FREE Investor Database

Top Venture Investors in Creator Economy Industry

Top Venture Investors in Creator Economy Industry

Discover leading VC and CVC investors specializing in Creator Economy. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The Creator Economy has witnessed a surge in investment activity over the past three years, reflecting the growing importance of this dynamic sector. Since 2022, the industry has seen a flurry of investments, with hundreds of deals being struck across various segments, from content creation platforms to monetization tools. According to industry estimates, over $10 billion has been poured into the Creator Economy during this period, fueling the growth of innovative startups like Patreon, Substack, and Cameo. Some of the most significant deals include Snap's acquisition of Voisey for $50 million and Twitch's $1.5 billion investment in its creator ecosystem. Interestingly, the Creator Economy has also attracted the attention of traditional media giants, with companies like Disney and NBCUniversal making strategic investments to tap into this burgeoning market. As the demand for creator-driven content continues to rise, the Creator Economy is poised to remain a key focus for investors seeking to capitalize on this transformative shift in the digital landscape.

96 active VC investors in Creator Economy

In the last three years, the Creator Economy has seen a surge of investment from active venture capital firms. Key players include Andreessen Horowitz, which has backed platforms like Patreon and Substack, and Lightspeed Venture Partners, which has invested in companies like Cameo and Koji. One of the biggest venture capital rounds in the Creator Economy was Canva's $200 million Series E in 2021, led by T. Rowe Price and Dragoneer Investment Group, valuing the design platform at $40 billion and solidifying its position as a leading creator-focused technology company.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Creator Economy | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Zino Ventures | it, communications, digital, media, mobile, web, clean tech, renewable energy, biotech, medical devices, food, beverage, financial services, agriculture | New Zealand | Series A, Series B | ||

| Zhongmi Capital | consumer technology, martech, big data, pan-entertainment, digital marketing, sports | Pre-Seed, Seed, Series A, Series B | |||

| Zeta Alpha | Creator Economy | Seed | |||

| Zero-One Capital | Creator Economy | ||||

| Zero Gravity Capital | e-commerce, robotics, fintech, edtech, data analytics, AI, beauty tech, streaming platform | Slovakia | Series A, Series B, Seed | ||

| Zentro Founders | media, fintech, marketplaces | ||||

| Zeno Ventures | Creator Economy | Generalist | Series A, Series B | ||

| Zen Girişim | Creator Economy | ||||

| Zelkova Ventures | Creator Economy | Generalist | Seed | USD 15000000 |

82 active CVC investors in Creator Economy

Active corporate venture capital (CVC) firms have been investing in the Creator Economy, recognizing its potential. Notable players include Snap Ventures, which backed Cameo, and Adobe Ventures, which invested in Canva. These CVC firms are shaping the future of content creation and monetization.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| Z Venture Capital | Creator Economy | Brunei; Cambodia; East Timor; Indonesia; Laos; Malaysia; Myanmar; Philippines; Singapore; Thailand; Vietnam; Japan; South Korea; United States | Seed | ||

| Wormhole Capital | Creator Economy | Series A, Seed, Series B, Series C | |||

| Wayra UK | fintech, Cloud/Infrastructure, Telecommunications, hardware, Industry, Consumer Goods, Smart Cities, Mobility, E-commerce, Legal, Networks, Construction, Engineering, Cloud services, Education, Customer Service, Security, Entertainment, Analytics, Marketing, AI, Social Networks, Tourism, FinTech, Healthcare, Transport, Media, Financial, Electronics | United Kingdom, United States | Seed Round, Series A, Series B, Pre Seed Round | ||

| Washington University in St. Louis | agriculture, apparel, banking, beauty, biotech, chemicals, communication, construction, consulting, crypto, ecommerce, education, electronics, energy, engineering, entertainment, fashion, fintech, food, beverage, gaming, healthcare, manufacturing, media, medical service, medicine, mobile app, outdoor, retail, service, social media, software, software as service, technology, human resources | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Virgin Group | travel, leisure, health, wellness, music, entertainment, telecoms, media, financial services, space. | United States; United Kingdom | Series C, Series D, Series F, Series E | ||

| TS Ventures Fond | ai, big data, b2b, enterprise, cloud, infrastructure, consumer, retail, developer tools, ecommerce, edtech, fintech, media, content, productivity | Seed, Series A, Pre-Seed, Series B | |||

| Telefonica Innovation Ventures | Creator Economy | Spain; United Kingdom; Germany; Brazil; United States; Israel; Argentina; Chile; Colombia; Ecuador; Peru; Mexico; Uruguay | Series A, Series B, Series E | ||

| SRI Ventures | 3d and virtual environments, advanced manipulation and automation, drug discovery and development, bioinformatics and computational biology, computer vision, communications and networking, robotics, sensors and signal processing, image and video processing, medical and surgical devices, quantum sensing, artificial intelligence and machine learning, gps tracking and precision navigation, speech, language, and audio technologies, satellite systems | Seed | |||

| Slack Fund | voice and video, it and security, productivity, wellness, developer tools | Generalist | Series A, Pre-Seed, Seed | ||

| SIS Ventures | Creator Economy | United Kingdom | Series A, Seed |

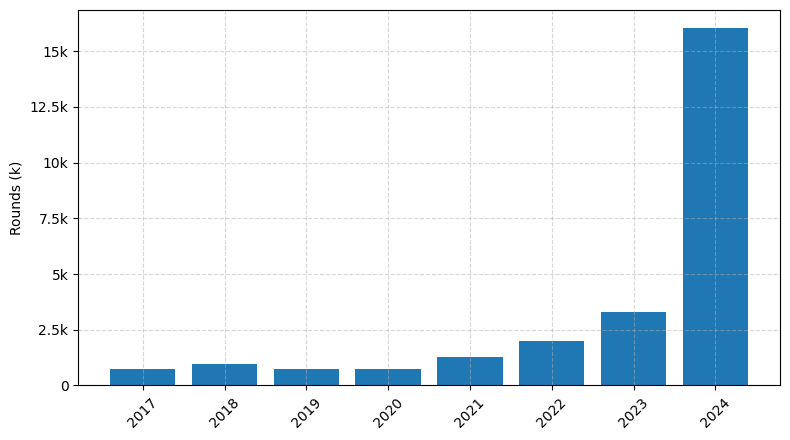

Investments by year: Round

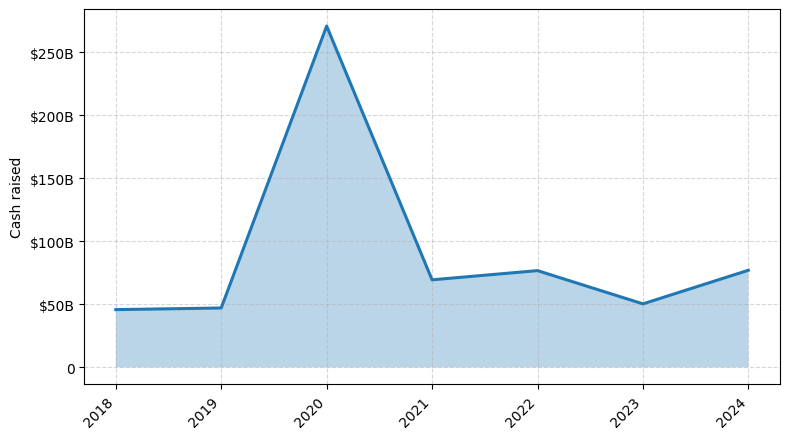

Investments by year: Cash raised

How is fundraising in Creator Economy different from other VC fundraising

The Creator Economy presents unique fundraising challenges compared to traditional startup fundraising. Unlike tech startups, creators often have a more direct connection with their audience, which can be leveraged for crowdfunding and fan-driven investments. However, creators may lack the traditional business acumen and financial projections that investors typically expect. Additionally, the Creator Economy is highly dependent on platform algorithms and changing consumer trends, making it more difficult to predict long-term growth and sustainability. Creators must also navigate complex licensing and rights issues, which can complicate their financial models. As a result, Creator Economy fundraising often requires a more nuanced approach, focusing on the creator's personal brand, community engagement, and innovative revenue streams, rather than solely on traditional business metrics.

Top Funded Creator Economy Startups

Here is a summary of the top-funded Creator Economy startups:

• Patreon: Approximately $413 million in total funding, focused on providing subscription-based monetization tools for creators.

• Kajabi: Approximately $300 million in total funding, focused on offering an all-in-one platform for creating and selling digital products.

• Cameo: Approximately $165 million in total funding, focused on enabling creators to sell personalized video messages.

• Substack: Approximately $82 million in total funding, focused on providing newsletter publishing and subscription tools for creators.

• Gumroad: Approximately $75 million in total funding, focused on offering a platform for creators to sell digital products and services.

• Patreon: Approximately $413 million in total funding, focused on providing subscription-based monetization tools for creators.

• Kajabi: Approximately $300 million in total funding, focused on offering an all-in-one platform for creating and selling digital products.

• Cameo: Approximately $165 million in total funding, focused on enabling creators to sell personalized video messages.

• Substack: Approximately $82 million in total funding, focused on providing newsletter publishing and subscription tools for creators.

• Gumroad: Approximately $75 million in total funding, focused on offering a platform for creators to sell digital products and services.

What you should include in Creator Economy pitch deck

When creating a pitch deck for the creator economy, include the following unique slides:

1. Creator Profile: Highlight the creator's background, audience, and unique value proposition.

2. Content Strategy: Outline the creator's content creation process and distribution plan.

3. Monetization Model: Explain the creator's revenue streams, such as sponsorships, subscriptions, or e-commerce.

4. Growth Potential: Demonstrate the creator's ability to expand their audience and diversify their offerings.

5. Competitive Landscape: Analyze the creator's position within the competitive creator economy market.

Ensure these slides effectively communicate the creator's strengths, opportunities, and potential for success in the dynamic creator economy.

1. Creator Profile: Highlight the creator's background, audience, and unique value proposition.

2. Content Strategy: Outline the creator's content creation process and distribution plan.

3. Monetization Model: Explain the creator's revenue streams, such as sponsorships, subscriptions, or e-commerce.

4. Growth Potential: Demonstrate the creator's ability to expand their audience and diversify their offerings.

5. Competitive Landscape: Analyze the creator's position within the competitive creator economy market.

Ensure these slides effectively communicate the creator's strengths, opportunities, and potential for success in the dynamic creator economy.

How to Prepare Your Creator Economy Startup for Investment

Preparing a Creator Economy startup for investment requires a strategic approach to showcase the venture's potential and appeal to venture capital (VC) investors. As an advisory, it is crucial to ensure that your startup is well-positioned to attract the attention and confidence of potential investors.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined value proposition: Demonstrate how your startup's products or services uniquely address the needs of the creator community and provide tangible benefits.

2. Robust market analysis: Provide a comprehensive understanding of the creator economy landscape, including market size, growth trends, and the competitive landscape.

3. Scalable business model: Outline a sustainable and scalable business model that can generate consistent revenue and profitability as the startup grows.

4. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of the founding team and key personnel.

5. Compelling growth strategy: Present a well-thought-out plan for user acquisition, customer retention, and expansion into new markets or verticals.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Creator Economy startup for long-term success.

When crafting your pitch deck, VC investors typically expect the following:

1. Clearly defined value proposition: Demonstrate how your startup's products or services uniquely address the needs of the creator community and provide tangible benefits.

2. Robust market analysis: Provide a comprehensive understanding of the creator economy landscape, including market size, growth trends, and the competitive landscape.

3. Scalable business model: Outline a sustainable and scalable business model that can generate consistent revenue and profitability as the startup grows.

4. Experienced and capable team: Highlight the expertise, relevant experience, and complementary skills of the founding team and key personnel.

5. Compelling growth strategy: Present a well-thought-out plan for user acquisition, customer retention, and expansion into new markets or verticals.

By addressing these key elements in your pitch deck, you can increase the likelihood of securing investment and positioning your Creator Economy startup for long-term success.