FREE Investor Database

Top Venture Investors in Media/Entertainment Industry

Top Venture Investors in Media/Entertainment Industry

Discover leading VC and CVC investors specializing in Media/Entertainment. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The media and entertainment industry has witnessed a surge of investments in the past three years, reflecting the growing demand for innovative content and immersive experiences. Since 2022, the sector has seen a significant influx of capital, with numerous startups and established players securing funding to drive their growth and expansion.

Over the past three years, the media and entertainment industry has witnessed a staggering number of investments, with hundreds of deals being struck across various segments, including streaming platforms, gaming studios, and content production companies. The total amount invested in this sector during this period has reached well into the billions of dollars, showcasing the strong investor confidence in the industry's potential.

Some of the core startups that have received substantial investments include Canva, a visual communication platform, Roblox, a leading gaming and social platform, and Spotify, the global audio streaming giant. Additionally, several high-profile deals, such as the acquisition of Activision Blizzard by Microsoft for a staggering $68.7 billion, have further highlighted the industry's attractiveness to investors.

In summary, the media and entertainment industry has experienced a remarkable investment boom in the past three years, with a significant influx of capital and a growing number of successful startups and deals, underscoring the sector's resilience and promising future.

Over the past three years, the media and entertainment industry has witnessed a staggering number of investments, with hundreds of deals being struck across various segments, including streaming platforms, gaming studios, and content production companies. The total amount invested in this sector during this period has reached well into the billions of dollars, showcasing the strong investor confidence in the industry's potential.

Some of the core startups that have received substantial investments include Canva, a visual communication platform, Roblox, a leading gaming and social platform, and Spotify, the global audio streaming giant. Additionally, several high-profile deals, such as the acquisition of Activision Blizzard by Microsoft for a staggering $68.7 billion, have further highlighted the industry's attractiveness to investors.

In summary, the media and entertainment industry has experienced a remarkable investment boom in the past three years, with a significant influx of capital and a growing number of successful startups and deals, underscoring the sector's resilience and promising future.

96 active VC investors in Media/Entertainment

In the last three years, the media and entertainment industry has seen a surge of investment from active venture capital firms. Key players include Andreessen Horowitz, which has backed companies like Clubhouse, and Lightspeed Venture Partners, which has invested in Snap and Discord. One of the biggest venture capital rounds in the last two years was Bytedance's $2 billion Series E in 2020, which propelled the TikTok parent company to a valuation of over $100 billion, solidifying its position as a dominant force in the social media and entertainment landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Media/Entertainment | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zhongmi Capital | consumer technology, martech, big data, pan-entertainment, digital marketing, sports | Pre-Seed, Seed, Series A, Series B | |||

| Zeta Alpha | Media/Entertainment | Seed | |||

| Zero-One Capital | Media/Entertainment | ||||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Zentro Founders | media, fintech, marketplaces | ||||

| Zeno Ventures | Media/Entertainment | Generalist | Series A, Series B | ||

| Zen Girişim | Media/Entertainment | ||||

| Zelkova Ventures | Media/Entertainment | Generalist | Seed | USD 15000000 |

82 active CVC investors in Media/Entertainment

Active corporate venture capital firms investing in media and entertainment over the past three years include Disney's Steamboat Ventures, which backed virtual production startup Pixotope, and Sony's Innovation Fund, which invested in AI-powered video editing platform Enlight. NBCUniversal's NBCU Next also made notable investments in immersive media and gaming startups.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Media/Entertainment | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Wormhole Capital | Media/Entertainment | Series A, Seed, Series B, Series C | |||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| TS Ventures Fond | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Seed, Series A, Pre-Seed, Series B | |||

| Telefonica Innovation Ventures | Media/Entertainment | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| SRI Ventures | 3d and virtual environments, advanced manipulation and automation, drug discovery and development, bioinformatics and computational biology, computer vision, communications and networking, robotics, sensors and signal processing, image and video processing, medical and surgical devices, quantum sensing, artificial intelligence and machine learning, gps tracking and precision navigation, speech, language, and audio technologies, satellite systems | Seed | |||

| Slack Fund | voice and video, it and security, productivity, wellness, developer tools | Generalist | Series A, Pre-Seed, Seed | ||

| SIS Ventures | Media/Entertainment | United Kingdom | Series A, Seed |

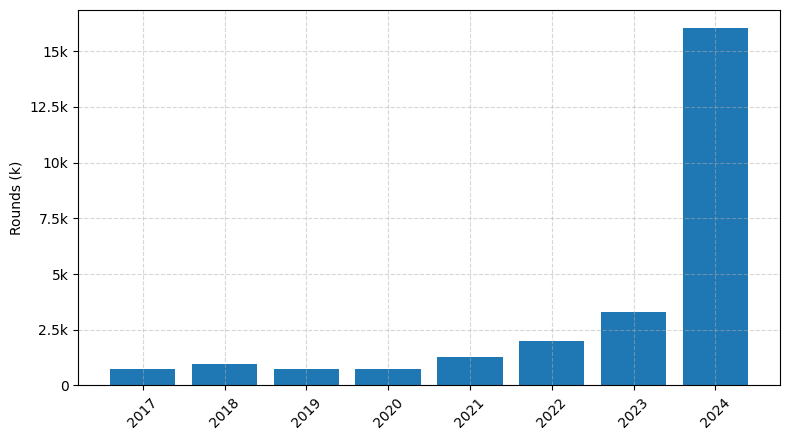

Investments by year: Round

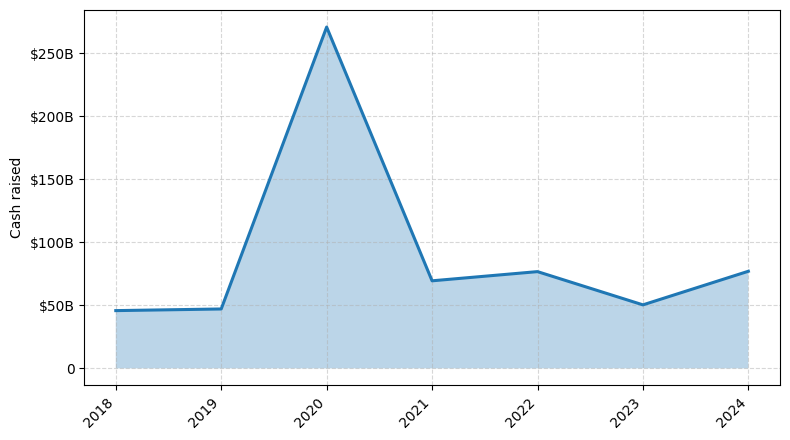

Investments by year: Cash raised

How is fundraising in Media/Entertainment different from other VC fundraising

Fundraising in the media and entertainment industry differs from general startup fundraising in several key ways. Firstly, the success of a media/entertainment venture is often heavily dependent on the creative talent and vision of the team, rather than solely on the business model. Investors in this space must assess the artistic merit and market appeal of the content, in addition to the financial projections.

Additionally, media/entertainment projects typically have a shorter timeline to monetization compared to many tech startups, which can make securing long-term funding more challenging. Lastly, the industry is highly competitive and subject to rapidly changing consumer preferences, requiring investors to have a deep understanding of the market dynamics. These unique challenges necessitate a specialized approach to fundraising in the media and entertainment sector.

Additionally, media/entertainment projects typically have a shorter timeline to monetization compared to many tech startups, which can make securing long-term funding more challenging. Lastly, the industry is highly competitive and subject to rapidly changing consumer preferences, requiring investors to have a deep understanding of the market dynamics. These unique challenges necessitate a specialized approach to fundraising in the media and entertainment sector.

Top Funded Media/Entertainment Startups

1. Netflix: Approximately $15 billion in total funding, focused on streaming video content.

2. Spotify: Approximately $2 billion in total funding, focused on music streaming.

3. Epic Games: Approximately $3.4 billion in total funding, focused on video game development and distribution.

4. Roblox: Approximately $1.5 billion in total funding, focused on user-generated online gaming.

5. ByteDance (TikTok): Approximately $7.7 billion in total funding, focused on short-form video content.

2. Spotify: Approximately $2 billion in total funding, focused on music streaming.

3. Epic Games: Approximately $3.4 billion in total funding, focused on video game development and distribution.

4. Roblox: Approximately $1.5 billion in total funding, focused on user-generated online gaming.

5. ByteDance (TikTok): Approximately $7.7 billion in total funding, focused on short-form video content.

What you should include in Media/Entertainment pitch deck

When creating a pitch deck for a media or entertainment venture, the following unique slides should be included:

1. Industry Overview: Provide an analysis of the current state and trends within the target industry.

2. Target Audience: Clearly define the demographics, preferences, and behaviors of the intended audience.

3. Unique Value Proposition: Highlight the distinctive features, benefits, or innovations that set your offering apart from competitors.

4. Content Strategy: Outline your plan for developing and distributing engaging, high-quality content that resonates with your target audience.

5. Monetization Model: Explain how you intend to generate revenue and achieve financial sustainability.

1. Industry Overview: Provide an analysis of the current state and trends within the target industry.

2. Target Audience: Clearly define the demographics, preferences, and behaviors of the intended audience.

3. Unique Value Proposition: Highlight the distinctive features, benefits, or innovations that set your offering apart from competitors.

4. Content Strategy: Outline your plan for developing and distributing engaging, high-quality content that resonates with your target audience.

5. Monetization Model: Explain how you intend to generate revenue and achieve financial sustainability.

How to Prepare Your Media/Entertainment Startup for Investment

Preparing a Media/Entertainment startup for investment requires a strategic approach to showcase the venture's potential and appeal to venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract investment.

When presenting to VC investors, startups in the Media/Entertainment sector should be prepared to demonstrate the following:

1. Unique Value Proposition: Clearly articulate the startup's distinctive offering and how it addresses a specific market need or gap.

2. Scalable Business Model: Demonstrate a viable and scalable business model that can generate sustainable revenue and growth.

3. Competitive Advantage: Highlight the startup's competitive edge, such as innovative technology, proprietary content, or a strong brand presence.

4. Experienced Team: Showcase the startup's leadership team, highlighting their relevant industry expertise and track record of success.

5. Market Opportunity: Provide a comprehensive analysis of the target market, including market size, growth potential, and the startup's ability to capture a significant market share.

By addressing these key elements in the pitch deck, Media/Entertainment startups can increase their chances of securing investment from VC investors who are seeking promising ventures with the potential for long-term success.

When presenting to VC investors, startups in the Media/Entertainment sector should be prepared to demonstrate the following:

1. Unique Value Proposition: Clearly articulate the startup's distinctive offering and how it addresses a specific market need or gap.

2. Scalable Business Model: Demonstrate a viable and scalable business model that can generate sustainable revenue and growth.

3. Competitive Advantage: Highlight the startup's competitive edge, such as innovative technology, proprietary content, or a strong brand presence.

4. Experienced Team: Showcase the startup's leadership team, highlighting their relevant industry expertise and track record of success.

5. Market Opportunity: Provide a comprehensive analysis of the target market, including market size, growth potential, and the startup's ability to capture a significant market share.

By addressing these key elements in the pitch deck, Media/Entertainment startups can increase their chances of securing investment from VC investors who are seeking promising ventures with the potential for long-term success.