FREE Investor Database

Top Venture Investors in Fitness Industry

Top Venture Investors in Fitness Industry

Discover leading VC and CVC investors specializing in Fitness. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The fitness industry has witnessed a surge of investment activity in the past three years, reflecting the growing importance of health and wellness in our lives. Since 2022, the sector has seen a significant influx of capital, with numerous startups and established players attracting the attention of investors.

Over the last three years, the fitness industry has witnessed a staggering number of investments, with hundreds of deals being struck across the globe. The total amount of money invested in the sector during this period has reached billions of dollars, as investors recognize the immense potential for growth and innovation.

Some of the core startups that have received substantial investments include Peloton, Tonal, and Hydrow, each offering unique fitness solutions that have captured the imagination of consumers. Additionally, several high-profile deals, such as the acquisition of Mirror by Lululemon for $500 million, have made headlines and showcased the industry's potential.

In summary, the fitness industry has experienced a remarkable surge in investment activity, with billions of dollars being poured into the sector and numerous startups and established players benefiting from this influx of capital.

Over the last three years, the fitness industry has witnessed a staggering number of investments, with hundreds of deals being struck across the globe. The total amount of money invested in the sector during this period has reached billions of dollars, as investors recognize the immense potential for growth and innovation.

Some of the core startups that have received substantial investments include Peloton, Tonal, and Hydrow, each offering unique fitness solutions that have captured the imagination of consumers. Additionally, several high-profile deals, such as the acquisition of Mirror by Lululemon for $500 million, have made headlines and showcased the industry's potential.

In summary, the fitness industry has experienced a remarkable surge in investment activity, with billions of dollars being poured into the sector and numerous startups and established players benefiting from this influx of capital.

99 active VC investors in Fitness

In the last three years, the fitness industry has seen a surge in venture capital investment, with several active firms focusing on this sector. Key players include Lerer Hippeau, which has backed companies like Tonal and Tempo, and Forerunner Ventures, which has invested in Peloton and Mirror. One of the biggest venture capital rounds in the fitness space was Peloton's $550 million Series F round in 2020, which propelled the company's growth and solidified its position as a leader in the connected fitness market.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Yellowdog | climate, environmental, wellness, healthcare, education, workstyle | South Korea; United States | Seed, Series A, Series B | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Willow Growth Partners | health and wellness, beauty, personal care, apparel and accessories, food and beverage, baby and home, commerce | United States | Seed, Series A | USD 28000000 | |

| Willamette Valley Capital | energy, software, robotics, medical, chemistry, apparel, cosmetics | United States | Seed, Series A | USD 605000 | |

| White Paper Capital | blockchain, financial inclusion, education, equal rights, mental health, meditation, environmental protection | Generalist | Generalist, Series E, Series C, Seed, Series B, Series D, Series A |

22 active CVC investors in Fitness

Active corporate venture capital (CVC) firms have been investing in the fitness industry, seeking to capitalize on the growing demand for innovative health and wellness solutions. Key players include Adidas Ventures, which invested in smart fitness mirror company Tonal, and Nike's Venture Capital arm, which backed connected fitness platform Zwift.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| Stanford GSB Impact Fund | education, energy and the environment, fintech, food, agriculture, justice, healthcare, urban development | Generalist; United States | Seed, Series A | ||

| Sony Innovation Fund | Fitness | Generalist | Seed | ||

| Slack Fund | voice and video, it and security, productivity, wellness, developer tools | Generalist | Series A, Pre-Seed, Seed | ||

| SCOR Ventures | Fitness | Generalist; Canada; United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Algeria; Cameroon; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam | Seed, Series A, Series B | ||

| RPG Ventures | software, ayurvedic, cybersecurity, logistics, mental health, elderly care products | Generalist | Seed, Series A, Series B | ||

| Oscar & Paul Beiersdorf Venture Capital | sustainability, life science, biotech, digital solutions and digital health, new business models, beauty tech | South Korea; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Canada; United States | Series A |

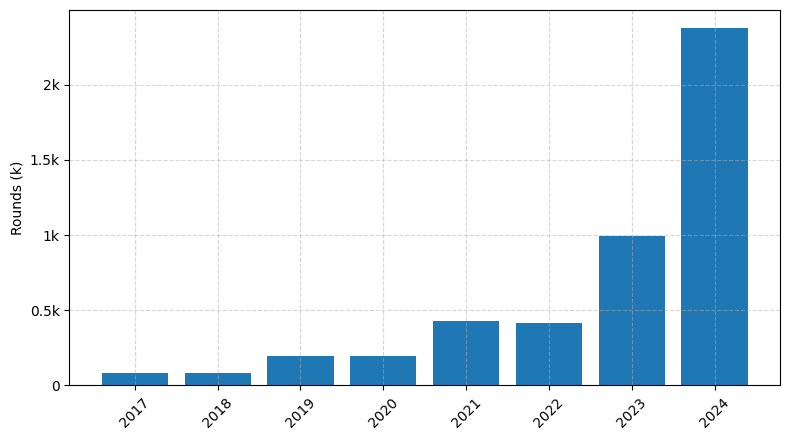

Investments by year: Round

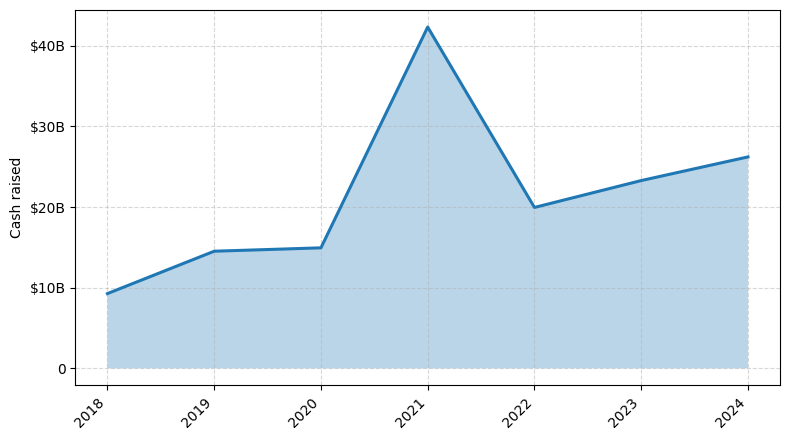

Investments by year: Cash raised

How is fundraising in Fitness different from other VC fundraising

Fundraising in the fitness industry presents unique challenges compared to general startup fundraising. Fitness businesses often require significant upfront investments in physical infrastructure, such as gym equipment and facility buildouts, which can make it more capital-intensive than software-based startups. Additionally, the fitness industry is highly competitive, with a need to differentiate products and services to attract and retain customers. Fitness startups must also navigate regulatory and compliance requirements, such as licensing and insurance, which can add complexity to the fundraising process. Furthermore, the success of a fitness business is often closely tied to the personal brand and expertise of the founders, making it crucial to convey a compelling vision and team to potential investors. These factors can make fundraising in the fitness industry more nuanced and demanding than in other sectors.

Top Funded Fitness Startups

Here is a summary of the top-funded Fitness startups:

• Peloton: Approximately $1.8 billion in total funding. Key focus area: Connected fitness equipment and digital fitness content.

• ClassPass: Approximately $549 million in total funding. Key focus area: Fitness class subscription service.

• Tonal: Approximately $450 million in total funding. Key focus area: Smart home gym equipment.

• Mirror: Approximately $74 million in total funding. Key focus area: Interactive home fitness mirrors.

• Zwift: Approximately $450 million in total funding. Key focus area: Virtual fitness training platform.

• Peloton: Approximately $1.8 billion in total funding. Key focus area: Connected fitness equipment and digital fitness content.

• ClassPass: Approximately $549 million in total funding. Key focus area: Fitness class subscription service.

• Tonal: Approximately $450 million in total funding. Key focus area: Smart home gym equipment.

• Mirror: Approximately $74 million in total funding. Key focus area: Interactive home fitness mirrors.

• Zwift: Approximately $450 million in total funding. Key focus area: Virtual fitness training platform.

What you should include in Fitness pitch deck

When creating a Fitness pitch deck, the following unique slides should be included:

1. Industry Overview: Provide an analysis of the fitness industry, including market size, growth trends, and key players.

2. Target Audience: Clearly define your target customer demographics and their specific fitness needs.

3. Unique Value Proposition: Highlight the unique features or services that differentiate your fitness business from competitors.

4. Revenue Model: Explain your pricing structure, membership plans, and potential revenue streams.

5. Competitive Advantage: Demonstrate how your fitness business has a competitive edge in the market.

6. Expansion Plan: Outline your strategy for scaling and growing your fitness business.

1. Industry Overview: Provide an analysis of the fitness industry, including market size, growth trends, and key players.

2. Target Audience: Clearly define your target customer demographics and their specific fitness needs.

3. Unique Value Proposition: Highlight the unique features or services that differentiate your fitness business from competitors.

4. Revenue Model: Explain your pricing structure, membership plans, and potential revenue streams.

5. Competitive Advantage: Demonstrate how your fitness business has a competitive edge in the market.

6. Expansion Plan: Outline your strategy for scaling and growing your fitness business.

How to Prepare Your Fitness Startup for Investment

Preparing a Fitness startup for investment requires a strategic approach to ensure that the business is attractive to potential venture capital (VC) investors. Here's a summary of the key steps:

To prepare your Fitness startup for investment, you should focus on demonstrating the following in your pitch deck:

1. Clearly defined market opportunity: Provide a comprehensive analysis of the target market, its size, growth potential, and your startup's competitive advantage.

2. Scalable business model: Showcase a sustainable and scalable revenue model that can attract and retain customers while generating consistent profits.

3. Experienced management team: Highlight the expertise and relevant experience of your founding team, as well as their ability to execute the business plan.

4. Traction and growth metrics: Demonstrate your startup's ability to acquire customers, generate revenue, and achieve measurable growth milestones.

5. Compelling value proposition: Articulate the unique value your Fitness startup offers to customers and how it addresses their pain points or needs.

By addressing these key elements, you can increase the likelihood of securing investment from VC investors who are looking for promising Fitness startups with the potential for long-term success.

To prepare your Fitness startup for investment, you should focus on demonstrating the following in your pitch deck:

1. Clearly defined market opportunity: Provide a comprehensive analysis of the target market, its size, growth potential, and your startup's competitive advantage.

2. Scalable business model: Showcase a sustainable and scalable revenue model that can attract and retain customers while generating consistent profits.

3. Experienced management team: Highlight the expertise and relevant experience of your founding team, as well as their ability to execute the business plan.

4. Traction and growth metrics: Demonstrate your startup's ability to acquire customers, generate revenue, and achieve measurable growth milestones.

5. Compelling value proposition: Articulate the unique value your Fitness startup offers to customers and how it addresses their pain points or needs.

By addressing these key elements, you can increase the likelihood of securing investment from VC investors who are looking for promising Fitness startups with the potential for long-term success.