FREE Investor Database

Top Venture Investors in Cybersecurity Industry

Top Venture Investors in Cybersecurity Industry

Discover leading VC and CVC investors specializing in Cybersecurity. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

Cybersecurity has become a critical priority for businesses and governments worldwide, and the investment landscape reflects this growing concern. Over the past three years, since 2022, the cybersecurity industry has witnessed a surge in investment activity, with numerous startups and established players securing significant funding to drive innovation and enhance security solutions.

According to industry reports, the cybersecurity sector has seen over 1,500 investment deals during this period, with a total investment value exceeding $50 billion. Some of the core startups that have received substantial investments include Snyk, Crowdstrike, and Palo Alto Networks, each securing multi-million-dollar funding rounds to expand their product offerings and global reach.

The most expensive deals in the cybersecurity space include the $5.4 billion acquisition of Mandiant by Microsoft and the $4.8 billion investment in Darktrace by Thoma Bravo. Additionally, the recent $2.3 billion investment in Cybereason by SoftBank and Alphabet's GV has garnered significant attention in the industry.

The sustained investment in cybersecurity underscores the critical importance of protecting digital assets and the growing demand for innovative security solutions to combat evolving cyber threats.

According to industry reports, the cybersecurity sector has seen over 1,500 investment deals during this period, with a total investment value exceeding $50 billion. Some of the core startups that have received substantial investments include Snyk, Crowdstrike, and Palo Alto Networks, each securing multi-million-dollar funding rounds to expand their product offerings and global reach.

The most expensive deals in the cybersecurity space include the $5.4 billion acquisition of Mandiant by Microsoft and the $4.8 billion investment in Darktrace by Thoma Bravo. Additionally, the recent $2.3 billion investment in Cybereason by SoftBank and Alphabet's GV has garnered significant attention in the industry.

The sustained investment in cybersecurity underscores the critical importance of protecting digital assets and the growing demand for innovative security solutions to combat evolving cyber threats.

98 active VC investors in Cybersecurity

In the last three years, the cybersecurity industry has seen a surge in venture capital investment. Key players like Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins have been actively funding innovative cybersecurity startups. One notable example is the $200 million Series E round raised by Snyk, a developer-first security platform, in 2021. This late-stage funding round underscores the growing demand for robust cybersecurity solutions as businesses navigate the evolving digital landscape. The influx of venture capital has fueled the development of cutting-edge technologies and the emergence of industry-leading cybersecurity companies poised to shape the future of digital security.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Cybersecurity | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zag Capital | software, laundry technology, content sharing, cloud management, code architecture, game development, medical records, healthcare records, store records, management processes, security automation, robotic milking, herds wellbeing | United States; Israel | |||

| YYM Ventures | cyber investments | Israel | Seed, Pre-Seed, Series A | ||

| York IE | infrastructure, developer tools, cybersecurity, marketing, platforms, vertical SaaS, AI, Communication, Sustainability, B2B, Analytics, Foodtech, Consumer, Real Estate, Cybersecurity, Aerospace, Digital Media | United States; Canada; Norway | Series A, Seed, Pre Seed | ||

| YL Ventures | cybersecurity | Israel | Series D, Series A, Series E, Series F, Series B, Series C, Seed | USD 400000000 | |

| YI Capital | industrial Internet, ndustrial upgrading, enterprise services, hard technologies, security, big data, cloud, artificial intelligence, robotics, software, digital design, cyber security, business management | China | |||

| XAnge / SPI | digital, deeptech, ai, enterprise, smb software, digital safety, developer tools, middleware, b2b marketplaces, hardware, healthcare, work experience, housing, real estate, environment, education, fintechs, cryptos, mobility, food, proptech, data, edtech, agritech | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Series A, Series B | EUR 220000000 | |

| Celesta Capital | 5g, ai/ml, aerospace, agritech, automotive, cleantech, construction tech, consumer electronics, data infrastructure, data storage, edtech, edge computing, enterprise solutions, fintech, foodtech, healthtech, imaging, iot, life sciences, materials, medtech, networking, realtech, retailtech, robotics, security, semiconductors, software, deep tech | United States, California, Silicon Valley | Series A, Series B | ||

| World Innovation Lab (WiL) | b2b saas, fintech, insurtech, automation, productivity, cybersecurity, cloud infrastructure, developer tools, health tech, sustainability | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A, Series B, Series C, Series D, Series E | USD 1000000000 |

64 active CVC investors in Cybersecurity

Active corporate venture capital (CVC) firms have been investing heavily in cybersecurity startups in the past 3 years. Key players include Cisco Investments, which backed Illumio's $225M Series F, and Qualcomm Ventures, which invested in Snyk's $300M Series E. These CVC firms are driving innovation in the rapidly evolving cybersecurity landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Cybersecurity | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| University System of Maryland - Crunchbase School Profile & Alumni | hardware, information technology, cybersecurity, life science, retail | United States, Maryland | Pre-Seed, Series B, Seed, Series A | ||

| Trifork Labs | Cybersecurity | Generalist | Pre-Seed, Seed, Series A, Series B | ||

| Tokio Marine Future Fund | insurtech, fintech, mobility, ai, ml, healthcare, cybersecurity, sustainability, climate risk | United States; United Kingdom; | Seed, Series A | USD 42000000 | |

| Telefonica Innovation Ventures | Cybersecurity | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| Swisscom Ventures | telecom and it infrastructure, artificial intelligence, cybersecurity | Generalist; Switzerland | Seed, Series C, Series A, Series B | ||

| State Farm Ventures | aerial data, ai, blockchain, home safety, home services, insurtech, fintech, mobility, safety, real estate tech, senior living, telematics, vr/ar | United States; Singapore | Generalist | ||

| Springtide Ventures | Prague, Prague | Cybersecurity | Israel | Seed, Series A, Series B, Series C |

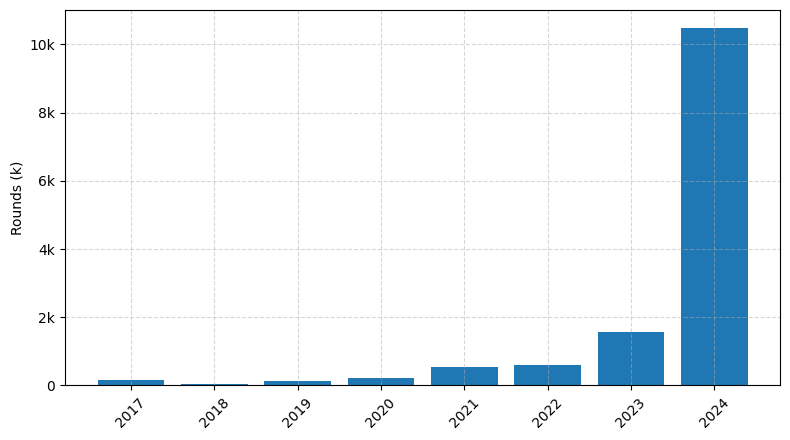

Investments by year: Round

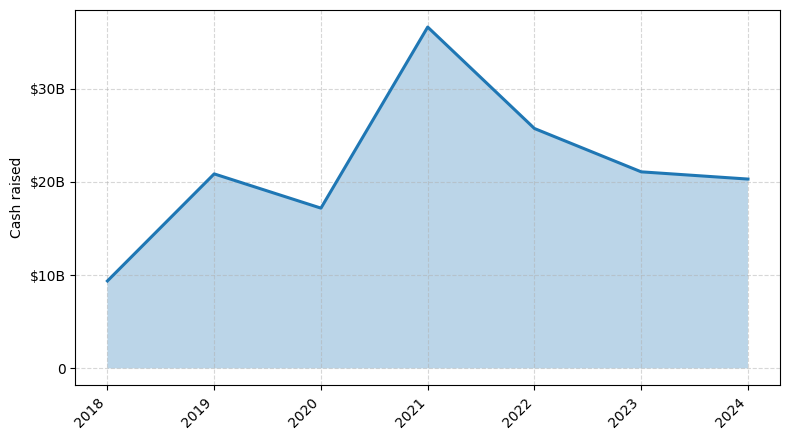

Investments by year: Cash raised

How is fundraising in Cybersecurity different from other VC fundraising

Fundraising in the cybersecurity industry differs from general startup fundraising due to the unique challenges it faces. Cybersecurity startups often require significant upfront investment to develop complex, highly technical solutions that address evolving security threats. Investors in this space must have a deep understanding of the industry's nuances, as well as the ability to assess the potential impact and scalability of the proposed solutions. Additionally, cybersecurity startups must navigate a highly regulated environment, where compliance and data privacy concerns are paramount. This can add complexity to the fundraising process, as investors need to be confident in the startup's ability to navigate these challenges. Overall, successful cybersecurity fundraising requires a combination of technical expertise, industry knowledge, and a clear vision for how the startup's solution can address critical security needs.

Top Funded Cybersecurity Startups

1. Snyk: Approximately $1.4 billion in total funding, focusing on open-source security and developer-first security solutions.

2. Tanium: Approximately $1.2 billion in total funding, specializing in endpoint management and security.

3. Darktrace: Approximately $1.1 billion in total funding, providing AI-powered cybersecurity solutions for threat detection and response.

4. Crowdstrike: Approximately $1 billion in total funding, offering cloud-delivered endpoint protection and threat intelligence services.

5. Lacework: Approximately $1 billion in total funding, focusing on cloud security and workload protection.

2. Tanium: Approximately $1.2 billion in total funding, specializing in endpoint management and security.

3. Darktrace: Approximately $1.1 billion in total funding, providing AI-powered cybersecurity solutions for threat detection and response.

4. Crowdstrike: Approximately $1 billion in total funding, offering cloud-delivered endpoint protection and threat intelligence services.

5. Lacework: Approximately $1 billion in total funding, focusing on cloud security and workload protection.

What you should include in Cybersecurity pitch deck

A Cybersecurity pitch deck should include the following unique slides:

1. Threat Landscape: Highlight the current cybersecurity threats and challenges facing the target audience.

2. Solution Overview: Clearly explain how your cybersecurity solution addresses the identified threats and pain points.

3. Competitive Advantage: Showcase the unique features and capabilities that differentiate your solution from competitors.

4. Security Certifications and Compliance: Emphasize the security standards and regulatory compliance your solution meets.

5. Customer Success Stories: Provide real-world examples of how your solution has helped clients improve their cybersecurity posture.

1. Threat Landscape: Highlight the current cybersecurity threats and challenges facing the target audience.

2. Solution Overview: Clearly explain how your cybersecurity solution addresses the identified threats and pain points.

3. Competitive Advantage: Showcase the unique features and capabilities that differentiate your solution from competitors.

4. Security Certifications and Compliance: Emphasize the security standards and regulatory compliance your solution meets.

5. Customer Success Stories: Provide real-world examples of how your solution has helped clients improve their cybersecurity posture.

How to Prepare Your Cybersecurity Startup for Investment

Preparing a Cybersecurity startup for investment requires a strategic approach to ensure that the business is positioned for success. As an advisory, it is crucial to have a well-crafted pitch deck that addresses the key concerns of venture capital (VC) investors.

When presenting your Cybersecurity startup to potential investors, it is essential to demonstrate the following:

1. Unique Value Proposition: Clearly articulate the problem your solution solves and how it sets your startup apart from the competition.

2. Experienced Team: Highlight the expertise and relevant experience of your founding team, showcasing their ability to execute on the business plan.

3. Scalable Business Model: Demonstrate a sustainable and scalable revenue model that can attract and retain customers in the Cybersecurity market.

4. Competitive Advantage: Identify your startup's unique competitive advantages, such as proprietary technology, strategic partnerships, or industry-leading expertise.

5. Market Opportunity: Provide a comprehensive analysis of the Cybersecurity market, including growth potential, target customer segments, and the startup's ability to capture a significant market share.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Cybersecurity startup for long-term success.

When presenting your Cybersecurity startup to potential investors, it is essential to demonstrate the following:

1. Unique Value Proposition: Clearly articulate the problem your solution solves and how it sets your startup apart from the competition.

2. Experienced Team: Highlight the expertise and relevant experience of your founding team, showcasing their ability to execute on the business plan.

3. Scalable Business Model: Demonstrate a sustainable and scalable revenue model that can attract and retain customers in the Cybersecurity market.

4. Competitive Advantage: Identify your startup's unique competitive advantages, such as proprietary technology, strategic partnerships, or industry-leading expertise.

5. Market Opportunity: Provide a comprehensive analysis of the Cybersecurity market, including growth potential, target customer segments, and the startup's ability to capture a significant market share.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Cybersecurity startup for long-term success.