elements, aerospace startups can increase their chances of securing the necessary investment to propel their business forward and capitalize on the growing opportunities in the dynamic aerospace industry.

When preparing for a pitch deck review, VC investors typically expect the following from aerospace startups:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the target market, its size, growth potential, and the startup's ability to capture a significant share.

2. Innovative technology and intellectual property: Highlight the startup's unique technological advantages, patents, or proprietary solutions that set it apart from competitors.

3. Experienced and capable team: Emphasize the expertise, relevant experience, and complementary skills of the founding team and key personnel.

4. Robust financial projections: Present realistic financial projections, including revenue models, cost structures, and a clear path to profitability and scalability.

5. Compelling go-to-market strategy: Outline a well-thought-out plan for product development, customer acquisition, and market penetration.

By addressing these key elements, aerospace startups can increase their chances of securing the necessary investment to propel their business forward and capitalize on the growing opportunities in the dynamic aerospace industry.