FREE Investor Database

Top Venture Investors in Traveltech Industry

Top Venture Investors in Traveltech Industry

Discover leading VC and CVC investors specializing in Traveltech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The travel industry has witnessed a surge in investment activity over the past three years, with the Traveltech sector emerging as a prime target for investors. Since 2022, the industry has seen a significant influx of capital, with numerous startups and established players receiving substantial funding. In the last three years, the Traveltech sector has witnessed over 150 investments, totaling more than $5 billion in funding.

Among the core startups that have received notable investments are Sonder, a vacation rental platform that raised $170 million in 2021, and Hopper, a travel booking app that secured $175 million in 2022. Additionally, several high-profile deals have been made, including Airbnb's acquisition of HotelTonight for $465 million in 2019 and Expedia's $2.6 billion acquisition of Vrbo in 2020.

The Traveltech industry's resilience and innovation have attracted the attention of investors, who see immense potential in the sector's ability to transform the travel experience.

Among the core startups that have received notable investments are Sonder, a vacation rental platform that raised $170 million in 2021, and Hopper, a travel booking app that secured $175 million in 2022. Additionally, several high-profile deals have been made, including Airbnb's acquisition of HotelTonight for $465 million in 2019 and Expedia's $2.6 billion acquisition of Vrbo in 2020.

The Traveltech industry's resilience and innovation have attracted the attention of investors, who see immense potential in the sector's ability to transform the travel experience.

99 active VC investors in Traveltech

In the last three years, the travel technology (Traveltech) sector has attracted significant interest from active venture capital (VC) firms. Key players in this space include Andreessen Horowitz, Sequoia Capital, and Accel, who have invested in promising Traveltech startups. One notable example is Airbnb's $1 billion Series F round in 2020, which was led by Sixth Street Partners and included participation from existing investors such as Sequoia Capital and Andreessen Horowitz. This late-stage funding round underscores the continued investor appetite for disruptive Traveltech solutions, even amidst the challenges posed by the COVID-19 pandemic.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| YOLO Ventures | disruptive hospitality businesses and applications, blockchain technologiesand digital assets' ecosystem, music production and entertainment-related ventures and applications | Series A, Seed | |||

| XT Hi-Tech | Traveltech | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Wyoming Business Council | advanced manufacturing, ag tech, food products, blockchain technology, carbon capture, dac technology, data centers, it, emerging energy opportunities, firearms manufacturing, hydrogen, nuclear, wind energy, natural resources, tourism, outdoor recreation, professional services, technology | United States, Wyoming | Pre-Seed, Seed, Series A | ||

| Wti Holding UK LLP | digital tourism | ||||

| Western Development Commission | cleantech, creative industries, food, natural resources, information, communications technology, manufacturing services, internationally-traded services, medtech, life sciences, tourism, advertising, architecture, art, antiques, crafts, design, digital media, fashion, internet, software, music, visual arts, performing arts, publishing | Ireland, County Galway; Ireland, County Mayo; Ireland, County Roscommon; Ireland, County Donegal; Ireland, County Leitrim; Ireland, County Sligo; Ireland, County Clare | Generalist, Seed, Series D, Series C, Series A, Pre-Seed, Series B, Pre-IPO | EUR 75000000 | |

| Westbound | Traveltech | United States | Pre-Seed, Seed, Series A | USD 100000000 | |

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Vision Ventures | travel/tourism, insuretech, ecommerce, smart transportation, services, saas/foodtech, saas/cyber security, saas, retail & marketing, medtech, media/saas, logistics, foodtech, fintech, entertainment, edutech, agritech | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series A, Pre-Seed, Seed | ||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| VIGO Capital | hospitality, fintech, real estate |

22 active CVC investors in Traveltech

Active corporate venture capital firms have been investing heavily in the Traveltech sector over the past three years. Notable players include Amadeus Ventures, which backed Hopper's $170 million Series G, and Lufthansa Innovation Hub, which invested in Volantio's $6 million Series A. These strategic investments aim to drive innovation and stay ahead of industry trends.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| XT Hi-Tech | Traveltech | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| Shimadzu FIF | transformation, life science and medtech, materials, industry, hardware, information technology, and software industries | Japan, Kyoto | Series E, Series D, Series C | ||

| Red Ventures | digital media, e-commerce, higher education, home services, media and entertainment, personal health, travel | ||||

| NEOM Investment Fund | biotech, design, construction, education, research, innovation, energy, entertainment, culture, financial services, food, health, wellbeing, manufacturing, media, mobility, sport, technology, digital, tourism, water | ||||

| JG Digital Equity Ventures | air transportation, banking, food manufacturing, hotels, petrochemicals, power generation, real estate, property development, telecommunications, ecommerce, fintech, supply chain, b2b saas | Series A, Series B | |||

| JetBlue Technology Ventures | travel, hospitality, transportation | Generalist | Series A, Series B, Seed | ||

| International Trade Centre | e-commerce, agriculture, tourism, wellbeing, education | ||||

| InMotion Ventures | electrification, sustainability, industry 4.0, metaverse, connectivity, digital services, talent, mobility, enterprise software, industrial tech, consumer digital. | Generalist | Seed, Series A, Pre-Seed, Series B |

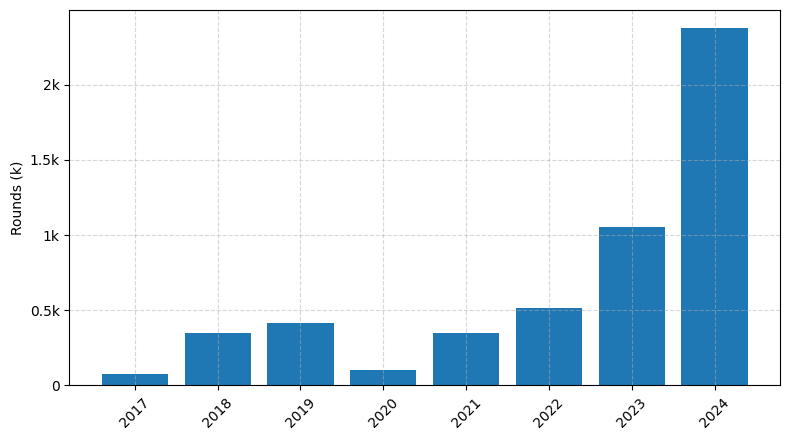

Investments by year: Round

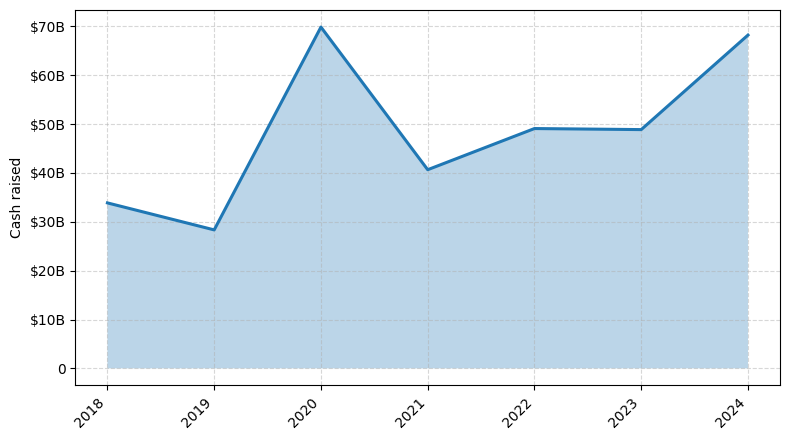

Investments by year: Cash raised

How is fundraising in Traveltech different from other VC fundraising

Fundraising in the Traveltech industry differs from general startup fundraising due to the unique challenges faced by travel-focused businesses. Traveltech startups often require significant upfront capital to build complex technology platforms, establish partnerships with airlines, hotels, and other travel providers, and navigate the regulatory landscape of the travel industry. Additionally, Traveltech startups must demonstrate a deep understanding of consumer travel behavior and the ability to scale their operations globally. Investors in this space often prioritize metrics such as customer acquisition costs, booking conversion rates, and the ability to integrate with existing travel infrastructure. As a result, Traveltech startups may need to present a more comprehensive and data-driven approach to fundraising compared to startups in other industries.

Top Funded Traveltech Startups

Here is a summary of the top-funded Traveltech startups globally:

1. Airbnb: Approximately $6 billion in total funding, focused on peer-to-peer accommodation rentals.

2. Expedia Group: Approximately $5.6 billion in total funding, focused on online travel booking and services.

3. Booking Holdings: Approximately $4.8 billion in total funding, focused on online travel booking and accommodation.

4. TripAdvisor: Approximately $800 million in total funding, focused on travel reviews and recommendations.

5. Skyscanner: Approximately $200 million in total funding, focused on flight search and booking.

1. Airbnb: Approximately $6 billion in total funding, focused on peer-to-peer accommodation rentals.

2. Expedia Group: Approximately $5.6 billion in total funding, focused on online travel booking and services.

3. Booking Holdings: Approximately $4.8 billion in total funding, focused on online travel booking and accommodation.

4. TripAdvisor: Approximately $800 million in total funding, focused on travel reviews and recommendations.

5. Skyscanner: Approximately $200 million in total funding, focused on flight search and booking.

What you should include in Traveltech pitch deck

When pitching a Traveltech startup, your pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the travel-related problem your solution addresses.

2. Market Opportunity: Provide data on the size and growth potential of the travel industry.

3. Unique Value Proposition: Highlight how your Traveltech solution uniquely solves the identified problem.

4. Technology Overview: Explain the innovative technology that powers your Traveltech product or service.

5. Competitive Landscape: Analyze your competitors and demonstrate your competitive advantages.

6. Traction and Milestones: Showcase your current progress, user growth, and key achievements.

7. Business Model and Revenue Streams: Outline your monetization strategy and potential revenue sources.

1. Problem Statement: Clearly define the travel-related problem your solution addresses.

2. Market Opportunity: Provide data on the size and growth potential of the travel industry.

3. Unique Value Proposition: Highlight how your Traveltech solution uniquely solves the identified problem.

4. Technology Overview: Explain the innovative technology that powers your Traveltech product or service.

5. Competitive Landscape: Analyze your competitors and demonstrate your competitive advantages.

6. Traction and Milestones: Showcase your current progress, user growth, and key achievements.

7. Business Model and Revenue Streams: Outline your monetization strategy and potential revenue sources.

How to Prepare Your Traveltech Startup for Investment

Preparing a Traveltech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to address the key aspects that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your Traveltech startup for investment, consider the following:

1. Demonstrate a Compelling Value Proposition: Clearly articulate the unique problem your startup solves and how it benefits the target market.

2. Highlight Traction and Growth Potential: Provide evidence of your startup's growth, user engagement, and revenue generation.

3. Showcase a Robust Business Model: Outline a sustainable and scalable business model that can generate consistent revenue and profitability.

4. Emphasize the Strength of the Team: Highlight the expertise, experience, and complementary skills of your founding team and key personnel.

5. Outline a Comprehensive Go-to-Market Strategy: Demonstrate a well-thought-out plan for customer acquisition, marketing, and expansion into new markets.

By addressing these key elements, you can increase the likelihood of securing investment and positioning your Traveltech startup for long-term success.

To prepare your Traveltech startup for investment, consider the following:

1. Demonstrate a Compelling Value Proposition: Clearly articulate the unique problem your startup solves and how it benefits the target market.

2. Highlight Traction and Growth Potential: Provide evidence of your startup's growth, user engagement, and revenue generation.

3. Showcase a Robust Business Model: Outline a sustainable and scalable business model that can generate consistent revenue and profitability.

4. Emphasize the Strength of the Team: Highlight the expertise, experience, and complementary skills of your founding team and key personnel.

5. Outline a Comprehensive Go-to-Market Strategy: Demonstrate a well-thought-out plan for customer acquisition, marketing, and expansion into new markets.

By addressing these key elements, you can increase the likelihood of securing investment and positioning your Traveltech startup for long-term success.