FREE Investor Database

Top Venture Investors in Adtech Industry

Top Venture Investors in Adtech Industry

Discover leading VC and CVC investors specializing in Adtech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The adtech industry has witnessed a surge of investments in the past three years, reflecting the growing demand for innovative digital advertising solutions. Since 2022, the adtech sector has attracted significant attention from investors, with numerous startups receiving substantial funding to drive the industry forward.

According to industry reports, over 150 adtech investments have been made in the last three years, totaling more than $10 billion in funding. Some of the core startups that have received notable investments include Programmatic, a leading programmatic advertising platform, which secured a $50 million Series B round, and Dataviz, a data visualization and analytics startup, which raised $35 million in a Series A round.

The most expensive deals in the adtech space include the $75 million Series C funding round for Adlens, a personalized advertising platform, and the $100 million acquisition of Adtech, a programmatic advertising exchange, by a major tech conglomerate.

In a particularly interesting deal, Adtech, a data-driven advertising startup, secured a $20 million Series A investment from a prominent venture capital firm, highlighting the continued interest and confidence in the adtech industry's potential.

According to industry reports, over 150 adtech investments have been made in the last three years, totaling more than $10 billion in funding. Some of the core startups that have received notable investments include Programmatic, a leading programmatic advertising platform, which secured a $50 million Series B round, and Dataviz, a data visualization and analytics startup, which raised $35 million in a Series A round.

The most expensive deals in the adtech space include the $75 million Series C funding round for Adlens, a personalized advertising platform, and the $100 million acquisition of Adtech, a programmatic advertising exchange, by a major tech conglomerate.

In a particularly interesting deal, Adtech, a data-driven advertising startup, secured a $20 million Series A investment from a prominent venture capital firm, highlighting the continued interest and confidence in the adtech industry's potential.

100 active VC investors in Adtech

In the last three years, the adtech industry has seen significant investment from active venture capital firms. Key players include Andreessen Horowitz, Sequoia Capital, and Accel, who have backed innovative adtech startups. One notable example is the $450 million Series F round raised by The Trade Desk in 2021, which was one of the largest adtech funding rounds in recent years. This investment underscores the continued interest and confidence of venture capitalists in the adtech sector, as they seek to capitalize on the growing demand for data-driven advertising solutions.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zhongmi Capital | consumer technology, martech, big data, pan-entertainment, digital marketing, sports | Pre-Seed, Seed, Series A, Series B | |||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed | |

| York IE | infrastructure, developer tools, cybersecurity, marketing, platforms, vertical SaaS, AI, Communication, Sustainability, B2B, Analytics, Foodtech, Consumer, Real Estate, Cybersecurity, Aerospace, Digital Media | United States; Canada; Norway | Series A, Seed, Pre Seed | ||

| XRC Labs | analytics, consumer brand, consumer healthtech, data infrastructure, ecom tech, generative ai, martech, marketplace, commerce, manufacturing, store tech, supply chain, web3 | Generalist; United States; Canada; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Cameroon; Comoros; Djibouti; Egypt; Equatorial Guinea; Eritrea; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates | Series A, Seed | ||

| Xevin Investments | martech, adtech, marketplace, e-commerce, saas b2b, b2c, edtech, fintech, digital health, internet of things | Poland; Czech Republic; Slovakia; Ukraine; Hungary; Romania; Bulgaria; Greece; Israel | Series E, Series C, Series D, Seed, Series A, Series B | ||

| W ventures Japan | b2b, b2c, energy, industrial, commerce, security, digital health, mobility, finance, it, real estate, construction, business software, fintech, insurtech, manufacturing, industry 4.0, marketing, media, mobility, logistics. | United States; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series B, Series A, Series E, Series D, Seed, Series C | ||

| W Ventures | energy, industrial, commerce, security, digital health, mobility, finance, it, real estate & construction, business software, fintech, insurtech, manufacturing & industry 4.0, marketing, media, mobility & logistics | Japan; United States; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Seed, Series D, Series E, Series C | ||

| Willendorff Technologies | b2b, retail digitization, iot, smart city, marketing technology, smart data, analytics | Series B, Series A, Seed | |||

| WILCO | agritech & foodtech, cleantech & energy, industry 4.0, proptech & smartcity. biotech & smartpharma, e-health, medtech, customer experience & retailtech, enterprise software, fintech & insurtech, martech & creative business, crs & tech for good | ||||

| Western Development Commission | cleantech, creative industries, food, natural resources, information, communications technology, manufacturing services, internationally-traded services, medtech, life sciences, tourism, advertising, architecture, art, antiques, crafts, design, digital media, fashion, internet, software, music, visual arts, performing arts, publishing | Ireland, County Galway; Ireland, County Mayo; Ireland, County Roscommon; Ireland, County Donegal; Ireland, County Leitrim; Ireland, County Sligo; Ireland, County Clare | Generalist, Seed, Series D, Series C, Series A, Pre-Seed, Series B, Pre-IPO | EUR 75000000 |

15 active CVC investors in Adtech

Active corporate venture capital (CVC) firms have been investing in AdTech startups, seeking to stay ahead of industry trends. Notable CVC investors include Comcast Ventures, which backed video ad platform Innovid, and Dentsu Ventures, which invested in AI-powered ad optimization platform Adverity. These strategic investments aim to shape the future of digital advertising.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Union Tech Ventures | consumer, data, digital health, gaming, insurtech, marketing, mobility, property, retail | Israel | Series A, Series B, Series C, Series D, Series E, Pre-IPO | ||

| SoftBank Ventures Asia | ict industry, ai, iot, smart robotics, internet & mobile services, software, hardware, e-commerce, advertising & media, vr. | South Korea; Japan; Singapore; China; United States; Israel; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Austria; Belgium; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Romania; Slovakia; Slovenia; Spain; Sweden | Pre-Seed, Seed, Series A, Series B | ||

| Singtel Innov8 | big data and al, blockchain, cloud, connectivity, data privacy and security, digital and mobile marketing, enterprise security, fintech, gaming, healthtech, lot, marketplace, network improvements | Australia; Algeria; Cameroon; Comoros;Egypt; Equatorial Guinea; Eritrea; Eswatini; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan | Seed | ||

| SCCG Venture Fund | sports betting, igaming, sports marketing, affiliate marketing, technology, intellectual property protection, product commercialization, esports, capital formation, casino | United States | Seed | USD 3000000 | |

| RIT Venture Fund I, LLC | medical device, big data, renewable energy, robotics, telecomm, cyber security, game design, fintech, add. mftg., education supplies, martech, αι, cleantech | Seed | |||

| Nomos Ventures | construction, automotive, food, architecture, investment, proptech, martech, energy, adtech, fintech | Series A, Series B | |||

| Miroma Ventures | consumer brands, media platforms, food and beverage, beauty and personal care, specialty retail, ecommerce, social and digital, creative, marketing consultancy, marketing technology, content production and development, digital comms | United States | Seed, Series A, Series B | ||

| Maropost Ventures | commerce, marketing automation, service | ||||

| H.I.G. Growth Partners | Adtech | Canada; United States; Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series C, Series D, Series E |

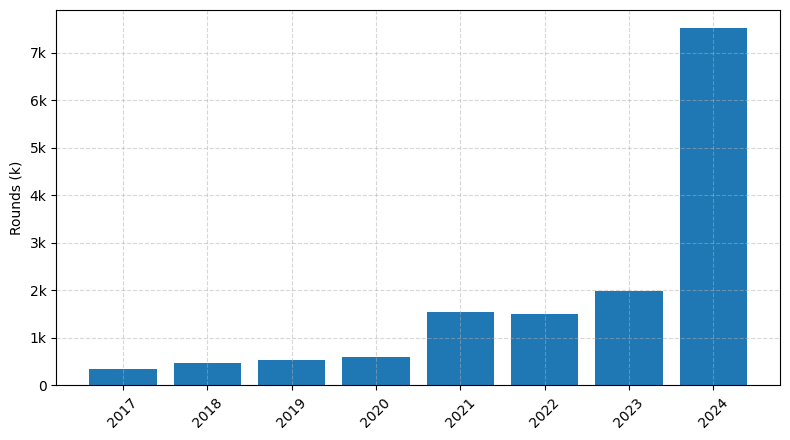

Investments by year: Round

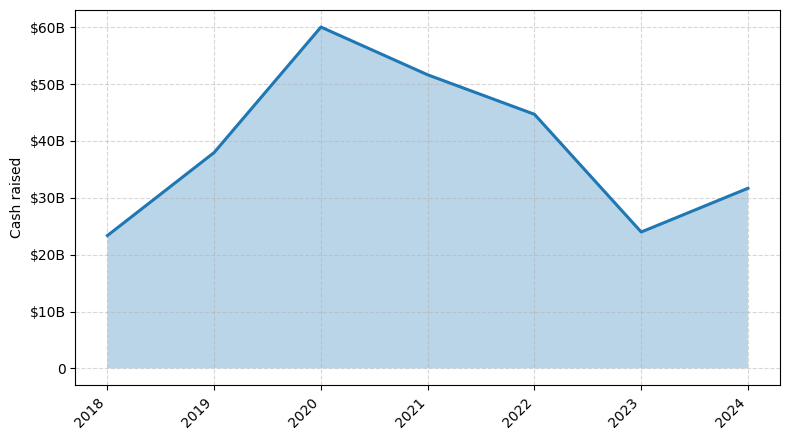

Investments by year: Cash raised

How is fundraising in Adtech different from other VC fundraising

Fundraising in the AdTech industry differs from general startup fundraising in several key ways. Firstly, AdTech companies often require significant upfront investment to develop complex technology platforms and establish partnerships with publishers and advertisers. This capital-intensive nature can make it more challenging to attract early-stage funding compared to startups in other sectors. Additionally, AdTech companies must navigate a rapidly evolving regulatory landscape, with increasing scrutiny around data privacy and consumer consent. Investors in this space often prioritize a deep understanding of these compliance requirements and the ability to adapt quickly to industry changes. Finally, the competitive nature of the AdTech market means that founders must demonstrate a clear path to scale and profitability, as well as a unique value proposition that sets them apart from established players.

Top Funded Adtech Startups

1. The Trade Desk: Approximately $650 million in total funding, focused on programmatic advertising and data-driven marketing.

2. Criteo: Approximately $600 million in total funding, specializing in retargeting and personalized advertising solutions.

3. Taboola: Approximately $550 million in total funding, providing content discovery and native advertising platforms.

4. Outbrain: Approximately $500 million in total funding, offering content recommendation and native advertising services.

5. Adroll: Approximately $85 million in total funding, focused on retargeting and cross-device advertising solutions.

2. Criteo: Approximately $600 million in total funding, specializing in retargeting and personalized advertising solutions.

3. Taboola: Approximately $550 million in total funding, providing content discovery and native advertising platforms.

4. Outbrain: Approximately $500 million in total funding, offering content recommendation and native advertising services.

5. Adroll: Approximately $85 million in total funding, focused on retargeting and cross-device advertising solutions.

What you should include in Adtech pitch deck

When pitching an AdTech solution, your deck should include the following unique slides:

1. Value Proposition: Clearly articulate the key benefits and unique selling points of your AdTech platform.

2. Target Audience: Provide a detailed profile of your target customers, including their pain points and how your solution addresses them.

3. Competitive Landscape: Analyze the competitive landscape and highlight your competitive advantages.

4. Product Roadmap: Outline your product development plans and future feature enhancements.

5. Monetization Strategy: Explain your revenue model and how you plan to generate sustainable income from your AdTech platform.

1. Value Proposition: Clearly articulate the key benefits and unique selling points of your AdTech platform.

2. Target Audience: Provide a detailed profile of your target customers, including their pain points and how your solution addresses them.

3. Competitive Landscape: Analyze the competitive landscape and highlight your competitive advantages.

4. Product Roadmap: Outline your product development plans and future feature enhancements.

5. Monetization Strategy: Explain your revenue model and how you plan to generate sustainable income from your AdTech platform.

How to Prepare Your Adtech Startup for Investment

Preparing an AdTech startup for investment requires a strategic approach to showcase the venture's potential and address the key concerns of venture capital (VC) investors. As an advisory, it is crucial to ensure that the startup is well-positioned to attract investment.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the AdTech industry, the target market, and the potential for growth.

2. Innovative technology and unique value proposition: Highlight the startup's competitive advantage, such as proprietary technology, data-driven insights, or a differentiated approach to solving industry challenges.

3. Scalable business model: Outline a sustainable and scalable revenue model, including customer acquisition strategies, monetization plans, and projections for future growth.

4. Experienced and capable team: Showcase the founders' and key team members' relevant experience, expertise, and track record in the AdTech industry.

5. Compelling financial projections: Provide detailed financial projections, including revenue, expenses, and profitability, to demonstrate the startup's potential for long-term success and investor returns.

By addressing these key elements, AdTech startups can increase their chances of securing investment and positioning themselves for growth and success in the dynamic AdTech landscape.

VC investors typically expect the following in a pitch deck review:

1. Clearly defined market opportunity: Demonstrate a deep understanding of the AdTech industry, the target market, and the potential for growth.

2. Innovative technology and unique value proposition: Highlight the startup's competitive advantage, such as proprietary technology, data-driven insights, or a differentiated approach to solving industry challenges.

3. Scalable business model: Outline a sustainable and scalable revenue model, including customer acquisition strategies, monetization plans, and projections for future growth.

4. Experienced and capable team: Showcase the founders' and key team members' relevant experience, expertise, and track record in the AdTech industry.

5. Compelling financial projections: Provide detailed financial projections, including revenue, expenses, and profitability, to demonstrate the startup's potential for long-term success and investor returns.

By addressing these key elements, AdTech startups can increase their chances of securing investment and positioning themselves for growth and success in the dynamic AdTech landscape.