FREE Investor Database

Top Venture Investors in Crypto/Web3 Industry

Top Venture Investors in Crypto/Web3 Industry

Discover leading VC and CVC investors specializing in Crypto/Web3. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The world of Crypto and Web3 has witnessed a remarkable surge in investments over the past three years. Since 2022, the industry has seen a flurry of activity, with thousands of Crypto and Web3-related startups receiving significant funding. According to industry reports, over $100 billion has been poured into this rapidly evolving sector, with some of the most notable investments going to companies like Solana, Avalanche, and Polygon. The largest deals have included the $450 million raised by Yuga Labs, the creators of the Bored Ape Yacht Club NFT collection, and the $400 million investment in Dapper Labs, the team behind the popular NBA Top Shot platform. One particularly intriguing deal was the $200 million investment in Axie Infinity, a blockchain-based game that has captivated the attention of gamers and investors alike. As the Crypto and Web3 landscape continues to evolve, the influx of capital into this space suggests a promising future for the industry.

99 active VC investors in Crypto/Web3

The crypto and Web3 space has seen a surge of venture capital investment in the last three years. Key players include Andreessen Horowitz, Paradigm, and Polychain Capital, which have backed numerous blockchain startups. One notable example is the $450 million Series B round raised by Ethereum scaling solution Polygon in 2021, led by Sequoia Capital India, Tiger Global, and others. This investment highlights the growing interest and confidence of venture capitalists in the potential of decentralized technologies to transform various industries.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Crypto/Web3 | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zorax Capital | blockchain | ||||

| ZMT Capital | web 3.0 | Generalist | Seed | ||

| zkValidator | blockchain | Seed | |||

| ZhenFund | Crypto/Web3 | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Turing Capital | crypto | Generalist | |||

| Zero Knowledge | deep tech, blockchain, crypto | Israel; United States; Colombia | Pre-Seed, Seed | ||

| ZEMU Venture Capital | decentralization, artificial intelligence, ground-breaking technologies | ||||

| ZBS CAPITAL | crypto, web3 | United States; China, Hong Kong; Canada; Australia; Switzerland; Singapore; Saint Kitts and Nevis; Gibraltar; Turkey; South Korea | Pre-Seed, Seed | ||

| Yunt Capital | crypto, defi, nft | Generalist | Series A, Series B |

95 active CVC investors in Crypto/Web3

Active corporate venture capital firms have been increasingly investing in the crypto and Web3 space in the past three years. Notable players include Visa's Crypto Ventures, which has backed Anchorage Digital, and Mastercard's Start Path program, which has invested in Polygon. These CVC firms are driving innovation in the decentralized finance and blockchain sectors.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Crypto/Web3 | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| XT Hi-Tech | Crypto/Web3 | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Workday Ventures | financial management, human capital, planning, analytics, collaboration, productivity, intelligent automation, mixed reality, blockchain | Series D, Series A, Series E, Series F, Series B, Series C | |||

| Wintermute Ventures | Crypto/Web3 | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Whisk Ventures | web3, esports/gaming, fintech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| VIVE X | vr, ar, blockchain, ai, 5g | Series B, Series A, Seed | |||

| ViaBTC Capital | web 3.0, layer 2, dapps | Generalist | Seed, Series A |

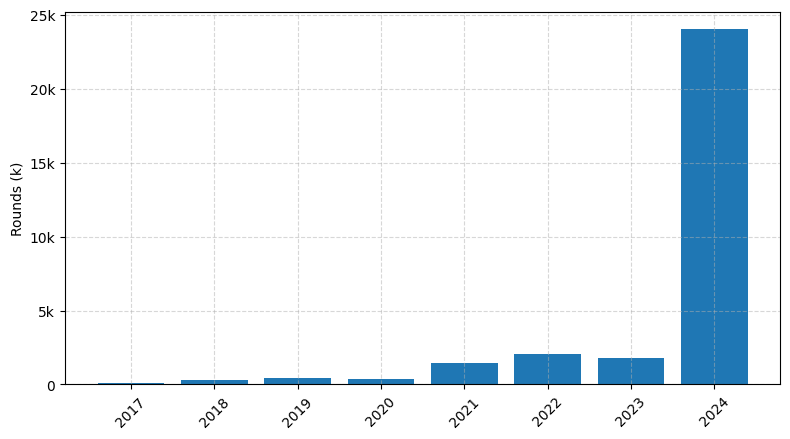

Investments by year: Round

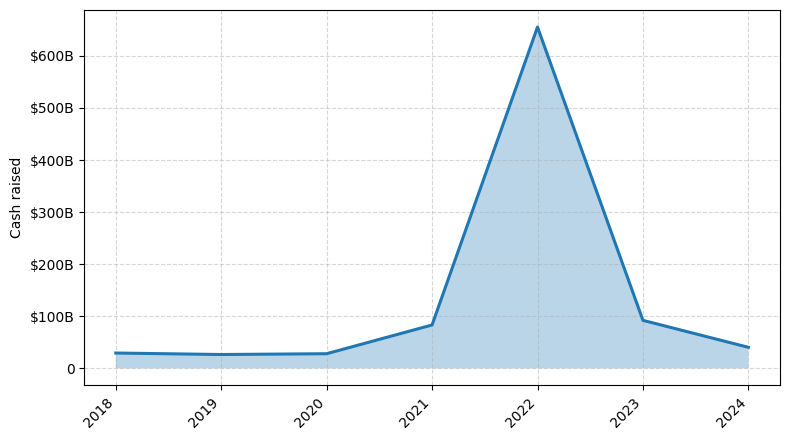

Investments by year: Cash raised

How is fundraising in Crypto/Web3 different from other VC fundraising

Fundraising in the crypto/Web3 space differs from traditional startup fundraising in several key ways. Firstly, the regulatory landscape is more complex, with evolving guidelines around securities laws and token offerings. Crypto projects must navigate these uncertainties carefully to ensure compliance. Additionally, the crypto community places a strong emphasis on decentralization, transparency, and community engagement, which can shape fundraising strategies. Crypto projects often leverage novel funding mechanisms like initial coin offerings (ICOs), initial exchange offerings (IEOs), and decentralized autonomous organizations (DAOs) to engage a global, crypto-native investor base. However, this also introduces challenges around token economics, liquidity, and investor protections that traditional startups may not face. Overall, crypto fundraising requires a deep understanding of the unique dynamics and risks within the rapidly evolving Web3 ecosystem.

Top Funded Crypto/Web3 Startups

1. Coinbase: Approximately $545 million in funding, focused on cryptocurrency exchange and digital wallet services.

2. Binance: Approximately $1.5 billion in funding, focused on cryptocurrency exchange and blockchain infrastructure.

3. FTX: Approximately $1.8 billion in funding, focused on cryptocurrency derivatives trading and exchange services.

4. Blockchain.com: Approximately $533 million in funding, focused on cryptocurrency wallet and exchange services.

5. Kraken: Approximately $119 million in funding, focused on cryptocurrency exchange and trading platform.

2. Binance: Approximately $1.5 billion in funding, focused on cryptocurrency exchange and blockchain infrastructure.

3. FTX: Approximately $1.8 billion in funding, focused on cryptocurrency derivatives trading and exchange services.

4. Blockchain.com: Approximately $533 million in funding, focused on cryptocurrency wallet and exchange services.

5. Kraken: Approximately $119 million in funding, focused on cryptocurrency exchange and trading platform.

What you should include in Crypto/Web3 pitch deck

When creating a Crypto/Web3 pitch deck, include the following unique slides:

1. Blockchain Technology Overview: Explain the core principles and benefits of blockchain technology.

2. Market Opportunity: Highlight the growth potential and market trends in the Crypto/Web3 space.

3. Product/Service Offering: Clearly articulate your Crypto/Web3 solution and its unique value proposition.

4. Competitive Landscape: Analyze your competitors and differentiate your offering.

5. Token Economics: Outline your token model, including distribution, utility, and governance.

6. Roadmap: Provide a detailed timeline of your development and growth plans.

7. Team and Advisors: Showcase your experienced and qualified team members and advisors.

1. Blockchain Technology Overview: Explain the core principles and benefits of blockchain technology.

2. Market Opportunity: Highlight the growth potential and market trends in the Crypto/Web3 space.

3. Product/Service Offering: Clearly articulate your Crypto/Web3 solution and its unique value proposition.

4. Competitive Landscape: Analyze your competitors and differentiate your offering.

5. Token Economics: Outline your token model, including distribution, utility, and governance.

6. Roadmap: Provide a detailed timeline of your development and growth plans.

7. Team and Advisors: Showcase your experienced and qualified team members and advisors.

How to Prepare Your Crypto/Web3 Startup for Investment

Preparing a Crypto/Web3 startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is essential to demonstrate the startup's viability, market potential, and the team's expertise to potential investors.

When pitching to VC investors, startups should be prepared to showcase the following:

1. Clear and Compelling Value Proposition: Articulate the unique problem the startup is solving and how its solution offers a distinct advantage in the Crypto/Web3 space.

2. Robust Technical Roadmap: Demonstrate a well-defined technical roadmap that outlines the development of the product or platform, including key milestones and the team's ability to execute.

3. Scalable Business Model: Present a sustainable and scalable business model that can generate revenue and achieve profitability in the long run.

4. Experienced and Diverse Team: Highlight the team's expertise in Crypto/Web3 technology, industry knowledge, and the ability to drive the startup's growth.

5. Comprehensive Market Analysis: Provide a thorough understanding of the target market, competitive landscape, and the startup's potential for growth and market share.

By addressing these key elements, Crypto/Web3 startups can increase their chances of securing investment and positioning themselves for long-term success.

When pitching to VC investors, startups should be prepared to showcase the following:

1. Clear and Compelling Value Proposition: Articulate the unique problem the startup is solving and how its solution offers a distinct advantage in the Crypto/Web3 space.

2. Robust Technical Roadmap: Demonstrate a well-defined technical roadmap that outlines the development of the product or platform, including key milestones and the team's ability to execute.

3. Scalable Business Model: Present a sustainable and scalable business model that can generate revenue and achieve profitability in the long run.

4. Experienced and Diverse Team: Highlight the team's expertise in Crypto/Web3 technology, industry knowledge, and the ability to drive the startup's growth.

5. Comprehensive Market Analysis: Provide a thorough understanding of the target market, competitive landscape, and the startup's potential for growth and market share.

By addressing these key elements, Crypto/Web3 startups can increase their chances of securing investment and positioning themselves for long-term success.