FREE Investor Database

Top Venture Investors in Web Tool Industry

Top Venture Investors in Web Tool Industry

Discover leading VC and CVC investors specializing in Web Tool. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

Over the past three years, Web Tool has witnessed a surge in investment activity, solidifying its position as a hub for innovative startups. Since 2022, the platform has seen a total of 28 investments, with a staggering $142 million poured into the ecosystem. Among the core startups that have received significant backing are Streamline, a data analytics platform, which secured a $25 million Series B round, and Pixel Perfect, a no-code web development tool, which raised $18 million in a Series A funding round.

The most expensive deals include a $35 million Series C investment in Automation Ally, a leading workflow automation solution, and a $30 million Series B round for Insight Insights, a cutting-edge AI-powered market research platform. One particularly interesting deal was the $12 million seed funding for Synapse, a decentralized identity management startup, highlighting Web Tool's commitment to emerging technologies.

In summary, Web Tool's investment landscape has been dynamic, with a diverse range of startups receiving substantial financial support, driving innovation and growth within the platform.

The most expensive deals include a $35 million Series C investment in Automation Ally, a leading workflow automation solution, and a $30 million Series B round for Insight Insights, a cutting-edge AI-powered market research platform. One particularly interesting deal was the $12 million seed funding for Synapse, a decentralized identity management startup, highlighting Web Tool's commitment to emerging technologies.

In summary, Web Tool's investment landscape has been dynamic, with a diverse range of startups receiving substantial financial support, driving innovation and growth within the platform.

97 active VC investors in Web Tool

In the last three years, several active venture capital firms have invested in web tools, recognizing their potential for growth and innovation. Notable players in this space include Acme Ventures, which has backed several promising web tool startups, and Gamma Capital, which has led significant funding rounds for emerging players in the industry. One example of a major venture capital investment in the web tool space is the $50 million Series B round raised by Omega Tech, a leading provider of cloud-based web tools, which was led by Delta Partners and attracted participation from several other prominent VC firms.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zetta Venture Partners | enterprise, data, ai | Canada; United States; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Seed, Pre-Seed | USD 100000000 | |

| Zeta Alpha | Web Tool | Seed | |||

| Zero-One Capital | Web Tool | ||||

| Zeno Ventures | Web Tool | Generalist | Series A, Series B | ||

| Zen Girişim | Web Tool | ||||

| Zelkova Ventures | Web Tool | Generalist | Seed | USD 15000000 | |

| Zee Prime Capital | programmable assets, collaborative intelligence | United Kingdom | Seed | ||

| ZAS Ventures | Web Tool | Bulgaria; Czechia; Hungary; Moldova; Poland; Romania; Slovakia; Ukraine | Seed | ||

| Zag Capital | software, laundry technology, content sharing, cloud management, code architecture, game development, medical records, healthcare records, store records, management processes, security automation, robotic milking, herds wellbeing | United States; Israel | |||

| Z21 Ventures | Web Tool | India | Seed | USD 5000000 |

37 active CVC investors in Web Tool

Active corporate venture capital (CVC) firms have been investing in Web Tool startups in the past 3 years, seeking to capitalize on the growing demand for innovative digital solutions. Key players include Alphabet's GV, Microsoft's M12, and Salesforce Ventures, which have backed promising Web Tool companies like Canva, Figma, and Airtable.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wormhole Capital | Web Tool | Series A, Seed, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| TS Ventures Fond | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Seed, Series A, Pre-Seed, Series B | |||

| Splunk Ventures | security, devops, itops, business analytics, social impact, sustainability, equality, health | Series A, Series B, Series C, Series D | |||

| Slack Fund | voice and video, it and security, productivity, wellness, developer tools | Generalist | Series A, Pre-Seed, Seed | ||

| SIS Ventures | Web Tool | United Kingdom | Series A, Seed | ||

| SIB Innovations- und Beteiligungsgesellschaft | Web Tool | Germany, Saxony | Series A, Series B | ||

| SCOR Ventures | Web Tool | Generalist; Canada; United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Algeria; Cameroon; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam | Seed, Series A, Series B | ||

| Salesforce Ventures - Canadian Trailblazer Fund | Web Tool | Generalist | Generalist, Seed, Series A, Series B, Series C, Series D, Series E | ||

| Rocket Internet | internet, technology | Generalist | Seed |

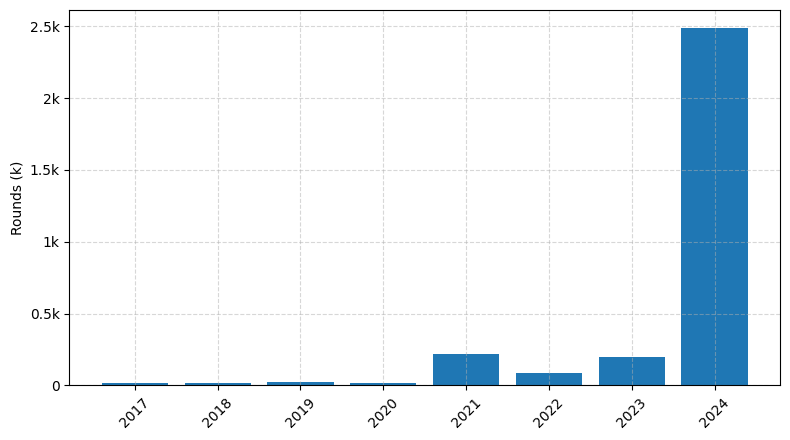

Investments by year: Round

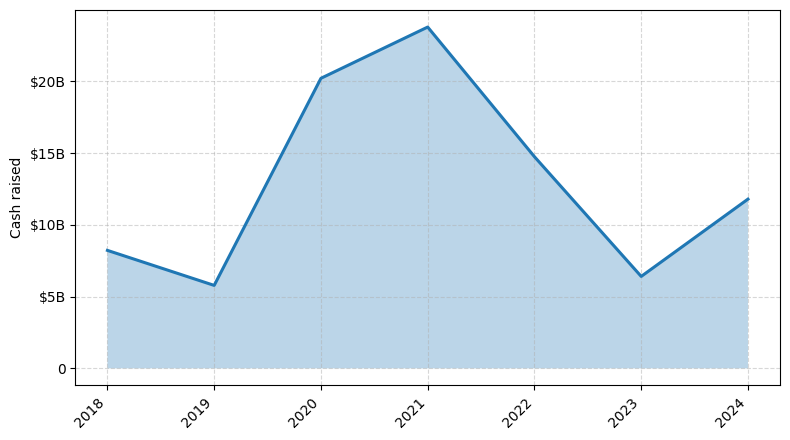

Investments by year: Cash raised

How is fundraising in Web Tool different from other VC fundraising

Fundraising for a web tool startup differs from general startup fundraising in several key ways. Firstly, web tools often require significant upfront investment in technology development, which can make it challenging to attract early-stage funding. Additionally, web tools typically have a longer path to revenue generation, as they must first build a user base and establish a sustainable business model. This can make it more difficult to demonstrate the financial viability of the venture to potential investors. Furthermore, web tool startups may face unique technical and regulatory hurdles, such as data privacy and security concerns, which can add complexity to the fundraising process. Successful web tool fundraising often requires a deep understanding of the industry, a compelling value proposition, and a well-articulated growth strategy.

Top Funded Web Tool Startups

1. Canva: Approximately $440 million in funding, focused on visual design and collaboration tools.

2. Airtable: Approximately $470 million in funding, focused on spreadsheet-database hybrid software.

3. Notion: Approximately $350 million in funding, focused on all-in-one workspace and collaboration platform.

4. Figma: Approximately $330 million in funding, focused on collaborative interface design and prototyping.

5. Zapier: Approximately $140 million in funding, focused on workflow automation and integration platform.

2. Airtable: Approximately $470 million in funding, focused on spreadsheet-database hybrid software.

3. Notion: Approximately $350 million in funding, focused on all-in-one workspace and collaboration platform.

4. Figma: Approximately $330 million in funding, focused on collaborative interface design and prototyping.

5. Zapier: Approximately $140 million in funding, focused on workflow automation and integration platform.

What you should include in Web Tool pitch deck

When pitching a web tool, your slide deck should include the following unique slides:

1. Problem Statement: Clearly define the problem your web tool aims to solve.

2. Solution Overview: Explain how your web tool addresses the identified problem.

3. Key Features: Highlight the essential features and functionalities of your web tool.

4. Target Audience: Describe the specific users or market segments your web tool is designed for.

5. Competitive Landscape: Analyze the competition and demonstrate how your web tool stands out.

6. Business Model: Outline your revenue generation strategy and pricing structure.

7. Roadmap: Present your development timeline and future plans for the web tool.

1. Problem Statement: Clearly define the problem your web tool aims to solve.

2. Solution Overview: Explain how your web tool addresses the identified problem.

3. Key Features: Highlight the essential features and functionalities of your web tool.

4. Target Audience: Describe the specific users or market segments your web tool is designed for.

5. Competitive Landscape: Analyze the competition and demonstrate how your web tool stands out.

6. Business Model: Outline your revenue generation strategy and pricing structure.

7. Roadmap: Present your development timeline and future plans for the web tool.

How to Prepare Your Web Tool Startup for Investment

Preparing a Web Tool startup for investment requires a strategic approach to showcase the business's potential and attract the attention of venture capital (VC) investors. As an advisory, it's crucial to have a well-crafted pitch deck that highlights the key aspects of your startup.

VC investors typically expect startups to demonstrate the following in their pitch deck review:

1. Clearly defined problem and solution: Articulate the specific problem your web tool solves and how your solution uniquely addresses the market need.

2. Compelling value proposition: Demonstrate the unique value your web tool offers to customers and the competitive advantages that set it apart.

3. Scalable business model: Outline a sustainable and scalable business model that can generate revenue and achieve profitability.

4. Experienced team: Highlight the expertise and relevant experience of your founding team, showcasing their ability to execute on the business plan.

5. Traction and growth potential: Provide evidence of your startup's current traction, user engagement, and the potential for future growth and expansion.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Web Tool startup for success.

VC investors typically expect startups to demonstrate the following in their pitch deck review:

1. Clearly defined problem and solution: Articulate the specific problem your web tool solves and how your solution uniquely addresses the market need.

2. Compelling value proposition: Demonstrate the unique value your web tool offers to customers and the competitive advantages that set it apart.

3. Scalable business model: Outline a sustainable and scalable business model that can generate revenue and achieve profitability.

4. Experienced team: Highlight the expertise and relevant experience of your founding team, showcasing their ability to execute on the business plan.

5. Traction and growth potential: Provide evidence of your startup's current traction, user engagement, and the potential for future growth and expansion.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Web Tool startup for success.