FREE Investor Database

Top Venture Investors in LegalTech Industry

Top Venture Investors in LegalTech Industry

Discover leading VC and CVC investors specializing in LegalTech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

98 active VC investors in LegalTech

In the last three years, the LegalTech industry has seen a surge of investment from active venture capital firms. Key players include Andreessen Horowitz, Bessemer Venture Partners, and Kleiner Perkins, who have recognized the potential for innovation in the legal sector. One notable example is Clio, a legal practice management software provider, which raised a $250 million Series D round led by TCV and JMI Equity in 2021, one of the largest venture capital rounds in the LegalTech space in recent years, highlighting the growing interest and investment in this rapidly evolving industry.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| VentureFriends | proptech, marketplace, fintech, logistics tech, adtech, healthtech, hrtech, food tech, audiotech, consumer tech, govtech, big data, marketing tech, enterprise tech, b2c, b2b | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series A, Seed | USD 112000000 | |

| Velocity Capital Management | content, intellectual property, sports ecosystem, gaming, esports, sports betting, fitness, wellness, media, entertainment | United States | Series C, Series D, Series F, Series E | ||

| Urban Innovation Fund | transportation, energy & sustainability, proptech, the future of work & edtech, business services & fintech, public health & safety, govtech, food systems | Generalist | Seed | USD 121000000 | |

| Underline Ventures | manufacturing, dev tools, cybersecurity, agtech, e-commerce, travel tech, ai, big data, hr tech, legal tech | Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine | Seed | USD 20000000 | |

| Trust Ventures | LegalTech | United States | Seed | USD 200000000 | |

| Trilogy Equity Partners | mobile operators, wireless | Canada, British Columbia; United States, Oregon; United States, Washington; United States, Idaho | Seed | USD 150000000 | |

| Tradeworks.vc | logistics, b2b, orchestration, procurement, ecommerce, manufacturing, duty, tax, compliance, freight forwarding, contract, 4th party, distribution, warehousing, airfreight, ports, intermodal, equipment, trade finance, insurance, shipping, asset operation | Seed, Series A, Series B | |||

| TQ Ventures | LegalTech | United Kingdom; United States; Israel; Poland | Seed, Series A |

11 active CVC investors in LegalTech

Active corporate venture capital (CVC) firms have been investing in LegalTech startups, recognizing the industry's potential. Key players include Deloitte Ventures, which backed legal AI platform Luminance, and Dentons' NextLaw Labs, which invested in contract management solution Evisort. These CVC firms are driving innovation in the legal sector.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| Snowflake | ai, ml, data engineering, governance, security, data visualization, industry solutions, marketplace, data science, data analytics, data visualization, data governance, data security, industry data | Generalist; United States | Series B, Series A, Series C, Series D, Series E, Pre-IPO | ||

| Reinventure | financial services, data, payments, lending/funds, bitcoin/trust, security, ai, identity, middleware, regtech, hr, food, property, healthcare | Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam | Seed | ||

| Opera Tech Ventures | fintech, insurtech, alternative data, cyber, embedded finance, mobility tech, neo banking, open banking, open insurance, payment, proptech, regtech, sustainable finance | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Canada; United States; Antigua and Barbuda; Argentina; The Bahamas; Barbados; Belize; Bolivia; Brazil; Chile; Colombia; Costa Rica; Cuba; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Trinidad and Tobago; Uruguay; Venezuela; Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | Series B, Series A, Series C | ||

| Nasdaq Ventures | market infrastructure, data, analytics, workflow technologies, anti-financial crime, blockchain, digital assets, environmental, social, governance, new marketplaces, emerging technologies, ai, quantum computing, fintech | Seed, Series A, Series B | |||

| Mishcon de Reya | legaltech | Generalist | Seed, Pre-Seed | ||

| Malakoff Humanis | health, insurance | France | Seed, Buyout, Series B, Series C | ||

| HPI Seed | ai, ml & data, business process tech, cyber security, digital platforms, digital health, digital industry, edtech, gov- & legaltech, smart energy | Germany; United States | Series A, Pre-Seed, Series B | ||

| Crowley | digitallyenabled logistics, green supplychain, fleet decarbonization, government services. decarbonize shipping, carbon recapture, alternative fuels | United States | Seed, Series A |

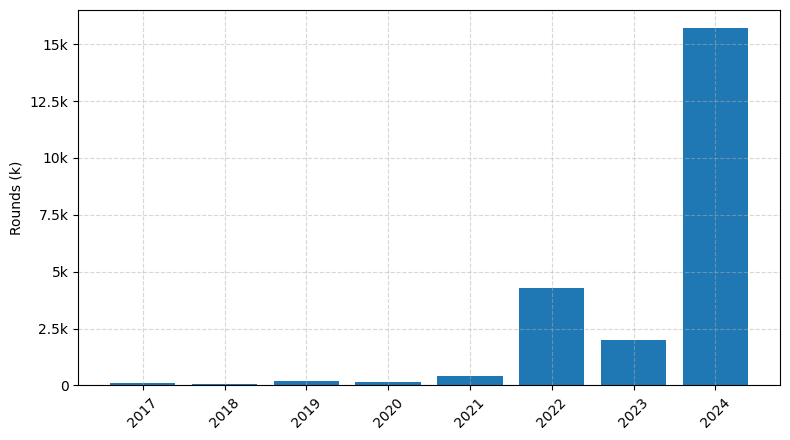

Investments by year: Round

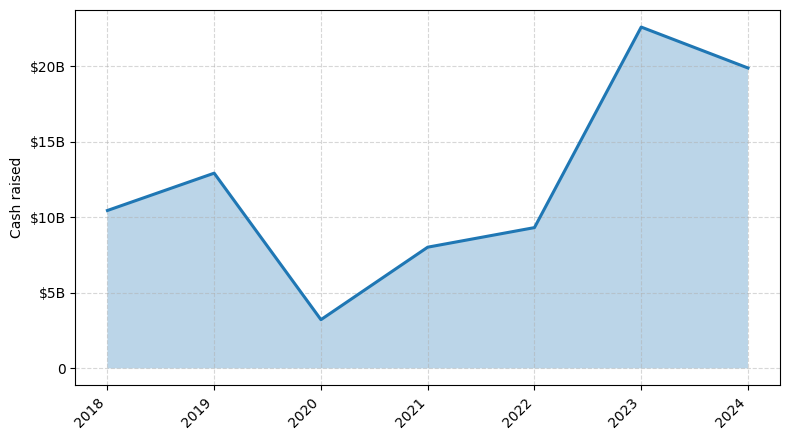

Investments by year: Cash raised

How is fundraising in LegalTech different from other VC fundraising

Fundraising in the LegalTech space differs from general startup fundraising due to the unique challenges faced by this industry. LegalTech startups must navigate the highly regulated legal sector, where conservative decision-making and risk aversion are the norm. Investors often require a deeper understanding of the legal landscape and the potential impact of new technologies on the industry. Additionally, LegalTech startups must demonstrate a clear value proposition that resonates with law firms, corporate legal departments, and other key stakeholders in the legal ecosystem. The sales cycle in LegalTech can be longer and more complex, requiring startups to have a well-defined go-to-market strategy and a strong understanding of the regulatory environment. These factors can make fundraising in the LegalTech space more challenging compared to other startup sectors.

Top Funded LegalTech Startups

1. Clio: Approximately $290 million in funding, focused on cloud-based practice management software for law firms.

2. Relativity: Approximately $250 million in funding, specializing in e-discovery and legal document management solutions.

3. Axiom: Approximately $200 million in funding, providing alternative legal services and talent solutions.

4. Everlaw: Approximately $190 million in funding, offering cloud-based e-discovery and litigation management platform.

5. Onit: Approximately $175 million in funding, focused on enterprise legal management and business process automation.

2. Relativity: Approximately $250 million in funding, specializing in e-discovery and legal document management solutions.

3. Axiom: Approximately $200 million in funding, providing alternative legal services and talent solutions.

4. Everlaw: Approximately $190 million in funding, offering cloud-based e-discovery and litigation management platform.

5. Onit: Approximately $175 million in funding, focused on enterprise legal management and business process automation.

What you should include in pitch deck

How to Prepare Your LegalTech Startup for Investment

Preparing a LegalTech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your LegalTech startup for investment, consider the following:

1. Clearly define the problem your solution solves: Demonstrate a deep understanding of the legal industry's pain points and how your technology-driven solution addresses them effectively.

2. Highlight your unique value proposition: Emphasize the competitive advantages of your product or service, such as innovative features, superior user experience, or cost-effectiveness.

3. Provide evidence of market traction: Present data on user growth, customer retention, and revenue generation to showcase the viability and scalability of your business model.

4. Assemble a strong and experienced team: Investors will assess the expertise, complementary skills, and track record of your founding and management team.

5. Outline a comprehensive go-to-market strategy: Demonstrate a well-thought-out plan for customer acquisition, sales, and marketing to drive sustainable growth.

By addressing these key elements, you can increase the likelihood of securing investment and positioning your LegalTech startup for long-term success.

To prepare your LegalTech startup for investment, consider the following:

1. Clearly define the problem your solution solves: Demonstrate a deep understanding of the legal industry's pain points and how your technology-driven solution addresses them effectively.

2. Highlight your unique value proposition: Emphasize the competitive advantages of your product or service, such as innovative features, superior user experience, or cost-effectiveness.

3. Provide evidence of market traction: Present data on user growth, customer retention, and revenue generation to showcase the viability and scalability of your business model.

4. Assemble a strong and experienced team: Investors will assess the expertise, complementary skills, and track record of your founding and management team.

5. Outline a comprehensive go-to-market strategy: Demonstrate a well-thought-out plan for customer acquisition, sales, and marketing to drive sustainable growth.

By addressing these key elements, you can increase the likelihood of securing investment and positioning your LegalTech startup for long-term success.