FREE Investor Database

Top Venture Investors in Cloud Industry

Top Venture Investors in Cloud Industry

Discover leading VC and CVC investors specializing in Cloud. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The cloud computing industry has witnessed a surge in investments over the past three years, reflecting the growing demand for cloud-based solutions and the increasing importance of digital transformation. Since 2022, the cloud sector has attracted significant attention from investors, with numerous startups and established companies receiving substantial funding.

In the last three years, the cloud industry has seen a remarkable number of investments, with over 500 deals recorded. The total amount of money invested in cloud-related companies during this period has exceeded $100 billion, showcasing the immense potential and growth of this sector.

Some of the core startups that have received notable investments include Snowflake, a data cloud platform that raised $3.4 billion in its IPO, and Databricks, an AI and data analytics company that secured a $1 billion investment. Additionally, several high-profile deals, such as Microsoft's acquisition of Nuance Communications for $19.7 billion and Google's $2.1 billion purchase of Looker, have further solidified the cloud industry's position as a prime investment destination.

The cloud computing industry's rapid growth and the substantial investments it has attracted in the past three years highlight its transformative potential and the ongoing shift towards cloud-based solutions across various industries.

In the last three years, the cloud industry has seen a remarkable number of investments, with over 500 deals recorded. The total amount of money invested in cloud-related companies during this period has exceeded $100 billion, showcasing the immense potential and growth of this sector.

Some of the core startups that have received notable investments include Snowflake, a data cloud platform that raised $3.4 billion in its IPO, and Databricks, an AI and data analytics company that secured a $1 billion investment. Additionally, several high-profile deals, such as Microsoft's acquisition of Nuance Communications for $19.7 billion and Google's $2.1 billion purchase of Looker, have further solidified the cloud industry's position as a prime investment destination.

The cloud computing industry's rapid growth and the substantial investments it has attracted in the past three years highlight its transformative potential and the ongoing shift towards cloud-based solutions across various industries.

98 active VC investors in Cloud

In the last three years, the cloud computing industry has attracted significant investment from active venture capital firms. Key players include Andreessen Horowitz, Sequoia Capital, and Accel, which have backed numerous cloud-based startups. One notable example is Databricks, a data analytics platform, which raised a $1 billion Series G round in 2021, led by Andreessen Horowitz and other investors. This record-breaking funding round highlights the growing demand for cloud-based data and analytics solutions, as well as the continued interest of venture capitalists in the cloud computing space.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zeta Alpha | Cloud | Seed | |||

| Zero-One Capital | Cloud | ||||

| Zeno Ventures | Cloud | Generalist | Series A, Series B | ||

| Zen Girişim | Cloud | ||||

| Zelkova Ventures | Cloud | Generalist | Seed | USD 15000000 | |

| Zee Prime Capital | programmable assets, collaborative intelligence | United Kingdom | Seed | ||

| ZAS Ventures | Cloud | Bulgaria; Czechia; Hungary; Moldova; Poland; Romania; Slovakia; Ukraine | Seed | ||

| Zag Capital | Cloud | United States | Seed | ||

| Z5 Capital | infrastructure, cloud, data management,enterprise,(ai), machine learning (ml),security | United States | Seed | USD 4300000 | |

| Z21 Ventures | Cloud | India | Seed | USD 5000000 |

90 active CVC investors in Cloud

Active corporate venture capital (CVC) firms have been investing heavily in cloud technologies over the past three years. Notable players include Microsoft's M12, which backed cloud security startup Sysdig, and Salesforce Ventures, which invested in cloud data management platform Snowflake. These CVC firms are driving innovation in the cloud space through strategic investments.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| XT Hi-Tech | Cloud | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Xerox Ventures | Cloud | Seed | |||

| Wormhole Capital | Cloud | Series A, Seed, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed | ||

| Wintermute Ventures | Cloud | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| TS Ventures Fond | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Seed, Series A, Pre-Seed, Series B | |||

| Trifork Labs | Cloud | Generalist | Pre-Seed, Seed, Series A, Series B |

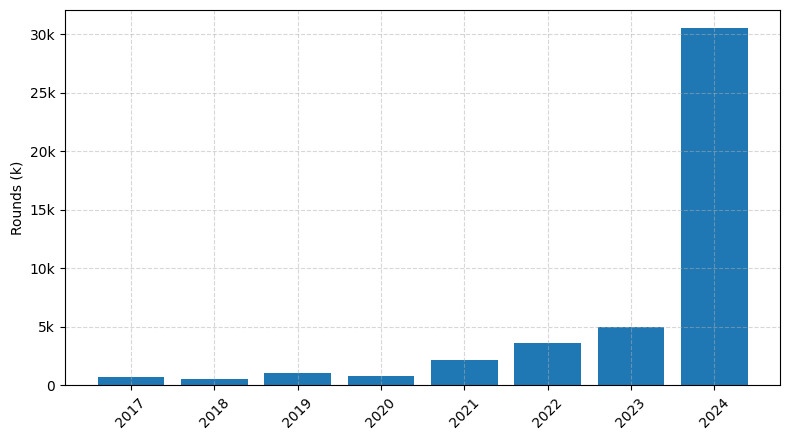

Investments by year: Round

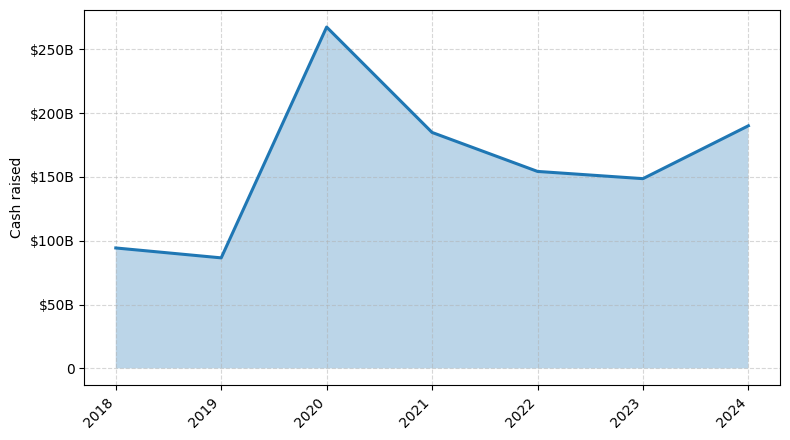

Investments by year: Cash raised

How is fundraising in Cloud different from other VC fundraising

Fundraising for cloud-based startups differs from general startup fundraising in several key ways. Cloud companies often require significant upfront investment in infrastructure and technology, which can make it more challenging to achieve profitability in the early stages. Additionally, cloud startups must navigate the complexities of cloud pricing models, data security, and regulatory compliance, which can add additional hurdles to the fundraising process. Investors in the cloud space also tend to have a more specialized understanding of the unique challenges and opportunities in the cloud market, which can make it more difficult for cloud startups to appeal to a broader range of investors. Overall, cloud startups must be prepared to address these unique challenges and demonstrate a clear path to long-term profitability and scalability in order to successfully raise funds.

Top Funded Cloud Startups

1. Snowflake: Approximately $1.4 billion in total funding, focused on cloud-based data warehousing and analytics.

2. Databricks: Approximately $1.9 billion in total funding, focused on unified data analytics and AI platform.

3. Confluent: Approximately $455 million in total funding, focused on cloud-native data streaming platform.

4. Hashicorp: Approximately $349 million in total funding, focused on cloud infrastructure automation and security.

5. Instacart: Approximately $2.7 billion in total funding, focused on on-demand grocery delivery platform.

2. Databricks: Approximately $1.9 billion in total funding, focused on unified data analytics and AI platform.

3. Confluent: Approximately $455 million in total funding, focused on cloud-native data streaming platform.

4. Hashicorp: Approximately $349 million in total funding, focused on cloud infrastructure automation and security.

5. Instacart: Approximately $2.7 billion in total funding, focused on on-demand grocery delivery platform.

What you should include in Cloud pitch deck

When pitching a cloud solution, your slide deck should include the following unique slides:

1. Cloud Architecture: Illustrate the technical infrastructure and components of your cloud-based offering.

2. Cloud Benefits: Highlight the key advantages of your cloud solution, such as scalability, cost-efficiency, and accessibility.

3. Cloud Security: Explain the robust security measures and compliance standards your cloud platform adheres to.

4. Cloud Migration: Outline the process and timeline for seamlessly transitioning clients from on-premises to cloud-based systems.

5. Cloud Roadmap: Showcase your future cloud product enhancements and the ongoing development of your cloud platform.

1. Cloud Architecture: Illustrate the technical infrastructure and components of your cloud-based offering.

2. Cloud Benefits: Highlight the key advantages of your cloud solution, such as scalability, cost-efficiency, and accessibility.

3. Cloud Security: Explain the robust security measures and compliance standards your cloud platform adheres to.

4. Cloud Migration: Outline the process and timeline for seamlessly transitioning clients from on-premises to cloud-based systems.

5. Cloud Roadmap: Showcase your future cloud product enhancements and the ongoing development of your cloud platform.

How to Prepare Your Cloud Startup for Investment

Preparing a Cloud startup for investment requires a strategic approach to showcase the business's potential and attract the attention of venture capital (VC) investors. As an advisory, it is crucial to ensure that your startup is well-positioned to meet the expectations of VC investors during the pitch deck review process.

Here are five key elements VC investors typically expect startups to demonstrate:

1. Clearly defined market opportunity: Provide a comprehensive analysis of the target market, its size, growth potential, and the startup's competitive advantage.

2. Innovative and scalable technology: Highlight the uniqueness of your cloud-based solution, its technical capabilities, and the potential for scalability.

3. Experienced and capable team: Showcase the expertise and relevant experience of the founding team and key personnel, demonstrating their ability to execute the business plan.

4. Robust financial projections: Present detailed financial projections, including revenue models, cost structures, and a clear path to profitability and sustainability.

5. Compelling growth strategy: Outline a well-thought-out strategy for customer acquisition, market expansion, and long-term value creation.

By addressing these key elements in your pitch deck and overall business plan, you can increase the chances of securing investment from VC investors and propel your Cloud startup towards success.

Here are five key elements VC investors typically expect startups to demonstrate:

1. Clearly defined market opportunity: Provide a comprehensive analysis of the target market, its size, growth potential, and the startup's competitive advantage.

2. Innovative and scalable technology: Highlight the uniqueness of your cloud-based solution, its technical capabilities, and the potential for scalability.

3. Experienced and capable team: Showcase the expertise and relevant experience of the founding team and key personnel, demonstrating their ability to execute the business plan.

4. Robust financial projections: Present detailed financial projections, including revenue models, cost structures, and a clear path to profitability and sustainability.

5. Compelling growth strategy: Outline a well-thought-out strategy for customer acquisition, market expansion, and long-term value creation.

By addressing these key elements in your pitch deck and overall business plan, you can increase the chances of securing investment from VC investors and propel your Cloud startup towards success.