FREE Investor Database

Top Venture Investors in AR/VR Industry | Unicorn Nest Directory

Top Venture Investors in AR/VR Industry | Unicorn Nest Directory

Browse verified VC and CVC firms funding startups specializing in AR/VR. Discover your ideal investor match and find contacts of the right investors on Unicorn Nest.

Intro

The world of augmented reality (AR) and virtual reality (VR) has seen a surge of investments in the past three years, with the industry attracting significant attention and funding. Since 2022, the AR/VR sector has witnessed a flurry of activity, with numerous startups and established companies securing substantial investments to drive innovation and growth.

According to industry reports, over 500 AR/VR investments have been made in the last three years, totaling more than $15 billion in funding. Some of the core startups that have received notable investments include Niantic, the creators of the popular game Pokémon Go, which raised $300 million in 2022, and Spatial, a leading AR collaboration platform, which secured $25 million in 2021.

The most expensive deals in the AR/VR space include Meta's (formerly Facebook) acquisition of Within, the creators of the popular VR fitness app Supernatural, for a reported $400 million. Additionally, Apple's continued investment in its AR/VR headset development, estimated to be in the billions, has been a significant driver of the industry's growth.

The investments in AR/VR reflect the growing demand for immersive technologies and the industry's potential to transform various sectors, from gaming and entertainment to enterprise applications and beyond.

According to industry reports, over 500 AR/VR investments have been made in the last three years, totaling more than $15 billion in funding. Some of the core startups that have received notable investments include Niantic, the creators of the popular game Pokémon Go, which raised $300 million in 2022, and Spatial, a leading AR collaboration platform, which secured $25 million in 2021.

The most expensive deals in the AR/VR space include Meta's (formerly Facebook) acquisition of Within, the creators of the popular VR fitness app Supernatural, for a reported $400 million. Additionally, Apple's continued investment in its AR/VR headset development, estimated to be in the billions, has been a significant driver of the industry's growth.

The investments in AR/VR reflect the growing demand for immersive technologies and the industry's potential to transform various sectors, from gaming and entertainment to enterprise applications and beyond.

98 active VC investors in AR/VR

In the last three years, the AR/VR industry has seen a surge of investment from venture capital firms. Key players include Andreessen Horowitz, which has backed companies like Rec Room and Spatial, and Sequoia Capital, which has invested in Niantic and Oculus. One of the biggest venture capital rounds in the last two years was Niantic's $300 million Series C funding in 2021, led by Coatue, Institutional Venture Partners, and aXiomatic Gaming. This investment underscores the growing interest and confidence in the potential of augmented and virtual reality technologies to transform various industries.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yıldız Tekno GSYO | artificial intelligence, ar, vr, financial technologies, robotics, insurance technologies, health technologies | Turkey | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| XRM Media | media technology, augmented reality, virtual reality, live streaming cgi, artificial intelligence, blockchain | ||||

| Xora Innovation | AR/VR | United States; United Kingdom; Singapore | Seed, Series A, Series B | ||

| Xfund | enterprise software, machine intelligence, computer vision, nlp, deep learning applications, frontier technologies, space, robotics, vr/ar, autonomous vehicles, healthit, consumer tech, marketplaces, ecommerce, mobile-first | Generalist; United States | Seed, Series A, Series B | USD 120000000 | |

| Workday Ventures | financial management, human capital, planning, analytics, collaboration, productivity, intelligent automation, mixed reality, blockchain | Series D, Series A, Series E, Series F, Series B, Series C | |||

| Women in XR | vr/ar, ai | United States | Seed | USD 5000000 | |

| WING by Digital Wallonia | saas, medtech, engineering tech, advanced tech, deep tech, artificial intelligence, the internet of things, saas software, blockchain technology, medtechs, augmented reality | Belgium, Wallonia | Pre-Seed, Seed, Series A | ||

| Western Development Commission | cleantech, creative industries, food, natural resources, information, communications technology, manufacturing services, internationally-traded services, medtech, life sciences, tourism, advertising, architecture, art, antiques, crafts, design, digital media, fashion, internet, software, music, visual arts, performing arts, publishing | Ireland, County Galway; Ireland, County Mayo; Ireland, County Roscommon; Ireland, County Donegal; Ireland, County Leitrim; Ireland, County Sligo; Ireland, County Clare | Generalist, Seed, Series D, Series C, Series A, Pre-Seed, Series B, Pre-IPO | EUR 75000000 | |

| VIVE X | vr, ar, blockchain, ai, 5g | Series B, Series A, Seed | |||

| Vito Ventures | internet of things, machine intelligence, frontier tech hardware, new-age enterprise software, distributed ledger technology, cyber security, augmented and virtual reality, autonomous systems | Generalist | Series A, Series B |

24 active CVC investors in AR/VR

Active corporate venture capital (CVC) firms have been investing heavily in the AR/VR space in recent years. Notable players include Microsoft's M12, which backed Varjo's advanced VR headsets, and Sony's Innovation Fund, which invested in Sandbox VR's location-based VR experiences. These CVC firms are driving innovation and shaping the future of immersive technologies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Workday Ventures | financial management, human capital, planning, analytics, collaboration, productivity, intelligent automation, mixed reality, blockchain | Series D, Series A, Series E, Series F, Series B, Series C | |||

| VIVE X | vr, ar, blockchain, ai, 5g | Series B, Series A, Seed | |||

| State Farm Ventures | aerial data, ai, blockchain, home safety, home services, insurtech, fintech, mobility, safety, real estate tech, senior living, telematics, vr/ar | United States; Singapore | Generalist | ||

| SRI Ventures | 3d and virtual environments, advanced manipulation and automation, drug discovery and development, bioinformatics and computational biology, computer vision, communications and networking, robotics, sensors and signal processing, image and video processing, medical and surgical devices, quantum sensing, artificial intelligence and machine learning, gps tracking and precision navigation, speech, language, and audio technologies, satellite systems | Seed | |||

| SoftBank Ventures Asia | ict industry, ai, iot, smart robotics, internet & mobile services, software, hardware, e-commerce, advertising & media, vr. | South Korea; Japan; Singapore; China; United States; Israel; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Austria; Belgium; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | Pre-Seed, Seed, Series A, Series B | ||

| SIX FinTech Ventures | AR/VR | Generalist; Switzerland; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Sweden | Seed, Series A, Series B | CHF 50000000 | |

| Safran Corporate Ventures | aviation, space, defense, data analytics, on-demand aviation, new maintenance methods, co-creation, collaborative engineering, ai, blockchain, connectivity, augmented cabin, comfort, in-flight entertainment, human-machine interface, nanotechnologies, surface treatment processes, composites, ceramics, advanced manufacturing processes, low-carbon materials, industry 4.0, non-destructive testing, augmented reality, industrial iot, robotics/cobotics, additive manufacturing, industrial cyber security | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Robert Bosch Venture Capital | ai, deep learning, automation, digitalization, semiconductor, next generation computer, ar / vr, mobility solutions, automation, electrification, sensors, mems devices, robotics, autonomous systems, enabling technologies, connectivity, signal processing and interpretation, human-machine-interface, modern software technologies, web/internet-based business models, climate tech, energy harvesting, distribution and storage, energy efficiency, healthcare, diagnostics and treatment, e-health devices, sensors | Generalist | Seed | USD 295000000 | |

| Bosch Ventures | deep-tech, ai / deep learning, automation & digitalization, semiconductor & next, generation computer, ar / vr, mobility solutions, electronics & power electronics, sensors, actuators, and mems devices, electric systems, incl. robotics, autonomous systems, connectivity, signal processing and interpretation, human-machine-interface (hmi), modern software technologies, web/internet based business models, climate tech, lab and point of care patient diagnostics, chronic diseases management with focus on pulmonary conditions, cancer diagnostics and treatment progress, e-health devices, sensors, applications and services | Generalist | USD 295000000 | ||

| Qualcomm Ventures | 5g, ai, automotive, consumer, enterprise & cloud, iot, xr/metaverse | United States; China; India; Israel; South Korea; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Seed |

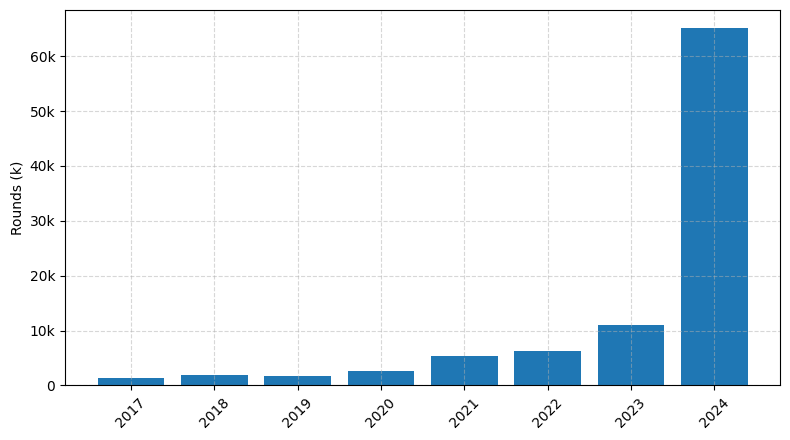

Investments by year: Round

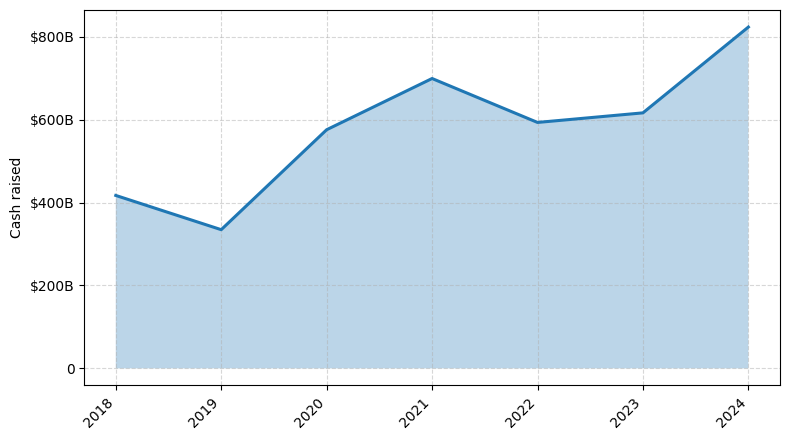

Investments by year: Cash raised

How is fundraising in AR/VR different from other VC fundraising

Fundraising for AR/VR startups differs from general startup fundraising due to the unique challenges posed by the emerging nature of the technology. Investors often have limited understanding of the technical complexities and market potential of AR/VR, making it more difficult to convey the value proposition. Additionally, the high development costs and longer timelines associated with building AR/VR products can be a deterrent for investors seeking quicker returns. Startups must also address concerns around user adoption, hardware limitations, and the need for specialized talent. To succeed in AR/VR fundraising, founders must clearly articulate the market opportunity, demonstrate technical feasibility, and provide a compelling roadmap for commercialization and growth. Establishing strategic partnerships and showcasing early traction can also help mitigate the perceived risks and increase investor confidence.

Top Funded AR/VR Startups

1. Magic Leap: Approximately $3.5 billion in funding, focused on developing augmented reality (AR) technology for enterprise and consumer applications.

2. Niantic: Approximately $1 billion in funding, known for developing the popular mobile game Pokémon GO, which utilizes AR technology.

3. Oculus (owned by Meta): Approximately $2.3 billion in funding, specializing in virtual reality (VR) hardware and software for gaming, entertainment, and enterprise use.

4. Snap Inc.: Approximately $3.4 billion in funding, known for its Snapchat app and its AR-powered camera features.

5. Unity Software: Approximately $2.5 billion in funding, providing a game engine and development platform for AR and VR applications.

2. Niantic: Approximately $1 billion in funding, known for developing the popular mobile game Pokémon GO, which utilizes AR technology.

3. Oculus (owned by Meta): Approximately $2.3 billion in funding, specializing in virtual reality (VR) hardware and software for gaming, entertainment, and enterprise use.

4. Snap Inc.: Approximately $3.4 billion in funding, known for its Snapchat app and its AR-powered camera features.

5. Unity Software: Approximately $2.5 billion in funding, providing a game engine and development platform for AR and VR applications.

What you should include in AR/VR pitch deck

When creating an AR/VR pitch deck, it's essential to include the following unique slides:

1. Technology Overview: Explain the underlying technology, its capabilities, and how it differs from traditional platforms.

2. Use Cases: Showcase specific applications and use cases that highlight the unique value proposition of your AR/VR solution.

3. Market Opportunity: Provide data-driven insights into the growing AR/VR market and the potential for your product to capture a significant share.

4. Competitive Landscape: Analyze the competitive environment and differentiate your offering from existing solutions.

5. Roadmap and Milestones: Outline your development plan, key milestones, and the timeline for bringing your AR/VR product to market.

1. Technology Overview: Explain the underlying technology, its capabilities, and how it differs from traditional platforms.

2. Use Cases: Showcase specific applications and use cases that highlight the unique value proposition of your AR/VR solution.

3. Market Opportunity: Provide data-driven insights into the growing AR/VR market and the potential for your product to capture a significant share.

4. Competitive Landscape: Analyze the competitive environment and differentiate your offering from existing solutions.

5. Roadmap and Milestones: Outline your development plan, key milestones, and the timeline for bringing your AR/VR product to market.

How to Prepare Your AR/VR Startup for Investment

Preparing an AR/VR startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract investment by demonstrating its viability, market opportunity, and competitive advantage.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined problem and solution: Articulate the specific problem the AR/VR technology solves and how the startup's solution is uniquely positioned to address it.

2. Compelling market opportunity: Provide a thorough analysis of the target market, including the size, growth potential, and the startup's ability to capture a significant share.

3. Innovative technology and intellectual property: Highlight the technical capabilities of the AR/VR solution, any proprietary technology, and the startup's ability to maintain a competitive edge.

4. Experienced and capable team: Showcase the expertise, relevant experience, and complementary skills of the founding team and key personnel.

5. Realistic financial projections and business model: Present a well-thought-out financial plan, including revenue streams, cost structure, and a clear path to profitability and scalability.

By addressing these key elements, the AR/VR startup can increase its chances of securing investment and positioning itself for long-term success.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined problem and solution: Articulate the specific problem the AR/VR technology solves and how the startup's solution is uniquely positioned to address it.

2. Compelling market opportunity: Provide a thorough analysis of the target market, including the size, growth potential, and the startup's ability to capture a significant share.

3. Innovative technology and intellectual property: Highlight the technical capabilities of the AR/VR solution, any proprietary technology, and the startup's ability to maintain a competitive edge.

4. Experienced and capable team: Showcase the expertise, relevant experience, and complementary skills of the founding team and key personnel.

5. Realistic financial projections and business model: Present a well-thought-out financial plan, including revenue streams, cost structure, and a clear path to profitability and scalability.

By addressing these key elements, the AR/VR startup can increase its chances of securing investment and positioning itself for long-term success.