FREE Investor Database

Top Venture Investors in Salestech Industry

Top Venture Investors in Salestech Industry

Discover leading VC and CVC investors specializing in Salestech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The world of Salestech has witnessed a surge of investments in the past three years, reflecting the growing importance of sales technology in the modern business landscape. Since 2022, the Salestech industry has seen a significant influx of capital, with numerous startups and established players receiving substantial funding to drive innovation and growth.

In the last three years, the Salestech sector has witnessed over 150 investments, with a total of $2.5 billion poured into the industry. Notable startups that have received substantial investments include Gong, a conversation intelligence platform that raised $250 million, and Outreach, a sales engagement platform that secured $200 million in funding.

Some of the most expensive deals in the Salestech space include Salesloft's $100 million Series E round and Clari's $150 million Series E. Additionally, the acquisition of Pipedrive by Visma for $1.5 billion stands out as a particularly interesting deal, showcasing the industry's potential for consolidation and strategic partnerships.

In summary, the Salestech industry has experienced a remarkable investment boom, with significant capital flowing into innovative startups and established players, driving the evolution of sales technology and its impact on modern business operations.

In the last three years, the Salestech sector has witnessed over 150 investments, with a total of $2.5 billion poured into the industry. Notable startups that have received substantial investments include Gong, a conversation intelligence platform that raised $250 million, and Outreach, a sales engagement platform that secured $200 million in funding.

Some of the most expensive deals in the Salestech space include Salesloft's $100 million Series E round and Clari's $150 million Series E. Additionally, the acquisition of Pipedrive by Visma for $1.5 billion stands out as a particularly interesting deal, showcasing the industry's potential for consolidation and strategic partnerships.

In summary, the Salestech industry has experienced a remarkable investment boom, with significant capital flowing into innovative startups and established players, driving the evolution of sales technology and its impact on modern business operations.

36 active VC investors in Salestech

In the last three years, the Salestech industry has attracted significant investment from active venture capital firms. Key players in this space include Accel, Sequoia Capital, and Andreessen Horowitz, who have backed innovative Salestech startups. One notable example is Gong.io, a conversation intelligence platform, which raised a $200 million Series D round in 2021, led by Coatue Management. This late-stage funding highlights the growing demand for Salestech solutions that empower sales teams with data-driven insights, helping them to improve their performance and drive business growth.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Vibranium.VC | b2b saas, productivity software, financial services, sales, marketing, media, information services | United States | Seed | USD 10000000 | |

| TVC Capital | software, ai, cannabis, collaboration, communication, success, data, integration, pipeline, ecommerce, fintech, healthcare, insurtech, mortgage, privacy, sales, marketing, devops, supply chain, logistics, wealthtech | Canada; United States | Series A, Series B, Series C, Series D | ||

| Triangle Tweener Fund | Salestech | United States, North Carolina | Seed, Series A | ||

| Super Capital | Salestech | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Seed, Pre-Seed, Series A | ||

| Structure Capital | Salestech | Seed, Series A, Series B, Series C, Series D, Series E | |||

| Struck Capital | Salestech | Generalist | Seed | ||

| Sopris Venture Capital | Salestech | United States; Canada | Series A, Series B | ||

| Simya VC | AI, Analytics, Cleantech, blockchain, energy, Industrial, Cloud Platform, Robotics, Biotechnology, Salestech, Agtech, B2B | United States; Germany; Turkey | Seed, Series A, Series B | USD 10000000 | |

| SaaSholic Fund | Salestech | Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay | Series A, Series B |

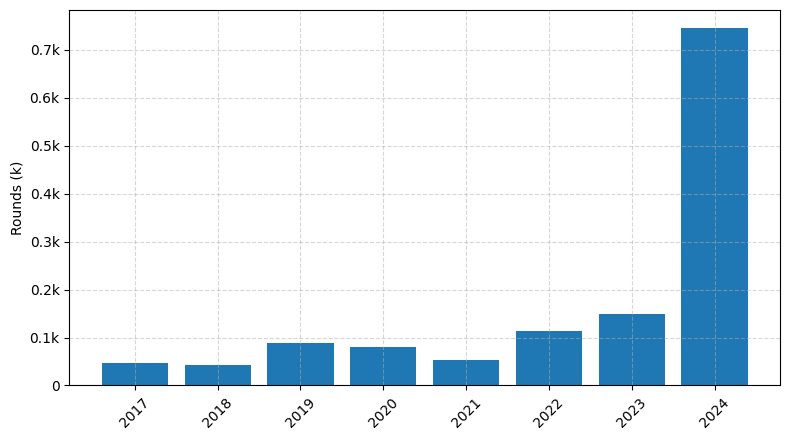

Investments by year: Round

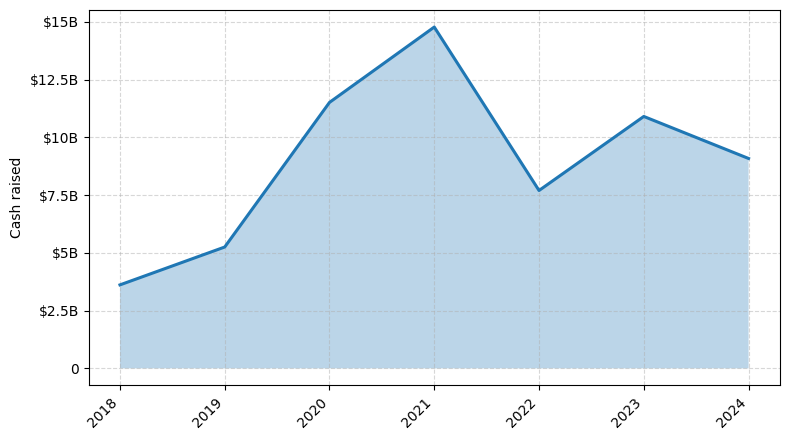

Investments by year: Cash raised

How is fundraising in Salestech different from other VC fundraising

Fundraising in Salestech differs from general startup fundraising due to the unique challenges faced by sales-focused businesses. Salestech startups often require significant upfront investment to build robust sales and marketing infrastructure, which can be a deterrent for some investors. Additionally, the sales cycle in Salestech can be longer and more complex, making it harder to demonstrate traction and growth to potential investors. Salestech startups also need to navigate the complex landscape of sales tools, integrations, and enterprise-level security requirements, which can add complexity to their fundraising efforts. As a result, Salestech founders often need to have a deep understanding of their target market, sales process, and the unique value proposition of their product to successfully raise funds and scale their business.

Top Funded Salestech Startups

Here is a summary of the top-funded Salestech startups globally:

- Gong: Approximately $583 million in total funding, focused on revenue intelligence.

- Salesloft: Approximately $475 million in total funding, focused on sales engagement.

- Outreach: Approximately $445 million in total funding, focused on sales engagement.

- Clari: Approximately $435 million in total funding, focused on revenue operations.

- Showpad: Approximately $160 million in total funding, focused on sales enablement.

- Gong: Approximately $583 million in total funding, focused on revenue intelligence.

- Salesloft: Approximately $475 million in total funding, focused on sales engagement.

- Outreach: Approximately $445 million in total funding, focused on sales engagement.

- Clari: Approximately $435 million in total funding, focused on revenue operations.

- Showpad: Approximately $160 million in total funding, focused on sales enablement.

What you should include in Salestech pitch deck

A Salestech pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the problem your Salestech solution addresses.

2. Solution Overview: Explain how your Salestech product solves the identified problem.

3. Competitive Landscape: Showcase your Salestech's unique features and advantages over competitors.

4. Go-to-Market Strategy: Outline your plan for effectively reaching and engaging your target customers.

5. Traction and Milestones: Highlight your Salestech's current achievements and future growth potential.

6. Team and Expertise: Introduce your experienced Salestech team and their relevant industry knowledge.

1. Problem Statement: Clearly define the problem your Salestech solution addresses.

2. Solution Overview: Explain how your Salestech product solves the identified problem.

3. Competitive Landscape: Showcase your Salestech's unique features and advantages over competitors.

4. Go-to-Market Strategy: Outline your plan for effectively reaching and engaging your target customers.

5. Traction and Milestones: Highlight your Salestech's current achievements and future growth potential.

6. Team and Expertise: Introduce your experienced Salestech team and their relevant industry knowledge.

How to Prepare Your Salestech Startup for Investment

Preparing a Salestech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

Here are five essential elements VC investors typically expect startups to demonstrate:

1. Clearly defined value proposition: Articulate the unique problem your Salestech solution solves and the tangible benefits it offers to customers.

2. Scalable and sustainable business model: Demonstrate a well-thought-out revenue model, customer acquisition strategies, and the potential for long-term growth.

3. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of the founding team and key personnel.

4. Competitive advantage and market opportunity: Provide a comprehensive analysis of the market landscape, your target audience, and the unique competitive edge your Salestech solution offers.

5. Traction and milestones: Showcase your startup's progress, including customer acquisition, revenue growth, and any significant milestones or achievements.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Salestech startup for long-term success.

Here are five essential elements VC investors typically expect startups to demonstrate:

1. Clearly defined value proposition: Articulate the unique problem your Salestech solution solves and the tangible benefits it offers to customers.

2. Scalable and sustainable business model: Demonstrate a well-thought-out revenue model, customer acquisition strategies, and the potential for long-term growth.

3. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of the founding team and key personnel.

4. Competitive advantage and market opportunity: Provide a comprehensive analysis of the market landscape, your target audience, and the unique competitive edge your Salestech solution offers.

5. Traction and milestones: Showcase your startup's progress, including customer acquisition, revenue growth, and any significant milestones or achievements.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Salestech startup for long-term success.