FREE Investor Database

Top Venture Investors in Agtech Industry

Top Venture Investors in Agtech Industry

Discover leading VC and CVC investors specializing in Agtech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

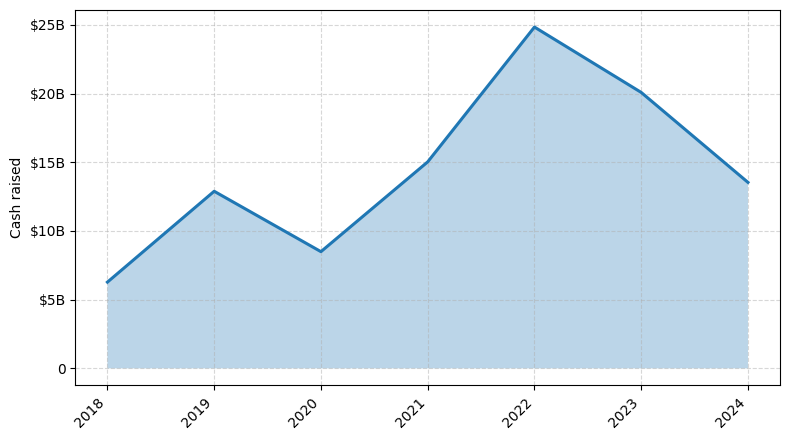

The agricultural technology (Agtech) sector has witnessed a surge in investment activity over the past three years, reflecting the growing recognition of its potential to address global food security and sustainability challenges. Since 2022, the Agtech industry has seen a significant influx of capital, with numerous startups receiving substantial funding to drive innovation and technological advancements.

According to industry reports, the Agtech sector has attracted over 1,500 investments in the last three years, totaling more than $25 billion in funding. Some of the core startups that have received notable investments include Indigo Agriculture, which raised $200 million in a Series E round, Farmers Business Network, which secured $250 million in a Series F round, and Benson Hill, which received $150 million in a Series D round. Additionally, several high-profile deals, such as Corteva Agriscience's $10 billion acquisition of Monsanto, have further highlighted the growing interest and investment in the Agtech space.

In summary, the Agtech industry has experienced a remarkable surge in investment activity, with substantial capital being deployed to support innovative startups and drive the transformation of the agricultural sector.

According to industry reports, the Agtech sector has attracted over 1,500 investments in the last three years, totaling more than $25 billion in funding. Some of the core startups that have received notable investments include Indigo Agriculture, which raised $200 million in a Series E round, Farmers Business Network, which secured $250 million in a Series F round, and Benson Hill, which received $150 million in a Series D round. Additionally, several high-profile deals, such as Corteva Agriscience's $10 billion acquisition of Monsanto, have further highlighted the growing interest and investment in the Agtech space.

In summary, the Agtech industry has experienced a remarkable surge in investment activity, with substantial capital being deployed to support innovative startups and drive the transformation of the agricultural sector.

98 active VC investors in Agtech

In the last three years, the Agtech industry has seen a surge of investment from active venture capital firms. Key players include Cultivian Sandbox Ventures, which has invested in innovative agricultural technologies, and Finistere Ventures, which has backed startups tackling challenges in food production and distribution. One notable example is Indigo Agriculture's $200 million Series E round in 2020, which was one of the largest Agtech investments in recent years, supporting the company's efforts to improve crop yields and sustainability through microbial solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zag Capital | software, laundry technology, content sharing, cloud management, code architecture, game development, medical records, healthcare records, store records, management processes, security automation, robotic milking, herds wellbeing | United States; Israel | |||

| Ylem Invest | ai, mobility, energy, fintech, agritech, healthcare | ||||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Yara Growth Ventures | agriculture, clean hydrogen | ||||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| Xinomavro Ventures | agtech, winetech, beverage innovations | Series B, Series A | |||

| XAnge / SPI | digital, deeptech, ai, enterprise, smb software, digital safety, developer tools, middleware, b2b marketplaces, hardware, healthcare, work experience, housing, real estate, environment, education, fintechs, cryptos, mobility, food, proptech, data, edtech, agritech | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Series A, Series B | EUR 220000000 |

45 active CVC investors in Agtech

Active corporate venture capital (CVC) firms have been increasingly investing in AgTech startups in the past three years. Notable players include Bayer's CropScience Ventures, which backed precision farming solutions, and Syngenta Group Ventures, which invested in novel crop protection technologies. These CVC firms are driving innovation in the agricultural sector.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Yara Growth Ventures | agriculture, clean hydrogen | ||||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| VIB | (bio)pharmaceuticals, diagnostics, agricultural improvements | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| Trimble Ventures | construction, transportation, agriculture, geospatial, technology, hardware, software applications, autonomy, robotics, sustainability, artificial intelligence, blockchain, augmented, mixed reality, iot analytics | Series B, Series A, Series E, Series D, Seed, Series C | USD 200000000 | ||

| Tin Shed Ventures | agriculture, supply chain, sorting and recycling | Seed, Series A, Series B | |||

| TELUS Ventures | ag tech, connected consumer, digital health, smart cities and iot | Canada; United States | |||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 |

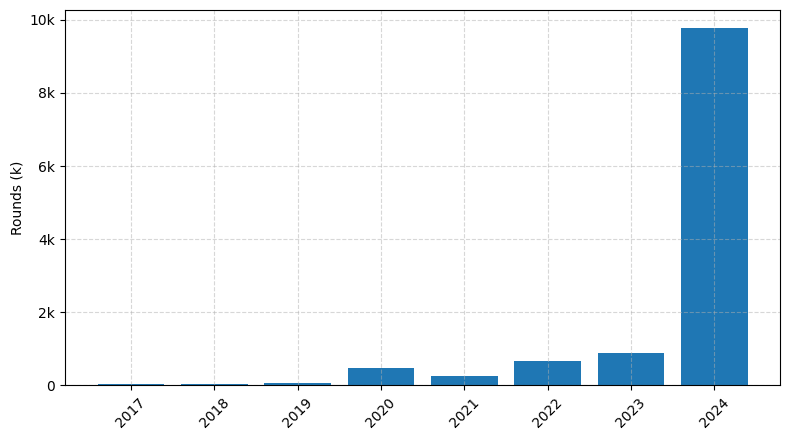

Investments by year: Round

Investments by year: Cash raised

How is fundraising in Agtech different from other VC fundraising

Fundraising in Agtech differs from general startup fundraising due to the unique challenges faced by the industry. Agtech companies often require significant capital investments for research, development, and scaling of their technologies, which can be more capital-intensive than traditional software startups. Additionally, the regulatory landscape in the agricultural sector can be complex, and investors may need to understand the nuances of this industry. Agtech startups also face the challenge of demonstrating the real-world impact and scalability of their solutions, which can be more difficult to quantify compared to traditional tech products. As a result, Agtech fundraising often requires a deep understanding of the industry, a strong focus on demonstrating the value proposition, and a willingness to navigate the regulatory environment.

Top Funded Agtech Startups

1. Indigo Agriculture: Approximately $1.2 billion in total funding, focused on improving crop yields and sustainability through microbial technologies.

2. Farmers Business Network: Approximately $800 million in total funding, providing data-driven insights and services to farmers.

3. Ginkgo Bioworks: Approximately $1.9 billion in total funding, specializing in synthetic biology for agricultural applications.

4. Plenty: Approximately $500 million in total funding, developing vertical farming solutions to increase food production.

5. Bayer Crop Science: Approximately $63 billion in total funding, a leading provider of agricultural inputs and solutions.

2. Farmers Business Network: Approximately $800 million in total funding, providing data-driven insights and services to farmers.

3. Ginkgo Bioworks: Approximately $1.9 billion in total funding, specializing in synthetic biology for agricultural applications.

4. Plenty: Approximately $500 million in total funding, developing vertical farming solutions to increase food production.

5. Bayer Crop Science: Approximately $63 billion in total funding, a leading provider of agricultural inputs and solutions.

What you should include in Agtech pitch deck

When creating an AgTech pitch deck, include the following unique slides:

1. Problem Statement: Clearly define the agricultural challenge your solution addresses.

2. Market Opportunity: Demonstrate the size and growth potential of the target market.

3. Technology Overview: Explain the innovative technology that underpins your AgTech solution.

4. Competitive Advantage: Highlight the unique features that differentiate your offering from competitors.

5. Traction and Milestones: Showcase your achievements, such as pilot projects, partnerships, or customer testimonials.

6. Go-to-Market Strategy: Outline your plan to effectively reach and engage your target customers.

7. Financial Projections: Provide a compelling financial model and growth projections.

1. Problem Statement: Clearly define the agricultural challenge your solution addresses.

2. Market Opportunity: Demonstrate the size and growth potential of the target market.

3. Technology Overview: Explain the innovative technology that underpins your AgTech solution.

4. Competitive Advantage: Highlight the unique features that differentiate your offering from competitors.

5. Traction and Milestones: Showcase your achievements, such as pilot projects, partnerships, or customer testimonials.

6. Go-to-Market Strategy: Outline your plan to effectively reach and engage your target customers.

7. Financial Projections: Provide a compelling financial model and growth projections.

How to Prepare Your Agtech Startup for Investment

Preparing an AgTech startup for investment requires a strategic approach to ensure that the business is investor-ready. As an advisory, it is essential to focus on key areas that venture capital (VC) investors typically expect startups to demonstrate in their pitch deck review.

To prepare your AgTech startup for investment, consider the following:

1. Clearly define your value proposition: Articulate the unique problem your solution solves and the benefits it offers to your target market.

2. Demonstrate a strong market opportunity: Provide data-driven insights into the size, growth potential, and competitive landscape of the AgTech industry.

3. Highlight your technology and intellectual property: Showcase the innovative nature of your technology and any patents or proprietary processes that give you a competitive edge.

4. Showcase a talented and experienced team: Emphasize the expertise and relevant experience of your founding team and key personnel.

5. Outline a scalable and sustainable business model: Demonstrate how your startup can achieve profitability and scale effectively, with a clear path to revenue generation and customer acquisition.

By addressing these key areas, you can increase your chances of securing investment and positioning your AgTech startup for long-term success.

To prepare your AgTech startup for investment, consider the following:

1. Clearly define your value proposition: Articulate the unique problem your solution solves and the benefits it offers to your target market.

2. Demonstrate a strong market opportunity: Provide data-driven insights into the size, growth potential, and competitive landscape of the AgTech industry.

3. Highlight your technology and intellectual property: Showcase the innovative nature of your technology and any patents or proprietary processes that give you a competitive edge.

4. Showcase a talented and experienced team: Emphasize the expertise and relevant experience of your founding team and key personnel.

5. Outline a scalable and sustainable business model: Demonstrate how your startup can achieve profitability and scale effectively, with a clear path to revenue generation and customer acquisition.

By addressing these key areas, you can increase your chances of securing investment and positioning your AgTech startup for long-term success.