FREE Investor Database

Top Venture Investors in Proptech Industry

Top Venture Investors in Proptech Industry

Discover leading VC and CVC investors specializing in Proptech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The Proptech industry has witnessed a surge in investment activity over the past three years, reflecting the growing recognition of the transformative potential of technology in the real estate sector. Since 2022, the Proptech landscape has seen a flurry of investments, with numerous startups receiving significant funding to drive innovation and disrupt traditional real estate practices.

In the last three years, the Proptech industry has witnessed over 500 investments, with a total of $15 billion poured into the sector. Notable startups that have received substantial investments include Opendoor, Compass, and Latch, each securing multi-million-dollar funding rounds. Some of the most expensive deals in the Proptech space include Opendoor's $1 billion Series E round and Compass' $370 million Series G funding. One particularly interesting deal was Latch's $152 million Series B, which highlighted the growing demand for smart home technology in the real estate industry.

The surge in Proptech investments underscores the industry's potential to revolutionize the way we approach real estate, from streamlining transactions to enhancing property management and user experiences.

In the last three years, the Proptech industry has witnessed over 500 investments, with a total of $15 billion poured into the sector. Notable startups that have received substantial investments include Opendoor, Compass, and Latch, each securing multi-million-dollar funding rounds. Some of the most expensive deals in the Proptech space include Opendoor's $1 billion Series E round and Compass' $370 million Series G funding. One particularly interesting deal was Latch's $152 million Series B, which highlighted the growing demand for smart home technology in the real estate industry.

The surge in Proptech investments underscores the industry's potential to revolutionize the way we approach real estate, from streamlining transactions to enhancing property management and user experiences.

98 active VC investors in Proptech

In the last three years, the Proptech industry has seen a surge of investment from active venture capital firms. Key players include Andreessen Horowitz, Fifth Wall, and Metaprop, which have collectively poured millions into innovative Proptech startups. One notable example is Opendoor's $4.8 billion Series F round in 2021, which was the largest venture capital investment in the Proptech space during this period. This funding round underscores the growing appetite for technology-driven solutions in the real estate sector, as investors seek to capitalize on the industry's digital transformation.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| Zigg Capital | real estate | Generalist | Seed | USD 225000000 | |

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| Zacua Ventures | productivity, building lifecycle, urbanization, buildings and cities | Generalist | Seed, Series A, Series B | USD 56000000 | |

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| York IE | infrastructure, developer tools, cybersecurity, marketing, platforms, vertical SaaS, AI, Communication, Sustainability, B2B, Analytics, Foodtech, Consumer, Real Estate, Cybersecurity, Aerospace, Digital Media | United States; Canada; Norway | Series A, Seed, Pre Seed | ||

| Xplor Investment | smart city, sustainability | Series B, Series A | |||

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| XAnge / SPI | digital, deeptech, ai, enterprise, smb software, digital safety, developer tools, middleware, b2b marketplaces, hardware, healthcare, work experience, housing, real estate, environment, education, fintechs, cryptos, mobility, food, proptech, data, edtech, agritech | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Series A, Series B | EUR 220000000 |

72 active CVC investors in Proptech

Active corporate venture capital (CVC) firms have been investing heavily in Proptech startups in the past 3 years. Notable players include Brookfield Ventures, Lennar's LenX, and Realogy Venture Group, backing innovative solutions in real estate, construction, and property management. Investments span from AI-powered property search to sustainable building materials.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| Viessmann | heat transfer, district heating, boiler rooms, manufactures, drinking water, renewable, climate control, horticulture, buildings, greenhouse cultivation, energy efficient | ||||

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| Trimble Ventures | construction, transportation, agriculture, geospatial | Generalist | Series A, Series B, Series C, Series D | ||

| Trifork Labs | Proptech | Generalist | Pre-Seed, Seed, Series A, Series B | ||

| TELUS Ventures | ag tech, connected consumer, digital health, smart cities and iot | Canada; United States | |||

| Suffolk Construction | real estate | United States | Seed | ||

| STIHL Digital | smart forestry, advanced gardening, landscaping, agriculture technology, construction technology, sustainability | United States; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Series A, Series B |

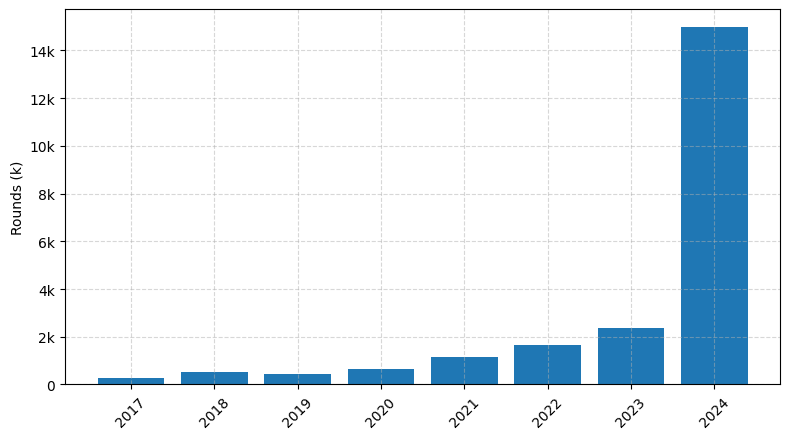

Investments by year: Round

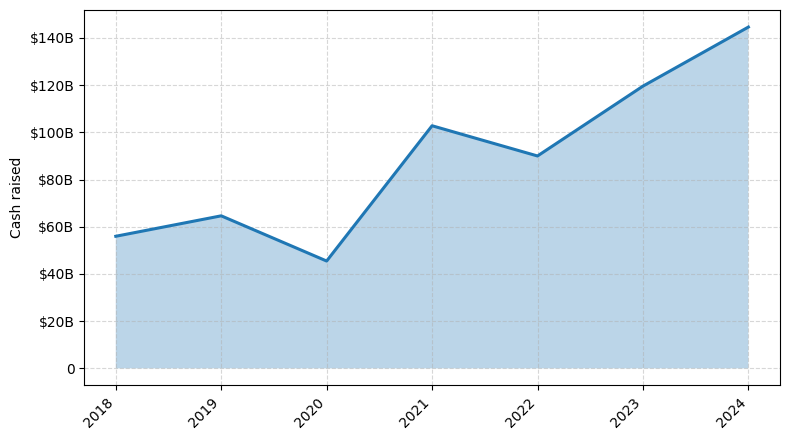

Investments by year: Cash raised

How is fundraising in Proptech different from other VC fundraising

Fundraising in the Proptech (Property Technology) industry differs from general startup fundraising due to the unique challenges faced by Proptech companies. Proptech startups often require significant capital to develop and scale their solutions, which typically involve integrating with complex real estate systems and processes. Additionally, the real estate industry can be slow to adopt new technologies, making it challenging for Proptech companies to gain traction and secure funding. Proptech startups must demonstrate a deep understanding of the real estate market, the ability to navigate regulatory hurdles, and a clear path to generating revenue and achieving profitability. Investors in the Proptech space often have specific domain expertise and may prioritize factors such as industry partnerships, customer traction, and the potential for scalable solutions that can disrupt traditional real estate practices.

Top Funded Proptech Startups

Here is a summary of the top-funded Proptech startups globally:

• Opendoor: Approximately $1.5 billion in total funding, focused on iBuying (instant home buying and selling).

• Compass: Approximately $1.2 billion in total funding, focused on real estate brokerage and technology.

• Airbnb: Approximately $6 billion in total funding, focused on short-term vacation rentals.

• Zillow: Approximately $2.6 billion in total funding, focused on real estate listings and data.

• Redfin: Approximately $167 million in total funding, focused on real estate brokerage and technology.

• Opendoor: Approximately $1.5 billion in total funding, focused on iBuying (instant home buying and selling).

• Compass: Approximately $1.2 billion in total funding, focused on real estate brokerage and technology.

• Airbnb: Approximately $6 billion in total funding, focused on short-term vacation rentals.

• Zillow: Approximately $2.6 billion in total funding, focused on real estate listings and data.

• Redfin: Approximately $167 million in total funding, focused on real estate brokerage and technology.

What you should include in Proptech pitch deck

When pitching a Proptech startup, your pitch deck should include the following unique slides:

1. Market Analysis: Provide an in-depth analysis of the real estate industry and the specific market opportunity your Proptech solution addresses.

2. Proptech Solution: Clearly explain how your technology-driven product or service solves a pressing problem for the real estate industry.

3. Competitive Landscape: Showcase your competitive advantage and differentiation from existing Proptech solutions in the market.

4. Traction and Milestones: Highlight your current user base, partnerships, and any significant achievements or milestones reached.

5. Go-to-Market Strategy: Outline your plan for effectively reaching and acquiring customers in the real estate industry.

1. Market Analysis: Provide an in-depth analysis of the real estate industry and the specific market opportunity your Proptech solution addresses.

2. Proptech Solution: Clearly explain how your technology-driven product or service solves a pressing problem for the real estate industry.

3. Competitive Landscape: Showcase your competitive advantage and differentiation from existing Proptech solutions in the market.

4. Traction and Milestones: Highlight your current user base, partnerships, and any significant achievements or milestones reached.

5. Go-to-Market Strategy: Outline your plan for effectively reaching and acquiring customers in the real estate industry.

How to Prepare Your Proptech Startup for Investment

Preparing a Proptech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is essential to focus on key areas that venture capital (VC) investors typically expect startups to demonstrate in their pitch deck review.

Here are five key elements VC investors typically look for:

1. Clearly defined problem and solution: Articulate the specific problem your Proptech startup aims to solve and how your solution effectively addresses it.

2. Compelling market opportunity: Demonstrate a deep understanding of the target market, its size, growth potential, and the competitive landscape.

3. Innovative technology and product roadmap: Showcase the unique features and capabilities of your Proptech solution, and outline a clear product development plan.

4. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of your founding team and key personnel.

5. Traction and scalable business model: Provide evidence of your startup's growth, customer acquisition, and a sustainable revenue model that can scale.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Proptech startup for long-term success.

Here are five key elements VC investors typically look for:

1. Clearly defined problem and solution: Articulate the specific problem your Proptech startup aims to solve and how your solution effectively addresses it.

2. Compelling market opportunity: Demonstrate a deep understanding of the target market, its size, growth potential, and the competitive landscape.

3. Innovative technology and product roadmap: Showcase the unique features and capabilities of your Proptech solution, and outline a clear product development plan.

4. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of your founding team and key personnel.

5. Traction and scalable business model: Provide evidence of your startup's growth, customer acquisition, and a sustainable revenue model that can scale.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Proptech startup for long-term success.