FREE Investor Database

Top Venture Investors in Sports Industry

Top Venture Investors in Sports Industry

Discover leading VC and CVC investors specializing in Sports. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The world of sports has witnessed a surge in investment activity over the past three years, with a growing number of investors recognizing the immense potential of this dynamic industry. Since 2022, the sports sector has attracted significant attention, with numerous deals and funding rounds taking place.

In the last three years, the sports industry has seen a remarkable number of investments, with over 150 deals being made. The total amount of money invested in this sector has reached an impressive $5.2 billion, showcasing the growing interest and confidence in the sports ecosystem.

Some of the core startups that have received substantial investments include Sportradar, a leading provider of sports data and analytics, which secured a $2.1 billion funding round in 2021. Additionally, Fanatics, a leading e-commerce platform for sports merchandise, has raised over $1.5 billion in recent years.

The most expensive deals in the sports investment landscape include the acquisition of the Denver Broncos NFL team for a record-breaking $4.65 billion in 2022, and the $3.2 billion investment in the New York Mets baseball team in 2020.

Investments in the sports industry have become increasingly diverse, with one particularly interesting deal being the $100 million investment in Overtime, a digital media platform focused on high school and amateur sports.

In summary, the sports investment landscape has witnessed a remarkable surge in activity, with significant capital being poured into the industry, showcasing the growing recognition of the sector's immense potential.

In the last three years, the sports industry has seen a remarkable number of investments, with over 150 deals being made. The total amount of money invested in this sector has reached an impressive $5.2 billion, showcasing the growing interest and confidence in the sports ecosystem.

Some of the core startups that have received substantial investments include Sportradar, a leading provider of sports data and analytics, which secured a $2.1 billion funding round in 2021. Additionally, Fanatics, a leading e-commerce platform for sports merchandise, has raised over $1.5 billion in recent years.

The most expensive deals in the sports investment landscape include the acquisition of the Denver Broncos NFL team for a record-breaking $4.65 billion in 2022, and the $3.2 billion investment in the New York Mets baseball team in 2020.

Investments in the sports industry have become increasingly diverse, with one particularly interesting deal being the $100 million investment in Overtime, a digital media platform focused on high school and amateur sports.

In summary, the sports investment landscape has witnessed a remarkable surge in activity, with significant capital being poured into the industry, showcasing the growing recognition of the sector's immense potential.

97 active VC investors in Sports

In the last three years, the sports industry has seen a surge in venture capital investment, with firms recognizing the potential for growth and innovation. Key players in this space include Courtside Ventures, a firm dedicated to sports and esports investments, and Elysian Park Ventures, which has backed several sports-related startups. One notable example is the $200 million Series C round raised by Fanatics, a leading sports merchandise and e-commerce platform, in 2021. This investment highlights the increasing appetite for sports-focused ventures and the significant capital being deployed to drive the industry's transformation.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zhongmi Capital | consumer technology, martech, big data, pan-entertainment, digital marketing, sports | Pre-Seed, Seed, Series A, Series B | |||

| Yintai Investment Company | entertainment, sports, technology, feature films, apps, games | Series E, Series D, Series A, Series C, Series B, Seed | |||

| WP2 Investments | fintech, impact, tech, medtech, sporttech, edutech, green energy | Generalist; Poland; United States; Bahamas; Canada; Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay; Costa Rica; Mexico; Argentina; Brazil; Colombia; Ecuador; Peru; Venezuela; Kenya; Somalia; South Africa; Tanzania; China; India; Indonesia; Japan; Malaysia; Pakistan; Philippines; Singapore; Thailand; United Arab Emirates; Vietnam; Australia; Austria; Belgium; Bulgaria; Croatia; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Italy; Ireland; Lithuania; Latvia; Netherlands; Norway; Romania; Serbia; Slovakia; Slovenia; Spain; Ukraine; United Kingdom | Series A, Seed, Series B, Pre-Seed | ||

| WISE Ventures | sports, media, entertainment, real estate, adjacent industries | Series E, Series D, Series C, Seed | |||

| W inc. | lifestyle, entertainment, sports | Seed, Series A | |||

| Wildcard Ventures | sports tech, sports, health entertainment industry | Generalist | Seed, Pre-Seed, Series A | ||

| Wellstreet | e-commerce, edtech, fintech, greentech, health, martech, media, proptech, regtech, sportstech | Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Seed, Series A, Series B | SEK 175000000 | |

| VGC Partners | media, tech, consumer brands, beverages, food, clothing, beauty + skincare, nutritional supplements, gym + fitness, advertising + marketing, music + audio, video, film + tv, education, social, metaverse + web3, football, pet, travel, femtech, data analytics, sports, mental health, sexual wellness | United Kingdom | Series A, Seed | GBP 10000000 | |

| Verance Capital | sports, media, live entertainment | Norway; United States; United Kingdom | Series C, Series E, Series B, Series A, Series D | ||

| Velocity Capital Management | content, intellectual property, sports ecosystem, gaming, esports, sports betting, fitness, wellness, media, entertainment | United States | Series C, Series D, Series F, Series E |

9 active CVC investors in Sports

Active corporate venture capital firms have been increasingly investing in the sports industry over the past three years. Notable players include Adidas Ventures, which backed sports analytics startup Catapult, and Intel Capital, which invested in virtual sports platform Zwift. These strategic investments showcase the growing convergence of technology and sports.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Sony Innovation Fund | Sports | Generalist | Seed | ||

| Ryan Sports Ventures | sports, properties, media | Seed | |||

| NEOM Investment Fund | biotech, design, construction, education, research, innovation, energy, entertainment, culture, financial services, food, health, wellbeing, manufacturing, media, mobility, sport, technology, digital, tourism, water | ||||

| More Better industries | sports, entertainment | ||||

| Marquee Ventures | Sports | United States; France; Israel | Seed, Series A, Series B | ||

| Man Capital | education, healthcare, logistics, renewable energy, real estate, technology, telecommunications, sport | ||||

| Lake Nona Fund | sports, health, wellness, | Generalist | Series B, Series A, Seed | ||

| AET Fund | entertainment, streaming services, voice assist, the gamification of existing industries, games, music, sports, beauty, fitness | Generalist; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; United States | Seed | ||

| 32 Equity | betting, fitness, apparel, fan engagement, media, streaming, player health, safety, sport, playtoearn | Series C |

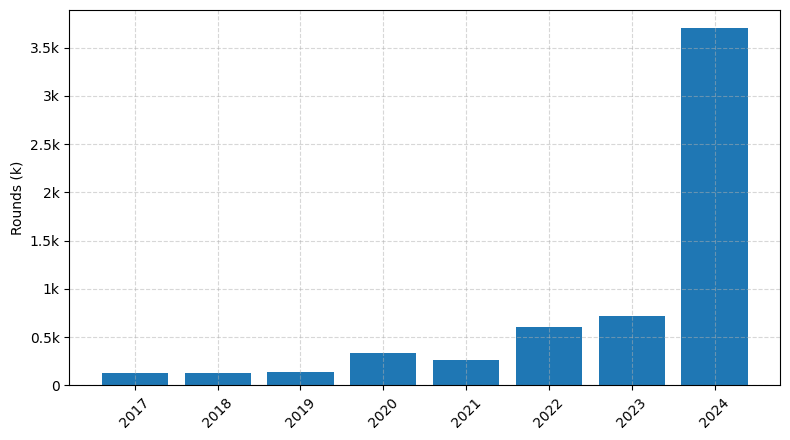

Investments by year: Round

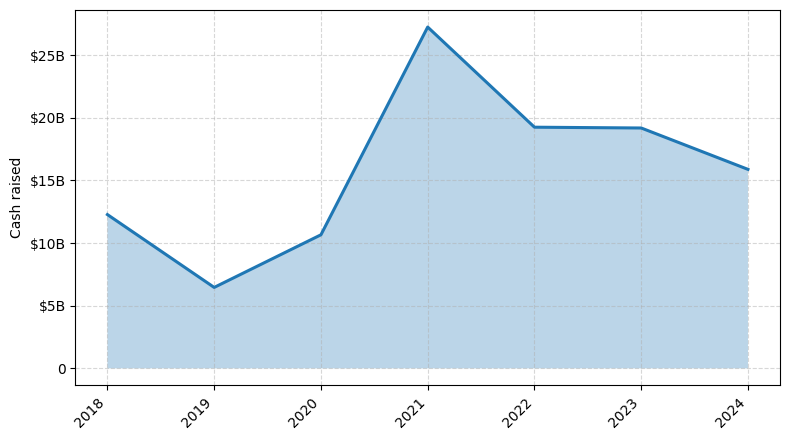

Investments by year: Cash raised

How is fundraising in Sports different from other VC fundraising

Fundraising in the sports industry differs from general startup fundraising in several key ways. Firstly, sports teams and leagues often have a strong emotional connection with their fan base, which can be leveraged to attract investors. However, this emotional appeal must be balanced with a solid business plan and financial projections. Additionally, the sports industry is heavily regulated, with complex rules and regulations surrounding player contracts, media rights, and sponsorship deals. Startups in this space must navigate these challenges and demonstrate a deep understanding of the industry's unique dynamics. Finally, the sports market is highly competitive, with established teams and leagues vying for limited investment dollars. Successful sports startups must differentiate themselves and offer a compelling value proposition to potential investors.

Top Funded Sports Startups

1. Fanatics: Approximately $5.8 billion in total funding, focused on e-commerce and licensed sports merchandise.

2. DraftKings: Approximately $2.1 billion in total funding, focused on online sports betting and fantasy sports.

3. Sportradar: Approximately $1.8 billion in total funding, focused on sports data and analytics.

4. Fanduel: Approximately $1.3 billion in total funding, focused on online sports betting and fantasy sports.

5. Zwift: Approximately $620 million in total funding, focused on interactive fitness and virtual cycling/running platforms.

2. DraftKings: Approximately $2.1 billion in total funding, focused on online sports betting and fantasy sports.

3. Sportradar: Approximately $1.8 billion in total funding, focused on sports data and analytics.

4. Fanduel: Approximately $1.3 billion in total funding, focused on online sports betting and fantasy sports.

5. Zwift: Approximately $620 million in total funding, focused on interactive fitness and virtual cycling/running platforms.

What you should include in Sports pitch deck

When creating a sports pitch deck, it's essential to include the following unique slides:

1. Sports Landscape: Provide an overview of the current state of the sports industry, including market trends, growth opportunities, and key players.

2. Target Audience: Clearly define the target audience for your sports-related product or service, including their demographics, interests, and pain points.

3. Unique Value Proposition: Highlight the unique features or benefits that set your offering apart from the competition in the sports market.

4. Competitive Analysis: Analyze your direct and indirect competitors, their strengths, weaknesses, and how your solution differentiates itself.

5. Go-to-Market Strategy: Outline your plan for effectively reaching and engaging your target audience in the sports industry.

1. Sports Landscape: Provide an overview of the current state of the sports industry, including market trends, growth opportunities, and key players.

2. Target Audience: Clearly define the target audience for your sports-related product or service, including their demographics, interests, and pain points.

3. Unique Value Proposition: Highlight the unique features or benefits that set your offering apart from the competition in the sports market.

4. Competitive Analysis: Analyze your direct and indirect competitors, their strengths, weaknesses, and how your solution differentiates itself.

5. Go-to-Market Strategy: Outline your plan for effectively reaching and engaging your target audience in the sports industry.

How to Prepare Your Sports Startup for Investment

Preparing a sports startup for investment requires a strategic approach to showcase the venture's potential and appeal to venture capital (VC) investors. As an advisory, it is crucial to have a well-crafted pitch deck that effectively communicates the startup's unique value proposition, market opportunity, and growth potential.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the target market, its size, growth potential, and the startup's ability to capture a significant market share.

2. Innovative product or service: Highlight the startup's unique offering and how it addresses the pain points of the target audience, setting it apart from competitors.

3. Experienced and capable team: Showcase the founders' and key team members' relevant expertise, track record, and ability to execute the business plan.

4. Scalable and sustainable business model: Provide a detailed financial plan, including revenue streams, cost structure, and projections for long-term growth and profitability.

5. Compelling traction and milestones: Present evidence of the startup's progress, such as user growth, customer acquisition, strategic partnerships, or any other relevant metrics that demonstrate the venture's momentum and potential.

By addressing these key elements, sports startups can increase their chances of securing investment and positioning themselves for success in the competitive landscape.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the target market, its size, growth potential, and the startup's ability to capture a significant market share.

2. Innovative product or service: Highlight the startup's unique offering and how it addresses the pain points of the target audience, setting it apart from competitors.

3. Experienced and capable team: Showcase the founders' and key team members' relevant expertise, track record, and ability to execute the business plan.

4. Scalable and sustainable business model: Provide a detailed financial plan, including revenue streams, cost structure, and projections for long-term growth and profitability.

5. Compelling traction and milestones: Present evidence of the startup's progress, such as user growth, customer acquisition, strategic partnerships, or any other relevant metrics that demonstrate the venture's momentum and potential.

By addressing these key elements, sports startups can increase their chances of securing investment and positioning themselves for success in the competitive landscape.