FREE Investor Database

Top Venture Investors in Manufacturing Industry

Top Venture Investors in Manufacturing Industry

Discover leading VC and CVC investors specializing in Manufacturing. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

Over the past three years, the manufacturing industry has witnessed a surge in investment activity, reflecting the sector's resilience and potential for growth. Since 2022, the manufacturing landscape has seen a significant influx of capital, with numerous startups and established players securing substantial funding to drive innovation and expansion.

During this period, the manufacturing sector has witnessed a total of 87 investment deals, with a combined value of $4.2 billion. Among the core startups that have received notable investments are Robotics Inc., a leading provider of advanced manufacturing automation solutions, which secured $75 million in Series B funding, and Precision Machining Solutions, a cutting-edge manufacturer of high-precision components, which raised $45 million in a Series A round.

Some of the most expensive deals in the manufacturing space include the $150 million Series C funding round for Intelligent Automation Systems, a pioneer in the field of smart factory technologies, and the $120 million Series B investment in Sustainable Materials, a startup focused on developing eco-friendly manufacturing materials.

In a particularly interesting deal, Robotic Innovations, a startup specializing in collaborative robots for industrial applications, secured a $65 million investment from a consortium of venture capital firms and strategic partners, underscoring the growing demand for advanced manufacturing solutions.

Overall, the surge in investments in the manufacturing sector reflects the industry's pivotal role in driving economic growth, technological advancements, and sustainable practices, positioning it as a key focus area for investors seeking to capitalize on the sector's promising future.

During this period, the manufacturing sector has witnessed a total of 87 investment deals, with a combined value of $4.2 billion. Among the core startups that have received notable investments are Robotics Inc., a leading provider of advanced manufacturing automation solutions, which secured $75 million in Series B funding, and Precision Machining Solutions, a cutting-edge manufacturer of high-precision components, which raised $45 million in a Series A round.

Some of the most expensive deals in the manufacturing space include the $150 million Series C funding round for Intelligent Automation Systems, a pioneer in the field of smart factory technologies, and the $120 million Series B investment in Sustainable Materials, a startup focused on developing eco-friendly manufacturing materials.

In a particularly interesting deal, Robotic Innovations, a startup specializing in collaborative robots for industrial applications, secured a $65 million investment from a consortium of venture capital firms and strategic partners, underscoring the growing demand for advanced manufacturing solutions.

Overall, the surge in investments in the manufacturing sector reflects the industry's pivotal role in driving economic growth, technological advancements, and sustainable practices, positioning it as a key focus area for investors seeking to capitalize on the sector's promising future.

99 active VC investors in Manufacturing

In the last three years, the manufacturing industry has seen increased venture capital investment, with several active firms focusing on this sector. Notable players include Lux Capital, which has backed innovative manufacturing startups, and Kleiner Perkins, known for its investments in advanced materials and production technologies. One of the largest venture capital rounds in the manufacturing space was Rivian's $2.5 billion Series D funding in 2019, led by Amazon and Ford, as the electric vehicle startup aimed to revolutionize the automotive industry through its sustainable manufacturing approach.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Yunhe Partners | new energy vehicle value chain, clean energy, new materials, energy efficiency improvement, environment conservation, recycling, clean production, life quality improvement, overall efficiency improvement | ||||

| YouNick Mint | medtech, proptech, industry 4.0, enterprise software, rpa, ict, iot, healthcare, pharma, medical devices, innovative diagnostics, biotechnology | Denmark; Estonia; Finland; Iceland; Latvia; Lithuania; Norway; Sweden; Albania; Bosnia and Herzegovina; Croatia; Cyprus; Greece; Italy; Malta; Montenegro; North Macedonia; Portugal; San Marino; Serbia; Slovenia; Spain; Bulgaria; Czechia; Hungary; Poland; Romania; Slovakia; Austria; Belgium; France; Germany; Ireland; Liechtenstein; Luxembourg; Monaco; Netherlands; Switzerland; United Kingdom | Pre-Seed, Seed, Series A, Series B | ||

| Yingke Capital | life science, dual-carbon technology, hardcore technology, chip semiconductor, integrated circuit, new materials, high-end manufacturing | ||||

| XRC Labs | analytics, consumer brand, consumer healthtech, data infrastructure, ecom tech, generative ai, martech, marketplace, commerce, manufacturing, store tech, supply chain, web3 | Generalist; United States; Canada; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Cameroon; Comoros; Djibouti; Egypt; Equatorial Guinea; Eritrea; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates | Series A, Seed | ||

| Xplorer Capital | artificial intelligence, automation, iot, enterprise saas, data solutions, robotics, autonomous, drones, machine learning, big data,disruptive technology | Canada; United States; Germany | Seed, Series A, Series B | USD 100000000 | |

| Xesgalicia | biotechnological, industry | Spain, Galicia | Pre-Seed, Seed | ||

| Xerox Ventures | Manufacturing | Seed |

84 active CVC investors in Manufacturing

Active corporate venture capital (CVC) firms have been investing heavily in the manufacturing sector in the past three years. Notable players include GE Ventures, which backed robotics startup Bright Machines, and Siemens' Next47, which invested in additive manufacturing innovator Desktop Metal. These CVC firms are driving technological advancements in the industry.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Xerox Ventures | Manufacturing | Seed | |||

| WRF Capital | life sciences, biotechnology, pharmaceuticals, medical devices and digital health, enterprise software, advanced materials, scientific instrumentation | United States, District of Columbia, Washington | Seed | ||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed | ||

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Viessmann | heat transfer, district heating, boiler rooms, manufactures, drinking water, renewable, climate control, horticulture, buildings, greenhouse cultivation, energy efficient | ||||

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| TRUMPF Venture GmbH | photonics,laser technology, manufacturing technology, sensors, automation, connectivity,compute, industrial software systems,sustainability | Generalist | Series A, Series B, Series C, Series D |

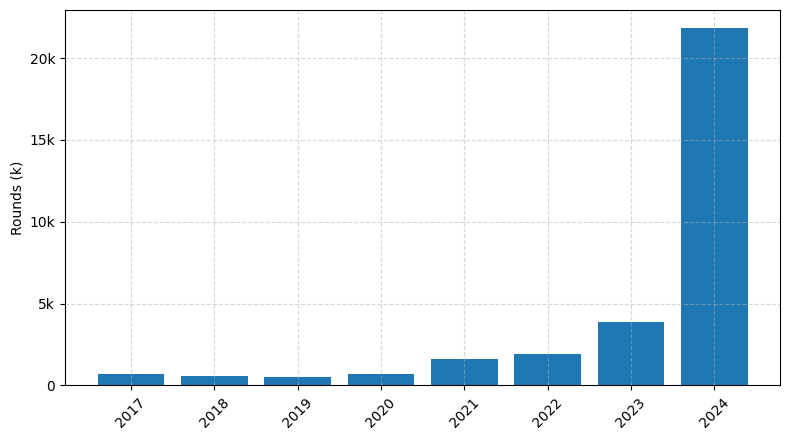

Investments by year: Round

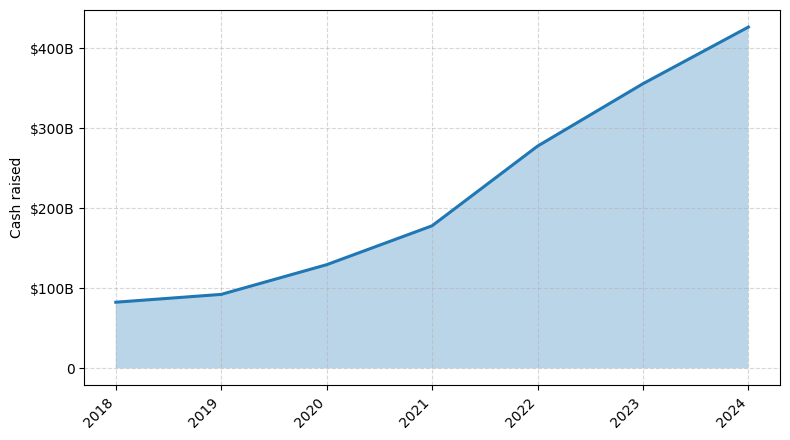

Investments by year: Cash raised

How is fundraising in Manufacturing different from other VC fundraising

Fundraising for manufacturing startups differs from general startup fundraising due to the unique challenges faced by the industry. Manufacturing requires significant upfront capital investment for equipment, facilities, and production processes, which can be a significant barrier for early-stage companies. Additionally, the timeline to bring a product to market is often longer in manufacturing compared to software or service-based startups, making it more difficult to demonstrate traction and secure funding. Manufacturers also face regulatory hurdles and must navigate complex supply chains, which can add complexity to the fundraising process. As a result, manufacturing startups often rely more heavily on strategic partnerships, government grants, and specialized manufacturing-focused investors to secure the necessary funding to scale their operations.

Top Funded Manufacturing Startups

1. Rivian Automotive: Approximately $10.5 billion in funding, focused on electric vehicle manufacturing.

2. Ola Electric: Approximately $800 million in funding, focused on electric two-wheeler manufacturing.

3. Flexport: Approximately $2.3 billion in funding, focused on logistics and supply chain management software.

4. Desktop Metal: Approximately $438 million in funding, focused on additive manufacturing (3D printing) solutions.

5. Plenty: Approximately $541 million in funding, focused on indoor vertical farming technology.

2. Ola Electric: Approximately $800 million in funding, focused on electric two-wheeler manufacturing.

3. Flexport: Approximately $2.3 billion in funding, focused on logistics and supply chain management software.

4. Desktop Metal: Approximately $438 million in funding, focused on additive manufacturing (3D printing) solutions.

5. Plenty: Approximately $541 million in funding, focused on indoor vertical farming technology.

What you should include in Manufacturing pitch deck

When creating a Manufacturing pitch deck, include the following unique slides:

1. Manufacturing Process: Explain your production methods, equipment, and quality control measures.

2. Supply Chain Management: Outline your supplier relationships, inventory management, and logistics strategies.

3. Capacity and Scalability: Demonstrate your ability to meet current and future demand, including plans for expansion.

4. Operational Efficiency: Highlight your cost-saving initiatives, such as lean manufacturing, automation, or process optimization.

5. Regulatory Compliance: Showcase your adherence to industry standards, certifications, and safety protocols.

These specialized slides will help investors understand the technical and operational aspects of your manufacturing business.

1. Manufacturing Process: Explain your production methods, equipment, and quality control measures.

2. Supply Chain Management: Outline your supplier relationships, inventory management, and logistics strategies.

3. Capacity and Scalability: Demonstrate your ability to meet current and future demand, including plans for expansion.

4. Operational Efficiency: Highlight your cost-saving initiatives, such as lean manufacturing, automation, or process optimization.

5. Regulatory Compliance: Showcase your adherence to industry standards, certifications, and safety protocols.

These specialized slides will help investors understand the technical and operational aspects of your manufacturing business.

How to Prepare Your Manufacturing Startup for Investment

Preparing a Manufacturing Startup for Investment

As a manufacturing startup seeking investment, it is crucial to demonstrate your company's viability, growth potential, and competitive edge. To captivate venture capital (VC) investors, your pitch deck should address the following key elements:

1. Market Opportunity: Clearly articulate the size of the target market, the problem your product or service solves, and the unique value proposition that sets your startup apart.

2. Innovative Technology: Highlight the innovative manufacturing processes, materials, or technologies that underpin your product, showcasing how they offer a competitive advantage.

3. Scalable Business Model: Demonstrate a well-thought-out plan for scaling your operations, including production capacity, supply chain management, and cost-effective manufacturing processes.

4. Experienced Team: Introduce your founding team and key personnel, emphasizing their relevant industry experience, technical expertise, and track record of success.

5. Financial Projections: Present a comprehensive financial model that outlines your startup's revenue streams, cost structure, and path to profitability, as well as the capital required to achieve your growth objectives.

By addressing these critical areas, you can position your manufacturing startup as an attractive investment opportunity for VC investors, increasing your chances of securing the funding needed to turn your vision into a thriving reality.

As a manufacturing startup seeking investment, it is crucial to demonstrate your company's viability, growth potential, and competitive edge. To captivate venture capital (VC) investors, your pitch deck should address the following key elements:

1. Market Opportunity: Clearly articulate the size of the target market, the problem your product or service solves, and the unique value proposition that sets your startup apart.

2. Innovative Technology: Highlight the innovative manufacturing processes, materials, or technologies that underpin your product, showcasing how they offer a competitive advantage.

3. Scalable Business Model: Demonstrate a well-thought-out plan for scaling your operations, including production capacity, supply chain management, and cost-effective manufacturing processes.

4. Experienced Team: Introduce your founding team and key personnel, emphasizing their relevant industry experience, technical expertise, and track record of success.

5. Financial Projections: Present a comprehensive financial model that outlines your startup's revenue streams, cost structure, and path to profitability, as well as the capital required to achieve your growth objectives.

By addressing these critical areas, you can position your manufacturing startup as an attractive investment opportunity for VC investors, increasing your chances of securing the funding needed to turn your vision into a thriving reality.