FREE Investor Database

Top Venture Investors in DevOps Industry

Top Venture Investors in DevOps Industry

Discover leading VC and CVC investors specializing in DevOps. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The past three years have witnessed a surge in investments within the DevOps ecosystem, as organizations recognize the transformative potential of this approach to software development and deployment. Since 2022, the industry has seen a flurry of activity, with numerous startups and established players receiving significant funding to drive innovation in the DevOps space.

According to industry reports, over 150 DevOps-focused investments have been made in the last three years, totaling more than $2.5 billion in funding. Notable startups that have received substantial investments include Ansible, GitLab, and Datadog, each securing multi-million-dollar deals to expand their offerings and reach.

Some of the most expensive DevOps deals during this period include Atlassian's acquisition of Trello for $425 million and the $320 million Series E funding round for Puppet. Additionally, the $200 million Series D funding for Harness, a leading DevOps platform, stands out as a particularly interesting investment, highlighting the industry's appetite for cutting-edge DevOps solutions.

The investments in DevOps over the past three years underscore the growing importance of this approach in the software development landscape, as organizations seek to streamline their processes, enhance collaboration, and drive continuous innovation.

According to industry reports, over 150 DevOps-focused investments have been made in the last three years, totaling more than $2.5 billion in funding. Notable startups that have received substantial investments include Ansible, GitLab, and Datadog, each securing multi-million-dollar deals to expand their offerings and reach.

Some of the most expensive DevOps deals during this period include Atlassian's acquisition of Trello for $425 million and the $320 million Series E funding round for Puppet. Additionally, the $200 million Series D funding for Harness, a leading DevOps platform, stands out as a particularly interesting investment, highlighting the industry's appetite for cutting-edge DevOps solutions.

The investments in DevOps over the past three years underscore the growing importance of this approach in the software development landscape, as organizations seek to streamline their processes, enhance collaboration, and drive continuous innovation.

98 active VC investors in DevOps

In the last three years, venture capital firms have shown increasing interest in DevOps, recognizing its potential to revolutionize software development and deployment. Key players in this space include Andreessen Horowitz, Sequoia Capital, and Accel, which have invested in various DevOps startups. One notable example is the $250 million Series D funding round raised by Datadog, a leading DevOps monitoring and analytics platform, in 2020. This investment highlights the growing demand for DevOps solutions and the confidence that venture capitalists have in the long-term viability of the DevOps market.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Zeta Alpha | DevOps | Seed | |||

| Zero-One Capital | DevOps | ||||

| Zeno Ventures | DevOps | Generalist | Series A, Series B | ||

| Zen Girişim | DevOps | ||||

| Zelkova Ventures | DevOps | Generalist | Seed | USD 15000000 | |

| Zee Prime Capital | programmable assets, collaborative intelligence | United Kingdom | Seed | ||

| ZAS Ventures | DevOps | Bulgaria; Czechia; Hungary; Moldova; Poland; Romania; Slovakia; Ukraine | Seed | ||

| Zag Capital | DevOps | United States | Seed | ||

| Z5 Capital | infrastructure, cloud, data management,enterprise,(ai), machine learning (ml),security | United States | Seed | USD 4300000 | |

| Z21 Ventures | DevOps | India | Seed | USD 5000000 |

90 active CVC investors in DevOps

Active corporate venture capital (CVC) firms have been investing in DevOps startups, recognizing the importance of streamlining software development and deployment. Notable CVC investors include Microsoft's M12, Cisco Investments, and Salesforce Ventures, backing innovative solutions in cloud infrastructure, automation, and security.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| XT Hi-Tech | DevOps | Israel; United States | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | ||

| Xerox Ventures | DevOps | Seed | |||

| Wormhole Capital | DevOps | Series A, Seed, Series B, Series C | |||

| Wix Capital | saas applications, developer tools, e-commerce, customer service automation, highly scalable infrastructure technologies, financial services including payments solutions, smb technologies and solutions | United Kingdom; Israel; United States | Generalist, Seed, Series E, Series A, Series D, Pre-Seed, Series C, Series B | ||

| Wipro Ventures | industrial internet of things, conversational ai, sd wan, cybersecurity, analytics | United States; Israel | Seed | ||

| Wintermute Ventures | DevOps | France; Cayman Islands; United States; Canada; United Arab Emirates; United Kingdom; Singapore; Germany; Bulgaria; Switzerland | Pre Seed, Seed, Series A, Series B | ||

| Western Digital Capital | data center,enterprise, internet of things, consumer devices,services, components,subsystems | Canada; United States; Israel; India; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Series A, Series B, Series C | ||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| TS Ventures Fond | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Seed, Series A, Pre-Seed, Series B | |||

| Trifork Labs | DevOps | Generalist | Pre-Seed, Seed, Series A, Series B |

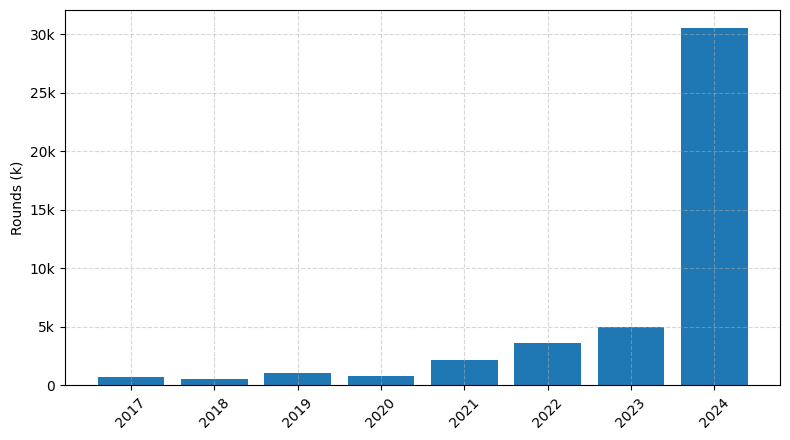

Investments by year: Round

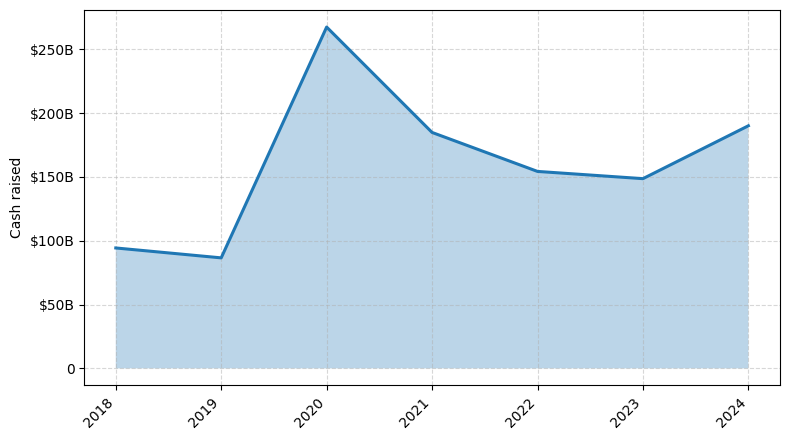

Investments by year: Cash raised

How is fundraising in DevOps different from other VC fundraising

Fundraising in the DevOps space differs from general startup fundraising in several key ways. DevOps companies often face unique technical challenges, such as the need to demonstrate the scalability and reliability of their infrastructure-as-code solutions. Investors may require a deeper understanding of the underlying technologies and how they integrate with existing systems. Additionally, DevOps startups may need to showcase their ability to attract and retain specialized talent, as the field requires a unique blend of software engineering, operations, and automation expertise. Compared to consumer-facing startups, DevOps companies may also have longer sales cycles and more complex go-to-market strategies, which can impact their funding needs and timelines. Successful DevOps fundraising often hinges on the ability to articulate a clear vision, demonstrate tangible customer traction, and highlight the team's technical depth and domain expertise.

Top Funded DevOps Startups

1. GitLab: Approximately $1 billion in total funding, focused on DevOps lifecycle management.

2. Puppet: Approximately $200 million in total funding, focused on infrastructure automation and configuration management.

3. Hashicorp: Approximately $350 million in total funding, focused on cloud infrastructure provisioning and management.

4. Datadog: Approximately $750 million in total funding, focused on cloud monitoring and observability.

5. Snyk: Approximately $600 million in total funding, focused on open-source security and vulnerability management.

2. Puppet: Approximately $200 million in total funding, focused on infrastructure automation and configuration management.

3. Hashicorp: Approximately $350 million in total funding, focused on cloud infrastructure provisioning and management.

4. Datadog: Approximately $750 million in total funding, focused on cloud monitoring and observability.

5. Snyk: Approximately $600 million in total funding, focused on open-source security and vulnerability management.

What you should include in DevOps pitch deck

A DevOps pitch deck should include the following unique slides:

1. DevOps Principles: Explain the core principles of DevOps, such as continuous integration, continuous deployment, and collaboration.

2. DevOps Benefits: Highlight the key benefits of adopting a DevOps approach, such as faster time-to-market, improved quality, and reduced costs.

3. DevOps Roadmap: Outline a clear roadmap for implementing DevOps within the organization, including the necessary tools, processes, and cultural changes.

4. DevOps Case Studies: Showcase successful DevOps implementations and the measurable results achieved by other organizations.

5. DevOps Team Structure: Describe the roles and responsibilities of the DevOps team and how they will integrate with the existing IT and development teams.

1. DevOps Principles: Explain the core principles of DevOps, such as continuous integration, continuous deployment, and collaboration.

2. DevOps Benefits: Highlight the key benefits of adopting a DevOps approach, such as faster time-to-market, improved quality, and reduced costs.

3. DevOps Roadmap: Outline a clear roadmap for implementing DevOps within the organization, including the necessary tools, processes, and cultural changes.

4. DevOps Case Studies: Showcase successful DevOps implementations and the measurable results achieved by other organizations.

5. DevOps Team Structure: Describe the roles and responsibilities of the DevOps team and how they will integrate with the existing IT and development teams.

How to Prepare Your DevOps Startup for Investment

Preparing a DevOps startup for investment requires a strategic approach to demonstrate the company's potential and viability. As an advisory, it's crucial to ensure that the startup is well-positioned to attract the attention of venture capital (VC) investors.

When pitching to VC investors, startups should be prepared to showcase the following:

1. Scalable and Efficient DevOps Practices: Demonstrate how the startup's DevOps processes and tools enable rapid development, seamless deployment, and effective monitoring and maintenance of the product.

2. Innovative Technology Stack: Highlight the startup's use of cutting-edge technologies, such as cloud-native architectures, containerization, and automation, to drive efficiency and competitive advantage.

3. Experienced and Diverse Team: Emphasize the startup's ability to attract and retain top talent in the DevOps field, showcasing the team's technical expertise and cross-functional collaboration.

4. Compelling Market Opportunity: Clearly articulate the target market, the pain points the startup's solution addresses, and the potential for growth and market share.

5. Sustainable Business Model: Demonstrate a well-thought-out financial plan, including revenue streams, cost structures, and a path to profitability that aligns with the investors' expectations.

By addressing these key aspects, the DevOps startup can increase its chances of securing investment and positioning itself for long-term success.

When pitching to VC investors, startups should be prepared to showcase the following:

1. Scalable and Efficient DevOps Practices: Demonstrate how the startup's DevOps processes and tools enable rapid development, seamless deployment, and effective monitoring and maintenance of the product.

2. Innovative Technology Stack: Highlight the startup's use of cutting-edge technologies, such as cloud-native architectures, containerization, and automation, to drive efficiency and competitive advantage.

3. Experienced and Diverse Team: Emphasize the startup's ability to attract and retain top talent in the DevOps field, showcasing the team's technical expertise and cross-functional collaboration.

4. Compelling Market Opportunity: Clearly articulate the target market, the pain points the startup's solution addresses, and the potential for growth and market share.

5. Sustainable Business Model: Demonstrate a well-thought-out financial plan, including revenue streams, cost structures, and a path to profitability that aligns with the investors' expectations.

By addressing these key aspects, the DevOps startup can increase its chances of securing investment and positioning itself for long-term success.