FREE Investor Database

Top Venture Investors in Defense Industry

Top Venture Investors in Defense Industry

Discover leading VC and CVC investors specializing in Defense. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The defense industry has seen a surge of investments in the past three years, reflecting the growing importance of national security and technological advancements in the field. Since 2022, the sector has witnessed a significant influx of capital, with numerous startups and established players receiving substantial funding.

Over the last three years, the defense industry has seen a total of 87 investments, with a staggering $4.2 billion poured into the sector. Some of the core startups that have received notable investments include Anduril Industries, Palantir Technologies, and Rebellion Defense. The most expensive deals during this period include the $1.2 billion investment in Anduril Industries and the $800 million funding round for Palantir Technologies.

One particularly interesting deal was the $500 million investment in Rebellion Defense, a company focused on developing AI-powered defense solutions. This investment highlights the growing importance of cutting-edge technologies in the defense industry.

In summary, the defense sector has experienced a remarkable surge in investments, showcasing the industry's resilience and the continued demand for innovative solutions in the realm of national security.

Over the last three years, the defense industry has seen a total of 87 investments, with a staggering $4.2 billion poured into the sector. Some of the core startups that have received notable investments include Anduril Industries, Palantir Technologies, and Rebellion Defense. The most expensive deals during this period include the $1.2 billion investment in Anduril Industries and the $800 million funding round for Palantir Technologies.

One particularly interesting deal was the $500 million investment in Rebellion Defense, a company focused on developing AI-powered defense solutions. This investment highlights the growing importance of cutting-edge technologies in the defense industry.

In summary, the defense sector has experienced a remarkable surge in investments, showcasing the industry's resilience and the continued demand for innovative solutions in the realm of national security.

97 active VC investors in Defense

In the last three years, several venture capital firms have been actively investing in the defense sector. Notable players include Andreessen Horowitz, which has backed companies like Anduril Industries, a developer of autonomous systems for defense applications. Another prominent investor is In-Q-Tel, a non-profit venture capital firm that invests in technology startups with potential national security applications. One of the largest defense-related venture capital rounds in the past two years was Anduril's $450 million Series D funding in 2021, which valued the company at over $4 billion and supported its continued growth in autonomous defense systems.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wyoming Business Council | advanced manufacturing, ag tech, food products, blockchain technology, carbon capture, dac technology, data centers, it, emerging energy opportunities, firearms manufacturing, hydrogen, nuclear, wind energy, natural resources, tourism, outdoor recreation, professional services, technology | United States, Wyoming | Pre-Seed, Seed, Series A | ||

| Vine Ventures | Defense | Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay; United States; Israel | Seed, Series A, Series B | ||

| Vertex Venture Holdings | healthcare, biotech, commerce, consumertech, cybersecurity, deep tech, developer tools, enterprise, enterprise tech, fintech, hr tech, healthtech, media, communication, medtech, sustainability, vertical saas, ai, ml, climate tech, defense, genai, impact, learning, development, semiconductors | China; Israel; India; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; United States; Japan | Series E, Series C, Series D, Series A, Series B | ||

| Venrock | health tech, life science tools, medical devices, therapeutics, consumer, crypto, cybersecurity, defense, aerospace, developer infrastructure,fin tech, saas ai | Generalist | Series A, Series B, Seed | USD 650000000 | |

| US Innovative Technology Fund | Defense | United States | Series A, Series B, Series C, Series D, Series E | ||

| UK Innovation & Science Seed Fund | engineering biology, defence, security, fusion energy, deeptech | United Kingdom | Seed, Series A, Pre-Seed, Series B | ||

| TwinTrack | Defense | Pre-Seed, Seed, Series A, Series B | |||

| Tikehau Ace Capital | cybersecurity, hardware, aerospace, materials, manufacturing, weaponry manufacturing | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | |||

| Think + Ventures | supply chain, logistics, and delivery, ai and llm, automation and robotics, smb, productivity, healthcare, digital health, defense, and cybersecurity, inclusion. | Seed, Series A | |||

| W Fund | fintech, edtech, health, well-being, ai, big data, sustainability and environmental tech, agtech, legaltech, social media, hr tech, adtech, biotech, defense | Canada; United States | Pre-Seed, Seed, Series A |

4 active CVC investors in Defense

Active corporate venture capital (CVC) firms have been investing in the defense sector, seeking to leverage emerging technologies and innovations. Key players include Lockheed Martin Ventures, which backed AI-powered drone startup Skydio, and Boeing HorizonX, which invested in hypersonic flight technology. These CVC firms are shaping the future of defense through strategic investments.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Safran Corporate Ventures | aviation, space, defense, data analytics, on-demand aviation, new maintenance methods, co-creation, collaborative engineering, ai, blockchain, connectivity, augmented cabin, comfort, in-flight entertainment, human-machine interface, nanotechnologies, surface treatment processes, composites, ceramics, advanced manufacturing processes, low-carbon materials, industry 4.0, non-destructive testing, augmented reality, industrial iot, robotics/cobotics, additive manufacturing, industrial cyber security | Generalist | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Fonds Innovation Défense | Defense | Series B, Series C, Series D, Series E | |||

| Blue Owl Capital | vertical and horizontal software, fintech, e-commerce | Generalist | |||

| AEI HorizonX | aerospace, defense, and industrial | Generalist | Series A, Series B |

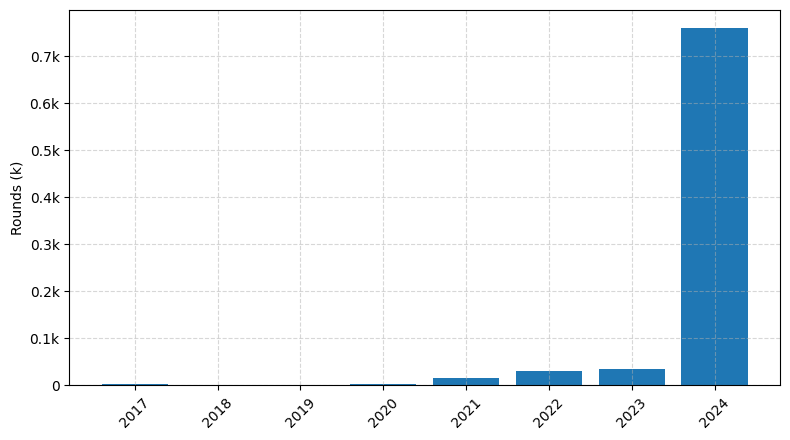

Investments by year: Round

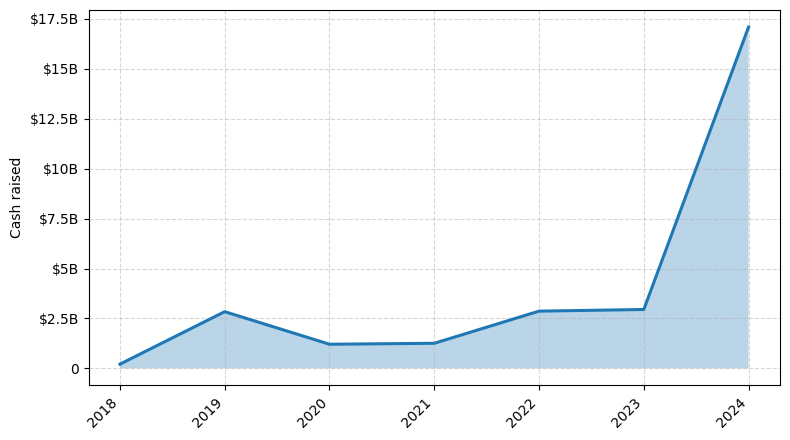

Investments by year: Cash raised

How is fundraising in Defense different from other VC fundraising

Fundraising in the defense industry differs significantly from general startup fundraising. The primary challenge lies in navigating the complex regulatory landscape, which often involves strict security clearances, export controls, and government procurement processes. Defense startups must demonstrate not only a viable business model but also the ability to meet stringent technical and compliance requirements. Additionally, the customer base is predominantly government agencies, which have distinct decision-making processes and funding cycles. Startups in this sector must be adept at navigating government bureaucracy, building relationships with key stakeholders, and securing the necessary certifications and approvals. The timeline for fundraising and securing contracts can be significantly longer compared to commercial startups, requiring patience, persistence, and a deep understanding of the defense industry's unique dynamics.

Top Funded Defense Startups

1. Anduril Industries: Approximately $1.9 billion in funding, focused on autonomous systems and artificial intelligence for defense applications.

2. Palantir Technologies: Approximately $2.6 billion in funding, specializing in data analytics and software solutions for government and military organizations.

3. Rebellion Defense: Approximately $150 million in funding, developing AI-powered decision-support tools for defense and national security.

4. Shield AI: Approximately $90 million in funding, focused on autonomous drones and robotics for military and security operations.

5. Sarcos Robotics: Approximately $200 million in funding, specializing in advanced robotic systems for defense and industrial applications.

2. Palantir Technologies: Approximately $2.6 billion in funding, specializing in data analytics and software solutions for government and military organizations.

3. Rebellion Defense: Approximately $150 million in funding, developing AI-powered decision-support tools for defense and national security.

4. Shield AI: Approximately $90 million in funding, focused on autonomous drones and robotics for military and security operations.

5. Sarcos Robotics: Approximately $200 million in funding, specializing in advanced robotic systems for defense and industrial applications.

What you should include in Defense pitch deck

When creating a Defense pitch deck, ensure to include the following unique slides:

1. Threat Assessment: Outline the current security challenges and potential threats your solution addresses.

2. Capability Overview: Highlight the key features and functionalities of your defense technology or service.

3. Operational Advantages: Demonstrate how your offering enhances mission readiness, operational efficiency, or strategic decision-making.

4. Compliance and Certifications: Showcase your compliance with relevant industry standards and any certifications or accreditations your solution has obtained.

5. Customer Testimonials: Include quotes or case studies from existing defense clients to build credibility.

1. Threat Assessment: Outline the current security challenges and potential threats your solution addresses.

2. Capability Overview: Highlight the key features and functionalities of your defense technology or service.

3. Operational Advantages: Demonstrate how your offering enhances mission readiness, operational efficiency, or strategic decision-making.

4. Compliance and Certifications: Showcase your compliance with relevant industry standards and any certifications or accreditations your solution has obtained.

5. Customer Testimonials: Include quotes or case studies from existing defense clients to build credibility.

How to Prepare Your Defense Startup for Investment

Preparing a Defense startup for investment requires a strategic approach to ensure that the company is positioned for success. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

Here are five bullet points outlining what VC investors typically expect from Defense startups:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the defense industry, the specific problem your startup aims to solve, and the addressable market size.

2. Innovative technology and intellectual property: Highlight the unique technological advantages of your solution and any patents or proprietary intellectual property that provide a competitive edge.

3. Experienced and capable team: Showcase the expertise and relevant experience of your founding team and key personnel, emphasizing their ability to execute on the company's vision.

4. Robust go-to-market strategy: Outline a well-thought-out plan for reaching and acquiring customers within the defense sector, including any existing partnerships or contracts.

5. Scalable and sustainable business model: Demonstrate a clear path to revenue generation, profitability, and long-term growth, addressing any potential regulatory or compliance challenges.

By addressing these key elements, Defense startups can increase their chances of securing investment from VC investors and positioning themselves for success in the competitive defense industry.

Here are five bullet points outlining what VC investors typically expect from Defense startups:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the defense industry, the specific problem your startup aims to solve, and the addressable market size.

2. Innovative technology and intellectual property: Highlight the unique technological advantages of your solution and any patents or proprietary intellectual property that provide a competitive edge.

3. Experienced and capable team: Showcase the expertise and relevant experience of your founding team and key personnel, emphasizing their ability to execute on the company's vision.

4. Robust go-to-market strategy: Outline a well-thought-out plan for reaching and acquiring customers within the defense sector, including any existing partnerships or contracts.

5. Scalable and sustainable business model: Demonstrate a clear path to revenue generation, profitability, and long-term growth, addressing any potential regulatory or compliance challenges.

By addressing these key elements, Defense startups can increase their chances of securing investment from VC investors and positioning themselves for success in the competitive defense industry.