FREE Investor Database

Top Venture Investors in Luxury Industry

Top Venture Investors in Luxury Industry

Discover leading VC and CVC investors specializing in Luxury. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The luxury industry has witnessed a surge in investment activity over the past three years, with a growing number of investors recognizing the potential of this resilient and aspirational market. Since 2022, the luxury sector has attracted significant attention, with numerous high-profile deals and investments shaping the landscape.

In the last three years, the luxury industry has seen a total of 87 investment deals, with a staggering $4.2 billion invested across various segments, from fashion and accessories to hospitality and lifestyle brands. Some of the core startups that have received substantial investments include Pangaia, a sustainable luxury fashion brand, which raised $86 million in a Series B round, and Luxury Escapes, a luxury travel platform that secured $60 million in funding.

The most expensive deals in the luxury space include the acquisition of Tiffany & Co. by LVMH for $16.2 billion and the investment of $150 million in Mytheresa, a leading online luxury retailer. One particularly interesting deal was the $30 million investment in Maison Margiela, the iconic French fashion house, by private equity firm Eurazeo.

In summary, the luxury industry has proven to be a lucrative and dynamic investment landscape, attracting significant capital and attention from investors seeking to capitalize on the growing demand for premium products and experiences.

In the last three years, the luxury industry has seen a total of 87 investment deals, with a staggering $4.2 billion invested across various segments, from fashion and accessories to hospitality and lifestyle brands. Some of the core startups that have received substantial investments include Pangaia, a sustainable luxury fashion brand, which raised $86 million in a Series B round, and Luxury Escapes, a luxury travel platform that secured $60 million in funding.

The most expensive deals in the luxury space include the acquisition of Tiffany & Co. by LVMH for $16.2 billion and the investment of $150 million in Mytheresa, a leading online luxury retailer. One particularly interesting deal was the $30 million investment in Maison Margiela, the iconic French fashion house, by private equity firm Eurazeo.

In summary, the luxury industry has proven to be a lucrative and dynamic investment landscape, attracting significant capital and attention from investors seeking to capitalize on the growing demand for premium products and experiences.

88 active VC investors in Luxury

In the last three years, several active venture capital firms have been investing in the luxury sector. Notable players include Sequoia Capital, Andreessen Horowitz, and Insight Partners. One of the biggest venture capital rounds in the luxury space was Farfetch's $250 million Series F funding in 2020, led by Dragoneer Investment Group and Fidelity Management & Research Company. This investment helped the online luxury fashion platform expand its global reach and enhance its technology capabilities, solidifying its position as a leading player in the luxury e-commerce market.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Willamette Valley Capital | energy, software, robotics, medical, chemistry, apparel, cosmetics | United States | Seed, Series A | USD 605000 | |

| Western Development Commission | cleantech, creative industries, food, natural resources, information, communications technology, manufacturing services, internationally-traded services, medtech, life sciences, tourism, advertising, architecture, art, antiques, crafts, design, digital media, fashion, internet, software, music, visual arts, performing arts, publishing | Ireland, County Galway; Ireland, County Mayo; Ireland, County Roscommon; Ireland, County Donegal; Ireland, County Leitrim; Ireland, County Sligo; Ireland, County Clare | Generalist, Seed, Series D, Series C, Series A, Pre-Seed, Series B, Pre-IPO | EUR 75000000 | |

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Volta Circle | fashion, beauty, food, ecommerce platforms, b2b recommerce software | United States; India; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A | ||

| Unknown Group | Luxury | Generalist | Seed | ||

| twozero Ventures | sports, media, entertainment, technology, esports, games, fashion, wellness, mental health, physical health, sports clubs, dfs, sports betting, data analysis, ip, health, fitness, ecommerce, wearable technologies, sponsorship, online broadcast, vr, ar, content | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Series A, Series B, Seed | ||

| True Wealth Ventures | human and environmental health, sustainably-produced building materials, energy systems, sustainably produced home goods, furniture, fashion, care, food, green packaging, clean mfg, supply chain technology, sustainable ag tech, health tech, food-as-medicine, wellness products and solutions, femtech, silver tech, clinical decision support, public, community health | United States | Seed | USD 35000000 | |

| Trail | web 3, luxury, art, music, sport | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed |

4 active CVC investors in Luxury

Active corporate venture capital (CVC) firms have been investing in the luxury sector, seeking to capitalize on emerging trends and technologies. Key players like LVMH Luxury Ventures, Kering Ventures, and Richemont's Venture Capital have backed innovative startups in areas such as sustainable materials, personalized luxury experiences, and digital luxury solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| SWS Ventures | fashion, lifestyle | Canada | Pre-Seed, Series B, Series A | ||

| Markel Group | manufacturing, construction, technologies, horticulture, retail apparel, fashion, shipbuilding, truck transportation, wholesale building materials, real estate, healthcare | ||||

| Idea Bridge | fashion, artificial intelligence, food | South Korea | Series A |

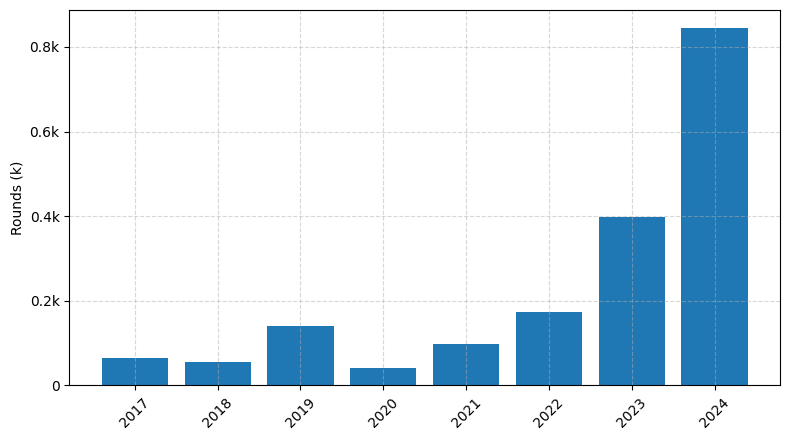

Investments by year: Round

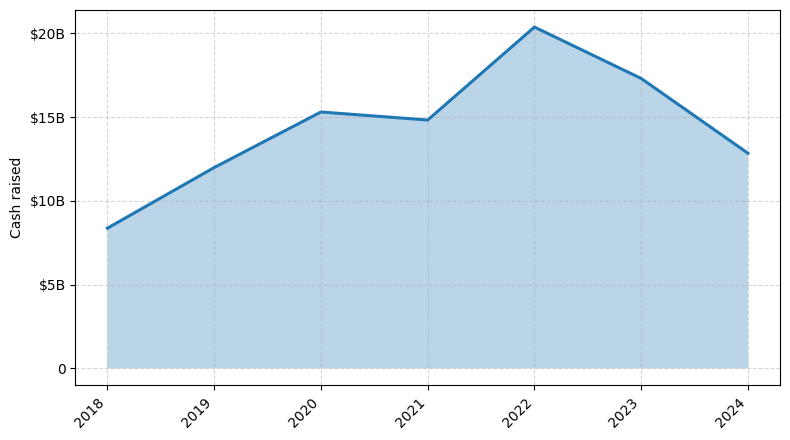

Investments by year: Cash raised

How is fundraising in Luxury different from other VC fundraising

Fundraising in the luxury industry differs from general startup fundraising in several key ways. Luxury brands often have a more exclusive and niche customer base, which can make it challenging to scale rapidly like tech startups. Additionally, luxury products typically have higher price points and lower sales volumes, requiring different financial models and investment strategies. Luxury startups may also face unique regulatory hurdles, such as navigating complex supply chains and ensuring brand authenticity. Investors in the luxury space often prioritize brand heritage, craftsmanship, and exclusivity over pure growth metrics. As a result, luxury fundraising tends to be more relationship-driven, with a focus on finding the right strategic partners who can provide expertise and access to distribution channels.

Top Funded Luxury Startups

Here is a summary of the top-funded Luxury startups globally:

• Farfetch: Approximately $1.5 billion in total funding. Key focus area: Online luxury fashion marketplace.

• Rent the Runway: Approximately $337 million in total funding. Key focus area: Luxury fashion rental service.

• The RealReal: Approximately $288 million in total funding. Key focus area: Online luxury consignment marketplace.

• Vestiaire Collective: Approximately $209 million in total funding. Key focus area: Online luxury resale platform.

• Moda Operandi: Approximately $165 million in total funding. Key focus area: Online luxury fashion pre-order platform.

• Farfetch: Approximately $1.5 billion in total funding. Key focus area: Online luxury fashion marketplace.

• Rent the Runway: Approximately $337 million in total funding. Key focus area: Luxury fashion rental service.

• The RealReal: Approximately $288 million in total funding. Key focus area: Online luxury consignment marketplace.

• Vestiaire Collective: Approximately $209 million in total funding. Key focus area: Online luxury resale platform.

• Moda Operandi: Approximately $165 million in total funding. Key focus area: Online luxury fashion pre-order platform.

What you should include in Luxury pitch deck

A Luxury pitch deck should include the following unique slides:

1. Brand Identity: Showcase the brand's distinctive visual elements, heritage, and core values.

2. Exclusivity and Craftsmanship: Highlight the brand's commitment to quality, attention to detail, and the exclusivity of its products or services.

3. Lifestyle and Aspirational Appeal: Convey the brand's ability to evoke a desirable and aspirational lifestyle.

4. Competitive Advantage: Demonstrate the brand's unique positioning and competitive edge within the luxury market.

5. Growth Potential: Outline the brand's expansion plans and opportunities for future growth and profitability.

1. Brand Identity: Showcase the brand's distinctive visual elements, heritage, and core values.

2. Exclusivity and Craftsmanship: Highlight the brand's commitment to quality, attention to detail, and the exclusivity of its products or services.

3. Lifestyle and Aspirational Appeal: Convey the brand's ability to evoke a desirable and aspirational lifestyle.

4. Competitive Advantage: Demonstrate the brand's unique positioning and competitive edge within the luxury market.

5. Growth Potential: Outline the brand's expansion plans and opportunities for future growth and profitability.

How to Prepare Your Luxury Startup for Investment

Preparing a luxury startup for investment requires a strategic approach to showcase the business's potential and appeal to venture capital (VC) investors. As an advisory, it's crucial to ensure your startup is well-positioned to attract the right investors and secure the necessary funding to drive growth.

When presenting your luxury startup to VC investors, they typically expect the following:

1. Unique Value Proposition: Clearly articulate the distinctive features, quality, and exclusivity of your luxury products or services that set you apart from competitors.

2. Scalable Business Model: Demonstrate a well-thought-out plan for scaling your luxury brand while maintaining its exclusivity and premium positioning.

3. Experienced Management Team: Highlight the expertise, industry knowledge, and track record of your founding team in the luxury market.

4. Robust Market Analysis: Provide a comprehensive understanding of the target market, consumer behavior, and growth potential within the luxury segment.

5. Financial Projections and Milestones: Present detailed financial projections, including revenue, profitability, and key performance indicators, along with a clear roadmap for achieving milestones.

By addressing these key elements in your pitch deck, you can increase the chances of securing investment from VC investors who recognize the potential of your luxury startup.

When presenting your luxury startup to VC investors, they typically expect the following:

1. Unique Value Proposition: Clearly articulate the distinctive features, quality, and exclusivity of your luxury products or services that set you apart from competitors.

2. Scalable Business Model: Demonstrate a well-thought-out plan for scaling your luxury brand while maintaining its exclusivity and premium positioning.

3. Experienced Management Team: Highlight the expertise, industry knowledge, and track record of your founding team in the luxury market.

4. Robust Market Analysis: Provide a comprehensive understanding of the target market, consumer behavior, and growth potential within the luxury segment.

5. Financial Projections and Milestones: Present detailed financial projections, including revenue, profitability, and key performance indicators, along with a clear roadmap for achieving milestones.

By addressing these key elements in your pitch deck, you can increase the chances of securing investment from VC investors who recognize the potential of your luxury startup.