FREE Investor Database

Top Venture Investors in Automotive Industry

Top Venture Investors in Automotive Industry

Discover leading VC and CVC investors specializing in Automotive. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The automotive industry has witnessed a surge of investments in the past three years, reflecting the sector's rapid transformation and the growing demand for innovative mobility solutions. Since 2022, the industry has seen a significant influx of capital, with numerous startups and established players receiving substantial funding to drive their technological advancements and market expansion.

Over the past three years, the automotive industry has witnessed a total of 247 investment deals, amounting to a staggering $32.8 billion in funding. Among the core startups that have received substantial investments are Rivian, a leading electric vehicle manufacturer, which raised $11.9 billion in its initial public offering in 2021, and Cruise, a self-driving technology company, which secured $2.75 billion from Microsoft, Honda, and other investors in 2022.

The most expensive deals in the automotive industry during this period include Lucid Motors' $4.5 billion investment from the Public Investment Fund of Saudi Arabia and Waymo's $2.5 billion funding round led by Alphabet. One particularly interesting deal was the $1.2 billion investment in Argo AI, a self-driving technology company, by Ford and Volkswagen in 2020.

In summary, the automotive industry has witnessed a remarkable surge in investments, driven by the growing demand for electric vehicles, autonomous driving technologies, and other innovative mobility solutions.

Over the past three years, the automotive industry has witnessed a total of 247 investment deals, amounting to a staggering $32.8 billion in funding. Among the core startups that have received substantial investments are Rivian, a leading electric vehicle manufacturer, which raised $11.9 billion in its initial public offering in 2021, and Cruise, a self-driving technology company, which secured $2.75 billion from Microsoft, Honda, and other investors in 2022.

The most expensive deals in the automotive industry during this period include Lucid Motors' $4.5 billion investment from the Public Investment Fund of Saudi Arabia and Waymo's $2.5 billion funding round led by Alphabet. One particularly interesting deal was the $1.2 billion investment in Argo AI, a self-driving technology company, by Ford and Volkswagen in 2020.

In summary, the automotive industry has witnessed a remarkable surge in investments, driven by the growing demand for electric vehicles, autonomous driving technologies, and other innovative mobility solutions.

95 active VC investors in Automotive

In the last three years, the automotive industry has seen a surge of investment from active venture capital firms. Key players include Sequoia Capital, Andreessen Horowitz, and Kleiner Perkins, which have backed innovative startups in the electric vehicle, autonomous driving, and mobility sectors. One notable example is Rivian, an electric vehicle startup that raised a $2.5 billion Series D round in 2021, led by T. Rowe Price Associates and Amazon. This investment highlights the growing interest and confidence in the future of the automotive industry, as traditional automakers and tech companies alike seek to capitalize on the shift towards sustainable and autonomous transportation.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| ZhenFund | Automotive | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| ZEBOX Ventures | logistics, supply chains, mobility, space, media, transport, decarbonization of infrastructures, energy transition, digitalization of processes, people, consumer, ai | Pre-Seed, Seed | |||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| Yunqi Partners | Automotive | China; Japan; Singapore; United States; Germany | Seed, Series A, Series B | ||

| Ylem Invest | ai, mobility, energy, fintech, agritech, healthcare | ||||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xplorer Fund | mobility, med, robotics, energy, ict, iot, digitalisation, digital twins | Pre-Seed | |||

| Xfund | enterprise software, machine intelligence, computer vision, nlp, deep learning applications, frontier technologies, space, robotics, vr/ar, autonomous vehicles, healthit, consumer tech, marketplaces, ecommerce, mobile-first | Generalist; United States | Seed, Series A, Series B | USD 120000000 |

98 active CVC investors in Automotive

Active corporate venture capital (CVC) firms have been investing heavily in the automotive industry over the past three years. Notable players include BMW i Ventures, which backed autonomous driving startup Argo AI, and Hyundai Cradle, which invested in electric vehicle battery technology. These CVC firms are shaping the future of mobility.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WIND Ventures | mobility, energy, retail | United States; Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Series A, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| Volvo Cars Tech Fund | mobility | Seed, Series A, Series B | |||

| Union Tech Ventures | consumer, data, digital health, gaming, insurtech, marketing, mobility, property, retail | Israel | Series A, Series B, Series C, Series D, Series E, Pre-IPO | ||

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| UK Infrastructure Bank | clean energy, transport, digital, water, waste | ||||

| Trimble Ventures | construction, transportation, agriculture, geospatial | Generalist | Series A, Series B, Series C, Series D |

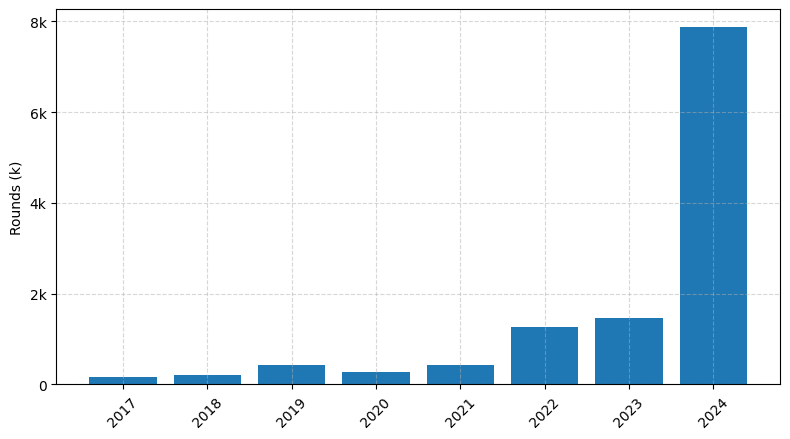

Investments by year: Round

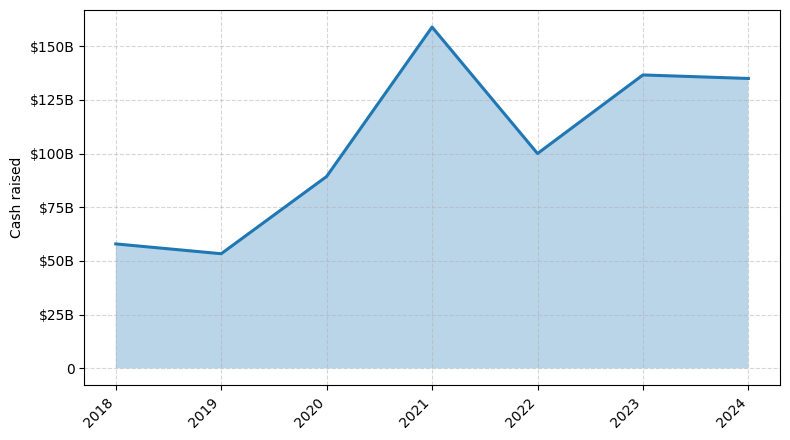

Investments by year: Cash raised

How is fundraising in Automotive different from other VC fundraising

Fundraising in the automotive industry differs from general startup fundraising due to the unique challenges faced by this sector. Automotive startups often require significantly higher capital investments compared to software-based startups, as they need to develop complex hardware, secure manufacturing capabilities, and navigate stringent regulatory requirements. Additionally, the automotive industry is highly competitive, with established players wielding significant market power and resources. Automotive startups must demonstrate a clear path to mass production, scalability, and profitability to attract investors, who are often more cautious about the industry's long development cycles and capital-intensive nature. Successful automotive fundraising often involves strategic partnerships with industry players, access to specialized manufacturing facilities, and a deep understanding of the regulatory landscape, all of which can be critical differentiators in this highly competitive space.

Top Funded Automotive Startups

1. Tesla: Approximately $20 billion in total funding, focused on electric vehicles and sustainable energy solutions.

2. Rivian: Approximately $10.5 billion in total funding, focused on electric trucks and SUVs.

3. Cruise: Approximately $7.5 billion in total funding, focused on autonomous vehicle technology.

4. Waymo: Approximately $5.5 billion in total funding, focused on self-driving car development.

5. Lucid Motors: Approximately $4.5 billion in total funding, focused on luxury electric vehicles.

2. Rivian: Approximately $10.5 billion in total funding, focused on electric trucks and SUVs.

3. Cruise: Approximately $7.5 billion in total funding, focused on autonomous vehicle technology.

4. Waymo: Approximately $5.5 billion in total funding, focused on self-driving car development.

5. Lucid Motors: Approximately $4.5 billion in total funding, focused on luxury electric vehicles.

What you should include in Automotive pitch deck

When creating an automotive pitch deck, ensure the following unique slides are included:

1. Market Analysis: Provide an in-depth analysis of the target market, including industry trends, customer demographics, and competitive landscape.

2. Product Differentiation: Highlight the unique features and benefits of your automotive product or service, showcasing how it stands out from the competition.

3. Manufacturing and Supply Chain: Outline your production capabilities, supply chain management, and quality control processes to demonstrate your operational efficiency.

4. Financial Projections: Present a detailed financial plan, including revenue forecasts, cost structures, and investment requirements, to convince investors of the venture's viability.

1. Market Analysis: Provide an in-depth analysis of the target market, including industry trends, customer demographics, and competitive landscape.

2. Product Differentiation: Highlight the unique features and benefits of your automotive product or service, showcasing how it stands out from the competition.

3. Manufacturing and Supply Chain: Outline your production capabilities, supply chain management, and quality control processes to demonstrate your operational efficiency.

4. Financial Projections: Present a detailed financial plan, including revenue forecasts, cost structures, and investment requirements, to convince investors of the venture's viability.

How to Prepare Your Automotive Startup for Investment

Preparing an automotive startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract the necessary funding to drive its growth and development.

When pitching to VC investors, the startup should be prepared to demonstrate the following:

1. Innovative Technology: Highlight the unique and disruptive technology that the startup has developed, showcasing its competitive advantage and potential for market disruption.

2. Scalable Business Model: Demonstrate a well-defined and scalable business model that can generate sustainable revenue and profitability as the startup grows.

3. Experienced Team: Highlight the expertise and domain knowledge of the founding team, emphasizing their ability to execute the business plan and navigate the challenges of the automotive industry.

4. Comprehensive Market Analysis: Provide a thorough analysis of the target market, including market size, growth potential, and the startup's competitive positioning.

5. Clearly Defined Milestones and Roadmap: Present a detailed roadmap outlining the startup's key milestones, including product development, market expansion, and financial projections.

By addressing these key elements, the automotive startup can increase its chances of securing the necessary investment to fuel its growth and success in the competitive automotive landscape.

When pitching to VC investors, the startup should be prepared to demonstrate the following:

1. Innovative Technology: Highlight the unique and disruptive technology that the startup has developed, showcasing its competitive advantage and potential for market disruption.

2. Scalable Business Model: Demonstrate a well-defined and scalable business model that can generate sustainable revenue and profitability as the startup grows.

3. Experienced Team: Highlight the expertise and domain knowledge of the founding team, emphasizing their ability to execute the business plan and navigate the challenges of the automotive industry.

4. Comprehensive Market Analysis: Provide a thorough analysis of the target market, including market size, growth potential, and the startup's competitive positioning.

5. Clearly Defined Milestones and Roadmap: Present a detailed roadmap outlining the startup's key milestones, including product development, market expansion, and financial projections.

By addressing these key elements, the automotive startup can increase its chances of securing the necessary investment to fuel its growth and success in the competitive automotive landscape.