FREE Investor Database

Top Venture Investors in Hardware Industry

Top Venture Investors in Hardware Industry

Discover leading VC and CVC investors specializing in Hardware. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

In the past three years since 2022, the hardware industry has witnessed a surge in investment activity, reflecting the growing demand for innovative technologies and the increasing importance of hardware solutions in various sectors. Over this period, the hardware investment landscape has seen a significant influx of capital, with numerous startups and established players securing substantial funding to drive their growth and development.

According to industry data, the hardware sector has attracted a remarkable number of investments, with over 500 deals completed in the last three years. The total amount of capital invested in these hardware ventures has exceeded $25 billion, showcasing the strong investor confidence in the industry's potential. Some of the core startups that have received notable investments include Neuralink, Nuro, and Rigetti Computing, each of which has secured multi-million-dollar funding rounds to advance their respective technologies.

The hardware investment landscape has also witnessed several high-profile and expensive deals, with companies like Nvidia and Intel leading the charge in acquiring hardware-focused startups to bolster their product portfolios and technological capabilities. One particularly interesting deal was the acquisition of Arm by Nvidia, a $40 billion transaction that has the potential to reshape the semiconductor industry.

In summary, the past three years have been a transformative period for the hardware investment landscape, with a significant influx of capital, a surge in the number of deals, and the emergence of several promising startups and high-profile acquisitions.

According to industry data, the hardware sector has attracted a remarkable number of investments, with over 500 deals completed in the last three years. The total amount of capital invested in these hardware ventures has exceeded $25 billion, showcasing the strong investor confidence in the industry's potential. Some of the core startups that have received notable investments include Neuralink, Nuro, and Rigetti Computing, each of which has secured multi-million-dollar funding rounds to advance their respective technologies.

The hardware investment landscape has also witnessed several high-profile and expensive deals, with companies like Nvidia and Intel leading the charge in acquiring hardware-focused startups to bolster their product portfolios and technological capabilities. One particularly interesting deal was the acquisition of Arm by Nvidia, a $40 billion transaction that has the potential to reshape the semiconductor industry.

In summary, the past three years have been a transformative period for the hardware investment landscape, with a significant influx of capital, a surge in the number of deals, and the emergence of several promising startups and high-profile acquisitions.

98 active VC investors in Hardware

In the past three years, several active venture capital firms have been investing in the hardware sector. Notable players include Andreessen Horowitz, which has backed companies like Rigetti Computing, a quantum computing startup, and Cruise, an autonomous vehicle company. Another key player is Softbank Vision Fund, which led a $2.25 billion Series B round for Cruise in 2019, one of the largest venture capital investments in the hardware space during this period. These investments highlight the continued interest and confidence of venture capitalists in innovative hardware technologies across various industries.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZhenFund | Hardware | United States; Canada; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Australia; New Zealand | Seed, Series A | ||

| Yunqi Partners | Hardware | China; Japan; Singapore; United States; Germany | Seed, Series A, Series B | ||

| Xplorer Capital | artificial intelligence, automation, iot, enterprise saas, data solutions, robotics, autonomous, drones, machine learning, big data,disruptive technology | Canada; United States; Germany | Seed, Series A, Series B | USD 100000000 | |

| Xerox Ventures | Hardware | Seed | |||

| XAnge / SPI | digital, deeptech, ai, enterprise, smb software, digital safety, developer tools, middleware, b2b marketplaces, hardware, healthcare, work experience, housing, real estate, environment, education, fintechs, cryptos, mobility, food, proptech, data, edtech, agritech | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Series A, Series B | EUR 220000000 | |

| Celesta Capital | 5g, ai/ml, aerospace, agritech, automotive, cleantech, construction tech, consumer electronics, data infrastructure, data storage, edtech, edge computing, enterprise solutions, fintech, foodtech, healthtech, imaging, iot, life sciences, materials, medtech, networking, realtech, retailtech, robotics, security, semiconductors, software, deep tech | United States, California, Silicon Valley | Series A, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Walden International | enterprise, consumer, media, semiconductors, ecommerce, hardware, future of work, cloud, telecommunications, manufacturing | Generalist | Series D, Series A, Series E, Series F, Series B, Series C, Seed | ||

| VoLo Earth Ventures | electricity, mobility, buildings, industry | United States | Pre-Seed, Seed, Series A, Series B | USD 90000000 |

30 active CVC investors in Hardware

Active corporate venture capital (CVC) firms have been investing in hardware startups, seeking to drive innovation and gain a competitive edge. Key players include Intel Capital, Qualcomm Ventures, and Samsung Ventures, with investments in areas like robotics, IoT, and advanced manufacturing technologies.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Xerox Ventures | Hardware | Seed | |||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| University System of Maryland - Crunchbase School Profile & Alumni | hardware, information technology, cybersecurity, life science, retail | United States, Maryland | Pre-Seed, Series B, Seed, Series A | ||

| Trimble Ventures | construction, transportation, agriculture, geospatial, technology, hardware, software applications, autonomy, robotics, sustainability, artificial intelligence, blockchain, augmented, mixed reality, iot analytics | Series B, Series A, Series E, Series D, Seed, Series C | USD 200000000 | ||

| Telefonica Innovation Ventures | Hardware | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| Swiss Post Ventures | communication, logistics, financial services, business process outsourcing, mobility markets | Generalist; Switzerland | Seed, Series A, Series B | ||

| State Farm Ventures | aerial data, ai, blockchain, home safety, home services, insurtech, fintech, mobility, safety, real estate tech, senior living, telematics, vr/ar | United States; Singapore | Generalist | ||

| Stanley Ventures | new materials, automation, 3d printing, robotics, recycling, electrification, industrial iot, manufacturing | Generalist | Seed, Series A, Series B | ||

| Sony Innovation Fund | Hardware | Generalist | Seed |

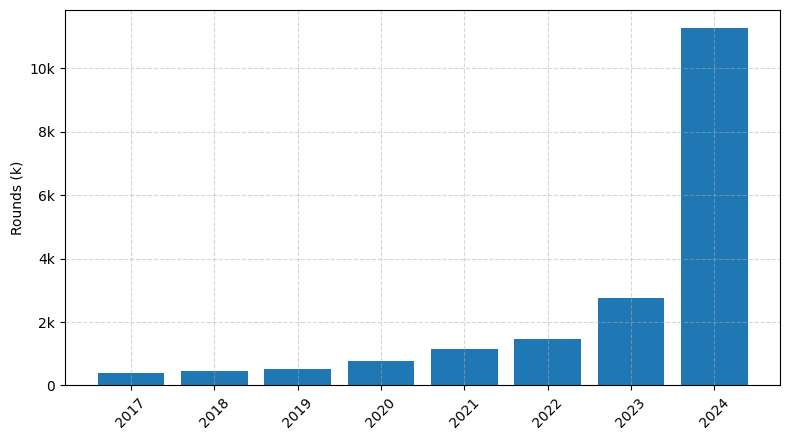

Investments by year: Round

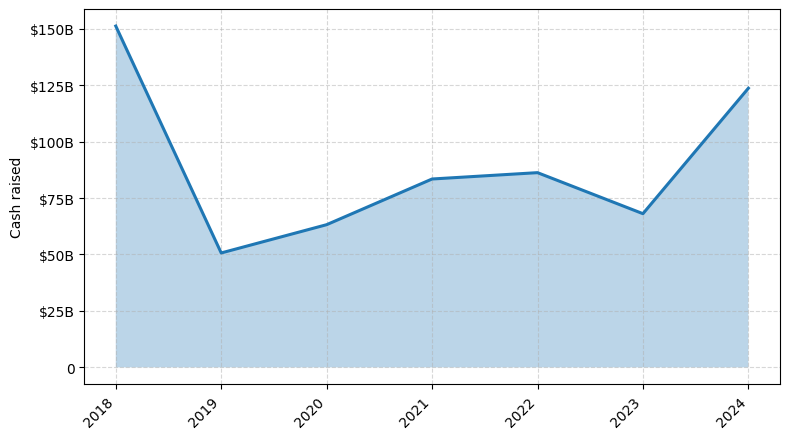

Investments by year: Cash raised

How is fundraising in Hardware different from other VC fundraising

Fundraising for hardware startups differs from general startup fundraising in several key ways. Hardware development requires significant upfront capital for prototyping, manufacturing, and inventory, which can make it more capital-intensive than software-based startups. Additionally, hardware startups often face longer development cycles and higher technical risks, which can make investors more cautious. Hardware startups also need to consider factors like supply chain management, logistics, and regulatory compliance, which add complexity to the fundraising process. As a result, hardware startups may need to seek specialized hardware-focused investors or explore alternative funding sources, such as crowdfunding or government grants, to secure the necessary resources to bring their products to market.

Top Funded Hardware Startups

1. Bytedance (TikTok): Approximately $7.5 billion in funding, focused on consumer electronics and social media platforms.

2. Instacart: Approximately $2.7 billion in funding, focused on grocery delivery and e-commerce.

3. Cruise: Approximately $7.3 billion in funding, focused on autonomous vehicle technology.

4. Nuro: Approximately $1.5 billion in funding, focused on autonomous delivery vehicles.

5. Rivian: Approximately $8 billion in funding, focused on electric vehicles and related technologies.

2. Instacart: Approximately $2.7 billion in funding, focused on grocery delivery and e-commerce.

3. Cruise: Approximately $7.3 billion in funding, focused on autonomous vehicle technology.

4. Nuro: Approximately $1.5 billion in funding, focused on autonomous delivery vehicles.

5. Rivian: Approximately $8 billion in funding, focused on electric vehicles and related technologies.

What you should include in Hardware pitch deck

When pitching a hardware product, your slide deck should include the following unique slides:

1. Product Demonstration: Showcase your hardware in action, highlighting its key features and functionalities.

2. Technical Specifications: Provide detailed information about the hardware's technical specifications, such as dimensions, weight, power requirements, and performance metrics.

3. Manufacturing and Supply Chain: Explain your manufacturing process, supply chain, and scalability plans to ensure reliable and consistent product delivery.

4. Intellectual Property: Highlight any patents, trademarks, or other intellectual property that protect your hardware's unique design or technology.

1. Product Demonstration: Showcase your hardware in action, highlighting its key features and functionalities.

2. Technical Specifications: Provide detailed information about the hardware's technical specifications, such as dimensions, weight, power requirements, and performance metrics.

3. Manufacturing and Supply Chain: Explain your manufacturing process, supply chain, and scalability plans to ensure reliable and consistent product delivery.

4. Intellectual Property: Highlight any patents, trademarks, or other intellectual property that protect your hardware's unique design or technology.

How to Prepare Your Hardware Startup for Investment

Preparing a hardware startup for investment can be a complex process, but it is essential to ensure the success of your venture. As an advisory, we recommend focusing on the following key aspects to make your startup attractive to venture capital (VC) investors.

When pitching to VC investors, they typically expect the startups to demonstrate:

1. A clear and compelling value proposition: Clearly articulate the problem your product solves and the unique benefits it offers to your target market.

2. Robust market analysis: Provide a thorough understanding of the market size, growth potential, and competitive landscape.

3. Innovative and scalable technology: Showcase the technical feasibility, intellectual property, and potential for scalability of your hardware solution.

4. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of your founding team.

5. Solid financial projections: Present a well-researched financial model, including detailed cost structures, revenue streams, and a clear path to profitability.

By addressing these key areas, you can increase your chances of securing investment and positioning your hardware startup for long-term success.

When pitching to VC investors, they typically expect the startups to demonstrate:

1. A clear and compelling value proposition: Clearly articulate the problem your product solves and the unique benefits it offers to your target market.

2. Robust market analysis: Provide a thorough understanding of the market size, growth potential, and competitive landscape.

3. Innovative and scalable technology: Showcase the technical feasibility, intellectual property, and potential for scalability of your hardware solution.

4. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of your founding team.

5. Solid financial projections: Present a well-researched financial model, including detailed cost structures, revenue streams, and a clear path to profitability.

By addressing these key areas, you can increase your chances of securing investment and positioning your hardware startup for long-term success.