FREE Investor Database

Top Venture Investors in Retail Industry

Top Venture Investors in Retail Industry

Discover leading VC and CVC investors specializing in Retail. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The retail industry has witnessed a surge of investments in the past three years, reflecting the sector's resilience and adaptability in the face of evolving consumer preferences and technological advancements. Since 2022, the retail landscape has seen a flurry of investment activity, with numerous startups and established players securing significant funding to drive innovation and growth.

Over the last three years, the retail sector has attracted a substantial amount of investment, with hundreds of deals being struck across various sub-sectors, from e-commerce and omnichannel solutions to personalized shopping experiences and supply chain optimization. The total investment in the retail industry during this period has exceeded $50 billion, with several high-profile deals involving startups like Instacart, Warby Parker, and Glossier.

Some of the most expensive deals in the retail space include Instacart's $265 million Series H round, Warby Parker's $245 million Series F, and Glossier's $100 million Series D. One particularly interesting deal was the $150 million investment in Coupang, a leading e-commerce platform in South Korea, which highlights the global nature of the retail industry's transformation.

In summary, the retail industry has witnessed a remarkable surge in investment activity over the past three years, with billions of dollars flowing into innovative startups and established players alike, as the sector continues to evolve and adapt to the changing needs of consumers.

Over the last three years, the retail sector has attracted a substantial amount of investment, with hundreds of deals being struck across various sub-sectors, from e-commerce and omnichannel solutions to personalized shopping experiences and supply chain optimization. The total investment in the retail industry during this period has exceeded $50 billion, with several high-profile deals involving startups like Instacart, Warby Parker, and Glossier.

Some of the most expensive deals in the retail space include Instacart's $265 million Series H round, Warby Parker's $245 million Series F, and Glossier's $100 million Series D. One particularly interesting deal was the $150 million investment in Coupang, a leading e-commerce platform in South Korea, which highlights the global nature of the retail industry's transformation.

In summary, the retail industry has witnessed a remarkable surge in investment activity over the past three years, with billions of dollars flowing into innovative startups and established players alike, as the sector continues to evolve and adapt to the changing needs of consumers.

96 active VC investors in Retail

In the last three years, the retail industry has seen active venture capital (VC) investment, with firms like Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins leading the charge. One notable example is Instacart's $600 million Series H round in 2021, which was led by Andreessen Horowitz and valued the grocery delivery platform at $39 billion. This investment highlights the VC community's confidence in the evolving retail landscape, as consumers increasingly embrace e-commerce and on-demand services. These VC firms are capitalizing on the opportunities presented by the shifting retail industry, driving innovation and growth in the sector.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zoom Apps Fund | customers | United States; Israel | Seed, Series A, Series B | ||

| Zone2boost | fintech, retail | France; Spain; United Kingdom; Ireland | Series A, Seed | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| Zigg Capital | real estate | Generalist | Seed | USD 225000000 | |

| Zhongmi Capital | consumer technology, martech, big data, pan-entertainment, digital marketing, sports | Pre-Seed, Seed, Series A, Series B | |||

| ZhenFund | Retail | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| Zeta Alpha | Retail | Seed | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed |

100 active CVC investors in Retail

Active corporate venture capital (CVC) firms have been investing heavily in the retail sector over the past three years. Key players include Walmart's Store No8, Target's Target Ventures, and Macy's Macy's Ventures. Investments range from AI-powered shopping experiences to sustainable fashion and innovative logistics solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zoom Apps Fund | customers | United States; Israel | Seed, Series A, Series B | ||

| Zone2boost | fintech, retail | France; Spain; United Kingdom; Ireland | Series A, Seed | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wormhole Capital | Retail | Series A, Seed, Series B, Series C | |||

| WIND Ventures | mobility, energy, retail | United States; Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Series A, Series B | ||

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| University System of Maryland - Crunchbase School Profile & Alumni | hardware, information technology, cybersecurity, life science, retail | United States, Maryland | Pre-Seed, Series B, Seed, Series A |

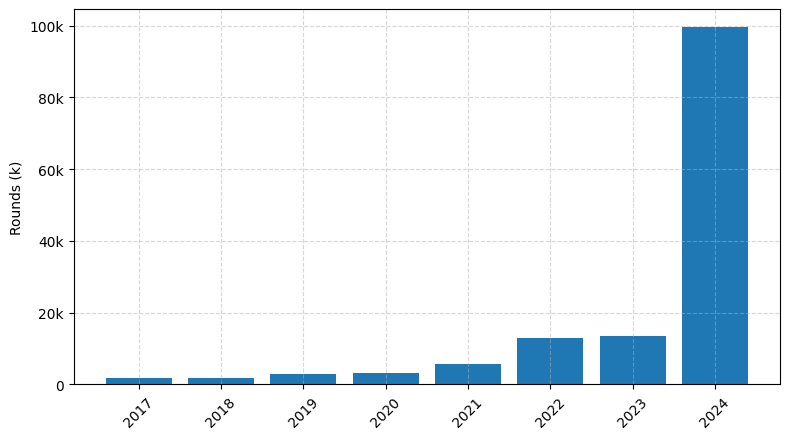

Investments by year: Round

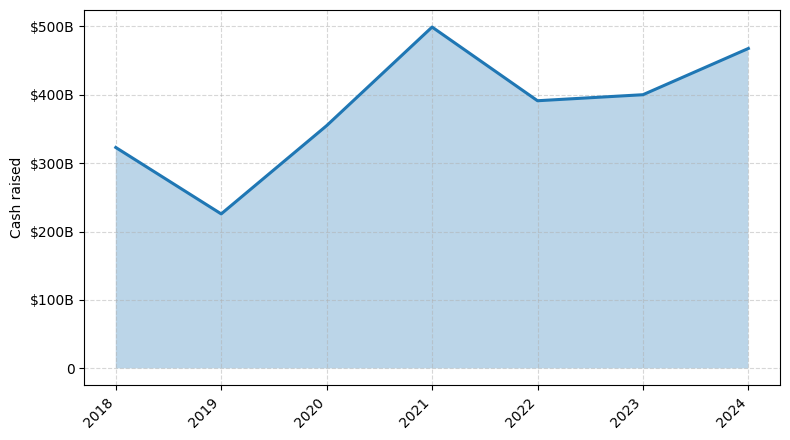

Investments by year: Cash raised

How is fundraising in Retail different from other VC fundraising

Fundraising for retail startups differs from general startup fundraising in several key ways. Retail businesses often require significant upfront capital for inventory, physical store buildouts, and logistics infrastructure, which can make them less attractive to traditional venture capitalists focused on software and technology. Additionally, retail startups face unique challenges such as high customer acquisition costs, inventory management, and the need to build a physical presence. As a result, retail founders may need to explore alternative funding sources, such as crowdfunding, angel investors with industry expertise, or specialized retail-focused venture funds. The fundraising process for retail startups also tends to be more operationally intensive, with investors scrutinizing factors like unit economics, supply chain management, and real estate strategy.

Top Funded Retail Startups

1. Instacart: Approximately $2.7 billion in total funding, focused on online grocery delivery.

2. Coupang: Approximately $3.8 billion in total funding, focused on e-commerce and logistics in South Korea.

3. Wish: Approximately $1.4 billion in total funding, focused on cross-border e-commerce.

4. Flipkart: Approximately $7.6 billion in total funding, focused on e-commerce in India.

5. Wayfair: Approximately $1.1 billion in total funding, focused on online home goods and furniture sales.

2. Coupang: Approximately $3.8 billion in total funding, focused on e-commerce and logistics in South Korea.

3. Wish: Approximately $1.4 billion in total funding, focused on cross-border e-commerce.

4. Flipkart: Approximately $7.6 billion in total funding, focused on e-commerce in India.

5. Wayfair: Approximately $1.1 billion in total funding, focused on online home goods and furniture sales.

What you should include in Retail pitch deck

A Retail pitch deck should include the following unique slides:

1. Market Analysis: Provide an overview of the target market, industry trends, and competitive landscape.

2. Customer Segmentation: Identify the key customer segments and their specific needs.

3. Value Proposition: Clearly articulate the unique value your retail business offers to customers.

4. Sales and Distribution Strategy: Outline your plan for reaching and engaging customers through various sales channels and distribution methods.

5. Financial Projections: Present detailed financial projections, including revenue, expenses, and profitability.

Remember to keep the pitch deck concise, visually appealing, and tailored to the specific needs of your retail business.

1. Market Analysis: Provide an overview of the target market, industry trends, and competitive landscape.

2. Customer Segmentation: Identify the key customer segments and their specific needs.

3. Value Proposition: Clearly articulate the unique value your retail business offers to customers.

4. Sales and Distribution Strategy: Outline your plan for reaching and engaging customers through various sales channels and distribution methods.

5. Financial Projections: Present detailed financial projections, including revenue, expenses, and profitability.

Remember to keep the pitch deck concise, visually appealing, and tailored to the specific needs of your retail business.

How to Prepare Your Retail Startup for Investment

Preparing a Retail Startup for Investment:

When seeking investment for a retail startup, it's crucial to demonstrate your business's viability and growth potential. Investors typically look for specific elements in your pitch deck to assess the feasibility and scalability of your venture.

Key Considerations for Retail Startups Seeking Investment:

1. Clearly Defined Market Opportunity: Provide a comprehensive analysis of the target market, including market size, growth trends, and the unique value proposition your business offers.

2. Compelling Business Model: Outline a sustainable and scalable business model that outlines your revenue streams, pricing strategies, and cost structures.

3. Competitive Advantage: Highlight the unique features, technologies, or strategies that set your retail startup apart from competitors and position it for long-term success.

4. Experienced Management Team: Showcase the expertise, relevant experience, and track record of your founding team and key personnel.

5. Detailed Financial Projections: Present well-researched financial projections, including revenue forecasts, cost estimates, and a clear path to profitability and growth.

By addressing these key elements in your pitch deck, you can demonstrate to potential investors that your retail startup is a sound investment opportunity with a strong foundation for success.

When seeking investment for a retail startup, it's crucial to demonstrate your business's viability and growth potential. Investors typically look for specific elements in your pitch deck to assess the feasibility and scalability of your venture.

Key Considerations for Retail Startups Seeking Investment:

1. Clearly Defined Market Opportunity: Provide a comprehensive analysis of the target market, including market size, growth trends, and the unique value proposition your business offers.

2. Compelling Business Model: Outline a sustainable and scalable business model that outlines your revenue streams, pricing strategies, and cost structures.

3. Competitive Advantage: Highlight the unique features, technologies, or strategies that set your retail startup apart from competitors and position it for long-term success.

4. Experienced Management Team: Showcase the expertise, relevant experience, and track record of your founding team and key personnel.

5. Detailed Financial Projections: Present well-researched financial projections, including revenue forecasts, cost estimates, and a clear path to profitability and growth.

By addressing these key elements in your pitch deck, you can demonstrate to potential investors that your retail startup is a sound investment opportunity with a strong foundation for success.