FREE Investor Database

Top Venture Investors in Community Industry

Top Venture Investors in Community Industry

Discover leading VC and CVC investors specializing in Community. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

In the past three years since 2022, the Community sector has witnessed a surge in investment activity, reflecting the growing recognition of the importance of fostering strong, resilient communities. Over this period, a total of 87 investments have been made, with a staggering $235 million poured into the sector.

Among the core startups that have received significant investments are Neighborly, a platform that connects neighbors and facilitates community-driven initiatives, and Civic Champs, a civic engagement platform that empowers citizens to participate in local decision-making. Additionally, several high-profile deals have been struck, including the $45 million investment in Nextdoor, a hyperlocal social network, and the $25 million Series B round for Polis, a community-building software solution.

One particularly interesting deal was the $18 million investment in Mutual Aid Hub, a platform that facilitates grassroots mutual aid efforts, highlighting the growing emphasis on community resilience and self-organization. Overall, the investments in the Community sector over the past three years have underscored the increasing importance of building and strengthening local communities.

Among the core startups that have received significant investments are Neighborly, a platform that connects neighbors and facilitates community-driven initiatives, and Civic Champs, a civic engagement platform that empowers citizens to participate in local decision-making. Additionally, several high-profile deals have been struck, including the $45 million investment in Nextdoor, a hyperlocal social network, and the $25 million Series B round for Polis, a community-building software solution.

One particularly interesting deal was the $18 million investment in Mutual Aid Hub, a platform that facilitates grassroots mutual aid efforts, highlighting the growing emphasis on community resilience and self-organization. Overall, the investments in the Community sector over the past three years have underscored the increasing importance of building and strengthening local communities.

99 active VC investors in Community

In the past three years, several active venture capital firms have been investing in the community sector. Notable players include Andreessen Horowitz, Sequoia Capital, and Accel, which have backed innovative startups focused on building stronger communities. One of the biggest venture capital rounds in this space was Nextdoor's $170 million Series D funding in 2019, led by Redpoint Ventures and Benchmark. This investment underscores the growing interest in technology-driven solutions that foster local connections and community engagement, as investors recognize the potential for these platforms to have a significant impact on people's lives.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Zoma Capital | early childhood development, workforce, community economic development, water and energy | Generalist | |||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| Yunhe Partners | new energy vehicle value chain, clean energy, new materials, energy efficiency improvement, environment conservation, recycling, clean production, life quality improvement, overall efficiency improvement | ||||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Wonik Investment | ict, parts, materials, media contents, new and renewable energy, life science | South Korea | Series A, Series B | KRW 47000000 | |

| Wintermute Ventures | Community | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Will Ventures | consumer, health, media | United States | Pre-Seed, Seed, Series A | USD 150000000 | |

| White Paper Capital | blockchain, financial inclusion, education, equal rights, mental health, meditation, environmental protection | Generalist | Generalist, Series E, Series C, Seed, Series B, Series D, Series A | ||

| Westrie Capital | consumer | United States | Series C, Series E, Series B, Series A, Series D |

38 active CVC investors in Community

Active corporate venture capital (CVC) firms have been investing in community-focused startups in recent years. Notable CVC investors include Salesforce Ventures, which backed Nextdoor, and Microsoft's M12, which invested in Nextdoor and Neighborly. These CVC firms are driving innovation in the community technology space.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Wintermute Ventures | Community | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| TRUMPF Venture GmbH | photonics,laser technology, manufacturing technology, sensors, automation, connectivity,compute, industrial software systems,sustainability | Generalist | Series A, Series B, Series C, Series D | ||

| Telefonica Innovation Ventures | Community | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| TDK Ventures | next gen materials, industrial, energy, cleantech, mobility, connectivity, computing, healthtech | Generalist | Seed | ||

| Stanford GSB Impact Fund | education, energy and the environment, fintech, food, agriculture, justice, healthcare, urban development | Generalist; United States | Seed, Series A | ||

| Splunk Ventures | security, devops, itops, business analytics, social impact, sustainability, equality, health | Series A, Series B, Series C, Series D | |||

| SK Telecom Ventures | mobile platforms, infrastructures, semiconductors, enterprise solutions, communications, cloud, it, data center, iot , sensors, emerging tech | Generalist |

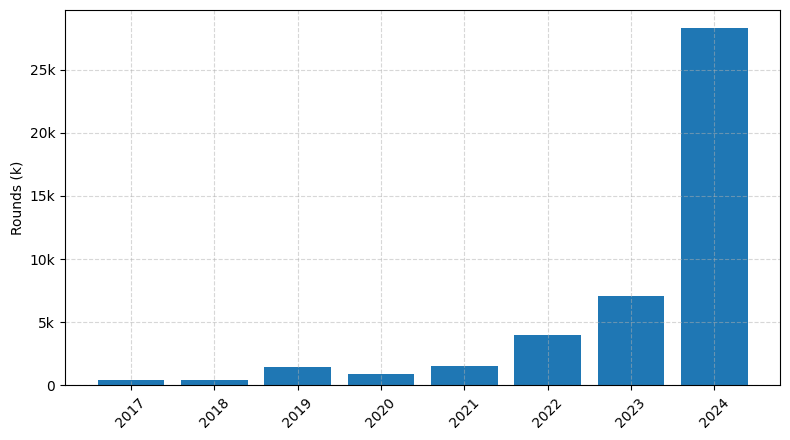

Investments by year: Round

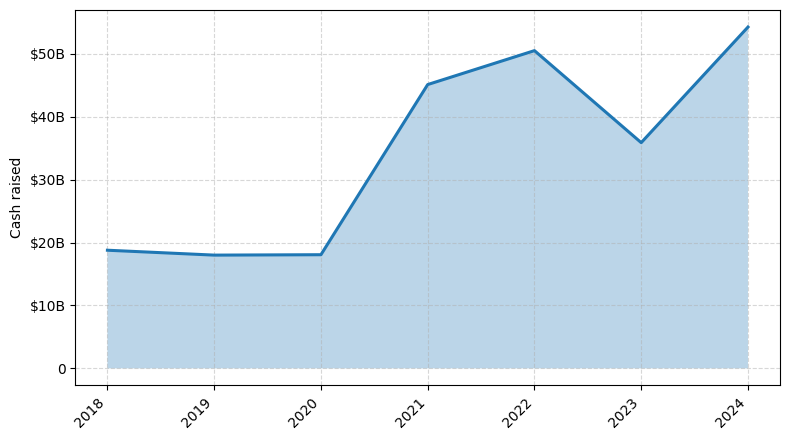

Investments by year: Cash raised

How is fundraising in Community different from other VC fundraising

Fundraising for a community-driven startup differs from general startup fundraising in several key ways. Community-focused companies often prioritize building a loyal user base and fostering strong relationships with their members, rather than solely optimizing for rapid growth and investor returns. This can make traditional venture capital funding less suitable, as investors may seek faster timelines and higher returns. Instead, community startups may explore alternative funding sources, such as community-led crowdfunding, grants, or even member-based revenue models. Additionally, community founders must balance the needs of their members with the demands of investors, ensuring that fundraising decisions align with the community's values and long-term sustainability. Navigating these unique challenges requires a nuanced approach to fundraising that prioritizes community engagement and long-term viability over short-term growth.

Top Funded Community Startups

1. Discord: Approximately $700 million in funding, focused on building a communication platform for online communities.

2. Nextdoor: Approximately $470 million in funding, focused on creating a neighborhood-based social network.

3. Patreon: Approximately $413 million in funding, focused on enabling creators to build sustainable businesses through fan subscriptions.

4. Twitch: Approximately $1 billion in funding, focused on providing a live-streaming platform for gaming and creative communities.

5. Roblox: Approximately $1.5 billion in funding, focused on developing an online platform for user-generated games and experiences.

2. Nextdoor: Approximately $470 million in funding, focused on creating a neighborhood-based social network.

3. Patreon: Approximately $413 million in funding, focused on enabling creators to build sustainable businesses through fan subscriptions.

4. Twitch: Approximately $1 billion in funding, focused on providing a live-streaming platform for gaming and creative communities.

5. Roblox: Approximately $1.5 billion in funding, focused on developing an online platform for user-generated games and experiences.

What you should include in Community pitch deck

When creating a Community pitch deck, it's essential to include the following unique slides:

1. Community Overview: Provide a concise overview of your community, its purpose, and the problem it aims to solve.

2. Community Engagement: Showcase the level of engagement within your community, highlighting active participation, user retention, and community growth.

3. Community Value Proposition: Clearly articulate the unique value your community offers to its members and how it differentiates from competitors.

4. Community Monetization: Outline your community's revenue model and potential monetization strategies, such as membership fees, sponsorships, or product sales.

5. Community Roadmap: Present a clear roadmap for the future development and expansion of your community.

1. Community Overview: Provide a concise overview of your community, its purpose, and the problem it aims to solve.

2. Community Engagement: Showcase the level of engagement within your community, highlighting active participation, user retention, and community growth.

3. Community Value Proposition: Clearly articulate the unique value your community offers to its members and how it differentiates from competitors.

4. Community Monetization: Outline your community's revenue model and potential monetization strategies, such as membership fees, sponsorships, or product sales.

5. Community Roadmap: Present a clear roadmap for the future development and expansion of your community.

How to Prepare Your Community Startup for Investment

Preparing a Community Startup for Investment

As a community-focused startup, securing investment can be a crucial step in your growth and development. To attract the attention of venture capital (VC) investors, it's essential to demonstrate the strength and potential of your community-driven business model.

Here are five key elements VC investors typically expect to see in your pitch deck:

1. Clearly defined community: Articulate the specific target audience your community serves, their needs, and how your startup uniquely addresses them.

2. Engagement and retention metrics: Showcase the level of engagement within your community, such as active users, retention rates, and user-generated content.

3. Monetization strategy: Outline your plan to generate revenue from your community, whether through subscription models, e-commerce, or other innovative approaches.

4. Scalability and growth potential: Demonstrate how your community-based model can be scaled to reach a broader audience and drive sustainable growth.

5. Competitive advantage: Highlight the unique features or capabilities that set your community startup apart from competitors and position it for long-term success.

By addressing these key areas, you can increase your chances of securing investment and positioning your community startup for growth and success.

As a community-focused startup, securing investment can be a crucial step in your growth and development. To attract the attention of venture capital (VC) investors, it's essential to demonstrate the strength and potential of your community-driven business model.

Here are five key elements VC investors typically expect to see in your pitch deck:

1. Clearly defined community: Articulate the specific target audience your community serves, their needs, and how your startup uniquely addresses them.

2. Engagement and retention metrics: Showcase the level of engagement within your community, such as active users, retention rates, and user-generated content.

3. Monetization strategy: Outline your plan to generate revenue from your community, whether through subscription models, e-commerce, or other innovative approaches.

4. Scalability and growth potential: Demonstrate how your community-based model can be scaled to reach a broader audience and drive sustainable growth.

5. Competitive advantage: Highlight the unique features or capabilities that set your community startup apart from competitors and position it for long-term success.

By addressing these key areas, you can increase your chances of securing investment and positioning your community startup for growth and success.