FREE Investor Database

Top Venture Investors in Medtech Industry

Top Venture Investors in Medtech Industry

Discover leading VC and CVC investors specializing in Medtech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The medical technology (Medtech) industry has witnessed a surge in investment activity over the past three years, reflecting the growing demand for innovative healthcare solutions. Since 2022, the Medtech sector has attracted significant attention from investors, with numerous startups and established companies securing substantial funding to drive their innovations forward.

In the last three years, the Medtech industry has seen over 500 investment deals, with a total value exceeding $25 billion. Some of the core startups that have received substantial investments include Butterfly Network, a pioneer in portable ultrasound technology, which raised $250 million, and Intuitive Surgical, a leading provider of robotic-assisted surgical systems, which secured $1.1 billion in funding.

The most expensive deals in the Medtech space include the $4.2 billion acquisition of Livongo Health by Teladoc Health and the $3.1 billion investment in Verily Life Sciences, a subsidiary of Alphabet Inc. One particularly interesting deal was the $200 million investment in Neuralink, Elon Musk's venture focused on developing brain-computer interface technology.

The Medtech industry's investment landscape has been dynamic, with a strong focus on cutting-edge technologies, personalized healthcare solutions, and the integration of digital tools to enhance patient outcomes and improve the efficiency of healthcare delivery.

In the last three years, the Medtech industry has seen over 500 investment deals, with a total value exceeding $25 billion. Some of the core startups that have received substantial investments include Butterfly Network, a pioneer in portable ultrasound technology, which raised $250 million, and Intuitive Surgical, a leading provider of robotic-assisted surgical systems, which secured $1.1 billion in funding.

The most expensive deals in the Medtech space include the $4.2 billion acquisition of Livongo Health by Teladoc Health and the $3.1 billion investment in Verily Life Sciences, a subsidiary of Alphabet Inc. One particularly interesting deal was the $200 million investment in Neuralink, Elon Musk's venture focused on developing brain-computer interface technology.

The Medtech industry's investment landscape has been dynamic, with a strong focus on cutting-edge technologies, personalized healthcare solutions, and the integration of digital tools to enhance patient outcomes and improve the efficiency of healthcare delivery.

99 active VC investors in Medtech

In the last three years, the Medtech industry has seen a surge of investment from active venture capital firms. Key players include Deerfield Management, which has backed several Medtech startups, and Sofinnova Partners, known for its focus on innovative healthcare solutions. One notable example is the $300 million Series E round raised by Tempus, a leading provider of AI-powered precision medicine solutions, in 2021. This funding round, one of the largest in the Medtech space, underscores the growing appetite for transformative technologies that can improve patient outcomes and drive the future of healthcare.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zühlke Ventures AG | healthtech | Switzerland; United States | Series A, Series B | ||

| Zoic Capital | healthcare, life science, med-tech, biotech | United States | Seed, Pre-Seed, Series A | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| YZR Capital | digital health, digital health services, digital medtech | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Pre-Seed, Seed, Series A | EUR 100000000 | |

| Yozma Group | communications, it, medical technologies | Armenia; Azerbaijan; Bahrain; Bangladesh; Bhutan; Brunei; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; Turkmenistan; United Arab Emirates; Uzbekistan; Vietnam; Yemen | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| Yaya Capital | Medtech | Brazil; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Xplorer Fund | mobility, med, robotics, energy, ict, iot, digitalisation, digital twins | Pre-Seed | |||

| Xerys | life science, medtech, biotech, sustainable development, greentech, cleantech, climate tech | France | Series A, Series B | ||

| Xenia Venture Capital | Medtech | Israel | Series A, Series B, Series C |

43 active CVC investors in Medtech

Active corporate venture capital (CVC) firms have been increasingly investing in the MedTech sector, seeking to capitalize on innovative technologies and solutions. Key players include Johnson & Johnson Innovation, Novartis Venture Fund, and Philips HealthWorks, which have backed promising startups developing cutting-edge medical devices, digital health platforms, and AI-powered diagnostics.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| We Venture Capital | healthcare, diagnostics | Series A, Series B, Seed | |||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Viva BioInnovator | biotech, biopharmaceuticals, devices, diagnostics, life science tools | Generalist | Series B, Series A | ||

| VIB | (bio)pharmaceuticals, diagnostics, agricultural improvements | Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| UPMC Enterprises | diagnostics, therapeutics | Generalist | Generalist, Seed | ||

| UnityPoint Health Ventures | care experience, care financing, care delivery and care innovation. digital therapeutics, health it, tech-enabled services, medical devices and diagnostics | United States, Iowa; United States, Illinois; United States, Wisconsin | Seed, Series A, Series B | ||

| Ucb Ventures | generation cell, gene therapy, regenerative medicine, cell, tissue homeostasis, rna modulation, synthetic biology therapeutics | United States; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B | ||

| TMC Venture Fund | digital health, medical devices, therapeutics | Seed | USD 50000000 |

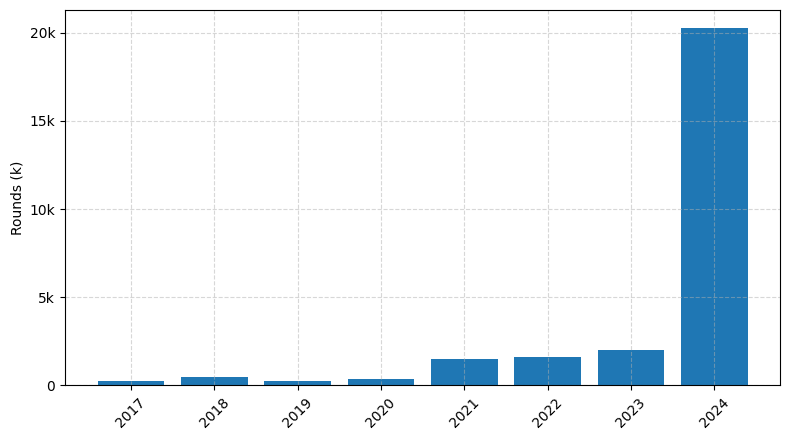

Investments by year: Round

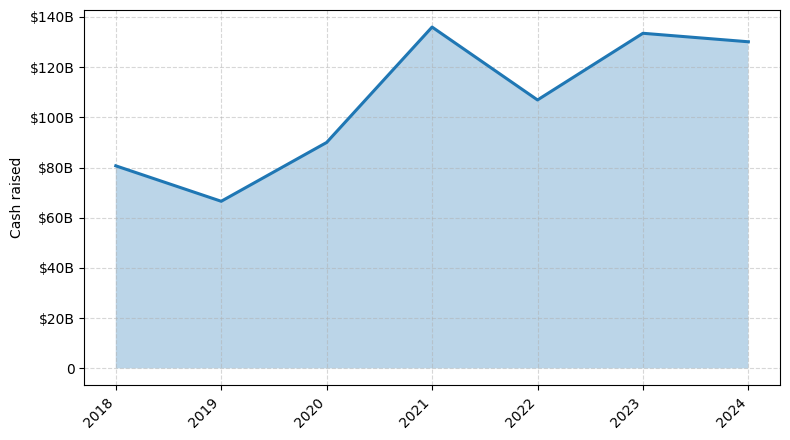

Investments by year: Cash raised

How is fundraising in Medtech different from other VC fundraising

Fundraising in the medical technology (Medtech) sector differs from general startup fundraising due to the unique challenges inherent in the industry. Medtech companies often face longer development timelines, more stringent regulatory requirements, and higher capital expenditures compared to other startups. Securing funding can be more challenging as investors may be wary of the extended time-to-market and the complex regulatory landscape. Additionally, Medtech startups must demonstrate not only technical feasibility but also clinical efficacy and safety, which can require extensive clinical trials and data collection. This adds to the overall cost and timeline of the fundraising process. As a result, Medtech startups often require more patient and specialized investors who understand the industry's nuances and are willing to navigate the unique obstacles that come with developing innovative medical technologies.

Top Funded Medtech Startups

1. Tempus: Approximately $1.1 billion in total funding, focused on developing AI-powered precision medicine solutions.

2. Butterfly Network: Approximately $400 million in total funding, focused on creating a handheld, AI-enabled ultrasound device.

3. Grail: Approximately $2 billion in total funding, focused on developing early cancer detection tests using genomic and machine learning technologies.

4. Guardant Health: Approximately $1.5 billion in total funding, focused on developing liquid biopsy tests for cancer diagnosis and treatment monitoring.

5. Verily (Alphabet's life sciences division): Approximately $2.1 billion in total funding, focused on developing healthcare technologies and life sciences solutions.

2. Butterfly Network: Approximately $400 million in total funding, focused on creating a handheld, AI-enabled ultrasound device.

3. Grail: Approximately $2 billion in total funding, focused on developing early cancer detection tests using genomic and machine learning technologies.

4. Guardant Health: Approximately $1.5 billion in total funding, focused on developing liquid biopsy tests for cancer diagnosis and treatment monitoring.

5. Verily (Alphabet's life sciences division): Approximately $2.1 billion in total funding, focused on developing healthcare technologies and life sciences solutions.

What you should include in Medtech pitch deck

A Medtech pitch deck should include the following unique slides:

1. Problem Statement: Clearly define the unmet medical need or problem your solution addresses.

2. Solution Overview: Explain how your Medtech innovation solves the identified problem.

3. Competitive Landscape: Highlight your competitive advantage and differentiation from existing solutions.

4. Regulatory Pathway: Outline the regulatory approval process and timeline for your Medtech product.

5. Commercialization Strategy: Describe your plan for market access, distribution, and adoption of your Medtech solution.

6. Team and Expertise: Showcase the relevant experience and qualifications of your Medtech team.

1. Problem Statement: Clearly define the unmet medical need or problem your solution addresses.

2. Solution Overview: Explain how your Medtech innovation solves the identified problem.

3. Competitive Landscape: Highlight your competitive advantage and differentiation from existing solutions.

4. Regulatory Pathway: Outline the regulatory approval process and timeline for your Medtech product.

5. Commercialization Strategy: Describe your plan for market access, distribution, and adoption of your Medtech solution.

6. Team and Expertise: Showcase the relevant experience and qualifications of your Medtech team.

How to Prepare Your Medtech Startup for Investment

Preparing a Medtech startup for investment requires a strategic approach to ensure that the business is investor-ready. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your Medtech startup for investment, consider the following:

1. Clearly define your value proposition: Demonstrate how your Medtech solution addresses a significant unmet need in the healthcare market and provides a unique competitive advantage.

2. Develop a robust business plan: Present a comprehensive and realistic plan that outlines your go-to-market strategy, financial projections, and a clear path to profitability.

3. Assemble a strong team: Highlight the expertise, experience, and complementary skills of your founding team and key personnel, showcasing their ability to execute the business plan.

4. Provide evidence of traction: Demonstrate early customer validation, strategic partnerships, or any other indicators of market acceptance and growth potential.

5. Articulate a clear regulatory and reimbursement strategy: Outline your understanding of the regulatory landscape and your plan to navigate the approval process, as well as your approach to securing reimbursement from payers.

By addressing these key elements, you can increase the likelihood of securing investment and positioning your Medtech startup for success.

To prepare your Medtech startup for investment, consider the following:

1. Clearly define your value proposition: Demonstrate how your Medtech solution addresses a significant unmet need in the healthcare market and provides a unique competitive advantage.

2. Develop a robust business plan: Present a comprehensive and realistic plan that outlines your go-to-market strategy, financial projections, and a clear path to profitability.

3. Assemble a strong team: Highlight the expertise, experience, and complementary skills of your founding team and key personnel, showcasing their ability to execute the business plan.

4. Provide evidence of traction: Demonstrate early customer validation, strategic partnerships, or any other indicators of market acceptance and growth potential.

5. Articulate a clear regulatory and reimbursement strategy: Outline your understanding of the regulatory landscape and your plan to navigate the approval process, as well as your approach to securing reimbursement from payers.

By addressing these key elements, you can increase the likelihood of securing investment and positioning your Medtech startup for success.