FREE Investor Database

Top Venture Investors in Insurtech Industry

Top Venture Investors in Insurtech Industry

Discover leading VC and CVC investors specializing in Insurtech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The Insurtech industry has witnessed a surge in investment activity over the past three years, reflecting the growing demand for innovative solutions in the insurance sector. Since 2022, the Insurtech space has seen a significant influx of capital, with numerous startups attracting substantial funding to drive their technological advancements.

In the last three years, the Insurtech industry has witnessed over 500 investment deals, totaling more than $15 billion in funding. Some of the core startups that have received notable investments include Lemonade, Hippo, and Bright Health, each securing multi-million-dollar funding rounds to expand their offerings and reach.

Several of the most expensive Insurtech deals during this period include Lemonade's $319 million Series D round in 2020 and Bright Health's $500 million Series E round in 2021. Additionally, the acquisition of Metromile by Lemonade for $500 million in 2021 was a particularly interesting deal, showcasing the industry's consolidation and the pursuit of synergies.

The investments in Insurtech over the past three years highlight the sector's growing importance and the industry's continued transformation through the integration of cutting-edge technologies.

In the last three years, the Insurtech industry has witnessed over 500 investment deals, totaling more than $15 billion in funding. Some of the core startups that have received notable investments include Lemonade, Hippo, and Bright Health, each securing multi-million-dollar funding rounds to expand their offerings and reach.

Several of the most expensive Insurtech deals during this period include Lemonade's $319 million Series D round in 2020 and Bright Health's $500 million Series E round in 2021. Additionally, the acquisition of Metromile by Lemonade for $500 million in 2021 was a particularly interesting deal, showcasing the industry's consolidation and the pursuit of synergies.

The investments in Insurtech over the past three years highlight the sector's growing importance and the industry's continued transformation through the integration of cutting-edge technologies.

99 active VC investors in Insurtech

In the last three years, the Insurtech industry has seen a surge of investment from active venture capital firms. Key players in this space include Sequoia Capital, Accel, and Andreessen Horowitz, who have backed innovative startups disrupting the insurance landscape. One notable example is the $200 million Series D round raised by Lemonade, a leading digital insurance provider, in 2020. This funding round, led by SoftBank Vision Fund, underscores the significant interest and confidence in Insurtech's potential to transform the traditional insurance industry through technology-driven solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Yıldız Tekno GSYO | artificial intelligence, ar, vr, financial technologies, robotics, insurance technologies, health technologies | Turkey | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| XYZ Venture Capital | fintech, enterprise, insurance | United States | Series A, Seed, Series B | USD 80000000 | |

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| W ventures Japan | b2b, b2c, energy, industrial, commerce, security, digital health, mobility, finance, it, real estate, construction, business software, fintech, insurtech, manufacturing, industry 4.0, marketing, media, mobility, logistics. | United States; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series B, Series A, Series E, Series D, Seed, Series C | ||

| W Ventures | energy, industrial, commerce, security, digital health, mobility, finance, it, real estate & construction, business software, fintech, insurtech, manufacturing & industry 4.0, marketing, media, mobility & logistics | Japan; United States; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Seed, Series D, Series E, Series C | ||

| World Innovation Lab (WiL) | b2b saas, fintech, insurtech, automation, productivity, cybersecurity, cloud infrastructure, developer tools, health tech, sustainability | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A, Series B, Series C, Series D, Series E | USD 1000000000 | |

| WILCO | agritech & foodtech, cleantech & energy, industry 4.0, proptech & smartcity. biotech & smartpharma, e-health, medtech, customer experience & retailtech, enterprise software, fintech & insurtech, martech & creative business, crs & tech for good | ||||

| White Hibiscus Capital | Insurtech | Israel; Algeria; Cameroon; Comoros;Egypt; Equatorial Guinea; Eritrea; Eswatini; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe | Series A, Series B |

28 active CVC investors in Insurtech

Active corporate venture capital (CVC) firms have been investing heavily in Insurtech over the past three years. Notable players include Allianz X, which backed digital insurance platform Wefox, and Ping An Global Voyager Fund, which invested in AI-powered insurance solutions. These CVC firms are driving innovation in the insurance industry through strategic investments.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Union Tech Ventures | consumer, data, digital health, gaming, insurtech, marketing, mobility, property, retail | Israel | Series A, Series B, Series C, Series D, Series E, Pre-IPO | ||

| Tokio Marine Future Fund | insurtech, fintech, mobility, ai, ml, healthcare, cybersecurity, sustainability, climate risk | United States; United Kingdom; | Seed, Series A | USD 42000000 | |

| State Farm Ventures | aerial data, ai, blockchain, home safety, home services, insurtech, fintech, mobility, safety, real estate tech, senior living, telematics, vr/ar | United States; Singapore | Generalist | ||

| State Auto Labs | distribution, technologies, products, operational solutions, data | United States | Seed, Series C, Series A, Series E, Series B | ||

| Sony Innovation Fund | Insurtech | Generalist | Seed | ||

| SOFTBANK Latin America Ventures | Insurtech | Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Seed | ||

| SIG Asia Investments, LLLP | Insurtech | Bahrain; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; United Arab Emirates; Vietnam | Generalist, Series A, Series B, Series C, Series D, Series E, Pre-IPO | ||

| Opera Tech Ventures | fintech, insurtech, alternative data, cyber, embedded finance, mobility tech, neo banking, open banking, open insurance, payment, proptech, regtech, sustainable finance | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Canada; United States; Antigua and Barbuda; Argentina; The Bahamas; Barbados; Belize; Bolivia; Brazil; Chile; Colombia; Costa Rica; Cuba; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Trinidad and Tobago; Uruguay; Venezuela; Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | Series B, Series A, Series C | ||

| NAB Ventures | Insurtech | Australia; United States | Seed, Series A, Series B |

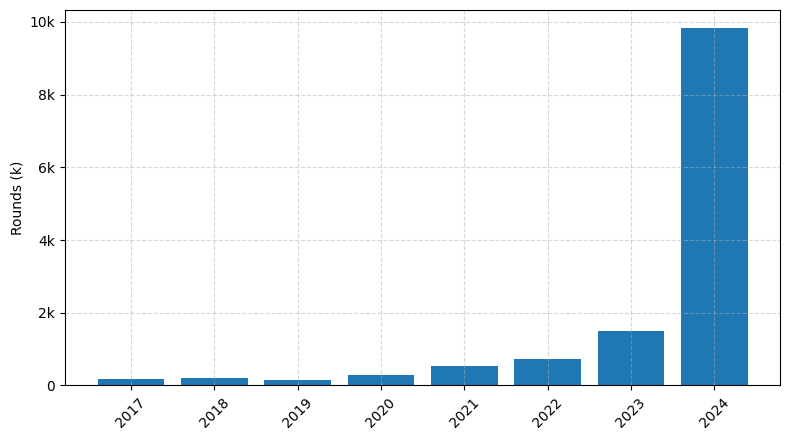

Investments by year: Round

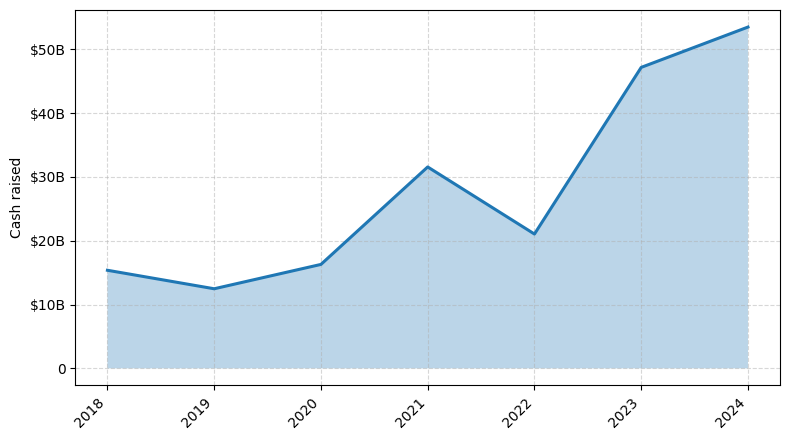

Investments by year: Cash raised

How is fundraising in Insurtech different from other VC fundraising

Fundraising in the Insurtech industry differs from general startup fundraising due to the unique challenges faced by Insurtech companies. Insurtech startups operate in a highly regulated industry, requiring extensive compliance and regulatory approval processes that can significantly impact their fundraising timeline and strategy. Additionally, Insurtech companies often need to demonstrate a deep understanding of the insurance industry, actuarial modeling, and risk management, which can be more complex than the typical tech startup. Investors in the Insurtech space tend to have a higher bar for technical expertise and industry knowledge, making it crucial for Insurtech founders to have a strong team with relevant experience. Furthermore, the long-term nature of insurance products and the need for substantial capital to underwrite risks can also influence the fundraising approach for Insurtech startups.

Top Funded Insurtech Startups

Here is a summary of the top-funded Insurtech startups globally:

1. Lemonade: Approximately $480 million in total funding, focused on home and renters insurance.

2. Bright Health: Approximately $1.5 billion in total funding, focused on health insurance.

3. Oscar Health: Approximately $1.6 billion in total funding, focused on health insurance.

4. Clover Health: Approximately $925 million in total funding, focused on Medicare Advantage plans.

5. Hippo: Approximately $709 million in total funding, focused on home insurance.

1. Lemonade: Approximately $480 million in total funding, focused on home and renters insurance.

2. Bright Health: Approximately $1.5 billion in total funding, focused on health insurance.

3. Oscar Health: Approximately $1.6 billion in total funding, focused on health insurance.

4. Clover Health: Approximately $925 million in total funding, focused on Medicare Advantage plans.

5. Hippo: Approximately $709 million in total funding, focused on home insurance.

What you should include in Insurtech pitch deck

When creating an Insurtech pitch deck, it's essential to include the following unique slides:

1. Industry Overview: Provide a comprehensive analysis of the insurance industry, highlighting the challenges and opportunities that your Insurtech solution addresses.

2. Insurtech Innovation: Showcase the unique features and capabilities of your Insurtech solution, emphasizing how it disrupts traditional insurance practices.

3. Competitive Advantage: Clearly articulate the competitive edge your Insurtech solution offers, such as improved customer experience, enhanced risk management, or increased operational efficiency.

4. Regulatory Compliance: Demonstrate your understanding of the regulatory landscape and how your Insurtech solution complies with relevant insurance laws and regulations.

1. Industry Overview: Provide a comprehensive analysis of the insurance industry, highlighting the challenges and opportunities that your Insurtech solution addresses.

2. Insurtech Innovation: Showcase the unique features and capabilities of your Insurtech solution, emphasizing how it disrupts traditional insurance practices.

3. Competitive Advantage: Clearly articulate the competitive edge your Insurtech solution offers, such as improved customer experience, enhanced risk management, or increased operational efficiency.

4. Regulatory Compliance: Demonstrate your understanding of the regulatory landscape and how your Insurtech solution complies with relevant insurance laws and regulations.

How to Prepare Your Insurtech Startup for Investment

Preparing an Insurtech startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is essential to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare an Insurtech startup for investment, consider the following:

1. Clearly define the problem you are solving and the unique value proposition of your solution.

2. Demonstrate a deep understanding of the insurance industry, including market trends, customer pain points, and regulatory landscape.

3. Provide a comprehensive analysis of your target market, including market size, growth potential, and competitive landscape.

4. Showcase a strong and experienced founding team with relevant expertise in the insurance and technology sectors.

5. Present a well-thought-out business model with a clear path to revenue generation and scalability.

By addressing these key elements, you can increase the likelihood of securing investment from VC investors and positioning your Insurtech startup for long-term success.

To prepare an Insurtech startup for investment, consider the following:

1. Clearly define the problem you are solving and the unique value proposition of your solution.

2. Demonstrate a deep understanding of the insurance industry, including market trends, customer pain points, and regulatory landscape.

3. Provide a comprehensive analysis of your target market, including market size, growth potential, and competitive landscape.

4. Showcase a strong and experienced founding team with relevant expertise in the insurance and technology sectors.

5. Present a well-thought-out business model with a clear path to revenue generation and scalability.

By addressing these key elements, you can increase the likelihood of securing investment from VC investors and positioning your Insurtech startup for long-term success.