FREE Investor Database

Top Venture Investors in IoT Industry

Top Venture Investors in IoT Industry

Discover leading VC and CVC investors specializing in IoT. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The Internet of Things (IoT) has been a rapidly growing sector, attracting significant investments in recent years. Over the past three years, since 2022, the IoT industry has witnessed a surge in investment activity, with numerous startups and established companies receiving substantial funding to drive innovation and expansion.

According to industry reports, the IoT sector has seen over 1,500 investments in the last three years, with a total investment value exceeding $25 billion. Some of the core startups that have received notable investments include Samsara, a leading provider of IoT-powered fleet management solutions, which raised $300 million in a Series G round, and Helium, a decentralized wireless network for IoT devices, which secured $200 million in a Series D funding round.

Among the most expensive deals, the acquisition of Arm by NVIDIA for $40 billion stands out as a significant milestone, showcasing the growing importance of IoT-related technologies. Additionally, the partnership between Amazon Web Services and Verizon to develop 5G-enabled IoT solutions has been an interesting development, highlighting the convergence of IoT and 5G technologies.

In summary, the IoT sector has experienced a remarkable investment boom, with substantial capital flowing into the industry to drive innovation, expand capabilities, and capitalize on the growing demand for connected devices and smart solutions.

According to industry reports, the IoT sector has seen over 1,500 investments in the last three years, with a total investment value exceeding $25 billion. Some of the core startups that have received notable investments include Samsara, a leading provider of IoT-powered fleet management solutions, which raised $300 million in a Series G round, and Helium, a decentralized wireless network for IoT devices, which secured $200 million in a Series D funding round.

Among the most expensive deals, the acquisition of Arm by NVIDIA for $40 billion stands out as a significant milestone, showcasing the growing importance of IoT-related technologies. Additionally, the partnership between Amazon Web Services and Verizon to develop 5G-enabled IoT solutions has been an interesting development, highlighting the convergence of IoT and 5G technologies.

In summary, the IoT sector has experienced a remarkable investment boom, with substantial capital flowing into the industry to drive innovation, expand capabilities, and capitalize on the growing demand for connected devices and smart solutions.

98 active VC investors in IoT

In the last three years, the IoT (Internet of Things) sector has attracted significant attention from venture capital firms. Key players in this space include Kleiner Perkins, Andreessen Horowitz, and Sequoia Capital, which have invested in a range of IoT startups. One notable example is the $200 million Series E funding round raised by Samsara, a leading IoT platform for transportation and industrial operations, in 2021. This investment highlights the growing interest and confidence in the IoT market, as investors recognize the potential for innovative solutions to transform various industries.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zukunftsfonds Heilbronn | IoT | United States; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Pre-Seed, Seed | ||

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| Yaletown Partners | software, data, iot, ai, cloud | Canada | Series C, Series D, Series F, Series E | USD 200000000 | |

| Xplorer Fund | mobility, med, robotics, energy, ict, iot, digitalisation, digital twins | Pre-Seed | |||

| Xplorer Capital | artificial intelligence, automation, iot, enterprise saas, data solutions, robotics, autonomous, drones, machine learning, big data,disruptive technology | Canada; United States; Germany | Seed, Series A, Series B | USD 100000000 | |

| Xevin Investments | martech, adtech, marketplace, e-commerce, saas b2b, b2c, edtech, fintech, digital health, internet of things | Poland; Czech Republic; Slovakia; Ukraine; Hungary; Romania; Bulgaria; Greece; Israel | Series E, Series C, Series D, Seed, Series A, Series B | ||

| Celesta Capital | 5g, ai/ml, aerospace, agritech, automotive, cleantech, construction tech, consumer electronics, data infrastructure, data storage, edtech, edge computing, enterprise solutions, fintech, foodtech, healthtech, imaging, iot, life sciences, materials, medtech, networking, realtech, retailtech, robotics, security, semiconductors, software, deep tech | United States, California, Silicon Valley | Series A, Series B | ||

| Wisemont Capital | IoT | ||||

| WING by Digital Wallonia | saas, medtech, engineering tech, advanced tech, deep tech, artificial intelligence, the internet of things, saas software, blockchain technology, medtechs, augmented reality | Belgium, Wallonia | Pre-Seed, Seed, Series A | ||

| Willendorff Technologies | b2b, retail digitization, iot, smart city, marketing technology, smart data, analytics | Series B, Series A, Seed |

38 active CVC investors in IoT

Active corporate venture capital (CVC) firms have been investing heavily in the IoT (Internet of Things) space in the past three years. Notable players include Intel Capital, which backed smart home platform Plume, and Qualcomm Ventures, which invested in IoT security startup Armis. These CVC firms are driving innovation in the rapidly evolving IoT landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Trimble Ventures | construction, transportation, agriculture, geospatial, technology, hardware, software applications, autonomy, robotics, sustainability, artificial intelligence, blockchain, augmented, mixed reality, iot analytics | Series B, Series A, Series E, Series D, Seed, Series C | USD 200000000 | ||

| Trifork Labs | IoT | Generalist | Pre-Seed, Seed, Series A, Series B | ||

| TELUS Ventures | ag tech, connected consumer, digital health, smart cities and iot | Canada; United States | |||

| Telefonica Innovation Ventures | IoT | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| Stanley Ventures | new materials, automation, 3d printing, robotics, recycling, electrification, industrial iot, manufacturing | Generalist | Seed, Series A, Series B | ||

| Sony Innovation Fund | IoT | Generalist | Seed | ||

| Softline Venture Partners | artificial intelligence, edtech, hrtech, cybersecurity, cloud services, iot, big data | Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Pre-Seed, Seed | ||

| SoftBank Ventures Asia | ict industry, ai, iot, smart robotics, internet & mobile services, software, hardware, e-commerce, advertising & media, vr. | South Korea; Japan; Singapore; China; United States; Israel; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Austria; Belgium; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | Pre-Seed, Seed, Series A, Series B | ||

| SK Telecom Ventures | mobile platforms, infrastructures, semiconductors, enterprise solutions, communications, cloud, it, data center, iot , sensors, emerging tech | Generalist |

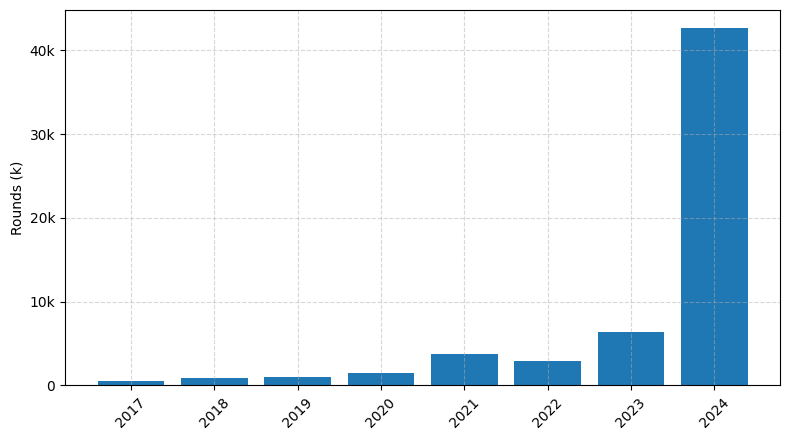

Investments by year: Round

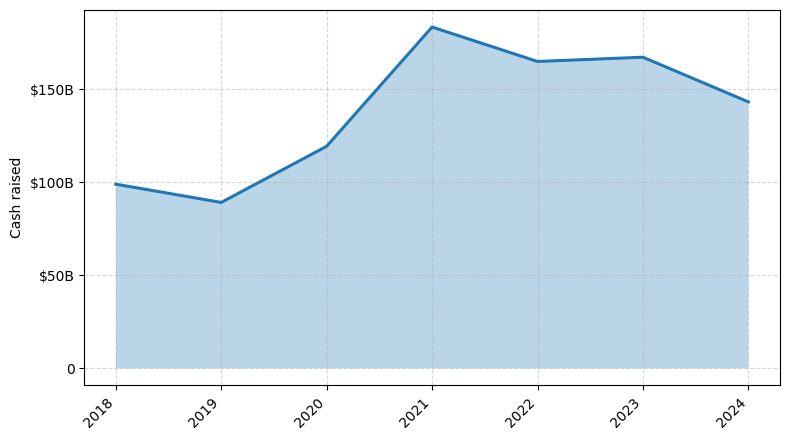

Investments by year: Cash raised

How is fundraising in different from other VC fundraising

Top Funded IoT Startups

Here is a summary of the top-funded IoT startups globally:

- Samsara: Approximately $930 million in funding, focused on industrial IoT solutions for fleet management and industrial operations.

- Particle: Approximately $81 million in funding, focused on IoT platform and development tools for connected devices.

- Helium: Approximately $200 million in funding, focused on decentralized wireless networks for IoT devices.

- Wiliot: Approximately $170 million in funding, focused on battery-free Bluetooth tags for asset tracking and supply chain management.

- Augury: Approximately $198 million in funding, focused on AI-powered predictive maintenance for industrial equipment.

- Samsara: Approximately $930 million in funding, focused on industrial IoT solutions for fleet management and industrial operations.

- Particle: Approximately $81 million in funding, focused on IoT platform and development tools for connected devices.

- Helium: Approximately $200 million in funding, focused on decentralized wireless networks for IoT devices.

- Wiliot: Approximately $170 million in funding, focused on battery-free Bluetooth tags for asset tracking and supply chain management.

- Augury: Approximately $198 million in funding, focused on AI-powered predictive maintenance for industrial equipment.

What you should include in IoT pitch deck

When pitching an IoT (Internet of Things) solution, your slide deck should include the following unique slides:

1. IoT Landscape: Provide an overview of the IoT market, trends, and key players.

2. Problem Statement: Clearly define the problem your IoT solution aims to solve and the target audience.

3. IoT Solution: Explain how your IoT technology works, its key features, and the value it delivers.

4. IoT Architecture: Illustrate the technical architecture of your IoT system, including hardware, software, and connectivity components.

5. IoT Use Cases: Showcase real-world examples of how your IoT solution has been implemented and the benefits it has provided.

1. IoT Landscape: Provide an overview of the IoT market, trends, and key players.

2. Problem Statement: Clearly define the problem your IoT solution aims to solve and the target audience.

3. IoT Solution: Explain how your IoT technology works, its key features, and the value it delivers.

4. IoT Architecture: Illustrate the technical architecture of your IoT system, including hardware, software, and connectivity components.

5. IoT Use Cases: Showcase real-world examples of how your IoT solution has been implemented and the benefits it has provided.

How to Prepare Your IoT Startup for Investment

Preparing an IoT (Internet of Things) startup for investment can be a crucial step in securing the necessary funding to drive growth and innovation. As an advisory, it is essential to ensure that your startup is well-positioned to attract the attention of venture capital (VC) investors.

When crafting your pitch deck, VC investors typically expect the following:

1. A clear and compelling value proposition: Demonstrate how your IoT solution addresses a specific problem or need in the market and how it provides a unique and differentiated value proposition.

2. Scalable and sustainable business model: Outline a well-defined revenue model, cost structure, and growth strategy that showcases the potential for long-term profitability and scalability.

3. Robust technology and intellectual property: Highlight the technical capabilities of your IoT platform, including its security features, data management capabilities, and potential for integration with other systems.

4. Experienced and dedicated team: Introduce your core team members, highlighting their relevant expertise, industry experience, and ability to execute on the business plan.

5. Competitive landscape and market opportunity: Provide a comprehensive analysis of the market, including the size, growth potential, and competitive landscape, to demonstrate the viability and potential for your IoT startup.

By addressing these key elements in your pitch deck, you can increase your chances of securing the necessary investment to propel your IoT startup forward.

When crafting your pitch deck, VC investors typically expect the following:

1. A clear and compelling value proposition: Demonstrate how your IoT solution addresses a specific problem or need in the market and how it provides a unique and differentiated value proposition.

2. Scalable and sustainable business model: Outline a well-defined revenue model, cost structure, and growth strategy that showcases the potential for long-term profitability and scalability.

3. Robust technology and intellectual property: Highlight the technical capabilities of your IoT platform, including its security features, data management capabilities, and potential for integration with other systems.

4. Experienced and dedicated team: Introduce your core team members, highlighting their relevant expertise, industry experience, and ability to execute on the business plan.

5. Competitive landscape and market opportunity: Provide a comprehensive analysis of the market, including the size, growth potential, and competitive landscape, to demonstrate the viability and potential for your IoT startup.

By addressing these key elements in your pitch deck, you can increase your chances of securing the necessary investment to propel your IoT startup forward.