FREE Investor Database

Top Venture Investors in Supply Chain Industry

Top Venture Investors in Supply Chain Industry

Discover leading VC and CVC investors specializing in Supply Chain. Find your ideal investor match and connect with the right funding partners on Unicorn Nest.

Intro

The supply chain industry has witnessed a surge of investments in the past three years, reflecting the growing importance of efficient and resilient logistics in the global economy. Since 2022, the sector has attracted significant attention from investors, with numerous startups and established players receiving substantial funding to drive innovation and technological advancements.

Over the past three years, the supply chain industry has seen a remarkable number of investments, with hundreds of deals being struck across the globe. The total amount of capital invested in this sector during this period has reached staggering heights, exceeding billions of dollars as companies seek to optimize their operations and stay ahead of the curve.

Among the core startups that have received substantial investments are Flexport, a digital freight forwarding platform, Convoy, a digital freight network, and Transfix, a technology-enabled logistics provider. These companies have secured multi-million-dollar funding rounds, showcasing the confidence investors have in their ability to transform the supply chain landscape.

Some of the most expensive deals in the supply chain industry during this period include the $1.2 billion investment in Flexport, the $400 million funding round for Convoy, and the $200 million raised by Transfix. Additionally, the acquisition of Roadie, a crowdsourced delivery platform, by Walmart for a reported $550 million stands out as an interesting and strategic deal.

In summary, the supply chain industry has witnessed a remarkable surge in investments over the past three years, with billions of dollars being poured into startups and established players alike, as the sector continues to evolve and adapt to the changing needs of the global economy.

Over the past three years, the supply chain industry has seen a remarkable number of investments, with hundreds of deals being struck across the globe. The total amount of capital invested in this sector during this period has reached staggering heights, exceeding billions of dollars as companies seek to optimize their operations and stay ahead of the curve.

Among the core startups that have received substantial investments are Flexport, a digital freight forwarding platform, Convoy, a digital freight network, and Transfix, a technology-enabled logistics provider. These companies have secured multi-million-dollar funding rounds, showcasing the confidence investors have in their ability to transform the supply chain landscape.

Some of the most expensive deals in the supply chain industry during this period include the $1.2 billion investment in Flexport, the $400 million funding round for Convoy, and the $200 million raised by Transfix. Additionally, the acquisition of Roadie, a crowdsourced delivery platform, by Walmart for a reported $550 million stands out as an interesting and strategic deal.

In summary, the supply chain industry has witnessed a remarkable surge in investments over the past three years, with billions of dollars being poured into startups and established players alike, as the sector continues to evolve and adapt to the changing needs of the global economy.

97 active VC investors in Supply Chain

In the last three years, the supply chain industry has seen a surge in venture capital investment, with several firms actively seeking innovative startups to back. Key players in this space include Bessemer Venture Partners, Kleiner Perkins, and Lightspeed Venture Partners. One notable example is the $260 million Series D round raised by Flexport, a digital freight forwarding platform, in 2021. This investment, led by Andreessen Horowitz, highlights the growing interest in technologies that streamline and optimize supply chain operations, as businesses seek to navigate the challenges posed by the COVID-19 pandemic and evolving consumer demands.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZIM Ventures | Supply Chain | Israel | Seed | ||

| Zimmermann Investments | logistics, it, financial services, food, wholesale, retail, catering, commercial property management, real estate, consumer internet, technology, fintech, b2c, b2b, education, social responsibility | Series A, Seed, Series B | |||

| ZGI Capital | metalworking, food industry, woodworking, logistics, it, engineering, retail, service exports | ||||

| ZEBOX Ventures | logistics, supply chains, mobility, space, media, transport, decarbonization of infrastructures, energy transition, digitalization of processes, people, consumer, ai | Pre-Seed, Seed | |||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| XRC Labs | analytics, consumer brand, consumer healthtech, data infrastructure, ecom tech, generative ai, martech, marketplace, commerce, manufacturing, store tech, supply chain, web3 | Generalist; United States; Canada; Albania; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czechia; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom; Algeria; Cameroon; Comoros; Djibouti; Egypt; Equatorial Guinea; Eritrea; Eswatini; Ethiopia; Gabon; Gambia; Ghana; Guinea; Guinea-Bissau; Ivory Coast; Kenya; Lesotho; Liberia; Libya; Madagascar; Malawi; Mali; Mauritania; Mauritius; Morocco; Mozambique; Namibia; Niger; Nigeria; Rwanda; Senegal; Seychelles; Sierra Leone; South Africa; Tanzania; Togo; Tunisia; Uganda; Zimbabwe; Argentina; Brazil; Chile; Colombia; Costa Rica; Dominica; Dominican Republic; Ecuador; El Salvador; Grenada; Guatemala; Guyana; Haiti; Honduras; Jamaica; Mexico; Nicaragua; Panama; Paraguay; Peru; Saint Kitts and Nevis; Saint Lucia; Saint Vincent and the Grenadines; Suriname; Uruguay; Australia; Cambodia; China; Fiji; India; Indonesia; Japan; Kazakhstan; Kiribati; Kyrgyzstan; Laos; Malaysia; Maldives; Marshall Islands; Micronesia; Mongolia; Myanmar; Nauru; Nepal; New Zealand; Pakistan; Palau; Papua New Guinea; Philippines; Samoa; Singapore; Solomon Islands; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Timor-Leste; Tonga; Turkey; Vietnam; Bahrain; Cyprus; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates | Series A, Seed | ||

| XPRESS Ventures | logtech | Seed, Pre-Seed | |||

| Xplore | fintech, insurtech, agritech, agri-food, distribution, logistics, health, aeronautics, maritime, real estate | France | Series A, Seed | ||

| Xerox Ventures | Supply Chain | Seed | |||

| W ventures Japan | b2b, b2c, energy, industrial, commerce, security, digital health, mobility, finance, it, real estate, construction, business software, fintech, insurtech, manufacturing, industry 4.0, marketing, media, mobility, logistics. | United States; Bahrain; Egypt; Israel; Jordan; Kuwait; Oman; Qatar; Saudi Arabia; Turkey; United Arab Emirates; Cambodia; Indonesia; Laos; Malaysia; Philippines; Singapore; Thailand; Vietnam; China; India; Japan; South Korea; Taiwan; Austria; United Kingdom; Luxembourg; Ireland; Netherlands; Monaco; Belgium; France; Germany; Switzerland; Albania; Bosnia and Herzegovina; Bulgaria; Croatia; Czech Republic; Georgia; Hungary; Kosovo; North Macedonia; Moldova; Montenegro; Poland; Romania; Serbia; Slovakia; Slovenia; Ukraine; Cyprus; Greece; Malta; Turkey; Spain; Portugal; Italy; Denmark; Finland; Iceland; Norway; Sweden; Estonia; Latvia; Lithuania; | Series B, Series A, Series E, Series D, Seed, Series C |

61 active CVC investors in Supply Chain

Active corporate venture capital (CVC) firms have been investing heavily in the supply chain sector in the past three years. Notable players include Maersk Growth, the CVC arm of the shipping giant, which has backed innovative logistics startups, and Honeywell Ventures, which has invested in technologies transforming warehouse operations.

| Fund | Location | Industry focus | Geo required | Rounds | Fund size |

|---|---|---|---|---|---|

| ZIM Ventures | Supply Chain | Israel | Seed | ||

| Yildiz Ventures | food, consumer goods, retail, agritech, deeptech, saas, ecommerce, mobility, logistics, fintech, gaming, hrtech | Generalist, Pre-Seed, Seed, Series A, Series B, Series C | |||

| Xerox Ventures | Supply Chain | Seed | |||

| Wamda Capital | industry, consumer, crypto, web3, ecommerce, education, fintech, food, healthcare, hr, talent, legal, mobility, logistics, real estate, retail, saas, enterprise software | Algeria; Bahrain; Egypt; Iraq; Israel; Jordan; Kuwait; Lebanon; Libya; Morocco; Oman; Qatar; Saudi Arabia; Tunisia; United Arab Emirates; Djibouti | Series B, Series A | USD 75000000 | |

| UL Ventures | healthcare, retail, manufacturing, supply chain, built environment, energy, automotive | Generalist | Series B, Seed, Series C, Series A | ||

| Tin Shed Ventures | agriculture, supply chain, sorting and recycling | Seed, Series A, Series B | |||

| Teklas Ventures | advanced manufacturing, new materials, supply chain, logistics, mobility | United States; Albania; Andorra; Austria; Belgium; Bosnia and Herzegovina; Bulgaria; Croatia; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Iceland; Ireland; Italy; Kosovo; Latvia; Liechtenstein; Lithuania; Luxembourg; Malta; Moldova; Monaco; Montenegro; Netherlands; North Macedonia; Norway; Poland; Portugal; Romania; San Marino; Serbia; Slovakia; Slovenia; Spain; Sweden; Switzerland; Turkey; Ukraine; United Kingdom | Generalist | ||

| Swiss Post Ventures | communication, logistics, financial services, business process outsourcing, mobility markets | Generalist; Switzerland | Seed, Series A, Series B | ||

| SOFTBANK Latin America Ventures | Supply Chain | Argentina; Brazil; Chile; Colombia; Costa Rica; Ecuador; Guatemala; Honduras; Mexico; Panama; Paraguay; Peru; Uruguay | Seed | ||

| SIG Asia Investments, LLLP | Supply Chain | Bahrain; Cambodia; China; Cyprus; East Timor; Egypt; Georgia; India; Indonesia; Iraq; Israel; Japan; Jordan; Kazakhstan; Kuwait; Kyrgyzstan; Laos; Lebanon; Malaysia; Maldives; Mongolia; Myanmar; Nepal; Oman; Pakistan; Philippines; Qatar; Saudi Arabia; Singapore; South Korea; Sri Lanka; Taiwan; Tajikistan; Thailand; Turkey; United Arab Emirates; Vietnam | Generalist, Series A, Series B, Series C, Series D, Series E, Pre-IPO |

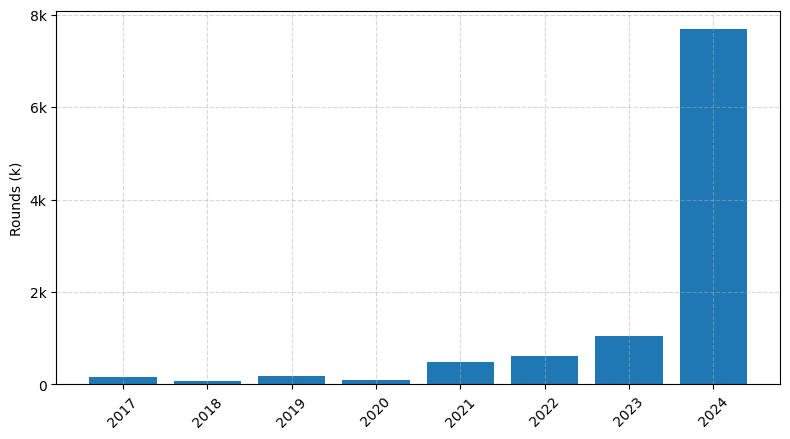

Investments by year: Round

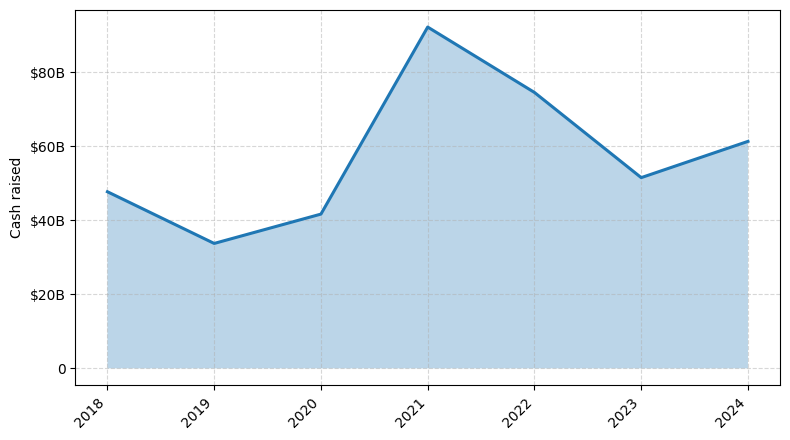

Investments by year: Cash raised

How is fundraising in Supply Chain different from other VC fundraising

Fundraising in the supply chain industry differs from general startup fundraising due to the unique challenges faced by supply chain businesses. Supply chain startups often require significant upfront capital to invest in infrastructure, logistics, and technology, which can make it more difficult to attract investors compared to software-based startups. Additionally, the supply chain industry is highly regulated, and startups must navigate complex compliance requirements, which can add to the fundraising challenges. Furthermore, the supply chain industry is often perceived as less glamorous than other tech sectors, which can make it harder to capture investor attention. As a result, supply chain startups may need to emphasize their practical solutions, scalability, and long-term potential to secure funding from investors who understand the unique dynamics of the industry.

Top Funded Supply Chain Startups

1. Flexport: Approximately $2.3 billion in total funding, focused on freight forwarding and customs brokerage.

2. Convoy: Approximately $668 million in total funding, focused on digital freight brokerage.

3. Transplace: Approximately $1.1 billion in total funding, focused on transportation management and logistics services.

4. FourKites: Approximately $400 million in total funding, focused on supply chain visibility and tracking.

5. project44: Approximately $500 million in total funding, focused on supply chain visibility and transportation management.

2. Convoy: Approximately $668 million in total funding, focused on digital freight brokerage.

3. Transplace: Approximately $1.1 billion in total funding, focused on transportation management and logistics services.

4. FourKites: Approximately $400 million in total funding, focused on supply chain visibility and tracking.

5. project44: Approximately $500 million in total funding, focused on supply chain visibility and transportation management.

What you should include in Supply Chain pitch deck

When creating a Supply Chain pitch deck, the following unique slides should be included:

1. Supply Chain Overview: Provide a comprehensive overview of your supply chain, including key processes, partners, and technologies.

2. Competitive Advantage: Highlight the unique aspects of your supply chain that give you a competitive edge in the market.

3. Cost Optimization: Demonstrate how your supply chain strategies and solutions can optimize costs and improve profitability.

4. Scalability and Flexibility: Showcase your supply chain's ability to adapt to changing market conditions and scale as the business grows.

5. Technology Integration: Highlight the innovative technologies and digital solutions integrated into your supply chain.

1. Supply Chain Overview: Provide a comprehensive overview of your supply chain, including key processes, partners, and technologies.

2. Competitive Advantage: Highlight the unique aspects of your supply chain that give you a competitive edge in the market.

3. Cost Optimization: Demonstrate how your supply chain strategies and solutions can optimize costs and improve profitability.

4. Scalability and Flexibility: Showcase your supply chain's ability to adapt to changing market conditions and scale as the business grows.

5. Technology Integration: Highlight the innovative technologies and digital solutions integrated into your supply chain.

How to Prepare Your Supply Chain Startup for Investment

Preparing a Supply Chain startup for investment requires a strategic approach to demonstrate the viability and growth potential of the business. As an advisory, it is crucial to ensure that the startup is well-positioned to attract the attention of venture capital (VC) investors.

When pitching to VC investors, startups in the Supply Chain industry should be prepared to showcase the following:

1. Innovative Technology: Demonstrate how the startup's technology or platform offers a unique and compelling solution to address the challenges in the supply chain industry.

2. Scalable Business Model: Provide a clear and data-driven plan for how the startup can scale its operations and achieve sustainable growth.

3. Experienced Team: Highlight the expertise and relevant experience of the founding team and key personnel to instill confidence in the investors.

4. Competitive Advantage: Clearly articulate the startup's competitive edge and how it differentiates itself from existing players in the market.

5. Market Opportunity: Provide a comprehensive analysis of the target market, its size, growth potential, and the startup's ability to capture a significant share.

By addressing these key elements in the pitch deck, Supply Chain startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.

When pitching to VC investors, startups in the Supply Chain industry should be prepared to showcase the following:

1. Innovative Technology: Demonstrate how the startup's technology or platform offers a unique and compelling solution to address the challenges in the supply chain industry.

2. Scalable Business Model: Provide a clear and data-driven plan for how the startup can scale its operations and achieve sustainable growth.

3. Experienced Team: Highlight the expertise and relevant experience of the founding team and key personnel to instill confidence in the investors.

4. Competitive Advantage: Clearly articulate the startup's competitive edge and how it differentiates itself from existing players in the market.

5. Market Opportunity: Provide a comprehensive analysis of the target market, its size, growth potential, and the startup's ability to capture a significant share.

By addressing these key elements in the pitch deck, Supply Chain startups can increase their chances of securing investment from VC investors and positioning themselves for long-term success.