FREE Investor Database

Top Venture Investors in Delivery Industry

Top Venture Investors in Delivery Industry

Discover leading VC and CVC investors specializing in Delivery. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The delivery industry has witnessed a surge of investments in the past three years, reflecting the growing demand for efficient and convenient transportation services. Since 2022, the sector has seen a significant influx of capital, with numerous startups and established players receiving substantial funding.

Over the last three years, the delivery industry has witnessed a total of 78 investments, amounting to a staggering $4.2 billion in funding. Among the core startups that have received substantial investments are Uber Eats, DoorDash, and Instacart, each securing multi-million-dollar deals to expand their operations and enhance their technological capabilities.

Some of the most expensive deals in the delivery industry include Uber Eats' $2.65 billion acquisition of Postmates in 2020 and DoorDash's $410 million Series G funding round in 2021. One particularly interesting deal was Instacart's $265 million Series H funding round in 2022, which valued the company at a remarkable $39 billion.

The delivery industry's investment landscape has been dynamic, with a focus on innovation, technology, and the pursuit of market dominance. As the demand for efficient and reliable delivery services continues to grow, the sector is poised for further expansion and investment opportunities.

Over the last three years, the delivery industry has witnessed a total of 78 investments, amounting to a staggering $4.2 billion in funding. Among the core startups that have received substantial investments are Uber Eats, DoorDash, and Instacart, each securing multi-million-dollar deals to expand their operations and enhance their technological capabilities.

Some of the most expensive deals in the delivery industry include Uber Eats' $2.65 billion acquisition of Postmates in 2020 and DoorDash's $410 million Series G funding round in 2021. One particularly interesting deal was Instacart's $265 million Series H funding round in 2022, which valued the company at a remarkable $39 billion.

The delivery industry's investment landscape has been dynamic, with a focus on innovation, technology, and the pursuit of market dominance. As the demand for efficient and reliable delivery services continues to grow, the sector is poised for further expansion and investment opportunities.

97 active VC investors in Delivery

In the last three years, the delivery industry has seen significant investment from active venture capital firms. Key players include Sequoia Capital, Accel, and Softbank Vision Fund, which have poured billions into the sector. One notable example is Instacart's $600 million Series G round in 2021, led by Andreessen Horowitz, Sequoia Capital, and D1 Capital Partners. This investment underscores the growing demand for on-demand delivery services and the confidence of venture capitalists in the long-term potential of the industry. As consumer preferences continue to evolve, the delivery sector remains a prime target for savvy investors seeking to capitalize on emerging market trends.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZIM Ventures | Delivery | Israel | Seed | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| ZEBOX Ventures | logistics, supply chains, mobility, space, media, transport, decarbonization of infrastructures, energy transition, digitalization of processes, people, consumer, ai | Pre-Seed, Seed | |||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| XRC Labs | analytics, consumer brand, consumer healthtech, data infrastructure, ecom tech, generative ai, martech, marketplace, commerce, manufacturing, store tech, supply chain, web3 | Generalist; United States; Canada; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Cameroon; Comoros; Djibouti; Egypt; Equatorial Guinea; Eritrea; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates | Series A, Seed | ||

| XPRESS Ventures | logtech | Seed, Pre-Seed | |||

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| Xerox Ventures | Delivery | Seed | |||

| W ventures Japan | b2b, b2c, energy, industrial, commerce, security, digital health, mobility, finance, it, real estate, construction, business software, fintech, insurtech, manufacturing, industry 4.0, marketing, media, mobility, logistics. | United States; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series B, Series A, Series E, Series D, Seed, Series C |

61 active CVC investors in Delivery

Active corporate venture capital (CVC) firms have been investing in the delivery sector, seeking to capitalize on the growing demand for convenient and efficient logistics solutions. Key players include Amazon's Alexa Fund, which backed Deliverr, and Uber's Uber Freight, which invested in Convoy, a digital freight brokerage platform.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZIM Ventures | Delivery | Israel | Seed | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Xerox Ventures | Delivery | Seed | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| Tin Shed Ventures | agriculture, supply chain, sorting and recycling | Seed, Series A, Series B | |||

| Teklas Ventures | advanced manufacturing, new materials, supply chain, logistics, mobility | United States; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Generalist | ||

| Swiss Post Ventures | communication, logistics, financial services, business process outsourcing, mobility markets | Generalist; Switzerland | Seed, Series A, Series B | ||

| SOFTBANK Latin America Ventures | Delivery | Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Seed | ||

| SIG Asia Investments, LLLP | Delivery | Bahrain; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; United Arab Emirates; Vietnam | Generalist, Series A, Series B, Series C, Series D, Series E, Pre-IPO |

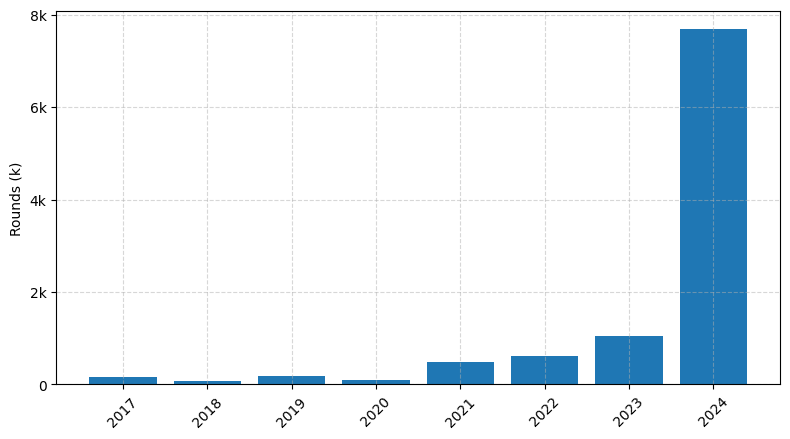

Investments by year: Round

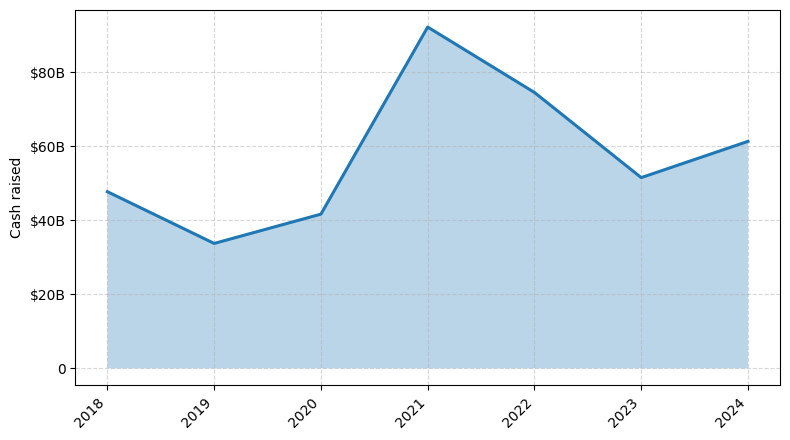

Investments by year: Cash raised

How is fundraising in Delivery different from other VC fundraising

Fundraising for delivery startups differs from general startup fundraising due to the unique challenges they face. Delivery startups often require significant upfront capital to build logistics infrastructure, establish partnerships with merchants, and acquire customers. Additionally, the high operational costs and thin profit margins in the delivery industry make it challenging to attract investors. Delivery startups must demonstrate a clear path to profitability and scalability, which can be more difficult to achieve compared to other tech-driven business models. Investors also scrutinize the delivery startup's ability to navigate regulatory hurdles, manage labor costs, and differentiate itself in a highly competitive market. Successful delivery startups must present a compelling vision, a robust operational plan, and a sustainable financial model to secure funding and achieve long-term success.

Top Funded Delivery Startups

Here is a summary of the top-funded Delivery startups:

• DoorDash: Approximately $5.7 billion in total funding, focused on food delivery.

• Instacart: Approximately $2.7 billion in total funding, focused on grocery delivery.

• Postmates: Approximately $678 million in total funding, focused on on-demand delivery.

• GrubHub: Approximately $284 million in total funding, focused on food delivery.

• Uber Eats: Approximately $200 million in total funding, focused on food delivery.

• DoorDash: Approximately $5.7 billion in total funding, focused on food delivery.

• Instacart: Approximately $2.7 billion in total funding, focused on grocery delivery.

• Postmates: Approximately $678 million in total funding, focused on on-demand delivery.

• GrubHub: Approximately $284 million in total funding, focused on food delivery.

• Uber Eats: Approximately $200 million in total funding, focused on food delivery.

What you should include in Delivery pitch deck

A Delivery pitch deck should include the following unique slides:

1. Value Proposition: Clearly articulate the problem your delivery service solves and the unique benefits it offers.

2. Target Market: Identify your target audience, their pain points, and how your delivery service addresses their needs.

3. Competitive Advantage: Highlight the features or capabilities that set your delivery service apart from competitors.

4. Business Model: Explain your revenue streams, pricing strategy, and how you plan to generate profits.

5. Growth Strategy: Outline your plans for scaling the business and expanding your delivery service's reach.

1. Value Proposition: Clearly articulate the problem your delivery service solves and the unique benefits it offers.

2. Target Market: Identify your target audience, their pain points, and how your delivery service addresses their needs.

3. Competitive Advantage: Highlight the features or capabilities that set your delivery service apart from competitors.

4. Business Model: Explain your revenue streams, pricing strategy, and how you plan to generate profits.

5. Growth Strategy: Outline your plans for scaling the business and expanding your delivery service's reach.

How to Prepare Your Delivery Startup for Investment

Preparing a Delivery startup for investment can be a crucial step in securing the necessary funding to scale and grow the business. To attract the attention of venture capital (VC) investors, it is essential to demonstrate the startup's potential and address the key factors that investors typically consider.

Here are five key elements VC investors typically expect to see in a Delivery startup's pitch deck:

1. Clearly defined market opportunity: Provide a comprehensive analysis of the target market, including the size, growth potential, and the startup's competitive advantage.

2. Innovative business model: Showcase the unique value proposition of the Delivery startup, highlighting how it differentiates itself from competitors and addresses unmet customer needs.

3. Scalable technology and operations: Demonstrate the startup's technological capabilities, operational efficiency, and the ability to scale the business as it grows.

4. Experienced and capable team: Highlight the expertise, relevant experience, and the complementary skills of the founding team and key personnel.

5. Solid financial projections: Present a detailed financial plan, including revenue streams, cost structures, and a clear path to profitability and sustainable growth.

By addressing these key elements, Delivery startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.

Here are five key elements VC investors typically expect to see in a Delivery startup's pitch deck:

1. Clearly defined market opportunity: Provide a comprehensive analysis of the target market, including the size, growth potential, and the startup's competitive advantage.

2. Innovative business model: Showcase the unique value proposition of the Delivery startup, highlighting how it differentiates itself from competitors and addresses unmet customer needs.

3. Scalable technology and operations: Demonstrate the startup's technological capabilities, operational efficiency, and the ability to scale the business as it grows.

4. Experienced and capable team: Highlight the expertise, relevant experience, and the complementary skills of the founding team and key personnel.

5. Solid financial projections: Present a detailed financial plan, including revenue streams, cost structures, and a clear path to profitability and sustainable growth.

By addressing these key elements, Delivery startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.