FREE Investor Database

Top Venture Investors in Healthtech Industry

Top Venture Investors in Healthtech Industry

Discover leading VC and CVC investors specializing in Healthtech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The healthcare industry has witnessed a surge in investment activity over the past three years, with the Healthtech sector emerging as a prime target for investors. Since 2022, the Healthtech industry has seen a remarkable influx of capital, with numerous startups receiving significant funding to drive innovation and transform the way healthcare is delivered.

In the last three years, the Healthtech sector has witnessed over 1,500 investments, with a total investment value exceeding $50 billion. Some of the core startups that have received substantial investments include Teladoc Health, Babylon Health, and Ro. Additionally, several high-profile deals have been made, including the $18.5 billion acquisition of Livongo by Teladoc Health and the $3.1 billion investment in Ro by SoftBank.

One particularly interesting deal was the $200 million Series C funding round for Tempus, a leading provider of AI-powered precision medicine solutions, which highlights the growing interest in leveraging technology to improve healthcare outcomes.

The surge in Healthtech investments underscores the industry's potential to revolutionize the way healthcare is accessed, delivered, and managed, with investors recognizing the transformative impact of these innovative solutions.

In the last three years, the Healthtech sector has witnessed over 1,500 investments, with a total investment value exceeding $50 billion. Some of the core startups that have received substantial investments include Teladoc Health, Babylon Health, and Ro. Additionally, several high-profile deals have been made, including the $18.5 billion acquisition of Livongo by Teladoc Health and the $3.1 billion investment in Ro by SoftBank.

One particularly interesting deal was the $200 million Series C funding round for Tempus, a leading provider of AI-powered precision medicine solutions, which highlights the growing interest in leveraging technology to improve healthcare outcomes.

The surge in Healthtech investments underscores the industry's potential to revolutionize the way healthcare is accessed, delivered, and managed, with investors recognizing the transformative impact of these innovative solutions.

96 active VC investors in Healthtech

In the last three years, the Healthtech industry has seen a surge of investment from active venture capital firms. Key players in this space include Andreessen Horowitz, which has backed companies like Devoted Health, and Sequoia Capital, which has invested in Ro, a telehealth startup. One of the biggest venture capital rounds in the last two years was Tempus' $200 million Series G funding in 2021, which valued the company at $8.1 billion. Tempus is a data-driven precision medicine company that uses machine learning and genomic sequencing to improve cancer treatment.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| Zühlke Ventures AG | healthtech | Switzerland; United States | Series A, Series B | ||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zoic Capital | healthcare, life science, med-tech, biotech | United States | Seed, Pre-Seed, Series A | ||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| ZIG Ventures | healthcare biomedical and sciences | Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand; | |||

| ZhenFund | Healthtech | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Zenture Capital Partners | Avon, Connecticut | digital transformation, healthcare, sustainability, ai, automation, | Seed, Pre-Seed |

98 active CVC investors in Healthtech

Active corporate venture capital (CVC) firms have been investing heavily in healthtech startups in the past three years. Notable players include Johnson & Johnson Innovation, Novartis Venture Fund, and Merck Global Health Innovation Fund, backing innovative solutions in digital health, medical devices, and biotechnology.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zynext Ventures | healthcare, biotech | Series A, Seed, Series B | |||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zeon Ventures | sustainable, healthy, sustainable planet, human health, amplified intelligence, materials, sustainability, climate, health | Series A, Seed, Series B | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| We Venture Capital | healthcare, diagnostics | Series A, Series B, Seed | |||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| Vanterra Ventures | consumer health, branded products, digital health, enabling technologies | United States | Seed, Series A, Series B, Series C |

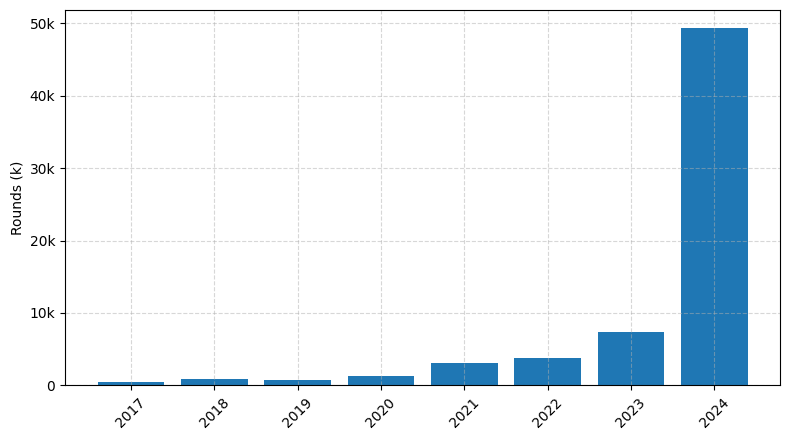

Investments by year: Round

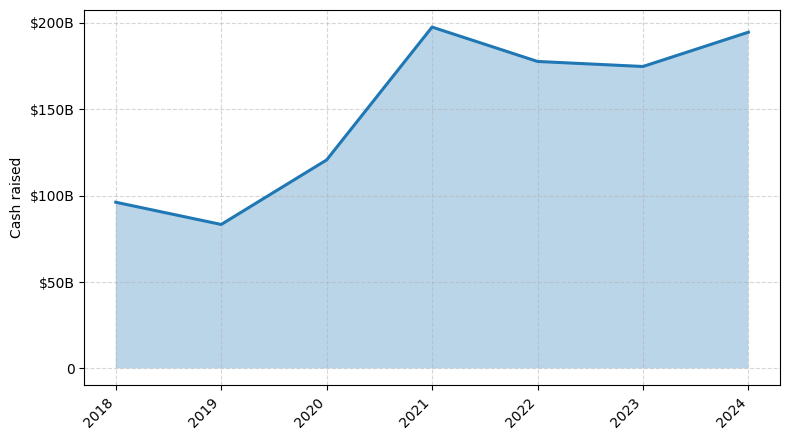

Investments by year: Cash raised

How is fundraising in Healthtech different from other VC fundraising

Fundraising in the Healthtech industry presents unique challenges compared to general startup fundraising. Healthtech companies often require significant upfront investment for research, development, and regulatory approval, which can extend the timeline to profitability. Additionally, the healthcare industry is highly regulated, and Healthtech startups must navigate complex compliance requirements, which can add complexity and risk to their business models. Investors in the Healthtech space tend to have a higher risk tolerance and a longer investment horizon, as they understand the potential for transformative impact on patient outcomes. Successful Healthtech fundraising requires a deep understanding of the regulatory landscape, a compelling value proposition, and a strong team with relevant industry expertise.

Top Funded Healthtech Startups

1. Tempus: Approximately $1.1 billion in total funding, focused on precision medicine and cancer genomics.

2. Olive: Approximately $856 million in total funding, focused on healthcare automation and artificial intelligence.

3. Ro: Approximately $876 million in total funding, focused on telehealth and online pharmacy services.

4. Noom: Approximately $655 million in total funding, focused on digital health and weight management.

5. Hims & Hers: Approximately $357 million in total funding, focused on telemedicine and online healthcare services.

2. Olive: Approximately $856 million in total funding, focused on healthcare automation and artificial intelligence.

3. Ro: Approximately $876 million in total funding, focused on telehealth and online pharmacy services.

4. Noom: Approximately $655 million in total funding, focused on digital health and weight management.

5. Hims & Hers: Approximately $357 million in total funding, focused on telemedicine and online healthcare services.

What you should include in Healthtech pitch deck

A Healthtech pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the healthcare problem your solution addresses.

2. Solution Overview: Explain how your Healthtech product or service solves the identified problem.

3. Market Opportunity: Demonstrate the size and growth potential of the target healthcare market.

4. Competitive Landscape: Highlight your competitive advantages and differentiation from existing solutions.

5. Regulatory and Compliance: Outline the regulatory requirements and how your Healthtech offering meets them.

6. Clinical Validation: Provide evidence of your product's efficacy and safety through clinical trials or pilot studies.

1. Problem Statement: Clearly define the healthcare problem your solution addresses.

2. Solution Overview: Explain how your Healthtech product or service solves the identified problem.

3. Market Opportunity: Demonstrate the size and growth potential of the target healthcare market.

4. Competitive Landscape: Highlight your competitive advantages and differentiation from existing solutions.

5. Regulatory and Compliance: Outline the regulatory requirements and how your Healthtech offering meets them.

6. Clinical Validation: Provide evidence of your product's efficacy and safety through clinical trials or pilot studies.

How to Prepare Your Healthtech Startup for Investment

Preparing a Healthtech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your Healthtech startup for investment, consider the following:

1. Clearly define your value proposition: Articulate the unique problem your solution solves and the tangible benefits it offers to your target market.

2. Demonstrate a strong market opportunity: Provide data-driven insights into the size, growth potential, and competitive landscape of the Healthtech industry.

3. Highlight your team's expertise: Showcase the relevant experience, skills, and track record of your founding team and key personnel.

4. Outline a robust go-to-market strategy: Describe your plan for customer acquisition, sales, and distribution channels to drive revenue growth.

5. Present a compelling financial model: Demonstrate a well-researched financial plan, including projections, milestones, and a clear path to profitability and scalability.

By addressing these key elements, you can increase your chances of securing investment and positioning your Healthtech startup for long-term success.

To prepare your Healthtech startup for investment, consider the following:

1. Clearly define your value proposition: Articulate the unique problem your solution solves and the tangible benefits it offers to your target market.

2. Demonstrate a strong market opportunity: Provide data-driven insights into the size, growth potential, and competitive landscape of the Healthtech industry.

3. Highlight your team's expertise: Showcase the relevant experience, skills, and track record of your founding team and key personnel.

4. Outline a robust go-to-market strategy: Describe your plan for customer acquisition, sales, and distribution channels to drive revenue growth.

5. Present a compelling financial model: Demonstrate a well-researched financial plan, including projections, milestones, and a clear path to profitability and scalability.

By addressing these key elements, you can increase your chances of securing investment and positioning your Healthtech startup for long-term success.