FREE Investor Database

Top Venture Investors in Gaming Industry

Top Venture Investors in Gaming Industry

Discover leading VC and CVC investors specializing in Gaming. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The gaming industry has witnessed a surge of investments in the past three years, with the sector emerging as a prime destination for investors seeking high-growth opportunities. Since 2022, the gaming industry has attracted a significant amount of capital, with numerous startups and established players securing substantial funding rounds.

Over the past three years, the gaming industry has seen a remarkable number of investments, with hundreds of deals being struck across the globe. The total amount of money invested in the gaming sector during this period has reached staggering heights, with billions of dollars flowing into the industry.

Among the core startups that have received substantial investments are Roblox, Epic Games, and Unity Technologies, each of which has secured multi-million-dollar funding rounds. Additionally, several high-profile deals, such as Microsoft's acquisition of Activision Blizzard for a whopping $68.7 billion, have further underscored the industry's appeal to investors.

In summary, the gaming industry has experienced a remarkable surge in investments over the past three years, with billions of dollars being poured into the sector and numerous startups and established players securing substantial funding rounds.

Over the past three years, the gaming industry has seen a remarkable number of investments, with hundreds of deals being struck across the globe. The total amount of money invested in the gaming sector during this period has reached staggering heights, with billions of dollars flowing into the industry.

Among the core startups that have received substantial investments are Roblox, Epic Games, and Unity Technologies, each of which has secured multi-million-dollar funding rounds. Additionally, several high-profile deals, such as Microsoft's acquisition of Activision Blizzard for a whopping $68.7 billion, have further underscored the industry's appeal to investors.

In summary, the gaming industry has experienced a remarkable surge in investments over the past three years, with billions of dollars being poured into the sector and numerous startups and established players securing substantial funding rounds.

98 active VC investors in Gaming

In the last three years, the gaming industry has attracted significant attention from active venture capital firms. Key players in this space include Andreessen Horowitz, Makers Fund, and Griffin Gaming Partners. One notable example is Epic Games' $1.78 billion Series H funding round in 2020, which was led by Sony and other investors. This investment underscores the growing interest in the gaming sector, as companies seek to capitalize on the increasing demand for immersive and innovative gaming experiences.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZBS CAPITAL | crypto, web3 | United States; China, Hong Kong; Canada; Australia; Switzerland; Singapore; Saint Kitts and Nevis; Gibraltar; Turkey; South Korea | Pre-Seed, Seed | ||

| Zag Capital | software, laundry technology, content sharing, cloud management, code architecture, game development, medical records, healthcare records, store records, management processes, security automation, robotic milking, herds wellbeing | United States; Israel | |||

| Yolo Investments | gaming, fintech | Generalist | Seed, Series A | EUR 100000000 | |

| Yintai Investment Company | entertainment, sports, technology, feature films, apps, games | Series E, Series D, Series A, Series C, Series B, Seed | |||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| YellowRockets.vc | web 3.0, gaming, future of work, edutech, online marketplaces | Generalist | Seed | ||

| WWVentures | web3, crypto, defi, infrastructure, tooling, gamifi, metaverse | United Kingdom; United States | Series A, Series B | ||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Woori Technology Investment | analytics, gaming, digital art, blockchain | South Korea; Cyprus; Italy; Iceland | Seed, Series A | ||

| Woodstock Fund | web3, convergence, infrastructure, ai, financialisation, defi, virtualisation, gaming, creator economy | Generalist | Series D, Series C, Series E, Series A, Series B | USD 100000000 |

29 active CVC investors in Gaming

Active corporate venture capital (CVC) firms have been investing heavily in the gaming industry over the past three years. Notable players include Tencent, Sony, and Microsoft, who have backed innovative gaming startups like Roblox, Epic Games, and Activision Blizzard. These strategic investments aim to shape the future of interactive entertainment.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wintermute Ventures | Gaming | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Whisk Ventures | web3, esports/gaming, fintech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Union Tech Ventures | consumer, data, digital health, gaming, insurtech, marketing, mobility, property, retail | Israel | Series A, Series B, Series C, Series D, Series E, Pre-IPO | ||

| Singtel Innov8 | big data and al, blockchain, cloud, connectivity, data privacy and security, digital and mobile marketing, enterprise security, fintech, gaming, healthtech, lot, marketplace, network improvements | Australia; Algeria; Cameroon; Comoros;Egypt; Equatorial Guinea; Eritrea; Eswatini; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Seed | ||

| SCCG Venture Fund | sports betting, igaming, sports marketing, affiliate marketing, technology, intellectual property protection, product commercialization, esports, capital formation, casino | United States | Seed | USD 3000000 | |

| SB Opportunity Fund | Gaming | United States | Generalist, Seed | ||

| Sankonline | health-tech, energy, gaming, mobility, foodtech, blockchain, nft based games, drones, logistics | Turkey; United States | Series B, Seed, Series A | ||

| Roosh Ventures | fintech, gaming, enterprise saas, vertical ai | Pre-Seed, Seed, Series A | |||

| RIT Venture Fund I, LLC | medical device, big data, renewable energy, robotics, telecomm, cyber security, game design, fintech, add. mftg., education supplies, martech, αι, cleantech | Seed |

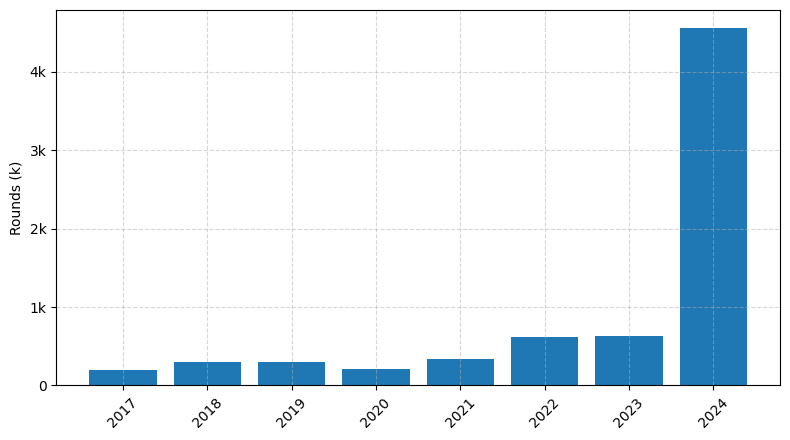

Investments by year: Round

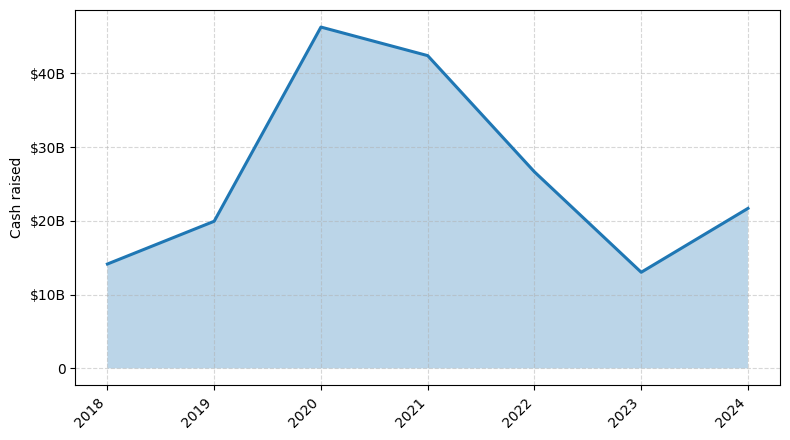

Investments by year: Cash raised

How is fundraising in Gaming different from other VC fundraising

Fundraising in the gaming industry differs from general startup fundraising in several key ways. Firstly, the gaming market is highly competitive and rapidly evolving, requiring gaming startups to have a strong understanding of emerging trends and technologies. Additionally, gaming companies often need significant upfront investment to develop high-quality games, which can be a significant barrier to entry. Furthermore, the success of a gaming startup is heavily dependent on the game's ability to attract and retain a large user base, which can be challenging to predict. As a result, gaming startups may need to demonstrate a proven track record of user engagement and monetization strategies to attract investors. Finally, the gaming industry is subject to unique regulatory and legal considerations, such as content ratings and intellectual property rights, which can also impact the fundraising process.

Top Funded Gaming Startups

Here is a summary of the top-funded Gaming startups globally:

• Epic Games: Approximately $3.4 billion in funding, focused on game development and digital distribution.

• Roblox: Approximately $1.7 billion in funding, focused on user-generated online gaming platform.

• Unity Technologies: Approximately $1.3 billion in funding, focused on game engine and development tools.

• Niantic: Approximately $1 billion in funding, focused on augmented reality gaming.

• Improbable: Approximately $600 million in funding, focused on virtual world simulation technology.

• Epic Games: Approximately $3.4 billion in funding, focused on game development and digital distribution.

• Roblox: Approximately $1.7 billion in funding, focused on user-generated online gaming platform.

• Unity Technologies: Approximately $1.3 billion in funding, focused on game engine and development tools.

• Niantic: Approximately $1 billion in funding, focused on augmented reality gaming.

• Improbable: Approximately $600 million in funding, focused on virtual world simulation technology.

What you should include in Gaming pitch deck

When creating a gaming pitch deck, include the following unique slides:

1. Game Concept: Clearly explain the game's premise, key features, and unique selling points.

2. Target Audience: Identify the target demographic and their preferences, highlighting how your game caters to their needs.

3. Gameplay Mechanics: Provide a detailed overview of the game's core mechanics, showcasing its engaging and innovative gameplay.

4. Monetization Strategy: Outline your plan for generating revenue, such as in-app purchases, subscriptions, or advertising.

5. Competitive Landscape: Analyze the market and your competitors, emphasizing your game's competitive advantages.

1. Game Concept: Clearly explain the game's premise, key features, and unique selling points.

2. Target Audience: Identify the target demographic and their preferences, highlighting how your game caters to their needs.

3. Gameplay Mechanics: Provide a detailed overview of the game's core mechanics, showcasing its engaging and innovative gameplay.

4. Monetization Strategy: Outline your plan for generating revenue, such as in-app purchases, subscriptions, or advertising.

5. Competitive Landscape: Analyze the market and your competitors, emphasizing your game's competitive advantages.

How to Prepare Your Gaming Startup for Investment

Preparing a gaming startup for investment requires a strategic approach to showcase the business's potential and attract the attention of venture capital (VC) investors. Here's a summary of the key steps:

1. Develop a Compelling Pitch Deck: Craft a well-structured pitch deck that highlights your startup's unique value proposition, market opportunity, competitive advantage, and financial projections.

2. Demonstrate Traction and Growth Potential: VC investors typically expect startups to demonstrate tangible traction, such as user growth, revenue, and engagement metrics, to validate the market demand for your product or service.

3. Assemble a Skilled Team: Investors will assess the strength and expertise of your founding team, as well as the broader talent pool within your organization, to ensure the successful execution of your business plan.

4. Articulate a Clear Go-to-Market Strategy: Outline your marketing and distribution strategies, including user acquisition channels, monetization models, and plans for scaling your business.

5. Highlight Competitive Advantages: Identify and emphasize the unique features, technologies, or intellectual property that set your gaming startup apart from the competition and create a sustainable competitive edge.

By addressing these key elements, you can increase your chances of securing investment and positioning your gaming startup for long-term success.

1. Develop a Compelling Pitch Deck: Craft a well-structured pitch deck that highlights your startup's unique value proposition, market opportunity, competitive advantage, and financial projections.

2. Demonstrate Traction and Growth Potential: VC investors typically expect startups to demonstrate tangible traction, such as user growth, revenue, and engagement metrics, to validate the market demand for your product or service.

3. Assemble a Skilled Team: Investors will assess the strength and expertise of your founding team, as well as the broader talent pool within your organization, to ensure the successful execution of your business plan.

4. Articulate a Clear Go-to-Market Strategy: Outline your marketing and distribution strategies, including user acquisition channels, monetization models, and plans for scaling your business.

5. Highlight Competitive Advantages: Identify and emphasize the unique features, technologies, or intellectual property that set your gaming startup apart from the competition and create a sustainable competitive edge.

By addressing these key elements, you can increase your chances of securing investment and positioning your gaming startup for long-term success.