FREE Investor Database

Top Venture Investors in Robotics Industry

Top Venture Investors in Robotics Industry

Discover leading VC and CVC investors specializing in Robotics. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The world of robotics has seen a surge in investment activity over the past three years, with a growing number of investors recognizing the immense potential of this rapidly evolving industry. Since 2022, the robotics sector has witnessed a flurry of investment deals, with numerous startups and established players securing significant funding to drive innovation and technological advancements.

According to industry reports, over 500 robotics investments have been made in the last three years, with a total value exceeding $25 billion. Some of the core startups that have received substantial investments include Agility Robotics, Nuro, and Fetch Robotics, each securing multi-million-dollar funding rounds. Additionally, several high-profile deals, such as the $2.1 billion acquisition of Kuka by Midea Group and the $1.1 billion investment in Cruise Automation by Honda, have further highlighted the growing interest in the robotics space.

In summary, the robotics industry has experienced a remarkable influx of investment capital in recent years, fueling the development of cutting-edge technologies and driving the transformation of various sectors, from manufacturing to logistics and beyond.

According to industry reports, over 500 robotics investments have been made in the last three years, with a total value exceeding $25 billion. Some of the core startups that have received substantial investments include Agility Robotics, Nuro, and Fetch Robotics, each securing multi-million-dollar funding rounds. Additionally, several high-profile deals, such as the $2.1 billion acquisition of Kuka by Midea Group and the $1.1 billion investment in Cruise Automation by Honda, have further highlighted the growing interest in the robotics space.

In summary, the robotics industry has experienced a remarkable influx of investment capital in recent years, fueling the development of cutting-edge technologies and driving the transformation of various sectors, from manufacturing to logistics and beyond.

97 active VC investors in Robotics

In the last three years, the robotics industry has seen a surge in venture capital investment. Key players like Softbank Vision Fund, Sequoia Capital, and Andreessen Horowitz have been actively investing in this space. One notable example is Cruise, the autonomous vehicle company, which raised a $2.75 billion funding round in 2021 led by Softbank Vision Fund, Honda, and other institutional investors. This investment highlights the growing interest and confidence in the future of robotics and autonomous technologies, as investors seek to capitalize on the industry's potential for innovation and disruption.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| ZhenFund | Robotics | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Yıldız Tekno GSYO | artificial intelligence, ar, vr, financial technologies, robotics, insurance technologies, health technologies | Turkey | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| YI Capital | industrial Internet, ndustrial upgrading, enterprise services, hard technologies, security, big data, cloud, artificial intelligence, robotics, software, digital design, cyber security, business management | China | |||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xplorer Fund | mobility, med, robotics, energy, ict, iot, digitalisation, digital twins | Pre-Seed | |||

| Xplorer Capital | artificial intelligence, automation, iot, enterprise saas, data solutions, robotics, autonomous, drones, machine learning, big data,disruptive technology | Canada; United States; Germany | Seed, Series A, Series B | USD 100000000 | |

| Xfund | enterprise software, machine intelligence, computer vision, nlp, deep learning applications, frontier technologies, space, robotics, vr/ar, autonomous vehicles, healthit, consumer tech, marketplaces, ecommerce, mobile-first | Generalist; United States | Seed, Series A, Series B | USD 120000000 | |

| Xerox Ventures | Robotics | Seed |

39 active CVC investors in Robotics

Active corporate venture capital (CVC) firms have been investing heavily in robotics over the past three years. Notable players include Intel Capital, which backed Fetch Robotics, and Siemens' Next47, which invested in Realtime Robotics. These CVC firms are driving innovation in areas like warehouse automation and industrial robotics.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Xerox Ventures | Robotics | Seed | |||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Trimble Ventures | construction, transportation, agriculture, geospatial, technology, hardware, software applications, autonomy, robotics, sustainability, artificial intelligence, blockchain, augmented, mixed reality, iot analytics | Series B, Series A, Series E, Series D, Seed, Series C | USD 200000000 | ||

| Toyota Ventures | artificial intelligence, autonomy, mobility, robotics, cloud technology, smart cities, digital health, fintech, materials, climate | Generalist | Seed, Series A, Series B | ||

| Stanley Ventures | new materials, automation, 3d printing, robotics, recycling, electrification, industrial iot, manufacturing | Generalist | Seed, Series A, Series B | ||

| SRI Ventures | 3d and virtual environments, advanced manipulation and automation, drug discovery and development, bioinformatics and computational biology, computer vision, communications and networking, robotics, sensors and signal processing, image and video processing, medical and surgical devices, quantum sensing, artificial intelligence and machine learning, gps tracking and precision navigation, speech, language, and audio technologies, satellite systems | Seed | |||

| Sony Innovation Fund | Robotics | Generalist | Seed | ||

| SoftBank Ventures Asia | ict industry, ai, iot, smart robotics, internet & mobile services, software, hardware, e-commerce, advertising & media, vr. | South Korea; Japan; Singapore; China; United States; Israel; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Austria; Belgium; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | Pre-Seed, Seed, Series A, Series B |

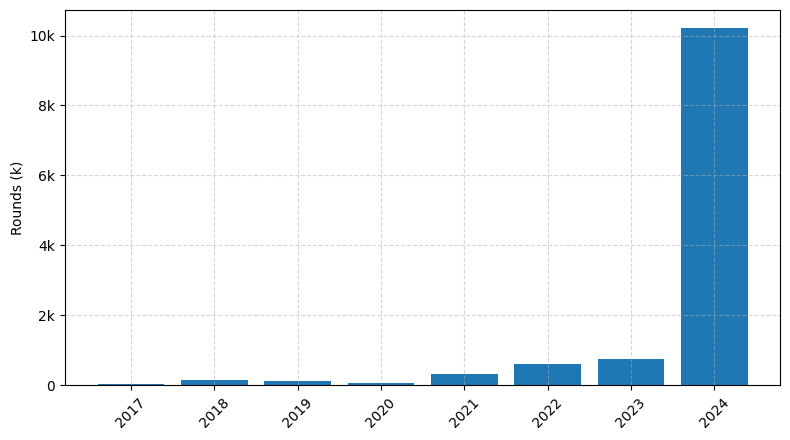

Investments by year: Round

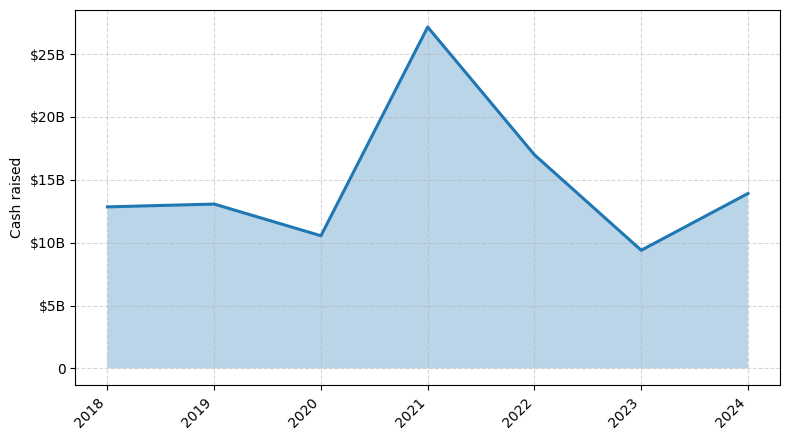

Investments by year: Cash raised

How is fundraising in Robotics different from other VC fundraising

Fundraising for robotics startups differs from general startup fundraising due to the unique challenges posed by the hardware-centric nature of the industry. Robotics companies often require significant upfront capital to develop prototypes, secure manufacturing capabilities, and navigate complex regulatory environments. Additionally, the longer product development cycles and higher technical risks associated with robotics can make investors more cautious. Robotics startups must demonstrate a clear path to commercialization, robust intellectual property, and a strong team with both technical and business expertise. They may also need to navigate specialized funding sources, such as government grants or industry-specific venture capital funds, to access the resources necessary for their capital-intensive endeavors. Effective fundraising in robotics requires a deep understanding of the industry's nuances and the ability to articulate a compelling vision that addresses the unique challenges faced by this dynamic and rapidly evolving sector.

Top Funded Robotics Startups

Here is a summary of the top-funded Robotics startups globally:

• Cruise: Approximately $10 billion in funding, focused on autonomous vehicle technology.

• Nuro: Approximately $2 billion in funding, focused on autonomous delivery vehicles.

• Fetch Robotics: Approximately $96 million in funding, focused on warehouse automation and logistics robots.

• Vicarious: Approximately $130 million in funding, focused on artificial general intelligence and machine learning.

• Anki: Approximately $200 million in funding, focused on consumer robotics and AI-powered toys.

• Cruise: Approximately $10 billion in funding, focused on autonomous vehicle technology.

• Nuro: Approximately $2 billion in funding, focused on autonomous delivery vehicles.

• Fetch Robotics: Approximately $96 million in funding, focused on warehouse automation and logistics robots.

• Vicarious: Approximately $130 million in funding, focused on artificial general intelligence and machine learning.

• Anki: Approximately $200 million in funding, focused on consumer robotics and AI-powered toys.

What you should include in Robotics pitch deck

When creating a Robotics pitch deck, the following unique slides should be included:

1. Technology Overview: Explain the core technology and innovations that power your robotic solution.

2. Market Opportunity: Demonstrate the size and growth potential of the target market for your robotics product or service.

3. Competitive Advantage: Highlight the unique features or capabilities that set your robotics solution apart from competitors.

4. Roadmap and Milestones: Outline your development plan, key milestones, and timeline for bringing your robotics product to market.

5. Team Expertise: Showcase the experience and qualifications of your robotics engineering and leadership team.

1. Technology Overview: Explain the core technology and innovations that power your robotic solution.

2. Market Opportunity: Demonstrate the size and growth potential of the target market for your robotics product or service.

3. Competitive Advantage: Highlight the unique features or capabilities that set your robotics solution apart from competitors.

4. Roadmap and Milestones: Outline your development plan, key milestones, and timeline for bringing your robotics product to market.

5. Team Expertise: Showcase the experience and qualifications of your robotics engineering and leadership team.

How to Prepare Your Robotics Startup for Investment

Preparing a Robotics startup for investment requires a strategic approach to ensure that the business is investment-ready. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

Here are five bullet points outlining what VC investors typically expect startups to demonstrate:

1. Clearly defined problem and solution: Articulate the specific problem your robotics solution addresses and how it provides a unique and innovative solution.

2. Scalable business model: Demonstrate a well-thought-out business model that can scale effectively and generate sustainable revenue.

3. Experienced team: Highlight the expertise and relevant experience of the founding team, showcasing their ability to execute the business plan.

4. Competitive advantage: Identify your startup's unique competitive edge, such as proprietary technology, patents, or strategic partnerships.

5. Realistic financial projections: Present detailed and realistic financial projections, including revenue, expenses, and a clear path to profitability.

By addressing these key elements, your Robotics startup can increase its chances of securing investment from VC investors and positioning itself for long-term success.

Here are five bullet points outlining what VC investors typically expect startups to demonstrate:

1. Clearly defined problem and solution: Articulate the specific problem your robotics solution addresses and how it provides a unique and innovative solution.

2. Scalable business model: Demonstrate a well-thought-out business model that can scale effectively and generate sustainable revenue.

3. Experienced team: Highlight the expertise and relevant experience of the founding team, showcasing their ability to execute the business plan.

4. Competitive advantage: Identify your startup's unique competitive edge, such as proprietary technology, patents, or strategic partnerships.

5. Realistic financial projections: Present detailed and realistic financial projections, including revenue, expenses, and a clear path to profitability.

By addressing these key elements, your Robotics startup can increase its chances of securing investment from VC investors and positioning itself for long-term success.