FREE Investor Database

Top Venture Investors in Mental Health Industry

Top Venture Investors in Mental Health Industry

Discover leading VC and CVC investors specializing in Mental Health. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

In the past three years, the mental health sector has witnessed a surge in investment activity, reflecting the growing recognition of the importance of mental well-being. Since 2022, the industry has seen a significant influx of capital, with numerous startups and established players receiving substantial funding to drive innovation and improve access to mental health services.

Over the past three years, the mental health investment landscape has been dynamic, with over 150 deals recorded. The total amount invested during this period has exceeded $2.5 billion, showcasing the strong investor appetite for solutions that address the growing demand for mental health support.

Notable startups that have received significant investments include Calm, a leading meditation and mindfulness app, which secured $75 million in funding, and Ginger, a virtual mental health platform, which raised $100 million. Additionally, several high-profile deals, such as the $250 million investment in Talkspace, a teletherapy provider, and the $200 million raised by Headspace, a meditation and mindfulness app, have further highlighted the industry's potential.

In summary, the mental health investment landscape has been thriving, with substantial capital flowing into the sector and a focus on developing innovative solutions to address the pressing need for accessible and effective mental health care.

Over the past three years, the mental health investment landscape has been dynamic, with over 150 deals recorded. The total amount invested during this period has exceeded $2.5 billion, showcasing the strong investor appetite for solutions that address the growing demand for mental health support.

Notable startups that have received significant investments include Calm, a leading meditation and mindfulness app, which secured $75 million in funding, and Ginger, a virtual mental health platform, which raised $100 million. Additionally, several high-profile deals, such as the $250 million investment in Talkspace, a teletherapy provider, and the $200 million raised by Headspace, a meditation and mindfulness app, have further highlighted the industry's potential.

In summary, the mental health investment landscape has been thriving, with substantial capital flowing into the sector and a focus on developing innovative solutions to address the pressing need for accessible and effective mental health care.

99 active VC investors in Mental Health

In the last three years, the mental health sector has seen a surge in venture capital investment, with several firms recognizing the growing need for innovative solutions. Key players include Optum Ventures, which has backed companies like Ginger and Mindstrong Health, and Andreessen Horowitz, which has invested in Calm and Lyra Health. One of the biggest venture capital rounds in the last two years was Calm's $75 million Series C in 2020, led by Lightspeed Venture Partners, reflecting the increasing investor interest in mental health technologies and services.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Yellowdog | climate, environmental, wellness, healthcare, education, workstyle | South Korea; United States | Seed, Series A, Series B | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| WorkLife Ventures | creators tools, designers tools, moneymakers tools, scientists tools, teams tools | Generalist | Generalist, Series A, Series B | USD 35000000 | |

| Willow Growth Partners | health and wellness, beauty, personal care, apparel and accessories, food and beverage, baby and home, commerce | United States | Seed, Series A | USD 28000000 | |

| Willamette Valley Capital | energy, software, robotics, medical, chemistry, apparel, cosmetics | United States | Seed, Series A | USD 605000 | |

| White Paper Capital | blockchain, financial inclusion, education, equal rights, mental health, meditation, environmental protection | Generalist | Generalist, Series E, Series C, Seed, Series B, Series D, Series A |

22 active CVC investors in Mental Health

Active corporate venture capital firms have been increasingly investing in mental health startups in the past three years. Notable players include Johnson & Johnson Innovation, Bayer G4A, and Novartis Venture Fund, which have backed innovative solutions for digital therapeutics, teletherapy, and mental wellness platforms.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zubi Capital | quality employment, education, demographic challenge, health, poverty, gender equality, climate change, water, biodiversity, sustainable infrastructures, sexual wellbeing, bioscience, robotics, AI | Spain | Seed, Series A | ||

| Yamaha Motor Ventures & Laboratory Silicon Valley | transportation, robotics, digital health, wellness, fintech, insurtech, data, ai, agriculture, carbon management, removal, energy, advanced materials | France; United States; Canada | Seed | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| Stanford GSB Impact Fund | education, energy and the environment, fintech, food, agriculture, justice, healthcare, urban development | Generalist; United States | Seed, Series A | ||

| Sony Innovation Fund | Mental Health | Generalist | Seed | ||

| Slack Fund | voice and video, it and security, productivity, wellness, developer tools | Generalist | Series A, Pre-Seed, Seed | ||

| SCOR Ventures | Mental Health | Generalist; Canada; United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Algeria; Cameroon; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam | Seed, Series A, Series B | ||

| RPG Ventures | software, ayurvedic, cybersecurity, logistics, mental health, elderly care products | Generalist | Seed, Series A, Series B | ||

| Oscar & Paul Beiersdorf Venture Capital | sustainability, life science, biotech, digital solutions and digital health, new business models, beauty tech | South Korea; Israel; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; Canada; United States | Series A |

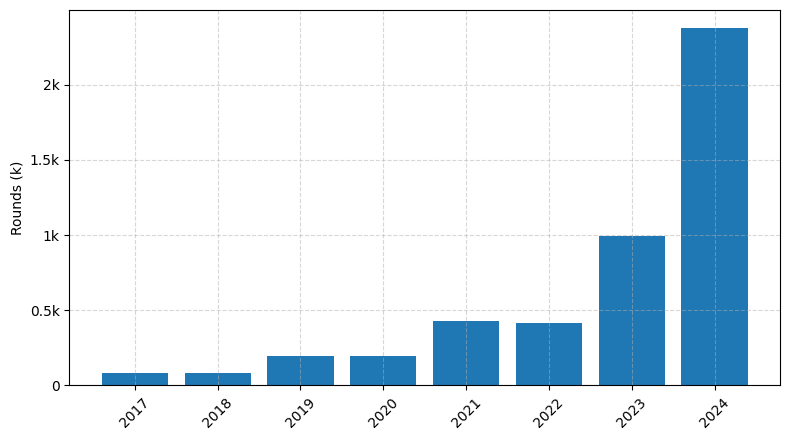

Investments by year: Round

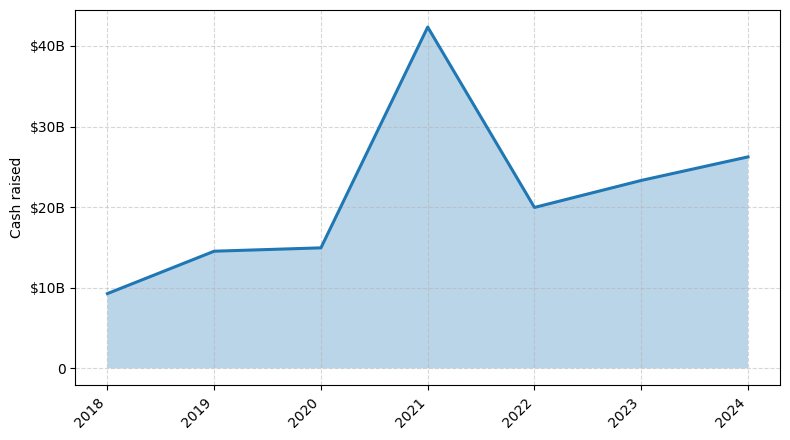

Investments by year: Cash raised

How is fundraising in different from other VC fundraising

Top Funded Mental Health Startups

1. Calm: Approximately $217 million in funding, focused on meditation and sleep.

2. Headspace: Approximately $215 million in funding, focused on mindfulness and meditation.

3. Ginger: Approximately $120 million in funding, focused on on-demand mental health coaching and therapy.

4. Lyra Health: Approximately $295 million in funding, focused on providing mental health benefits to employers.

5. Talkspace: Approximately $120 million in funding, focused on online therapy and counseling.

2. Headspace: Approximately $215 million in funding, focused on mindfulness and meditation.

3. Ginger: Approximately $120 million in funding, focused on on-demand mental health coaching and therapy.

4. Lyra Health: Approximately $295 million in funding, focused on providing mental health benefits to employers.

5. Talkspace: Approximately $120 million in funding, focused on online therapy and counseling.

What you should include in Mental Health pitch deck

When creating a Mental Health pitch deck, the following unique slides should be included:

1. Problem Statement: Clearly define the mental health issue or challenge you aim to address.

2. Target Audience: Identify the specific demographic or population you intend to serve.

3. Solution Overview: Explain your innovative approach to addressing the mental health problem.

4. Impact and Outcomes: Demonstrate the measurable positive impact your solution will have on individuals and communities.

5. Competitive Landscape: Highlight how your solution differentiates from existing mental health services or products.

6. Sustainability and Scalability: Outline your plan for long-term viability and potential for expansion.

1. Problem Statement: Clearly define the mental health issue or challenge you aim to address.

2. Target Audience: Identify the specific demographic or population you intend to serve.

3. Solution Overview: Explain your innovative approach to addressing the mental health problem.

4. Impact and Outcomes: Demonstrate the measurable positive impact your solution will have on individuals and communities.

5. Competitive Landscape: Highlight how your solution differentiates from existing mental health services or products.

6. Sustainability and Scalability: Outline your plan for long-term viability and potential for expansion.

How to Prepare Your Mental Health Startup for Investment

Preparing a Mental Health startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is crucial to present a comprehensive and compelling pitch deck that demonstrates the startup's viability, market opportunity, and competitive advantage.

VC investors typically expect the following from Mental Health startups in their pitch deck review:

1. Clear and Compelling Value Proposition: Articulate the startup's unique solution to a significant mental health challenge and how it delivers tangible benefits to the target audience.

2. Robust Market Analysis: Provide a thorough understanding of the market size, growth potential, and the startup's ability to capture a sizable market share.

3. Innovative Technology or Approach: Highlight the startup's innovative use of technology, such as digital platforms, AI-powered solutions, or novel therapeutic methods, to address mental health needs.

4. Experienced and Diverse Team: Showcase the startup's team, highlighting their relevant expertise, domain knowledge, and the complementary skills they bring to the table.

5. Scalable and Sustainable Business Model: Demonstrate the startup's ability to generate revenue, achieve profitability, and scale the business in a sustainable manner.

By addressing these key elements, Mental Health startups can increase their chances of securing investment and positioning themselves for long-term success.

VC investors typically expect the following from Mental Health startups in their pitch deck review:

1. Clear and Compelling Value Proposition: Articulate the startup's unique solution to a significant mental health challenge and how it delivers tangible benefits to the target audience.

2. Robust Market Analysis: Provide a thorough understanding of the market size, growth potential, and the startup's ability to capture a sizable market share.

3. Innovative Technology or Approach: Highlight the startup's innovative use of technology, such as digital platforms, AI-powered solutions, or novel therapeutic methods, to address mental health needs.

4. Experienced and Diverse Team: Showcase the startup's team, highlighting their relevant expertise, domain knowledge, and the complementary skills they bring to the table.

5. Scalable and Sustainable Business Model: Demonstrate the startup's ability to generate revenue, achieve profitability, and scale the business in a sustainable manner.

By addressing these key elements, Mental Health startups can increase their chances of securing investment and positioning themselves for long-term success.