FREE Investor Database

Top Venture Investors in Life sciences Industry

Top Venture Investors in Life sciences Industry

Discover leading VC and CVC investors specializing in Life sciences. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The life sciences sector has witnessed a surge in investment activity over the past three years, with a growing appetite for innovative solutions that address pressing healthcare challenges. Since 2022, the industry has seen a significant influx of capital, with numerous startups and established players securing substantial funding to drive their research and development efforts.

In the last three years, the life sciences sector has witnessed over 500 investment deals, totaling more than $50 billion in funding. Some of the core startups that have received notable investments include Moderna, Ginkgo Bioworks, and Verily Life Sciences, each securing multi-billion-dollar deals to advance their groundbreaking technologies.

The most expensive deals in the life sciences sector during this period include Moderna's $1.5 billion Series H round and Ginkgo Bioworks' $1.2 billion Series E funding. One particularly interesting deal was Verily Life Sciences' $1 billion investment from Alphabet, showcasing the growing interest of tech giants in the life sciences space.

The life sciences sector's investment landscape has been dynamic, with a strong focus on cutting-edge technologies, personalized medicine, and solutions that have the potential to transform healthcare delivery and patient outcomes.

In the last three years, the life sciences sector has witnessed over 500 investment deals, totaling more than $50 billion in funding. Some of the core startups that have received notable investments include Moderna, Ginkgo Bioworks, and Verily Life Sciences, each securing multi-billion-dollar deals to advance their groundbreaking technologies.

The most expensive deals in the life sciences sector during this period include Moderna's $1.5 billion Series H round and Ginkgo Bioworks' $1.2 billion Series E funding. One particularly interesting deal was Verily Life Sciences' $1 billion investment from Alphabet, showcasing the growing interest of tech giants in the life sciences space.

The life sciences sector's investment landscape has been dynamic, with a strong focus on cutting-edge technologies, personalized medicine, and solutions that have the potential to transform healthcare delivery and patient outcomes.

99 active VC investors in Life sciences

In the last three years, the life sciences sector has seen a surge in venture capital investment, with several prominent firms leading the charge. Key players include Flagship Pioneering, which has backed groundbreaking biotech startups, and Sofinnova Partners, known for its focus on innovative therapeutics. One notable example is the $700 million Series B funding round raised by Moderna in 2020, one of the largest venture capital deals in the life sciences space during this period. This investment underscores the growing appetite for transformative technologies that can address unmet medical needs.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zoic Capital | healthcare, life science, med-tech, biotech | United States | Seed, Pre-Seed, Series A | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| ZIG Ventures | healthcare biomedical and sciences | Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand; | |||

| Zentynel Frontier Investments | biotechnology | Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay | Seed | ||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| Yosemite | Life sciences | United States | Seed, Series B, Series A | USD 200000000 | |

| Yingke Capital | life science, dual-carbon technology, hardcore technology, chip semiconductor, integrated circuit, new materials, high-end manufacturing |

89 active CVC investors in Life sciences

Active corporate venture capital (CVC) firms have been increasingly investing in the life sciences sector in recent years. Notable players include Novartis Venture Fund, Johnson & Johnson Innovation, and Merck Global Health Innovation Fund, which have backed innovative startups in areas like gene therapy, digital health, and precision medicine.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Viva BioInnovator | biotech, biopharmaceuticals, devices, diagnostics, life science tools | Generalist | Series B, Series A | ||

| VIB | (bio)pharmaceuticals, diagnostics, agricultural improvements | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| University System of Maryland - Crunchbase School Profile & Alumni | hardware, information technology, cybersecurity, life science, retail | United States, Maryland | Pre-Seed, Series B, Seed, Series A | ||

| UnityPoint Health Ventures | care experience, care financing, care delivery and care innovation. digital therapeutics, health it, tech-enabled services, medical devices and diagnostics | United States, Iowa; United States, Illinois; United States, Wisconsin | Seed, Series A, Series B | ||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 |

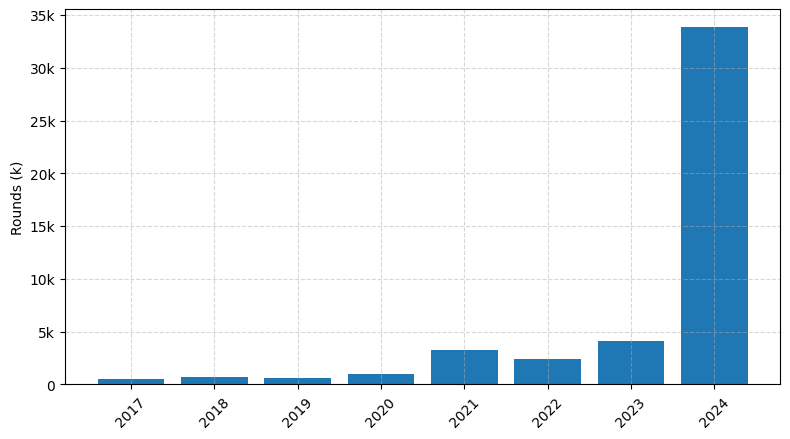

Investments by year: Round

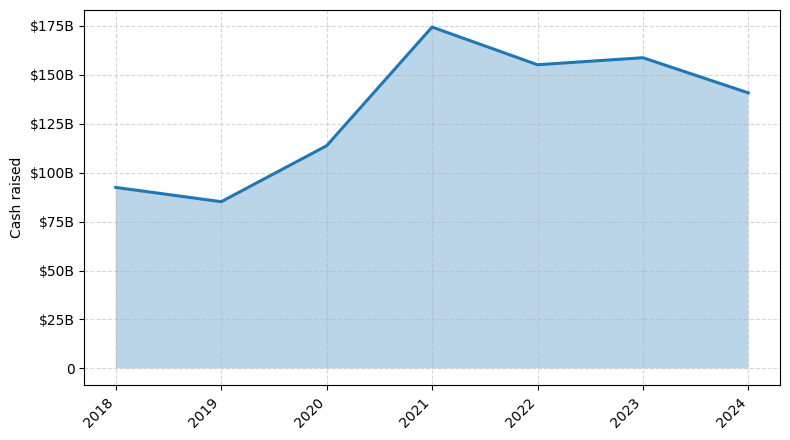

Investments by year: Cash raised

How is fundraising in Life sciences different from other VC fundraising

Fundraising in the life sciences industry differs from general startup fundraising in several key ways. Firstly, the development of life sciences products, such as drugs or medical devices, typically requires extensive and costly research and clinical trials, which can take years to complete. This lengthy timeline means that life sciences startups often require significantly more capital to reach critical milestones compared to other tech-driven startups. Additionally, the regulatory landscape in the life sciences industry is highly complex, and startups must navigate a rigorous approval process, which adds to the overall risk and uncertainty. Investors in this space often have a higher risk tolerance and a longer investment horizon, as they understand the unique challenges faced by life sciences companies. Effective fundraising in this sector requires a deep understanding of the industry's nuances and the ability to clearly communicate the potential impact and value proposition of the company's technology or product.

Top Funded Life sciences Startups

1. Moderna: Approximately $3.5 billion in total funding, focused on mRNA-based therapeutics and vaccines.

2. Ginkgo Bioworks: Approximately $1.9 billion in total funding, focused on engineering biology for various applications.

3. Tempus: Approximately $1.1 billion in total funding, focused on precision medicine and data-driven healthcare solutions.

4. Insitro: Approximately $600 million in total funding, focused on using machine learning to accelerate drug discovery and development.

5. Verily (Alphabet's life sciences division): Approximately $2.1 billion in total funding, focused on healthcare technology and life sciences research.

2. Ginkgo Bioworks: Approximately $1.9 billion in total funding, focused on engineering biology for various applications.

3. Tempus: Approximately $1.1 billion in total funding, focused on precision medicine and data-driven healthcare solutions.

4. Insitro: Approximately $600 million in total funding, focused on using machine learning to accelerate drug discovery and development.

5. Verily (Alphabet's life sciences division): Approximately $2.1 billion in total funding, focused on healthcare technology and life sciences research.

What you should include in Life sciences pitch deck

A life sciences pitch deck should include the following unique slides:

1. Disease/Unmet Need: Clearly define the medical condition or problem your solution addresses, and the current limitations in the market.

2. Technology/Solution: Explain your innovative technology or product, and how it uniquely solves the identified problem.

3. Competitive Landscape: Analyze the competitive environment and demonstrate your product's advantages over existing solutions.

4. Regulatory Pathway: Outline the regulatory approval process and timeline for your product, highlighting any unique considerations or advantages.

5. Clinical Data: Present compelling clinical evidence supporting the safety and efficacy of your solution.

1. Disease/Unmet Need: Clearly define the medical condition or problem your solution addresses, and the current limitations in the market.

2. Technology/Solution: Explain your innovative technology or product, and how it uniquely solves the identified problem.

3. Competitive Landscape: Analyze the competitive environment and demonstrate your product's advantages over existing solutions.

4. Regulatory Pathway: Outline the regulatory approval process and timeline for your product, highlighting any unique considerations or advantages.

5. Clinical Data: Present compelling clinical evidence supporting the safety and efficacy of your solution.

How to Prepare Your Life sciences Startup for Investment

Preparing a Life Sciences startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract the necessary funding to drive its growth and development.

VC investors typically expect the following in a pitch deck review:

1. Compelling Value Proposition: Clearly articulate the unmet need the startup's technology or product aims to address, and how it offers a unique and superior solution compared to existing alternatives.

2. Robust Scientific Validation: Demonstrate strong scientific evidence, such as pre-clinical or clinical data, supporting the efficacy and safety of the startup's technology or product.

3. Experienced and Capable Team: Highlight the expertise, relevant experience, and track record of the founding team and key personnel in the life sciences domain.

4. Comprehensive Intellectual Property (IP) Strategy: Ensure the startup has a robust IP portfolio, including patents, trade secrets, or other forms of protection, to safeguard its competitive advantage.

5. Detailed Commercialization Plan: Outline a well-defined strategy for navigating the regulatory landscape, securing necessary approvals, and effectively bringing the product to market.

By addressing these key elements, life sciences startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.

VC investors typically expect the following in a pitch deck review:

1. Compelling Value Proposition: Clearly articulate the unmet need the startup's technology or product aims to address, and how it offers a unique and superior solution compared to existing alternatives.

2. Robust Scientific Validation: Demonstrate strong scientific evidence, such as pre-clinical or clinical data, supporting the efficacy and safety of the startup's technology or product.

3. Experienced and Capable Team: Highlight the expertise, relevant experience, and track record of the founding team and key personnel in the life sciences domain.

4. Comprehensive Intellectual Property (IP) Strategy: Ensure the startup has a robust IP portfolio, including patents, trade secrets, or other forms of protection, to safeguard its competitive advantage.

5. Detailed Commercialization Plan: Outline a well-defined strategy for navigating the regulatory landscape, securing necessary approvals, and effectively bringing the product to market.

By addressing these key elements, life sciences startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.