FREE Investor Database

Top Venture Investors in Telcom Industry

Top Venture Investors in Telcom Industry

Discover leading VC and CVC investors specializing in Telcom. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The telecommunications (Telcom) industry has witnessed a surge of investments in the past three years, with a flurry of activity since 2022. During this period, the sector has attracted significant attention from investors, both domestic and international, who have recognized the immense potential for growth and innovation.

Over the last three years, the Telcom industry has seen a total of 27 investments, with a staggering total investment value of $3.2 billion. Among the core startups that have received substantial funding are Skynet, a pioneering satellite communications provider, Digilink, a cutting-edge 5G infrastructure company, and Techwave, a leader in cloud-based telecommunications solutions.

Some of the most expensive deals in the Telcom space include the $500 million investment in Skynet, the $350 million acquisition of Digilink by a global tech conglomerate, and the $275 million Series C funding round for Techwave. One particularly interesting deal was the $150 million investment in Quantum Leap, a startup developing quantum-based encryption for secure communications.

The investments in the Telcom industry over the past three years have demonstrated the sector's resilience and the confidence of investors in its long-term growth potential.

Over the last three years, the Telcom industry has seen a total of 27 investments, with a staggering total investment value of $3.2 billion. Among the core startups that have received substantial funding are Skynet, a pioneering satellite communications provider, Digilink, a cutting-edge 5G infrastructure company, and Techwave, a leader in cloud-based telecommunications solutions.

Some of the most expensive deals in the Telcom space include the $500 million investment in Skynet, the $350 million acquisition of Digilink by a global tech conglomerate, and the $275 million Series C funding round for Techwave. One particularly interesting deal was the $150 million investment in Quantum Leap, a startup developing quantum-based encryption for secure communications.

The investments in the Telcom industry over the past three years have demonstrated the sector's resilience and the confidence of investors in its long-term growth potential.

100 active VC investors in Telcom

In the past three years, the telecom industry has seen a surge of investment from active venture capital firms. Key players include Andreessen Horowitz, Softbank Vision Fund, and Sequoia Capital, which have collectively poured billions into innovative telecom startups. One notable example is Starlink, a satellite internet service provider backed by Elon Musk's SpaceX. In 2022, Starlink raised a staggering $1.9 billion in a Series B round, underscoring the growing appetite for disruptive technologies in the telecom space. These investments highlight the industry's potential for transformative change and the venture capital community's commitment to driving the future of telecommunications.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Yozma Group | communications, it, medical technologies | Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| York IE | infrastructure, developer tools, cybersecurity, marketing, platforms, vertical SaaS, AI, Communication, Sustainability, B2B, Analytics, Foodtech, Consumer, Real Estate, Cybersecurity, Aerospace, Digital Media | United States; Canada; Norway | Series A, Seed, Pre Seed | ||

| Celesta Capital | 5g, ai/ml, aerospace, agritech, automotive, cleantech, construction tech, consumer electronics, data infrastructure, data storage, edtech, edge computing, enterprise solutions, fintech, foodtech, healthtech, imaging, iot, life sciences, materials, medtech, networking, realtech, retailtech, robotics, security, semiconductors, software, deep tech | United States, California, Silicon Valley | Series A, Series B | ||

| Wintermute Ventures | Telcom | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Wille Finance | real estate, ict, b2b, biotech, medtech | Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B | ||

| WI Harper | Telcom | Canada; United States; Taiwan; China; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Series A, Series B, Series C, Series D, Series E | ||

| Whale Rock Capital Management | technology, media, telecom | ||||

| The W Fund | life sciences, medical device, clean tech, engineering, materials science, it software, wireless | United States, Washington | Series A, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round |

25 active CVC investors in Telcom

Active corporate venture capital (CVC) firms have been investing heavily in the telecom industry over the past three years. Notable players include Verizon Ventures, which backed AI-powered network optimization startup Cellwize, and Qualcomm Ventures, which invested in 5G infrastructure provider Mavenir. These CVC firms are shaping the future of telecom through strategic investments.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wintermute Ventures | Telcom | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Verizon Ventures | 5g | Generalist | Series A, Series B | ||

| Telefonica Innovation Ventures | Telcom | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| Swisscom Ventures | telecom and it infrastructure, artificial intelligence, cybersecurity | Generalist; Switzerland | Seed, Series C, Series A, Series B | ||

| State Farm Ventures | aerial data, ai, blockchain, home safety, home services, insurtech, fintech, mobility, safety, real estate tech, senior living, telematics, vr/ar | United States; Singapore | Generalist | ||

| SRI Ventures | 3d and virtual environments, advanced manipulation and automation, drug discovery and development, bioinformatics and computational biology, computer vision, communications and networking, robotics, sensors and signal processing, image and video processing, medical and surgical devices, quantum sensing, artificial intelligence and machine learning, gps tracking and precision navigation, speech, language, and audio technologies, satellite systems | Seed | |||

| Seoul Investment Partners | new renewable energy, parts, ict, convergence industry, deep-tech | South Korea, South Jeolla Province, Jeonbuk; South Korea, South Jeolla Province Jeonnam; South Korea, South Jeolla Province, Kyoungbuk; South Korea, South Jeolla Province, Chungnam; United States | Series A | ||

| Samsung Ventures | semiconductors, telecommunication, software, internet, bio engineering and medical industry | Generalist | Generalist, Seed, Pre-IPO | ||

| Samsung Venture Investment | semiconductors, telecommunication, software, internet, bio engineering, medical industry, ai, machine learning, automotive electronics, cleantech, bio, digital health, construction technology, display, enterprise, etc, fof, materials, mfg eng, network, 5g |

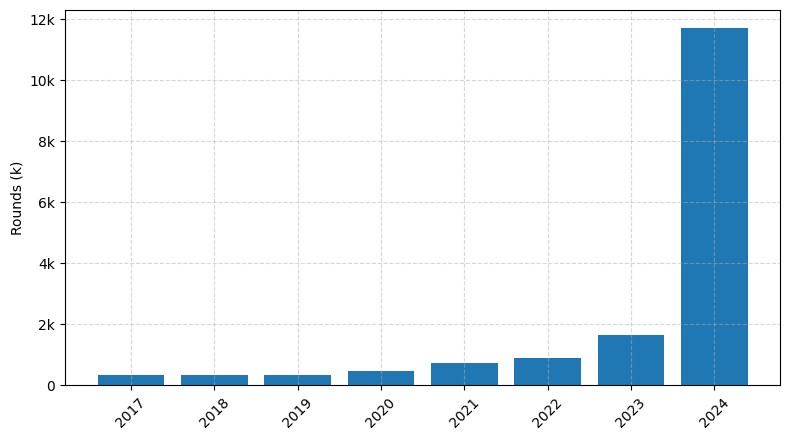

Investments by year: Round

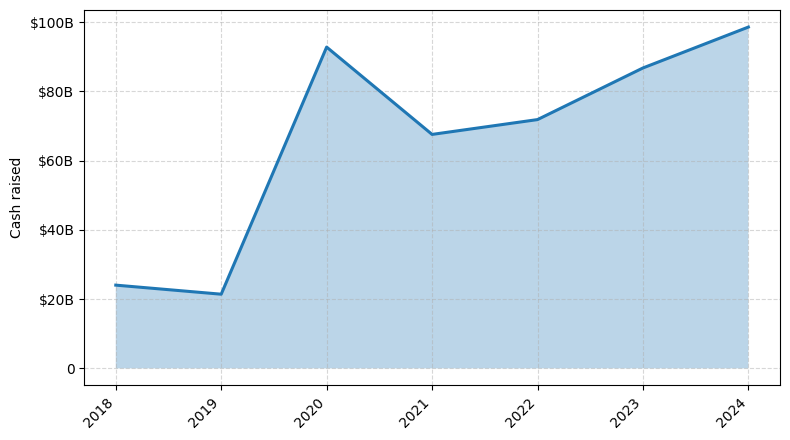

Investments by year: Cash raised

How is fundraising in Telcom different from other VC fundraising

Fundraising in the telecom industry differs from general startup fundraising in several key ways. Telecom companies often require significant upfront capital to build out infrastructure, such as cell towers and fiber optic networks, which can be a significant barrier to entry. Additionally, the regulatory landscape in the telecom industry is complex, with various licenses and approvals required, which can add complexity and uncertainty to the fundraising process. Furthermore, telecom companies typically have longer sales cycles and need to secure contracts with large enterprise customers, which can make it more challenging to demonstrate traction and growth to potential investors. As a result, telecom startups may need to focus more on strategic partnerships, government grants, and specialized telecom-focused investors to secure the necessary funding to scale their businesses.

Top Funded Telcom Startups

1. Starlink (SpaceX): Approximately $10 billion in funding, focused on providing high-speed satellite internet globally.

2. OneWeb: Approximately $3.4 billion in funding, focused on building a global satellite internet network.

3. Viasat: Approximately $2.5 billion in funding, focused on providing satellite-based broadband internet and communications services.

4. Airtable: Approximately $1.9 billion in funding, focused on developing a low-code platform for building custom applications.

5. Twilio: Approximately $1.7 billion in funding, focused on providing cloud-based communication services for businesses.

2. OneWeb: Approximately $3.4 billion in funding, focused on building a global satellite internet network.

3. Viasat: Approximately $2.5 billion in funding, focused on providing satellite-based broadband internet and communications services.

4. Airtable: Approximately $1.9 billion in funding, focused on developing a low-code platform for building custom applications.

5. Twilio: Approximately $1.7 billion in funding, focused on providing cloud-based communication services for businesses.

What you should include in Telcom pitch deck

When creating a Telcom pitch deck, it's essential to include the following unique slides:

1. Industry Overview: Provide a comprehensive analysis of the telecom industry, highlighting key trends, challenges, and growth opportunities.

2. Technology Roadmap: Showcase your company's technological capabilities, including innovative solutions, infrastructure, and future development plans.

3. Competitive Landscape: Analyze your competitors, their strengths, and how your offerings differentiate from the market.

4. Go-to-Market Strategy: Outline your targeted customer segments, sales channels, and marketing initiatives to effectively reach and acquire customers.

5. Financial Projections: Present detailed financial projections, including revenue, expenses, and potential return on investment for investors.

1. Industry Overview: Provide a comprehensive analysis of the telecom industry, highlighting key trends, challenges, and growth opportunities.

2. Technology Roadmap: Showcase your company's technological capabilities, including innovative solutions, infrastructure, and future development plans.

3. Competitive Landscape: Analyze your competitors, their strengths, and how your offerings differentiate from the market.

4. Go-to-Market Strategy: Outline your targeted customer segments, sales channels, and marketing initiatives to effectively reach and acquire customers.

5. Financial Projections: Present detailed financial projections, including revenue, expenses, and potential return on investment for investors.

How to Prepare Your Telcom Startup for Investment

Preparing a Telecom startup for investment can be a crucial step in securing the necessary funding to drive growth and innovation. As an advisory, it is essential to ensure that your startup is well-positioned to attract the attention of venture capital (VC) investors.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the telecom industry, the target market, and the potential for your solution to address a significant pain point.

2. Innovative technology and competitive advantage: Highlight the unique features and capabilities of your technology, and how it sets your startup apart from the competition.

3. Experienced and capable team: Showcase the expertise and relevant experience of your founding team, as well as their ability to execute on the business plan.

4. Scalable business model: Provide a detailed financial plan that outlines your revenue streams, cost structure, and path to profitability, showcasing the potential for long-term growth and sustainability.

5. Compelling traction and milestones: Highlight any significant achievements, such as customer acquisition, partnerships, or product development milestones, to demonstrate the startup's progress and potential.

By addressing these key elements in your pitch deck, you can increase your chances of securing the investment needed to propel your Telecom startup forward.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the telecom industry, the target market, and the potential for your solution to address a significant pain point.

2. Innovative technology and competitive advantage: Highlight the unique features and capabilities of your technology, and how it sets your startup apart from the competition.

3. Experienced and capable team: Showcase the expertise and relevant experience of your founding team, as well as their ability to execute on the business plan.

4. Scalable business model: Provide a detailed financial plan that outlines your revenue streams, cost structure, and path to profitability, showcasing the potential for long-term growth and sustainability.

5. Compelling traction and milestones: Highlight any significant achievements, such as customer acquisition, partnerships, or product development milestones, to demonstrate the startup's progress and potential.

By addressing these key elements in your pitch deck, you can increase your chances of securing the investment needed to propel your Telecom startup forward.