FREE Investor Database

Top Venture Investors in AI Industry | Unicorn Nest Directory

Top Venture Investors in AI Industry | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups specializing in AI. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

In the past three years, the world has witnessed a remarkable surge in investments in the field of artificial intelligence (AI). Since 2022, the AI industry has attracted a staggering amount of capital, with thousands of investments pouring in from venture capitalists, tech giants, and private equity firms. According to industry reports, the total investment in AI startups and companies has exceeded $150 billion, with a significant portion of this funding going towards cutting-edge technologies, such as machine learning, natural language processing, and computer vision.

Some of the most notable AI startups that have received substantial investments include OpenAI, DeepMind, and Anthropic, each of which has secured multi-million-dollar funding rounds to further their research and development efforts. Additionally, several high-profile deals, such as Microsoft's acquisition of Nuance Communications for $19.7 billion and Google's investment in Anthropic's $200 million Series B round, have highlighted the growing importance and potential of AI in various industries.

In summary, the past three years have witnessed a remarkable surge in AI investments, with billions of dollars flowing into the sector and fueling the growth of innovative startups and technologies that are poised to transform the way we live and work.

Some of the most notable AI startups that have received substantial investments include OpenAI, DeepMind, and Anthropic, each of which has secured multi-million-dollar funding rounds to further their research and development efforts. Additionally, several high-profile deals, such as Microsoft's acquisition of Nuance Communications for $19.7 billion and Google's investment in Anthropic's $200 million Series B round, have highlighted the growing importance and potential of AI in various industries.

In summary, the past three years have witnessed a remarkable surge in AI investments, with billions of dollars flowing into the sector and fueling the growth of innovative startups and technologies that are poised to transform the way we live and work.

98 active VC investors in AI

In the last three years, the venture capital landscape has seen a surge in investment in artificial intelligence (AI) startups. Key players in this space include Andreessen Horowitz, Sequoia Capital, and Accel, which have all made significant bets on AI-driven companies. One of the biggest venture capital rounds in the last two years was OpenAI's $1 billion funding round in 2021, led by Microsoft, which aimed to support the company's research and development efforts in advanced AI systems. This investment highlights the growing interest and confidence in the transformative potential of AI technology across various industries.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | AI | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zukunftsfonds Heilbronn | AI | United States; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Pre-Seed, Seed | ||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zhongmi Capital | consumer technology, martech, big data, pan-entertainment, digital marketing, sports | Pre-Seed, Seed, Series A, Series B | |||

| ZhenFund | AI | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Zetta Venture Partners | enterprise, data, ai | Canada; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed | USD 100000000 | |

| Zeta Alpha | AI | Seed | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zero-One Capital | AI | ||||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed |

98 active CVC investors in AI

Active corporate venture capital (CVC) firms have been investing heavily in AI startups in the past 3 years. Notable players include Google Ventures, which backed DeepMind, and Intel Capital, which invested in Habana Labs. These CVC firms are driving innovation by providing funding and strategic support to promising AI companies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | AI | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| XT Hi-Tech | AI | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Wormhole Capital | AI | Series A, Seed, Series B, Series C | |||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed | ||

| Wintermute Ventures | AI | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| VIVE X | vr, ar, blockchain, ai, 5g | Series B, Series A, Seed |

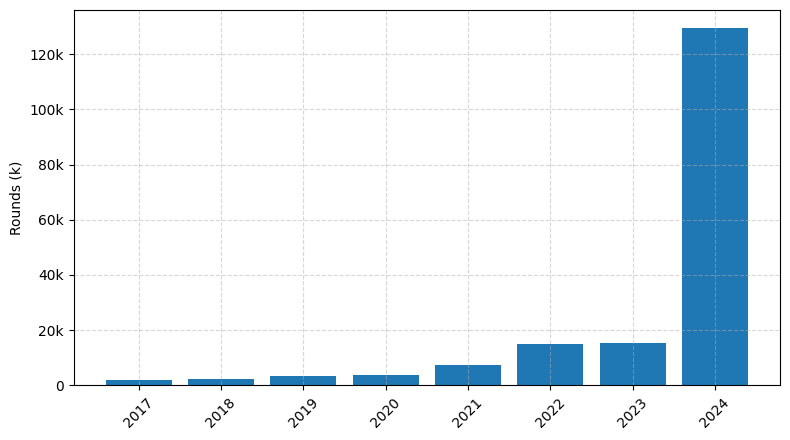

Investments by year: Round

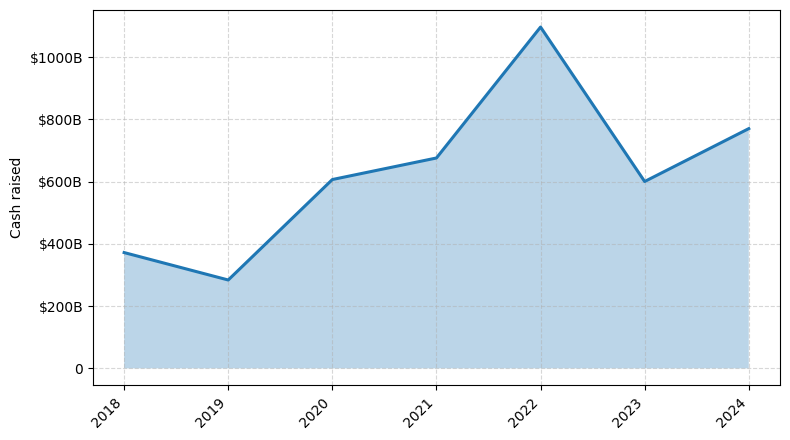

Investments by year: Cash raised

How is fundraising in AI different from other VC fundraising

Fundraising for AI startups differs from general startup fundraising due to the unique challenges posed by the technology. AI development requires significant upfront investment in research, data acquisition, and model training, which can make the path to profitability longer and more uncertain. Investors in AI startups must have a deeper understanding of the technical aspects of the technology, its potential applications, and the competitive landscape. Additionally, the ethical and regulatory considerations surrounding AI, such as data privacy and algorithmic bias, can add complexity to the fundraising process. AI startups must be able to articulate their value proposition, technical roadmap, and mitigation strategies for these challenges to attract investors and secure the necessary funding for their development and growth.

Top Funded AI Startups

1. OpenAI: Approximately $1 billion in funding, focused on developing advanced language models and AI systems.

2. DeepMind: Approximately $1.5 billion in funding, focused on general artificial intelligence research and development.

3. Anthropic: Approximately $200 million in funding, focused on developing safe and ethical AI systems.

4. Stability AI: Approximately $101 million in funding, focused on building open-source AI models and tools.

5. Anthropic: Approximately $200 million in funding, focused on developing safe and ethical AI systems.

2. DeepMind: Approximately $1.5 billion in funding, focused on general artificial intelligence research and development.

3. Anthropic: Approximately $200 million in funding, focused on developing safe and ethical AI systems.

4. Stability AI: Approximately $101 million in funding, focused on building open-source AI models and tools.

5. Anthropic: Approximately $200 million in funding, focused on developing safe and ethical AI systems.

What you should include in AI pitch deck

When pitching an AI-powered solution, your pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the problem your AI solution aims to solve.

2. AI Approach: Explain how your AI technology works and its key features.

3. Competitive Advantage: Highlight the unique aspects of your AI solution that set it apart from competitors.

4. Data and Training: Provide details on the data sources and training processes used to develop your AI model.

5. Roadmap and Milestones: Outline your plan for further development and implementation of your AI solution.

1. Problem Statement: Clearly define the problem your AI solution aims to solve.

2. AI Approach: Explain how your AI technology works and its key features.

3. Competitive Advantage: Highlight the unique aspects of your AI solution that set it apart from competitors.

4. Data and Training: Provide details on the data sources and training processes used to develop your AI model.

5. Roadmap and Milestones: Outline your plan for further development and implementation of your AI solution.

How to Prepare Your AI Startup for Investment

Preparing an AI startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capitalists (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract investment by demonstrating its unique value proposition, technical expertise, and a clear path to growth and profitability.

When pitching to VC investors, startups should be prepared to address the following key aspects:

1. Clearly defined problem and solution: Articulate the specific problem the AI technology aims to solve and how the proposed solution is innovative and superior to existing alternatives.

2. Robust technical capabilities: Demonstrate the depth of the team's expertise in AI, machine learning, and related technologies, as well as the strength of the underlying algorithms and data sources.

3. Scalable business model: Outline a sustainable and scalable business model that can generate revenue and achieve profitability in the long run.

4. Competitive advantage: Highlight the startup's unique competitive edge, such as proprietary technology, strategic partnerships, or a strong intellectual property portfolio.

5. Experienced and dedicated team: Showcase the founding team's relevant experience, domain expertise, and commitment to the venture's success.

By addressing these key elements, AI startups can increase their chances of securing investment and positioning themselves for long-term growth and success.

When pitching to VC investors, startups should be prepared to address the following key aspects:

1. Clearly defined problem and solution: Articulate the specific problem the AI technology aims to solve and how the proposed solution is innovative and superior to existing alternatives.

2. Robust technical capabilities: Demonstrate the depth of the team's expertise in AI, machine learning, and related technologies, as well as the strength of the underlying algorithms and data sources.

3. Scalable business model: Outline a sustainable and scalable business model that can generate revenue and achieve profitability in the long run.

4. Competitive advantage: Highlight the startup's unique competitive edge, such as proprietary technology, strategic partnerships, or a strong intellectual property portfolio.

5. Experienced and dedicated team: Showcase the founding team's relevant experience, domain expertise, and commitment to the venture's success.

By addressing these key elements, AI startups can increase their chances of securing investment and positioning themselves for long-term growth and success.