FREE Investor Database

Top Venture Investors in Foodtech Industry

Top Venture Investors in Foodtech Industry

Discover leading VC and CVC investors specializing in Foodtech. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The Foodtech industry has witnessed a surge in investment activity over the past three years, with a growing appetite for innovative solutions that disrupt traditional food systems. Since 2022, the sector has seen a significant influx of capital, with numerous startups receiving substantial funding to drive their transformative ideas forward.

In the last three years, the Foodtech industry has witnessed over 500 investments, with a total of $15 billion poured into the sector. Some of the core startups that have received substantial investments include Impossible Foods, which raised $700 million, and Oatly, which secured $200 million. Additionally, several high-profile deals have been made, such as Instacart's $265 million funding round and Deliveroo's $575 million raise.

One particularly interesting deal was the $100 million investment in Apeel Sciences, a company that develops plant-based coatings to extend the shelf life of produce, showcasing the industry's focus on sustainability and reducing food waste.

The Foodtech industry's investment landscape has been dynamic, with a strong emphasis on innovative solutions that address the evolving needs of consumers and the global food system.

In the last three years, the Foodtech industry has witnessed over 500 investments, with a total of $15 billion poured into the sector. Some of the core startups that have received substantial investments include Impossible Foods, which raised $700 million, and Oatly, which secured $200 million. Additionally, several high-profile deals have been made, such as Instacart's $265 million funding round and Deliveroo's $575 million raise.

One particularly interesting deal was the $100 million investment in Apeel Sciences, a company that develops plant-based coatings to extend the shelf life of produce, showcasing the industry's focus on sustainability and reducing food waste.

The Foodtech industry's investment landscape has been dynamic, with a strong emphasis on innovative solutions that address the evolving needs of consumers and the global food system.

95 active VC investors in Foodtech

In the last three years, the Foodtech industry has seen a surge of investment from active venture capital firms. Key players include Andreessen Horowitz, which has backed companies like Impossible Foods, and Khosla Ventures, known for its investments in Apeel Sciences and Eat Just. One of the biggest venture capital rounds in the Foodtech space was Impossible Foods' $500 million Series F in 2020, which propelled the plant-based meat startup's growth and expansion. This round highlights the increasing investor appetite for innovative Foodtech solutions that address sustainability and consumer trends in the food industry.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| ZORA Ventures | climate change, sustainable food systems, deep tech | Israel | Series A, Series B | ||

| Zira Capital | food industry, cosmetics, water, sanitation, waste management, education, industry, it, health services, textile, transport | Mali | |||

| Zintinus | food tech | Generalist; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania | Series A, Series B | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| Zest Group | artificial intelligence, cybersecurity, cleanteach, data, business software, healthtech, insurtech, fintech, lifestyle, consumertech, smart city, factory, food, agritech | Italy | Pre-Seed, Seed | ||

| Zane Venture Fund | housing, climate, digital health, financial inclusion, housing security, food access, stability, health equity, financial inclusion, education | United States | Series A, Pre-Seed, Seed, Series B | ||

| ZAKA Ventures | Prague, Prague | e-commerce, edtech & entertainment, enterprise tech, fintech, health & biotech, hospitality, gastro, hr tech, it, marketing, mobility, proptech & construction | Generalist; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czechia; Georgia; Hungary; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; United Kingdom; Estonia; Latvia; Lithuania; Germany; Switzerland; Austria | Pre-Seed, Seed |

50 active CVC investors in Foodtech

Active corporate venture capital (CVC) firms have been investing heavily in the Foodtech sector in the past 3 years. Notable players include Tyson New Ventures, which backed plant-based meat startup Beyond Meat, and Danone Manifesto Ventures, which invested in alternative protein company Laird Superfood.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZX Ventures | beverage, direct to consumer, circular ventures, future of socializing | Seed, Series C, Series A, Series B | |||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| VTC Ventures | life sciences, biopharmaceuticals, pharmaceuticals, medical technology and devices, biotechnology, food and ag, engineering, advanced materials, advanced chemicals | United States | Series A, Series B, Seed | ||

| Tyson Ventures | future of food | ||||

| Teknoloji Yatirim | saas, health and life quality technologies, agriculture and food technologies, clean technologies | Turkey | Series B, Series A | EUR 20000000 | |

| Syngenta Ventures | agri-food system, food | ||||

| Stanford GSB Impact Fund | education, energy and the environment, fintech, food, agriculture, justice, healthcare, urban development | Generalist; United States | Seed, Series A | ||

| Sony Innovation Fund | Foodtech | Generalist | Seed | ||

| Seeds Capital | manufacturing, health, biomedical sciences, sustainability, agritech, foodtech, artificial intelligence, blockchain, quantum, space technologies, maritime tech, engineering, urban solutions | Singapore | Pre-Seed, Seed, Series A, Series B |

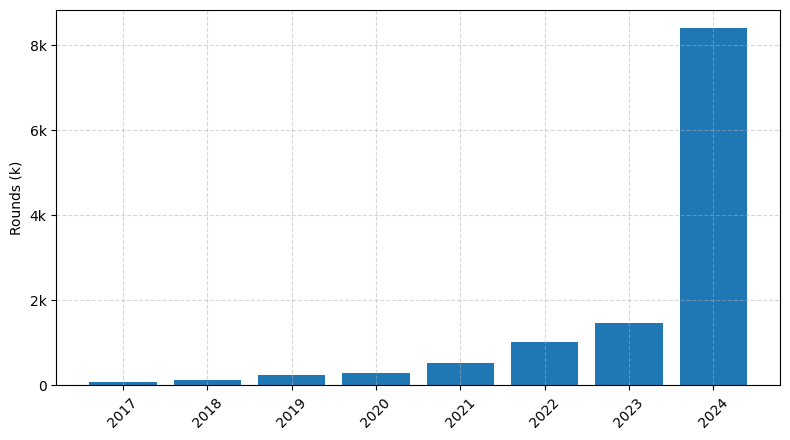

Investments by year: Round

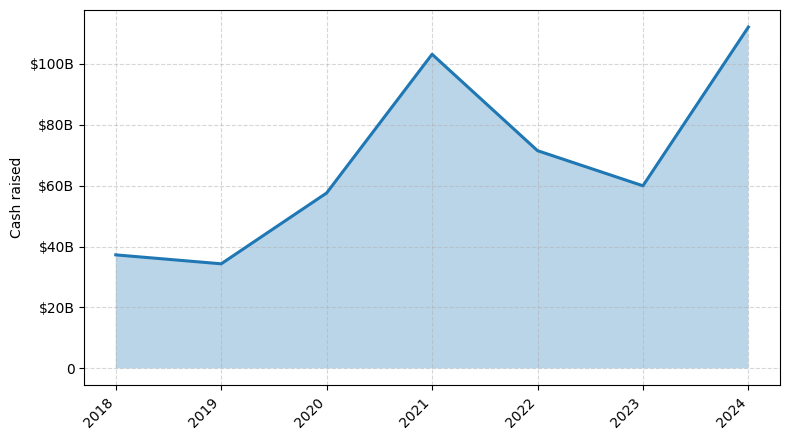

Investments by year: Cash raised

How is fundraising in Foodtech different from other VC fundraising

Fundraising in the Foodtech industry presents unique challenges compared to general startup fundraising. Foodtech startups often require significant capital for research, development, and scaling production, which can be more capital-intensive than software-based startups. Additionally, Foodtech companies must navigate complex regulatory environments, food safety standards, and supply chain logistics, which can add complexity to the fundraising process. Investors in the Foodtech space may also have specific industry expertise and expectations, requiring founders to demonstrate a deep understanding of the market and their competitive advantages. Furthermore, the long development timelines and potential for regulatory hurdles in Foodtech can make it more challenging to attract and retain investor interest compared to faster-moving, software-driven startups. Addressing these unique Foodtech challenges is crucial for Foodtech startups seeking to successfully raise funds and scale their businesses.

Top Funded Foodtech Startups

1. Instacart: Approximately $2.7 billion in total funding, focused on online grocery delivery.

2. Impossible Foods: Approximately $1.5 billion in total funding, focused on plant-based meat alternatives.

3. Doordash: Approximately $2.5 billion in total funding, focused on food delivery.

4. Meituan: Approximately $7.2 billion in total funding, focused on on-demand delivery services.

5. Deliveroo: Approximately $1.7 billion in total funding, focused on food delivery.

2. Impossible Foods: Approximately $1.5 billion in total funding, focused on plant-based meat alternatives.

3. Doordash: Approximately $2.5 billion in total funding, focused on food delivery.

4. Meituan: Approximately $7.2 billion in total funding, focused on on-demand delivery services.

5. Deliveroo: Approximately $1.7 billion in total funding, focused on food delivery.

What you should include in Foodtech pitch deck

When creating a Foodtech pitch deck, include the following unique slides:

1. Market Opportunity: Highlight the size, growth potential, and unmet needs in the food industry.

2. Product/Service Overview: Explain your innovative Foodtech solution and how it addresses the market's challenges.

3. Competitive Landscape: Analyze your competitors and differentiate your offering.

4. Business Model: Describe your revenue streams, pricing strategy, and scalability.

5. Traction and Milestones: Showcase your achievements, customer adoption, and future roadmap.

6. Team: Introduce your experienced and diverse Foodtech-focused team.

Ensure these slides effectively communicate your Foodtech venture's value proposition and competitive advantage within the 100-word limit.

1. Market Opportunity: Highlight the size, growth potential, and unmet needs in the food industry.

2. Product/Service Overview: Explain your innovative Foodtech solution and how it addresses the market's challenges.

3. Competitive Landscape: Analyze your competitors and differentiate your offering.

4. Business Model: Describe your revenue streams, pricing strategy, and scalability.

5. Traction and Milestones: Showcase your achievements, customer adoption, and future roadmap.

6. Team: Introduce your experienced and diverse Foodtech-focused team.

Ensure these slides effectively communicate your Foodtech venture's value proposition and competitive advantage within the 100-word limit.

How to Prepare Your Foodtech Startup for Investment

Preparing a Foodtech startup for investment requires a strategic approach to ensure that the business is investor-ready. As an advisory, it is crucial to address the key elements that venture capital (VC) investors typically expect to see in a pitch deck review.

To prepare your Foodtech startup for investment, consider the following:

1. Clearly define your value proposition: Articulate how your product or service solves a specific problem in the food industry and the unique benefits it offers to customers.

2. Demonstrate a scalable business model: Provide a detailed financial plan that showcases the potential for sustainable growth and profitability.

3. Highlight your competitive advantage: Emphasize the unique features, technologies, or strategies that set your startup apart from competitors.

4. Assemble a strong and experienced team: Showcase the expertise, relevant experience, and complementary skills of your founding team and key personnel.

5. Provide market insights and traction: Demonstrate a deep understanding of the target market, industry trends, and any early customer or revenue traction.

By addressing these key elements, you can increase the likelihood of securing investment for your Foodtech startup and positioning it for long-term success.

To prepare your Foodtech startup for investment, consider the following:

1. Clearly define your value proposition: Articulate how your product or service solves a specific problem in the food industry and the unique benefits it offers to customers.

2. Demonstrate a scalable business model: Provide a detailed financial plan that showcases the potential for sustainable growth and profitability.

3. Highlight your competitive advantage: Emphasize the unique features, technologies, or strategies that set your startup apart from competitors.

4. Assemble a strong and experienced team: Showcase the expertise, relevant experience, and complementary skills of your founding team and key personnel.

5. Provide market insights and traction: Demonstrate a deep understanding of the target market, industry trends, and any early customer or revenue traction.

By addressing these key elements, you can increase the likelihood of securing investment for your Foodtech startup and positioning it for long-term success.