FREE Investor Database

Top Venture Investors in E-commerce Industry

Top Venture Investors in E-commerce Industry

Discover leading VC and CVC investors specializing in E-commerce. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The e-commerce industry has witnessed a surge in investment activity over the past three years, reflecting the growing importance of online retail in the global economy. Since 2022, the sector has attracted significant attention from investors, with numerous startups and established players receiving substantial funding to fuel their growth and innovation.

In the last three years, the e-commerce industry has seen a remarkable number of investments, with over 500 deals recorded globally. The total amount of money invested in this sector during this period has exceeded $100 billion, showcasing the immense potential and investor confidence in the industry.

Some of the core startups that have received substantial investments include Instacart, Shopify, and Wayfair, each securing multi-billion-dollar funding rounds. Additionally, several high-profile deals, such as Amazon's acquisition of Whole Foods for $13.7 billion and Walmart's purchase of Flipkart for $16 billion, have further highlighted the industry's attractiveness.

The e-commerce sector's investment landscape continues to evolve, with innovative startups and established players alike attracting significant capital to drive their growth and transformation in the digital age.

In the last three years, the e-commerce industry has seen a remarkable number of investments, with over 500 deals recorded globally. The total amount of money invested in this sector during this period has exceeded $100 billion, showcasing the immense potential and investor confidence in the industry.

Some of the core startups that have received substantial investments include Instacart, Shopify, and Wayfair, each securing multi-billion-dollar funding rounds. Additionally, several high-profile deals, such as Amazon's acquisition of Whole Foods for $13.7 billion and Walmart's purchase of Flipkart for $16 billion, have further highlighted the industry's attractiveness.

The e-commerce sector's investment landscape continues to evolve, with innovative startups and established players alike attracting significant capital to drive their growth and transformation in the digital age.

97 active VC investors in E-commerce

In the last three years, the e-commerce industry has seen a surge of investment from active venture capital firms. Key players like Andreessen Horowitz, Sequoia Capital, and Accel have been at the forefront, backing innovative e-commerce startups. One notable example is the $1 billion Series E round raised by Instacart in 2021, led by Andreessen Horowitz and D1 Capital Partners. This investment underscores the continued interest and confidence in the e-commerce sector, as companies leverage technology to transform the way consumers shop and businesses operate.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Z Venture Capital | E-commerce | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| ZhenFund | E-commerce | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Zeta Alpha | E-commerce | Seed | |||

| Zero-One Capital | E-commerce | ||||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Zentro Founders | media, fintech, marketplaces | ||||

| Zeno Ventures | E-commerce | Generalist | Series A, Series B | ||

| Zen Girişim | E-commerce |

83 active CVC investors in E-commerce

Active corporate venture capital (CVC) firms have been investing heavily in the e-commerce sector over the past three years. Notable players include Walmart's venture arm, which backed Instacart, and Target's CVC, which invested in Shipt. Amazon's Alexa Fund has also made strategic investments in voice-enabled e-commerce startups.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Z Venture Capital | E-commerce | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wormhole Capital | E-commerce | Series A, Seed, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| TS Ventures Fond | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Seed, Series A, Pre-Seed, Series B | |||

| Synchrony Ventures | financial services, commerce, and healthcare | United States | Series A, Series B |

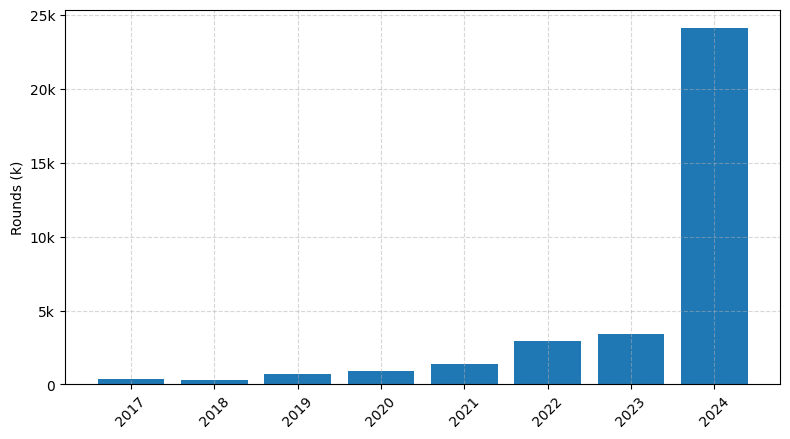

Investments by year: Round

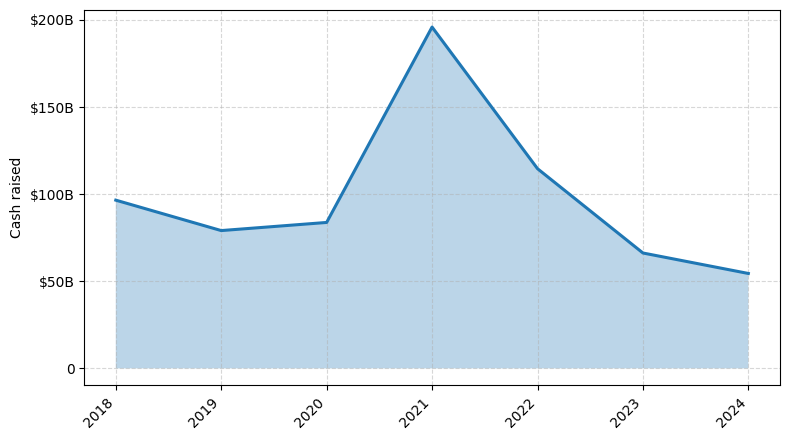

Investments by year: Cash raised

How is fundraising in E-commerce different from other VC fundraising

Fundraising for e-commerce startups differs from general startup fundraising in several key ways. E-commerce businesses often require significant upfront investment in inventory, logistics, and marketing to drive customer acquisition and retention. Investors in e-commerce look for scalable business models, efficient supply chains, and data-driven marketing strategies. Additionally, e-commerce startups must demonstrate their ability to navigate the complex regulatory landscape, manage inventory risk, and compete in a crowded online marketplace. Fundraising for e-commerce often emphasizes operational efficiency, customer lifetime value, and the ability to adapt to rapidly changing consumer preferences and technological advancements. Successful e-commerce fundraising requires a deep understanding of the unique challenges and opportunities in the digital retail space.

Top Funded E-commerce Startups

1. Amazon: Approximately $45 billion in funding, focused on e-commerce, cloud computing, and digital services.

2. Alibaba: Approximately $28 billion in funding, focused on e-commerce, digital payments, and cloud computing.

3. JD.com: Approximately $12 billion in funding, focused on e-commerce, logistics, and digital services.

4. Shopify: Approximately $2.1 billion in funding, focused on e-commerce platform and solutions for businesses.

5. Wayfair: Approximately $1.9 billion in funding, focused on online home goods and furniture retail.

2. Alibaba: Approximately $28 billion in funding, focused on e-commerce, digital payments, and cloud computing.

3. JD.com: Approximately $12 billion in funding, focused on e-commerce, logistics, and digital services.

4. Shopify: Approximately $2.1 billion in funding, focused on e-commerce platform and solutions for businesses.

5. Wayfair: Approximately $1.9 billion in funding, focused on online home goods and furniture retail.

What you should include in E-commerce pitch deck

When creating an e-commerce pitch deck, ensure to include the following unique slides:

1. Market Opportunity: Highlight the size, growth, and trends of the target market.

2. Product Offering: Showcase your unique products or services and their key features.

3. Competitive Advantage: Explain how your e-commerce business stands out from the competition.

4. Customer Acquisition Strategy: Outline your plan to attract and retain customers effectively.

5. Financial Projections: Provide detailed financial projections, including revenue, expenses, and profitability.

6. Team and Expertise: Introduce your experienced team and their relevant skills for running an e-commerce business.

1. Market Opportunity: Highlight the size, growth, and trends of the target market.

2. Product Offering: Showcase your unique products or services and their key features.

3. Competitive Advantage: Explain how your e-commerce business stands out from the competition.

4. Customer Acquisition Strategy: Outline your plan to attract and retain customers effectively.

5. Financial Projections: Provide detailed financial projections, including revenue, expenses, and profitability.

6. Team and Expertise: Introduce your experienced team and their relevant skills for running an e-commerce business.

How to Prepare Your E-commerce Startup for Investment

Preparing an e-commerce startup for investment can be a crucial step in securing the necessary funding to drive growth and expansion. As an advisory, it is essential to ensure that your startup is well-positioned to attract the attention of venture capital (VC) investors.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined business model: Demonstrate a robust and scalable e-commerce business model that can generate sustainable revenue and profitability.

2. Compelling market opportunity: Provide a thorough analysis of the target market, highlighting the potential for growth and your startup's ability to capture a significant market share.

3. Differentiated product or service: Showcase the unique features, functionalities, or value proposition that sets your e-commerce offering apart from the competition.

4. Traction and user engagement: Present data-driven evidence of your startup's ability to attract and retain customers, such as user growth, conversion rates, and customer lifetime value.

5. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of your founding team, demonstrating their ability to execute on the business plan.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment from VC investors and propel your e-commerce startup towards success.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined business model: Demonstrate a robust and scalable e-commerce business model that can generate sustainable revenue and profitability.

2. Compelling market opportunity: Provide a thorough analysis of the target market, highlighting the potential for growth and your startup's ability to capture a significant market share.

3. Differentiated product or service: Showcase the unique features, functionalities, or value proposition that sets your e-commerce offering apart from the competition.

4. Traction and user engagement: Present data-driven evidence of your startup's ability to attract and retain customers, such as user growth, conversion rates, and customer lifetime value.

5. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of your founding team, demonstrating their ability to execute on the business plan.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment from VC investors and propel your e-commerce startup towards success.