FREE Investor Database

Top Venture Investors in Future of Work Industry

Top Venture Investors in Future of Work Industry

Discover leading VC and CVC investors specializing in Future of Work. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The Future of Work has been a rapidly evolving landscape, with significant investments pouring in over the past three years. Since 2022, the industry has witnessed a surge of activity, with numerous startups and established players alike vying for a piece of the pie. According to industry reports, over 500 Future of Work-related investments have been made during this period, totaling a staggering $15 billion in funding.

Some of the core startups that have received substantial investments include Deel, a remote work platform that raised $425 million, and Hopin, a virtual events platform that secured $450 million. Additionally, several high-profile deals have been struck, such as Zoom's acquisition of Five9 for $14.7 billion and Microsoft's purchase of Nuance Communications for $19.7 billion.

One particularly interesting deal was the $200 million investment in Anthropic, an artificial intelligence research company focused on developing safe and ethical AI systems to support the Future of Work.

In summary, the investments in the Future of Work sector have been substantial, reflecting the growing importance of this rapidly evolving landscape.

Some of the core startups that have received substantial investments include Deel, a remote work platform that raised $425 million, and Hopin, a virtual events platform that secured $450 million. Additionally, several high-profile deals have been struck, such as Zoom's acquisition of Five9 for $14.7 billion and Microsoft's purchase of Nuance Communications for $19.7 billion.

One particularly interesting deal was the $200 million investment in Anthropic, an artificial intelligence research company focused on developing safe and ethical AI systems to support the Future of Work.

In summary, the investments in the Future of Work sector have been substantial, reflecting the growing importance of this rapidly evolving landscape.

98 active VC investors in Future of Work

In the last three years, venture capital firms have been actively investing in the Future of Work sector, recognizing the transformative potential of emerging technologies and changing workforce dynamics. Key players in this space include Andreessen Horowitz, Sequoia Capital, and Kleiner Perkins, which have backed innovative startups shaping the future of work. One notable example is Deel, a remote hiring and payroll platform, which raised a $425 million Series D round in 2021, led by the Y Combinator Continuity Fund. This investment highlights the growing demand for flexible, global workforce solutions as the world adapts to the post-pandemic work landscape.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Future of Work | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zoma Capital | early childhood development, workforce, community economic development, water and energy | Generalist | |||

| Zeal Capital Partners | financial technology, future of work & learning, health | Canada; United States | Series A, Seed | USD 62100000 | |

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| Yunqi Partners | Future of Work | China; Japan; Singapore; United States; Germany | Seed, Series A, Series B | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| YellowRockets.vc | web 3.0, gaming, future of work, edutech, online marketplaces | Generalist | Seed | ||

| Yellowdog | climate, environmental, wellness, healthcare, education, workstyle | South Korea; United States | Seed, Series A, Series B | ||

| Xploration Capital | next generation consumer, global talent mobility, quick commerce, digital education, edtech, digital health, passion economy, future of work, purpose driven entrepreneurship | United Kingdom | Series C, Series E, Series D, Series B, Series A |

27 active CVC investors in Future of Work

Active corporate venture capital firms have been investing heavily in the Future of Work space in the past three years. Notable players include Microsoft's M12, which has backed workforce analytics platform Visier, and Salesforce Ventures, which has invested in employee experience platform Qualtrics. These CVC firms are shaping the future of work through strategic investments in innovative startups.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Future of Work | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Workday Ventures | financial management, human capital, planning, analytics, collaboration, productivity, intelligent automation, mixed reality, blockchain | Series D, Series A, Series E, Series F, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| Softline Venture Partners | artificial intelligence, edtech, hrtech, cybersecurity, cloud services, iot, big data | Argentina; Brazil; Chile; Colombia; Ecuador; Guatemala; Honduras; Mexico; Paraguay; Peru; Uruguay; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Pre-Seed, Seed | ||

| SCB 10X | ai/deep tech, blockchain/web3, fintech and ai/ml, future of work and lifestyles | Generalist; China; United States; Israel; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; | Series A, Series B, Seed | ||

| SB Opportunity Fund | Future of Work | United States | Generalist, Seed | ||

| Salesforce Ventures - Canadian Trailblazer Fund | Future of Work | Generalist | Generalist, Seed, Series A, Series B, Series C, Series D, Series E | ||

| Reinventure | financial services, data, payments, lending/funds, bitcoin/trust, security, ai, identity, middleware, regtech, hr, food, property, healthcare | Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam | Seed |

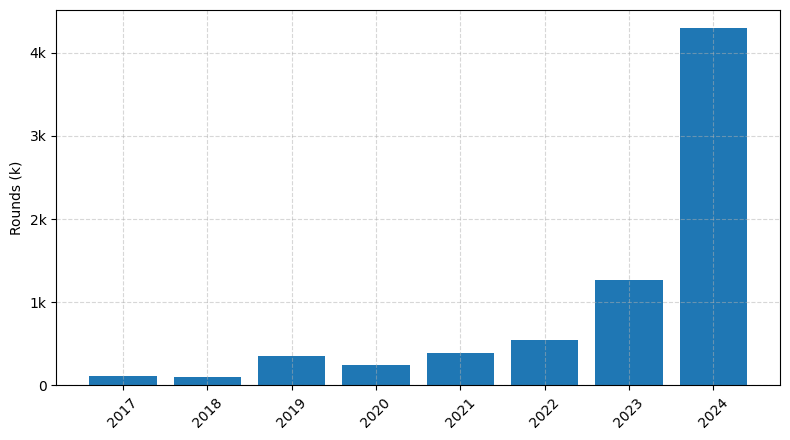

Investments by year: Round

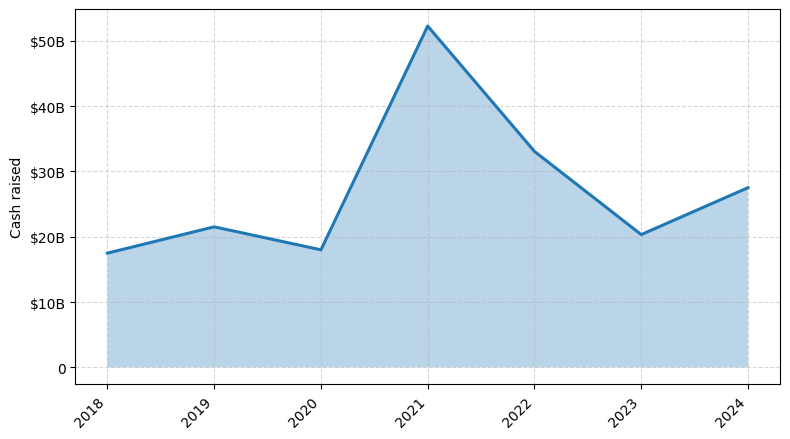

Investments by year: Cash raised

How is fundraising in Future of Work different from other VC fundraising

Fundraising for Future of Work startups differs from general startup fundraising in several key ways. Firstly, the Future of Work space is rapidly evolving, with new technologies and business models emerging constantly. Investors must understand the nuances of this dynamic landscape to make informed decisions. Additionally, Future of Work startups often tackle complex challenges related to workforce management, remote work, and the changing nature of employment, which may require specialized expertise from investors. Furthermore, the impact of these startups on the broader economy and societal well-being adds an extra layer of consideration for investors, who must weigh the potential for positive change alongside the traditional financial metrics. Navigating these unique challenges requires a deep understanding of the Future of Work domain and a willingness to think beyond traditional investment criteria.

Top Funded Future of Work Startups

Here is a summary of the top-funded Future of Work startups:

• Deel: Approximately $630 million in total funding, focused on global payroll and compliance for remote teams.

• Ramp: Approximately $1.1 billion in total funding, focused on corporate cards and expense management.

• Rippling: Approximately $700 million in total funding, focused on all-in-one HR, IT, and finance platform.

• Lattice: Approximately $200 million in total funding, focused on performance management and employee engagement.

• Gloat: Approximately $120 million in total funding, focused on internal talent marketplaces and workforce planning.

• Deel: Approximately $630 million in total funding, focused on global payroll and compliance for remote teams.

• Ramp: Approximately $1.1 billion in total funding, focused on corporate cards and expense management.

• Rippling: Approximately $700 million in total funding, focused on all-in-one HR, IT, and finance platform.

• Lattice: Approximately $200 million in total funding, focused on performance management and employee engagement.

• Gloat: Approximately $120 million in total funding, focused on internal talent marketplaces and workforce planning.

What you should include in Future of Work pitch deck

When creating a Future of Work pitch deck, ensure to include the following unique slides:

1. Trends and Drivers: Highlight the key trends and drivers shaping the future of work, such as automation, remote work, and workforce diversity.

2. Future Workforce Landscape: Outline the anticipated changes in the workforce, including skills in demand, workforce composition, and emerging job roles.

3. Technological Innovations: Showcase the latest technological advancements that will impact the future of work, such as artificial intelligence, augmented reality, and cloud computing.

4. Organizational Transformation: Explain how organizations must adapt their strategies, structures, and cultures to thrive in the evolving work environment.

5. Competitive Advantage: Demonstrate how your solution or offering can provide a competitive edge in the future of work landscape.

1. Trends and Drivers: Highlight the key trends and drivers shaping the future of work, such as automation, remote work, and workforce diversity.

2. Future Workforce Landscape: Outline the anticipated changes in the workforce, including skills in demand, workforce composition, and emerging job roles.

3. Technological Innovations: Showcase the latest technological advancements that will impact the future of work, such as artificial intelligence, augmented reality, and cloud computing.

4. Organizational Transformation: Explain how organizations must adapt their strategies, structures, and cultures to thrive in the evolving work environment.

5. Competitive Advantage: Demonstrate how your solution or offering can provide a competitive edge in the future of work landscape.

How to Prepare Your Future of Work Startup for Investment

Preparing a Future of Work startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is essential to ensure that the startup is well-positioned to attract investment.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined problem and solution: Demonstrate a deep understanding of the challenges faced by the target market and how the startup's solution effectively addresses those pain points.

2. Compelling market opportunity: Provide a comprehensive analysis of the addressable market, growth potential, and the startup's competitive advantage.

3. Experienced and capable team: Highlight the founders' and key team members' relevant expertise, track record, and ability to execute the business plan.

4. Scalable and sustainable business model: Outline a viable revenue generation strategy and a path to profitability that can be scaled effectively.

5. Traction and milestones: Showcase the startup's progress, including key metrics, customer acquisition, and any significant milestones achieved.

By addressing these key elements, the Future of Work startup can increase its chances of securing investment from VC investors and positioning itself for long-term success.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined problem and solution: Demonstrate a deep understanding of the challenges faced by the target market and how the startup's solution effectively addresses those pain points.

2. Compelling market opportunity: Provide a comprehensive analysis of the addressable market, growth potential, and the startup's competitive advantage.

3. Experienced and capable team: Highlight the founders' and key team members' relevant expertise, track record, and ability to execute the business plan.

4. Scalable and sustainable business model: Outline a viable revenue generation strategy and a path to profitability that can be scaled effectively.

5. Traction and milestones: Showcase the startup's progress, including key metrics, customer acquisition, and any significant milestones achieved.

By addressing these key elements, the Future of Work startup can increase its chances of securing investment from VC investors and positioning itself for long-term success.