FREE Investor Database

Top Venture Investors in Wearables Industry

Top Venture Investors in Wearables Industry

Discover leading VC and CVC investors specializing in Wearables. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The wearables industry has seen a surge of investment activity in the past three years, reflecting the growing demand for innovative and personalized technology solutions. Since 2022, the wearables market has witnessed a significant influx of capital, with numerous startups and established players securing substantial funding to drive their product development and market expansion.

Over the past three years, the wearables industry has seen a total of 87 investment deals, with a combined value of $2.3 billion. Some of the core startups that have received notable investments include Oura Health, a leader in smart ring technology, which raised $100 million in a Series C round, and Whoop, a fitness tracking platform, which secured $200 million in a Series F round.

The most expensive deals in the wearables space include Fitbit's acquisition by Google for $2.1 billion and the $400 million Series E funding round raised by Garmin, a renowned manufacturer of GPS-enabled devices. One particularly interesting deal was the $80 million Series B funding secured by Mojo Vision, a company developing augmented reality contact lenses.

The investments in the wearables industry highlight the growing importance of personalized technology solutions that seamlessly integrate with our daily lives, offering enhanced health, fitness, and lifestyle experiences.

Over the past three years, the wearables industry has seen a total of 87 investment deals, with a combined value of $2.3 billion. Some of the core startups that have received notable investments include Oura Health, a leader in smart ring technology, which raised $100 million in a Series C round, and Whoop, a fitness tracking platform, which secured $200 million in a Series F round.

The most expensive deals in the wearables space include Fitbit's acquisition by Google for $2.1 billion and the $400 million Series E funding round raised by Garmin, a renowned manufacturer of GPS-enabled devices. One particularly interesting deal was the $80 million Series B funding secured by Mojo Vision, a company developing augmented reality contact lenses.

The investments in the wearables industry highlight the growing importance of personalized technology solutions that seamlessly integrate with our daily lives, offering enhanced health, fitness, and lifestyle experiences.

99 active VC investors in Wearables

In the last three years, the wearables industry has seen a surge of investment from active venture capital firms. Key players include Kleiner Perkins, which has backed companies like Fitbit, and Sequoia Capital, which has invested in Oura Ring. One of the biggest venture capital rounds in the wearables space was Whoop's $200 million Series E in 2021, led by IVP and SoftBank Vision Fund 2. This funding round underscores the continued investor interest in innovative wearable technologies that can enhance health, fitness, and wellness tracking for consumers.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Yellowdog | climate, environmental, wellness, healthcare, education, workstyle | South Korea; United States | Seed, Series A, Series B | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Willow Growth Partners | health and wellness, beauty, personal care, apparel and accessories, food and beverage, baby and home, commerce | United States | Seed, Series A | USD 28000000 | |

| Willamette Valley Capital | energy, software, robotics, medical, chemistry, apparel, cosmetics | United States | Seed, Series A | USD 605000 | |

| White Paper Capital | blockchain, financial inclusion, education, equal rights, mental health, meditation, environmental protection | Generalist | Generalist, Series E, Series C, Seed, Series B, Series D, Series A |

22 active CVC investors in Wearables

Active corporate venture capital (CVC) firms have been investing in the wearables market, seeking to capitalize on the industry's growth. Notable CVC investors include Samsung Venture Investment, which backed Wearable X, and Intel Capital, which invested in Oura Health's smart ring. These strategic investments highlight the CVC's interest in shaping the future of wearable technology.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| Stanford GSB Impact Fund | education, energy and the environment, fintech, food, agriculture, justice, healthcare, urban development | Generalist; United States | Seed, Series A | ||

| Sony Innovation Fund | Wearables | Generalist | Seed | ||

| Slack Fund | voice and video, it and security, productivity, wellness, developer tools | Generalist | Series A, Pre-Seed, Seed | ||

| SCOR Ventures | Wearables | Generalist; Canada; United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Algeria; Cameroon; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam | Seed, Series A, Series B | ||

| RPG Ventures | software, ayurvedic, cybersecurity, logistics, mental health, elderly care products | Generalist | Seed, Series A, Series B | ||

| Oscar & Paul Beiersdorf Venture Capital | sustainability, life science, biotech, digital solutions and digital health, new business models, beauty tech | South Korea; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Canada; United States | Series A |

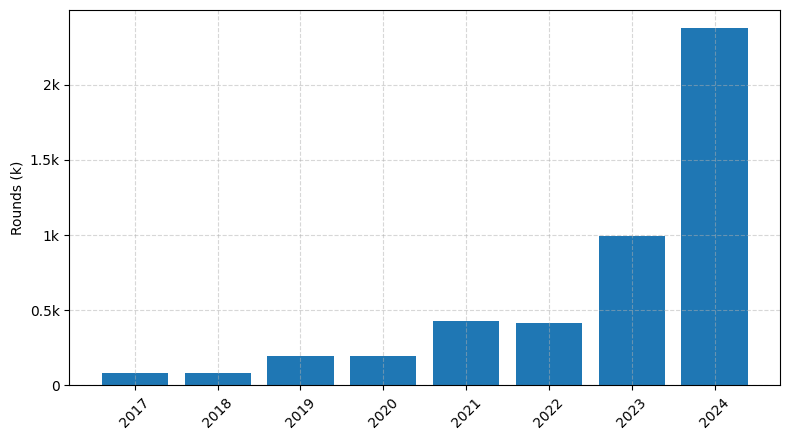

Investments by year: Round

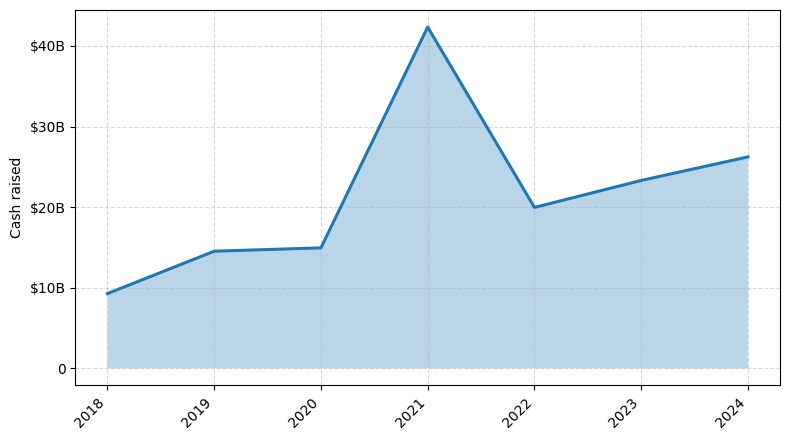

Investments by year: Cash raised

How is fundraising in Wearables different from other VC fundraising

Fundraising for wearable startups differs from general startup fundraising due to the unique challenges posed by the wearables market. Wearable devices require specialized hardware and software development, which can be more capital-intensive compared to software-only startups. Additionally, the wearables market is highly competitive, with established tech giants and smaller players vying for consumer attention. Investors may be more cautious about investing in wearables, as the market is still relatively new and consumer adoption can be unpredictable. Wearable startups must also address concerns about data privacy, security, and regulatory compliance, which can add complexity to their fundraising efforts. As a result, wearable startups may need to demonstrate a clear path to market, a unique value proposition, and a strong team with relevant expertise to secure funding from investors.

Top Funded Wearables Startups

1. Fitbit: Approximately $800 million in total funding, focused on fitness tracking and health monitoring wearables.

2. Garmin: Approximately $3.3 billion in total funding, focused on GPS-enabled smartwatches and fitness trackers.

3. Oura Health: Approximately $300 million in total funding, focused on sleep tracking and wellness monitoring wearables.

4. Whoop: Approximately $400 million in total funding, focused on performance optimization and recovery tracking wearables.

5. Sensoria: Approximately $20 million in total funding, focused on smart clothing and textile-based wearables.

2. Garmin: Approximately $3.3 billion in total funding, focused on GPS-enabled smartwatches and fitness trackers.

3. Oura Health: Approximately $300 million in total funding, focused on sleep tracking and wellness monitoring wearables.

4. Whoop: Approximately $400 million in total funding, focused on performance optimization and recovery tracking wearables.

5. Sensoria: Approximately $20 million in total funding, focused on smart clothing and textile-based wearables.

What you should include in Wearables pitch deck

When pitching a wearables product, your pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the problem your wearable device solves and the target market's pain points.

2. Product Overview: Provide a detailed description of your wearable device, its features, and how it addresses the identified problem.

3. Market Opportunity: Demonstrate the size and growth potential of the wearables market, highlighting your target segment.

4. Competitive Landscape: Analyze your competitors and differentiate your wearable device from existing solutions.

5. Technical Specifications: Outline the technical details, including the hardware, software, and any unique technological innovations.

1. Problem Statement: Clearly define the problem your wearable device solves and the target market's pain points.

2. Product Overview: Provide a detailed description of your wearable device, its features, and how it addresses the identified problem.

3. Market Opportunity: Demonstrate the size and growth potential of the wearables market, highlighting your target segment.

4. Competitive Landscape: Analyze your competitors and differentiate your wearable device from existing solutions.

5. Technical Specifications: Outline the technical details, including the hardware, software, and any unique technological innovations.

How to Prepare Your Wearables Startup for Investment

Preparing a Wearables startup for investment requires a strategic approach to ensure that the business is investor-ready. As an advisory, it is crucial to address the key aspects that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your Wearables startup for investment, consider the following:

1. Clearly define your value proposition: Demonstrate how your wearable technology solves a specific problem and provides a unique solution that sets it apart from competitors.

2. Showcase your market opportunity: Provide a comprehensive analysis of the target market, including market size, growth potential, and the addressable customer base.

3. Highlight your team's expertise: Emphasize the experience, skills, and track record of your founding team and key personnel, showcasing their ability to execute on the business plan.

4. Articulate your go-to-market strategy: Outline your plan for product development, manufacturing, distribution, and customer acquisition, highlighting the scalability and sustainability of your business model.

5. Demonstrate traction and milestones: Present tangible evidence of your startup's progress, such as user growth, revenue generation, strategic partnerships, or any other relevant metrics that validate the viability of your business.

By addressing these key elements, you can increase the likelihood of securing investment for your Wearables startup and positioning it for long-term success.

To prepare your Wearables startup for investment, consider the following:

1. Clearly define your value proposition: Demonstrate how your wearable technology solves a specific problem and provides a unique solution that sets it apart from competitors.

2. Showcase your market opportunity: Provide a comprehensive analysis of the target market, including market size, growth potential, and the addressable customer base.

3. Highlight your team's expertise: Emphasize the experience, skills, and track record of your founding team and key personnel, showcasing their ability to execute on the business plan.

4. Articulate your go-to-market strategy: Outline your plan for product development, manufacturing, distribution, and customer acquisition, highlighting the scalability and sustainability of your business model.

5. Demonstrate traction and milestones: Present tangible evidence of your startup's progress, such as user growth, revenue generation, strategic partnerships, or any other relevant metrics that validate the viability of your business.

By addressing these key elements, you can increase the likelihood of securing investment for your Wearables startup and positioning it for long-term success.