FREE Investor Database

Top Venture Investors in SaaS Industry

Top Venture Investors in SaaS Industry

Discover leading VC and CVC investors specializing in SaaS. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The software-as-a-service (SaaS) industry has witnessed a surge in investment activity over the past three years, with a significant influx of capital into the sector. Since 2022, the SaaS market has seen a remarkable number of investments, with over 1,500 deals completed. The total amount invested during this period has reached an astounding $150 billion, reflecting the growing demand for cloud-based software solutions.

Among the core startups that have received substantial investments are Canva, a design platform that raised $200 million, and Notion, a collaborative workspace tool that secured $275 million. Additionally, several high-profile deals have been made, including Salesforce's acquisition of Slack for $27.7 billion and Microsoft's purchase of Nuance Communications for $19.7 billion.

One particularly interesting deal was the $300 million investment in Figma, a design and collaboration platform, which highlighted the continued investor appetite for innovative SaaS solutions.

In summary, the SaaS industry has experienced a remarkable investment boom, with billions of dollars flowing into the sector and a growing number of startups and established players attracting significant funding.

Among the core startups that have received substantial investments are Canva, a design platform that raised $200 million, and Notion, a collaborative workspace tool that secured $275 million. Additionally, several high-profile deals have been made, including Salesforce's acquisition of Slack for $27.7 billion and Microsoft's purchase of Nuance Communications for $19.7 billion.

One particularly interesting deal was the $300 million investment in Figma, a design and collaboration platform, which highlighted the continued investor appetite for innovative SaaS solutions.

In summary, the SaaS industry has experienced a remarkable investment boom, with billions of dollars flowing into the sector and a growing number of startups and established players attracting significant funding.

94 active VC investors in SaaS

In the last three years, the SaaS industry has seen a surge of investment from active venture capital firms. Key players like Sequoia Capital, Andreessen Horowitz, and Accel have been at the forefront, backing promising SaaS startups. One notable example is Databricks' $1 billion Series G round in 2021, which was one of the largest venture capital investments in the SaaS space during this period. This funding round, led by Andreessen Horowitz, Amazon Web Services, and others, underscores the continued investor appetite for innovative SaaS solutions that drive digital transformation and data-driven decision-making.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | SaaS | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zukunftsfonds Heilbronn | SaaS | United States; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Pre-Seed, Seed | ||

| Zobito | enterprise software | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| Zillionize | enterprise software | United States | Seed | ||

| ZhenFund | SaaS | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Zetta Venture Partners | enterprise, data, ai | Canada; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed | USD 100000000 | |

| Zeta Alpha | SaaS | Seed | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zero-One Capital | SaaS |

100 active CVC investors in SaaS

Active corporate venture capital (CVC) firms have been investing heavily in the SaaS (Software as a Service) space in the past three years. Notable players include Microsoft's M12, which backed Databricks, and Salesforce Ventures, which invested in Slack. These CVC firms are driving innovation and shaping the future of the SaaS industry.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | SaaS | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| XT Hi-Tech | SaaS | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Xerox Ventures | SaaS | Seed | |||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Wormhole Capital | SaaS | Series A, Seed, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Wintermute Ventures | SaaS | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C |

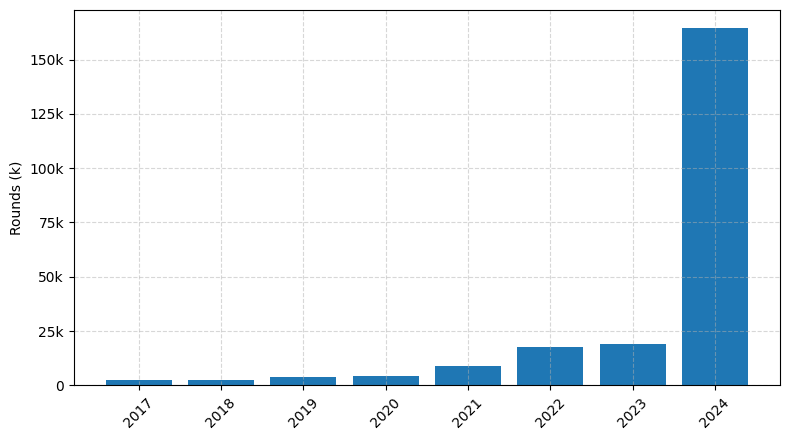

Investments by year: Round

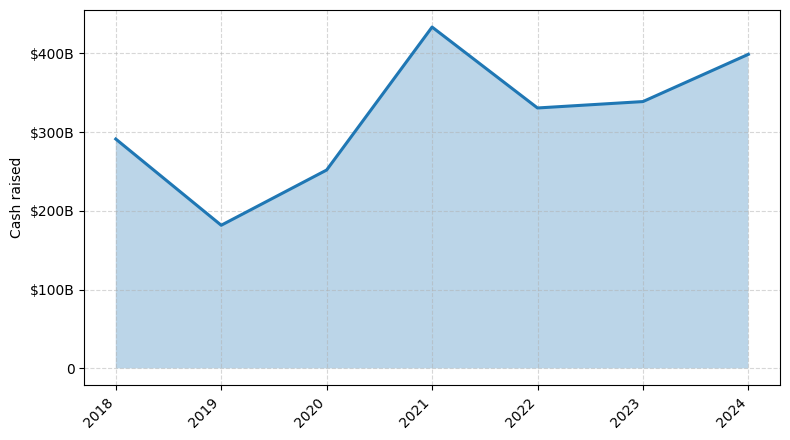

Investments by year: Cash raised

How is fundraising in SaaS different from other VC fundraising

Fundraising for SaaS (Software as a Service) startups differs from general startup fundraising in several key ways. SaaS businesses often have a longer sales cycle, requiring more patient capital to sustain growth. Investors also scrutinize SaaS metrics like monthly recurring revenue (MRR), customer acquisition cost (CAC), and churn rate more closely, as these metrics directly impact the company's long-term viability. Additionally, SaaS startups may need to invest heavily in product development and infrastructure upfront, which can make the path to profitability more challenging. Consequently, SaaS founders must be adept at communicating their business model, growth strategy, and financial projections to potential investors, who are looking for a clear path to scale and sustainable profitability.

Top Funded SaaS Startups

1. Salesforce: Approximately $20 billion in total funding, focused on customer relationship management (CRM) software.

2. Zoom: Approximately $1.5 billion in total funding, focused on video conferencing and collaboration tools.

3. Slack: Approximately $1.2 billion in total funding, focused on workplace communication and collaboration.

4. Dropbox: Approximately $1.7 billion in total funding, focused on cloud storage and file-sharing services.

5. Canva: Approximately $302 million in total funding, focused on graphic design and visual content creation.

2. Zoom: Approximately $1.5 billion in total funding, focused on video conferencing and collaboration tools.

3. Slack: Approximately $1.2 billion in total funding, focused on workplace communication and collaboration.

4. Dropbox: Approximately $1.7 billion in total funding, focused on cloud storage and file-sharing services.

5. Canva: Approximately $302 million in total funding, focused on graphic design and visual content creation.

What you should include in SaaS pitch deck

A SaaS (Software as a Service) pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the problem your SaaS solution addresses.

2. Value Proposition: Explain how your SaaS product uniquely solves the problem and provides value to customers.

3. Market Opportunity: Demonstrate the size and growth potential of the target market.

4. Competitive Landscape: Analyze your competitors and differentiate your SaaS offering.

5. Business Model: Outline your pricing strategy, revenue streams, and customer acquisition channels.

6. Traction and Milestones: Showcase your current progress, user growth, and key milestones achieved.

1. Problem Statement: Clearly define the problem your SaaS solution addresses.

2. Value Proposition: Explain how your SaaS product uniquely solves the problem and provides value to customers.

3. Market Opportunity: Demonstrate the size and growth potential of the target market.

4. Competitive Landscape: Analyze your competitors and differentiate your SaaS offering.

5. Business Model: Outline your pricing strategy, revenue streams, and customer acquisition channels.

6. Traction and Milestones: Showcase your current progress, user growth, and key milestones achieved.

How to Prepare Your SaaS Startup for Investment

Preparing a SaaS startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to have a well-defined business plan, a strong team, and a clear understanding of the market and competitive landscape.

When pitching to venture capital (VC) investors, startups should be prepared to demonstrate the following:

1. Scalable and Sustainable Business Model: VC investors typically look for SaaS startups with a scalable and sustainable business model that can generate recurring revenue and demonstrate a clear path to profitability.

2. Compelling Value Proposition: The startup should have a unique and compelling value proposition that addresses a significant market need and sets it apart from competitors.

3. Traction and Growth Potential: Investors will want to see evidence of traction, such as a growing customer base, increasing revenue, and a clear strategy for future growth.

4. Experienced and Capable Team: VC investors place a high value on the startup's management team, looking for individuals with relevant experience, a track record of success, and the ability to execute on the business plan.

5. Defensible Competitive Advantage: The startup should have a clear competitive advantage, whether it's through proprietary technology, a unique go-to-market strategy, or a strong brand presence.

By addressing these key areas, SaaS startups can increase their chances of securing investment and positioning themselves for long-term success.

When pitching to venture capital (VC) investors, startups should be prepared to demonstrate the following:

1. Scalable and Sustainable Business Model: VC investors typically look for SaaS startups with a scalable and sustainable business model that can generate recurring revenue and demonstrate a clear path to profitability.

2. Compelling Value Proposition: The startup should have a unique and compelling value proposition that addresses a significant market need and sets it apart from competitors.

3. Traction and Growth Potential: Investors will want to see evidence of traction, such as a growing customer base, increasing revenue, and a clear strategy for future growth.

4. Experienced and Capable Team: VC investors place a high value on the startup's management team, looking for individuals with relevant experience, a track record of success, and the ability to execute on the business plan.

5. Defensible Competitive Advantage: The startup should have a clear competitive advantage, whether it's through proprietary technology, a unique go-to-market strategy, or a strong brand presence.

By addressing these key areas, SaaS startups can increase their chances of securing investment and positioning themselves for long-term success.