FREE Investor Database

Top Venture Investors in Biotech Industry

Top Venture Investors in Biotech Industry

Discover leading VC and CVC investors specializing in Biotech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The biotech industry has been a hotbed of investment activity in recent years, with a surge of interest and capital flowing into the sector. Over the past three years, since 2022, the biotech industry has witnessed a remarkable influx of investments, with numerous startups and established players securing significant funding to drive innovation and research.

In the last three years, the biotech sector has seen a staggering number of investments, with over 500 deals completed. The total amount of money invested in the industry during this period has exceeded $50 billion, reflecting the growing confidence of investors in the potential of biotech solutions. Some of the core startups that have received substantial investments include Moderna, Regeneron, and Gilead Sciences, each securing multi-billion-dollar deals.

The most expensive deals in the biotech industry during this period include Pfizer's $11.6 billion acquisition of Trillium Therapeutics and Roche's $4.3 billion acquisition of Spark Therapeutics. One particularly interesting deal was Novartis' $9.7 billion investment in gene therapy startup Avexis, showcasing the industry's focus on cutting-edge technologies.

In summary, the biotech industry has experienced a remarkable surge in investment activity over the past three years, with billions of dollars flowing into the sector and fueling the development of innovative solutions.

In the last three years, the biotech sector has seen a staggering number of investments, with over 500 deals completed. The total amount of money invested in the industry during this period has exceeded $50 billion, reflecting the growing confidence of investors in the potential of biotech solutions. Some of the core startups that have received substantial investments include Moderna, Regeneron, and Gilead Sciences, each securing multi-billion-dollar deals.

The most expensive deals in the biotech industry during this period include Pfizer's $11.6 billion acquisition of Trillium Therapeutics and Roche's $4.3 billion acquisition of Spark Therapeutics. One particularly interesting deal was Novartis' $9.7 billion investment in gene therapy startup Avexis, showcasing the industry's focus on cutting-edge technologies.

In summary, the biotech industry has experienced a remarkable surge in investment activity over the past three years, with billions of dollars flowing into the sector and fueling the development of innovative solutions.

99 active VC investors in Biotech

In the last three years, the biotech industry has seen a surge in venture capital investments, with several prominent firms leading the charge. Key players include Flagship Pioneering, which has backed numerous successful biotech startups, and Andreessen Horowitz, known for its investments in cutting-edge technologies. One of the biggest venture capital rounds in the last two years was Moderna's $1.3 billion Series H funding in 2020, which propelled the company's groundbreaking mRNA vaccine development. This investment underscores the significant capital flowing into the biotech sector as it continues to drive innovation and tackle pressing healthcare challenges.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zoic Capital | healthcare, life science, med-tech, biotech | United States | Seed, Pre-Seed, Series A | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| ZIG Ventures | healthcare biomedical and sciences | Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand; | |||

| Zentynel Frontier Investments | biotechnology | Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay | Seed | ||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| Yosemite | Biotech | United States | Seed, Series B, Series A | USD 200000000 | |

| Yingke Capital | life science, dual-carbon technology, hardcore technology, chip semiconductor, integrated circuit, new materials, high-end manufacturing |

89 active CVC investors in Biotech

Active corporate venture capital (CVC) firms have been increasingly investing in the biotech sector, seeking to capitalize on the industry's rapid advancements. Key players include Novartis Venture Fund, which invested in gene therapy startup Spark Therapeutics, and Johnson & Johnson Innovation, which backed immunotherapy developer Gritstone Oncology.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Viva BioInnovator | biotech, biopharmaceuticals, devices, diagnostics, life science tools | Generalist | Series B, Series A | ||

| VIB | (bio)pharmaceuticals, diagnostics, agricultural improvements | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| University System of Maryland - Crunchbase School Profile & Alumni | hardware, information technology, cybersecurity, life science, retail | United States, Maryland | Pre-Seed, Series B, Seed, Series A | ||

| UnityPoint Health Ventures | care experience, care financing, care delivery and care innovation. digital therapeutics, health it, tech-enabled services, medical devices and diagnostics | United States, Iowa; United States, Illinois; United States, Wisconsin | Seed, Series A, Series B | ||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 |

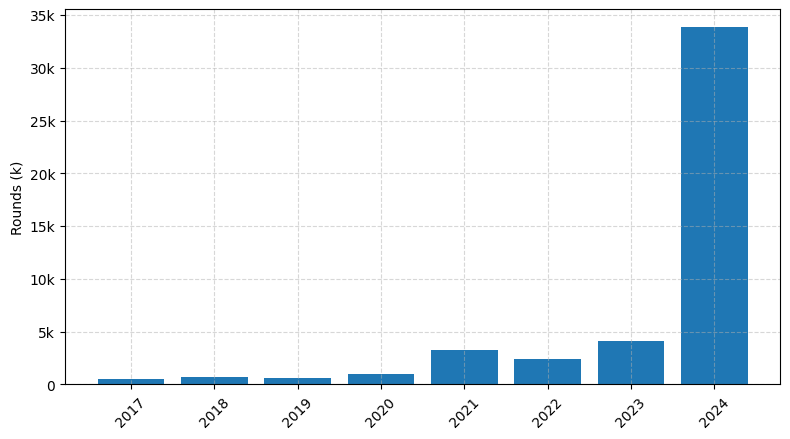

Investments by year: Round

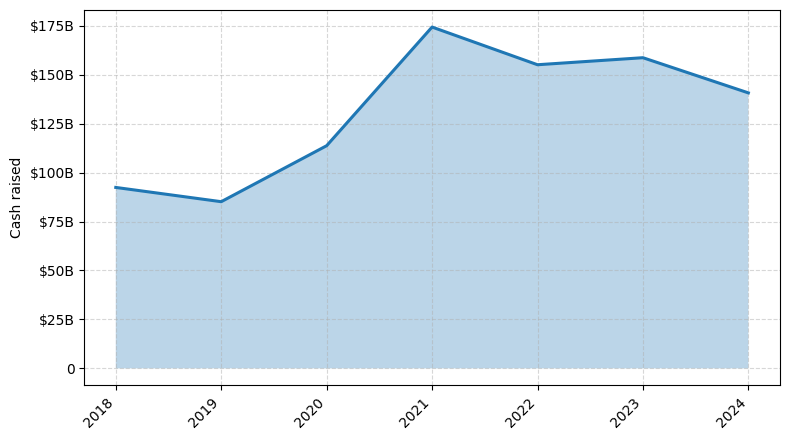

Investments by year: Cash raised

How is fundraising in Biotech different from other VC fundraising

Fundraising in the biotech industry differs from general startup fundraising due to the unique challenges faced by biotech companies. Biotech startups often require significant upfront capital to fund lengthy and costly research and development processes, including clinical trials, regulatory approvals, and manufacturing. Additionally, the timeline to generate revenue can be much longer in biotech compared to other sectors, as products must navigate complex regulatory hurdles before reaching the market. Biotech investors also tend to have a higher risk tolerance and a longer investment horizon, as the path to commercialization can be uncertain and protracted. As a result, biotech fundraising often involves specialized investors, such as venture capitalists, corporate partners, and government grants, who understand the industry's unique dynamics and are willing to provide the necessary funding and support to bring innovative therapies to patients.

Top Funded Biotech Startups

Here is a summary of the top-funded Biotech startups globally:

1. Moderna: Approximately $3.5 billion in total funding, focused on mRNA-based therapeutics and vaccines.

2. Ginkgo Bioworks: Approximately $1.9 billion in total funding, focused on engineering biology and synthetic biology.

3. Insitro: Approximately $600 million in total funding, focused on using machine learning to accelerate drug discovery.

4. Recursion Pharmaceuticals: Approximately $465 million in total funding, focused on using artificial intelligence for drug discovery.

5. Tempus: Approximately $450 million in total funding, focused on using data and analytics to improve cancer care.

1. Moderna: Approximately $3.5 billion in total funding, focused on mRNA-based therapeutics and vaccines.

2. Ginkgo Bioworks: Approximately $1.9 billion in total funding, focused on engineering biology and synthetic biology.

3. Insitro: Approximately $600 million in total funding, focused on using machine learning to accelerate drug discovery.

4. Recursion Pharmaceuticals: Approximately $465 million in total funding, focused on using artificial intelligence for drug discovery.

5. Tempus: Approximately $450 million in total funding, focused on using data and analytics to improve cancer care.

What you should include in Biotech pitch deck

A Biotech pitch deck should include the following unique slides:

1. Technology Overview: Explain the science behind your innovation and its potential impact.

2. Competitive Landscape: Highlight your competitive advantages and differentiation from existing solutions.

3. Intellectual Property: Showcase your patent portfolio and the strength of your IP protection.

4. Regulatory Pathway: Outline the regulatory approval process and your strategy for navigating it.

5. Clinical Development Plan: Provide a detailed timeline and milestones for your clinical trials and product development.

Remember to keep the pitch deck concise, visually appealing, and tailored to the specific interests of your target audience.

1. Technology Overview: Explain the science behind your innovation and its potential impact.

2. Competitive Landscape: Highlight your competitive advantages and differentiation from existing solutions.

3. Intellectual Property: Showcase your patent portfolio and the strength of your IP protection.

4. Regulatory Pathway: Outline the regulatory approval process and your strategy for navigating it.

5. Clinical Development Plan: Provide a detailed timeline and milestones for your clinical trials and product development.

Remember to keep the pitch deck concise, visually appealing, and tailored to the specific interests of your target audience.

How to Prepare Your Biotech Startup for Investment

Preparing a Biotech startup for investment requires a strategic approach to demonstrate the venture's potential and viability to venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract investment by addressing the key elements that VC investors typically expect to see in a pitch deck review.

Here are five key aspects that VC investors typically expect Biotech startups to demonstrate:

1. Compelling Value Proposition: Clearly articulate the unmet need in the market and how the startup's technology or product offers a unique and innovative solution.

2. Robust Scientific Validation: Provide strong scientific evidence and data supporting the efficacy and safety of the proposed technology or product.

3. Experienced Management Team: Highlight the expertise, relevant experience, and track record of the founding team and key personnel.

4. Comprehensive Intellectual Property (IP) Strategy: Demonstrate a robust IP portfolio or a clear plan to protect the startup's innovations.

5. Detailed Commercialization Roadmap: Present a well-defined strategy for navigating the regulatory landscape and a realistic plan for bringing the product to market.

By addressing these key elements, Biotech startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.

Here are five key aspects that VC investors typically expect Biotech startups to demonstrate:

1. Compelling Value Proposition: Clearly articulate the unmet need in the market and how the startup's technology or product offers a unique and innovative solution.

2. Robust Scientific Validation: Provide strong scientific evidence and data supporting the efficacy and safety of the proposed technology or product.

3. Experienced Management Team: Highlight the expertise, relevant experience, and track record of the founding team and key personnel.

4. Comprehensive Intellectual Property (IP) Strategy: Demonstrate a robust IP portfolio or a clear plan to protect the startup's innovations.

5. Detailed Commercialization Roadmap: Present a well-defined strategy for navigating the regulatory landscape and a realistic plan for bringing the product to market.

By addressing these key elements, Biotech startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.