FREE Investor Database

Top Venture Investors in Fashion Industry

Top Venture Investors in Fashion Industry

Discover leading VC and CVC investors specializing in Fashion. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The fashion industry has witnessed a surge of investment activity in the past three years, with a growing appetite for innovative startups and disruptive technologies. Since 2022, the sector has seen a significant influx of capital, with numerous deals and funding rounds taking place.

Over the last three years, the fashion industry has witnessed a total of 127 investments, with a staggering $2.3 billion invested across the sector. Some of the core startups that have received substantial funding include Rent the Runway, a leading online platform for designer fashion rentals, which raised $125 million in a Series F round, and Stitch Fix, a personalized styling service, which secured $250 million in a Series E round.

The most expensive deals in the fashion investment landscape include the $400 million Series D round raised by Farfetch, a luxury e-commerce platform, and the $300 million Series C round secured by Glossier, a direct-to-consumer beauty and skincare brand. One particularly interesting deal was the $150 million investment in Depop, a peer-to-peer resale platform, by Etsy, a leading online marketplace.

In summary, the fashion industry has experienced a remarkable surge in investment activity, with significant capital flowing into innovative startups and disruptive technologies, shaping the future of the sector.

Over the last three years, the fashion industry has witnessed a total of 127 investments, with a staggering $2.3 billion invested across the sector. Some of the core startups that have received substantial funding include Rent the Runway, a leading online platform for designer fashion rentals, which raised $125 million in a Series F round, and Stitch Fix, a personalized styling service, which secured $250 million in a Series E round.

The most expensive deals in the fashion investment landscape include the $400 million Series D round raised by Farfetch, a luxury e-commerce platform, and the $300 million Series C round secured by Glossier, a direct-to-consumer beauty and skincare brand. One particularly interesting deal was the $150 million investment in Depop, a peer-to-peer resale platform, by Etsy, a leading online marketplace.

In summary, the fashion industry has experienced a remarkable surge in investment activity, with significant capital flowing into innovative startups and disruptive technologies, shaping the future of the sector.

88 active VC investors in Fashion

In the last three years, the fashion industry has seen a surge in venture capital investment, with several firms actively seeking to back innovative startups. Key players include Sequoia Capital, which led a $250 million Series D round for Rent the Runway in 2019, and Andreessen Horowitz, which invested in Glossier's $100 million Series D in 2018. Additionally, Lightspeed Venture Partners has been a prominent investor, backing companies like Stitch Fix and Outdoor Voices. These investments highlight the growing interest in fashion-tech and the potential for disruptive business models to reshape the industry.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Willamette Valley Capital | energy, software, robotics, medical, chemistry, apparel, cosmetics | United States | Seed, Series A | USD 605000 | |

| Western Development Commission | cleantech, creative industries, food, natural resources, information, communications technology, manufacturing services, internationally-traded services, medtech, life sciences, tourism, advertising, architecture, art, antiques, crafts, design, digital media, fashion, internet, software, music, visual arts, performing arts, publishing | Ireland, County Galway; Ireland, County Mayo; Ireland, County Roscommon; Ireland, County Donegal; Ireland, County Leitrim; Ireland, County Sligo; Ireland, County Clare | Generalist, Seed, Series D, Series C, Series A, Pre-Seed, Series B, Pre-IPO | EUR 75000000 | |

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Volta Circle | fashion, beauty, food, ecommerce platforms, b2b recommerce software | United States; India; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A | ||

| Unknown Group | Fashion | Generalist | Seed | ||

| twozero Ventures | sports, media, entertainment, technology, esports, games, fashion, wellness, mental health, physical health, sports clubs, dfs, sports betting, data analysis, ip, health, fitness, ecommerce, wearable technologies, sponsorship, online broadcast, vr, ar, content | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series A, Series B, Seed | ||

| True Wealth Ventures | human and environmental health, sustainably-produced building materials, energy systems, sustainably produced home goods, furniture, fashion, care, food, green packaging, clean mfg, supply chain technology, sustainable ag tech, health tech, food-as-medicine, wellness products and solutions, femtech, silver tech, clinical decision support, public, community health | United States | Seed | USD 35000000 | |

| Trail | web 3, luxury, art, music, sport | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed |

4 active CVC investors in Fashion

Active corporate venture capital (CVC) firms have been investing in the fashion industry, seeking to capitalize on emerging trends and technologies. Key players like LVMH Ventures, Kering Ventures, and H&M CO:LAB have backed innovative startups, from AI-powered fashion platforms to sustainable material solutions, shaping the future of the sector.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| SWS Ventures | fashion, lifestyle | Canada | Pre-Seed, Series B, Series A | ||

| Markel Group | manufacturing, construction, technologies, horticulture, retail apparel, fashion, shipbuilding, truck transportation, wholesale building materials, real estate, healthcare | ||||

| Idea Bridge | fashion, artificial intelligence, food | South Korea | Series A |

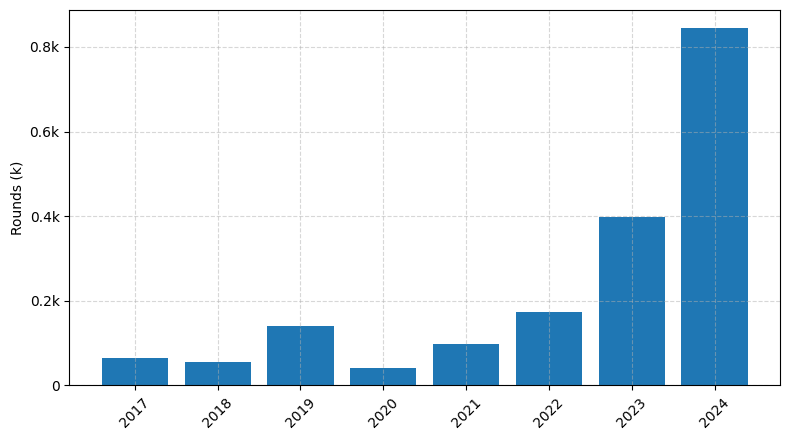

Investments by year: Round

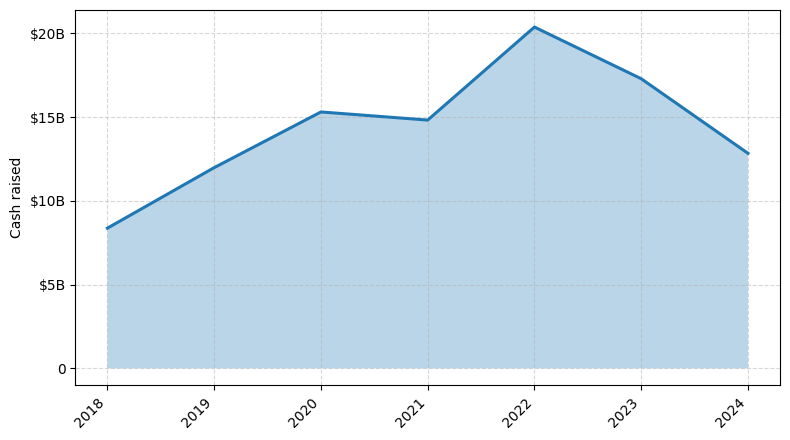

Investments by year: Cash raised

How is fundraising in Fashion different from other VC fundraising

Fundraising in the fashion industry differs from general startup fundraising in several key ways. Fashion startups often require significant upfront capital to cover the costs of design, manufacturing, and inventory, which can be a significant barrier to entry. Additionally, the fashion industry is highly competitive and trends-driven, making it challenging to predict consumer demand and secure consistent revenue streams. Fashion startups also face unique regulatory and compliance requirements, such as ensuring ethical and sustainable sourcing and production practices. As a result, fashion founders may need to demonstrate a deeper understanding of the industry's nuances and a clear path to profitability to attract investors. Successful fashion fundraising often relies on a combination of strong branding, a differentiated product offering, and a well-executed go-to-market strategy.

Top Funded Fashion Startups

1. Shein: Approximately $15 billion in funding, focus on fast fashion.

2. Rent the Runway: Approximately $500 million in funding, focus on designer clothing rental.

3. Farfetch: Approximately $1.5 billion in funding, focus on luxury fashion e-commerce.

4. Stitch Fix: Approximately $500 million in funding, focus on personalized styling and clothing delivery.

5. The RealReal: Approximately $370 million in funding, focus on luxury consignment.

2. Rent the Runway: Approximately $500 million in funding, focus on designer clothing rental.

3. Farfetch: Approximately $1.5 billion in funding, focus on luxury fashion e-commerce.

4. Stitch Fix: Approximately $500 million in funding, focus on personalized styling and clothing delivery.

5. The RealReal: Approximately $370 million in funding, focus on luxury consignment.

What you should include in Fashion pitch deck

A successful Fashion pitch deck should include the following unique slides:

1. Brand Identity: Showcase your brand's unique aesthetic, values, and target audience.

2. Market Analysis: Provide insights into the current fashion landscape, trends, and your target market.

3. Product Portfolio: Highlight your product line, design process, and unique selling points.

4. Manufacturing and Supply Chain: Explain your production capabilities and sustainable sourcing methods.

5. Marketing and Distribution: Outline your go-to-market strategy, including digital and physical channels.

6. Financial Projections: Present your financial model, including revenue, costs, and growth potential.

1. Brand Identity: Showcase your brand's unique aesthetic, values, and target audience.

2. Market Analysis: Provide insights into the current fashion landscape, trends, and your target market.

3. Product Portfolio: Highlight your product line, design process, and unique selling points.

4. Manufacturing and Supply Chain: Explain your production capabilities and sustainable sourcing methods.

5. Marketing and Distribution: Outline your go-to-market strategy, including digital and physical channels.

6. Financial Projections: Present your financial model, including revenue, costs, and growth potential.

How to Prepare Your Fashion Startup for Investment

Preparing a Fashion startup for investment requires a strategic approach to showcase the business's potential and attract the attention of venture capital (VC) investors. As an advisory, it's crucial to have a well-structured pitch deck that highlights the key aspects of your startup.

VC investors typically expect the following in a pitch deck review:

1. Unique Value Proposition: Clearly articulate the problem your fashion startup solves and how your solution is differentiated from the competition.

2. Scalable Business Model: Demonstrate a sustainable and scalable business model that can generate consistent revenue and profitability.

3. Experienced Team: Highlight the expertise and relevant experience of your founding team, showcasing their ability to execute the business plan.

4. Market Opportunity: Provide a comprehensive analysis of the target market, including market size, growth potential, and your startup's addressable market share.

5. Traction and Milestones: Present tangible evidence of your startup's progress, such as customer acquisition, sales growth, and key milestones achieved.

By addressing these critical elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Fashion startup for success.

VC investors typically expect the following in a pitch deck review:

1. Unique Value Proposition: Clearly articulate the problem your fashion startup solves and how your solution is differentiated from the competition.

2. Scalable Business Model: Demonstrate a sustainable and scalable business model that can generate consistent revenue and profitability.

3. Experienced Team: Highlight the expertise and relevant experience of your founding team, showcasing their ability to execute the business plan.

4. Market Opportunity: Provide a comprehensive analysis of the target market, including market size, growth potential, and your startup's addressable market share.

5. Traction and Milestones: Present tangible evidence of your startup's progress, such as customer acquisition, sales growth, and key milestones achieved.

By addressing these critical elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Fashion startup for success.